by Calculated Risk on 4/20/2017 09:58:00 AM

Thursday, April 20, 2017

Philly Fed: Manufacturing "Continued to expand, but at a slower pace" in April

Earlier from the Philly Fed: Current Indicators Continue to Reflect Growth

Results from the April Manufacturing Business Outlook Survey suggest that regional manufacturing activity continued to expand, but at a slower pace than last month. The diffusion indexes for general activity, new orders, and shipments remained positive but fell from their readings in March. The current employment index, however, improved slightly and continues to suggest expanding employment in the manufacturing sector. The survey’s future indicators continued to reflect general optimism but retreated from their high readings in the first three months of the year.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region decreased from a reading of 32.8 in March to 22.0 this month. The index has been positive for nine consecutive months and remains at a relatively high reading but has moved down the past two months ...

...

Firms reported an increase in manufacturing employment and work hours this month. The percentage of firms reporting an increase in employment (27 percent) exceeded the percentage reporting a decrease (8 percent). The current employment index improved 2 points, its fifth consecutive positive reading. Firms also reported an increase in work hours this month: The average workweek index was nearly unchanged at 18.9 and has registered a positive reading for six consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

This suggests the ISM manufacturing index will show slower expansion in April (but still solid).

Weekly Initial Unemployment Claims increase to 244,000

by Calculated Risk on 4/20/2017 08:35:00 AM

The DOL reported:

In the week ending April 15, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 10,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 243,000, a decrease of 4,250 from the previous week's unrevised average of 247,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 243,000.

This was at the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, April 19, 2017

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 4/19/2017 07:15:00 PM

Some interesting comments from Dave Altig, Nicholas Parker and Brent Meyer at Macroblog: The Fed’s Inflation Goal: What Does the Public Know?

[O]ne natural question is whether the public is aware of this 2 percent target. We've posed this question a few times to our Business Inflation Expectations Panel, which is a set of roughly 450 private, nonfarm firms in the Southeast. These firms range in size from large corporations to owner operators.Thursday:

Unsurprisingly, to us at least—and maybe to you if you're a regular macroblog reader—the typical respondent answered 2 percent (the same answer our panel gave us in 2015 and back in 2011). At a minimum, southeastern firms appear to have gotten and retained the message.

...

In a follow-up to our question about the numerical target, in the latest survey we asked our panel whether they thought the Fed was more, less, or equally likely to tolerate inflation below or above its target.

One in five respondents believes the Federal Reserve is more likely to accept inflation above its target, while nearly 40 percent believe it is more likely to accept inflation below its target. Twenty-five percent of firms believe the Federal Reserve is equally likely to accept inflation above or below its target. The remainder of respondents were unsure. This pattern was similar across firm sizes and industries.

In other words, more firms see the inflation target as a threshold (or ceiling) that the Fed is averse to crossing than see it as a symmetric target.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, up from 234 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 26.0, down from 32.8.

Fed's Beige Book: Modest to Moderate expansion, Tight labor markets

by Calculated Risk on 4/19/2017 02:07:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before April 10, 2017."

Economic activity increased in each of the twelve Federal Reserve Districts between mid-February and the end of March, with the pace of expansion equally split between modest and moderate. In addition, the pickup was evident to varying degrees across economic sectors. Manufacturing continued to expand at a modest to moderate pace, although growth in freight shipments slowed slightly. Consumer spending varied as reports of stronger light vehicle sales were accompanied by somewhat softer readings in non-auto retail spending. Tourism and travel activity generally picked up. On balance, reports suggested that residential construction growth accelerated somewhat even as growth in home sales slowed, in part due to a lack of inventory. Nonresidential construction remained strong, but became more mixed in some regions; leasing activity generally improved at a more modest pace. More than half of the reports suggested that loan volumes increased, while only one said they were down modestly. Non-financial services generally continued to expand steadily. Energy-related businesses noted improved conditions while agricultural conditions varied.And a few excerpts on real estate:

...

Employment expanded across the nation and increases ranged from modest to moderate during this period. Labor markets remained tight, and employers in most Districts had more difficulty filling low-skilled positions, although labor demand was stronger for higher skilled workers. Modest wage increases broadened, and reports noted bigger increases for workers with skills that are in short supply. A larger number of firms mentioned higher turnover rates and more difficulty retaining workers. A couple of Districts reported that worker shortages and increased labor costs were restraining growth in some sectors, including manufacturing, transportation, and construction. Businesses generally expected labor demand to increase moderately in the next six months, and looked for modest wage growth.

emphasis added

Boston: Residential real estate markets in the First District continued to struggle with a shortage of inventory. All six First District states as well as the Greater Boston area reported large declines in inventory for both single-family homes and condos from February 2016 to February 2017. ... New York: Housing markets across the District have been mixed but, on balance a bit stronger since the last report, with ongoing slack at the high end of the market. New York City's rental market has been steady to somewhat weaker. Landlord concessions have grown more prevalent in an effort to keep rents and vacancy rates steady. Effective rents (factoring in these concessions) have continued to decline--particularly on larger units and particularly in Manhattan. Elsewhere, rents continued to rise in northern New Jersey but were mostly flat across upstate New York. ... San Franciso: Conditions in real estate markets remained stable, and activity remained strong in most of the District. Demand for residential real estate remained robust in most parts of the District. Overall, contacts reported that construction activity was slowed only by a lack of available land, labor, and materials. Sales of new and existing homes were robust, and inventories remained low, with one contact in Seattle reporting that new property listings remained on the market for only a couple of days.Mostly inventories are low, and rents are soft.

AIA: Architecture Billings Index increased in March

by Calculated Risk on 4/19/2017 09:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index continues to strengthen

The first quarter of the year ended on a positive note for the Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 54.3, up from a score of 50.7 in the previous month. This score reflects a sizable increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.8, down from a reading of 61.5 the previous month, while the new design contracts index dipped from 54.7 to 52.3.

“The first quarter started out on uneasy footing, but fortunately ended on an upswing entering the traditionally busy spring season,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “All sectors showed growth except for the commercial/industrial market, which, for the first time in over a year displayed a decrease in design services.”

...

• Regional averages: Midwest (54.6), South (52.6), Northeast (52.4), West (50.2)

• Sector index breakdown: multi-family residential (54.6), mixed practice (53.7), institutional (52.9), commercial / industrial (49.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.3 in January, up from 50.7 in February. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017 and early 2018.

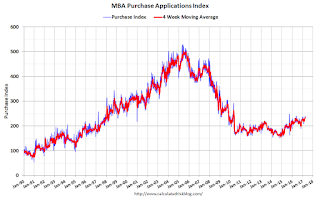

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/19/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 14, 2017. This week’s results do not include an adjustment for the Good Friday holiday.

... The Refinance Index increased 0.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 1 percent lower than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.22 percent, from 4.28 percent, with points decreasing to 0.35 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up.

However refinance activity has declined significantly since rates increased.

Tuesday, April 18, 2017

Wednesday: Beige Book

by Calculated Risk on 4/18/2017 08:39:00 PM

From Matthew Graham at Mortgage News Daily: Rates Pushing Deep Into Post-Election Range

After stumbling just slightly yesterday, mortgage rates returned to their recent habit of setting new 2017 lows today. At this point, we're getting closer and closer to post-election lows. You'd have to go all the way back to November, 14th 2016 to see anything lower.Wednesday:

In specific terms, even more lenders have joined the majority in quoting conventional 30yr fixed rates of 4.0% on top tier scenarios. The more aggressive lenders are now back into the high 3% territory (3.875% mainly, with a very small minority at 3.75%). Many lenders are quoting the same NOTE rates as yesterday, but today's upfront costs are moderately lower on average.

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Philly Fed: State Coincident Indexes increased in 44 states in February

by Calculated Risk on 4/18/2017 02:01:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2017. Over the past three months, the indexes increased in 47 states, decreased in two, and remained stable in one, for a three-month diffusion index of 90. In the past month, the indexes increased in 44 states, decreased in four, and remained stable in two, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In February 46 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

Comments on March Housing Starts

by Calculated Risk on 4/18/2017 11:45:00 AM

Earlier: Housing Starts decreased to 1.215 Million Annual Rate in March

The housing starts report released this morning showed starts were down in March compared to February, and were up 9.2% year-over-year compared to March 2016.

Note that multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last six months.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 9.2% in March 2017 compared to March 2016, and starts are up 8.1% year-to-date.

My guess is starts will increase around 3% to 7% in 2017.

This is a solid start to 2017, however the comparison was pretty easy in March.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has been moving more sideways recently. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect a few years of increasing single family starts and completions.

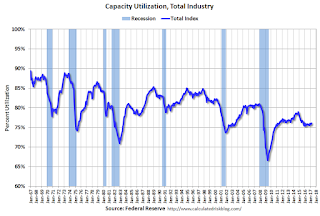

Industrial Production increased 0.5% in March

by Calculated Risk on 4/18/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.5 percent in March after moving up 0.1 percent in February. The increase in March was more than accounted for by a jump of 8.6 percent in the output of utilities—the largest in the history of the index—as the demand for heating returned to seasonal norms after being suppressed by unusually warm weather in February. Manufacturing output fell 0.4 percent in March, led by a large step-down in the production of motor vehicles and parts; factory output aside from motor vehicles and parts moved down 0.2 percent. The production at mines edged up 0.1 percent. For the first quarter as a whole, industrial production rose at an annual rate of 1.5 percent. At 104.1 percent of its 2012 average, total industrial production in March was 1.5 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.4 percentage point in March to 76.1 percent, a rate that is 3.8 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is 3.8% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 104.1. This is 19.6% above the recession low, and is close to the pre-recession peak.

This was close to expectations.