by Calculated Risk on 1/17/2017 10:21:00 AM

Tuesday, January 17, 2017

NY Fed: Manufacturing Activity Continues to Expand in New York Region

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity grew in January. The general business conditions index was little changed at 6.5, its third consecutive positive reading. The new orders index fell seven points to 3.1, indicating that orders increased at a slower clip than last month, and the shipments index held steady at 7.3, pointing to an ongoing increase in shipments. ...This was close to expectations, and suggests manufacturing activity expanded further in January.

...

The index for number of employees rose but held below zero at -1.7, a sign that employment levels edged slightly lower; the average workweek index, at -4.2, pointed to a small decline in hours worked.

...

Indexes for the six-month outlook suggested that respondents remained very optimistic about future conditions. The index for future business conditions was unchanged at 49.7, matching last month’s multiyear high.

emphasis added

Monday, January 16, 2017

Monday Night Futures

by Calculated Risk on 1/16/2017 07:37:00 PM

Weekend:

• Schedule for Week of Jan 15, 2017

Tuesday:

• At 8:30 AM ET,The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 8.0, down from 9.0.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 3, and DOW futures are down 28 (fair value).

Oil prices were down over the last week with WTI futures at $52.49 per barrel and Brent at $55.86 per barrel. A year ago, WTI was at $28, and Brent was at $28 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $1.92 per gallon - so gasoline prices are up 40 cents a gallon year-over-year.

Bank Failures by Year

by Calculated Risk on 1/16/2017 11:28:00 AM

In 2016, five FDIC insured banks failed. This was the lowest level since 2007.

Most of the great recession / housing bust / financial crisis related failures are behind us.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year, so the 5 failures in 2015 was close to normal.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. A large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s then during the recent crisis, the recent financial crisis was much worse (large banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Sunday, January 15, 2017

Krugman: "Infrastructure Delusions"

by Calculated Risk on 1/15/2017 12:14:00 PM

From Professor Krugman: Infrastructure Delusions

Ben Bernanke has a longish post about fiscal policy ... Notably, Bernanke, like yours truly, argues that the fiscal-stimulus case for deficit spending has gotten much weaker, but there’s still a case for borrowing to build infrastructure:CR Note: Just after the election, I noted that members of Mr. Trump's team had been talking about a $1 trillion infrastructure plan. However the infrastructure proposal really was a proposal for about $100 billion in tax credits to spur private investment in infrastructure. The $1 trillion in infrastructure investment was the projected size of the private investment, not the proposed government spending. This proposal is actually very modest in terms of a fiscal boost. Also, if this becomes a privatization scheme, then there might be a modest short term boost, but the long term impact would be negative.

When I was Fed chair, I argued on a number of occasions against fiscal austerity (tax increases, spending cuts). The economy at the time was suffering from high unemployment, and with monetary policy operating close to its limits, I pushed (unsuccessfully) for fiscal policies to increase aggregate demand and job creation. Today, with the economy approaching full employment, the need for demand-side stimulus, while perhaps not entirely gone, is surely much less than it was three or four years ago. There is still a case for fiscal policy action today, but to increase output without unduly increasing inflation the focus should be on improving productivity and aggregate supply—for example, through improved public infrastructure that makes our economy more efficient or tax reforms that promote private capital investment.But he gently expresses doubt that this kind of thing is actually going to happen:

In particular, will Republicans be willing to support big increases in spending, including infrastructure spending? Alternatively, if Congress opts to reduce the deficit impact of an infrastructure program by financing it through tax credits and public-private partnerships, as candidate Trump proposed, the program might turn out to be relatively small.Let me be less gentle: there will be no significant public investment program, for two reasons.

Saturday, January 14, 2017

Schedule for Week of Jan 15th

by Calculated Risk on 1/14/2017 08:09:00 AM

The key economic reports this week are Housing Starts, and the Consumer Price Index (CPI).

For manufacturing, December industrial production, and the January New York, and Philly Fed manufacturing surveys, will be released this week.

Speeches by Fed Chair Janet Yellen are scheduled on Wednesday and Thursday.

All US markets will be closed in observance of Martin Luther King Jr. Day

8:30 AM ET: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 8.0, down from 9.0.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 75.4%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 69, down from 70 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

3:00 PM: Speech, Fed Chair Janet Yellen, The Goals of Monetary Policy and How We Pursue Them, At the Commonwealth Club, San Francisco, California

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, up from 247 thousand the previous week.

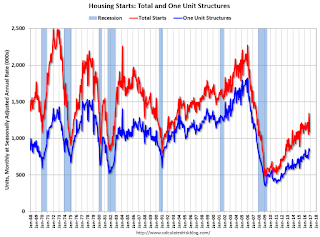

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts decreased to 1.090 Million (SAAR) in November. Single family starts decreased to 828 thousand SAAR in November.

The consensus is for 1.200 million, up from the November rate.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 16.0, down from 19.7.

8:00 PM: Speech, Fed Chair Janet Yellen, The Economic Outlook and the Conduct of Monetary Policy, At the Stanford Institute for Economic Policy Research, San Francisco, California

No economic releases scheduled.

Friday, January 13, 2017

Sacramento Housing in December: Sales down 2%, Active Inventory down 17% YoY

by Calculated Risk on 1/13/2017 07:39:00 PM

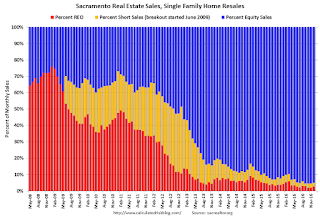

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December, total sales were down 2.6% from December 2015, and conventional equity sales were down 0.6% compared to the same month last year.

In December, 4.4% of all resales were distressed sales. This was up from 4.4% last month, and down from 8.3% in November 2015.

The percentage of REOs was at 2.5%, and the percentage of short sales was 2.3%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 16.6% year-over-year (YoY) in December. This was the 20th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.1% of all sales - this has been steadily declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Question #1 for 2017: What about fiscal and regulatory policy in 2017?

by Calculated Risk on 1/13/2017 02:30:00 PM

Late last year I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

1) US Policy: There is significant uncertainty as to fiscal and regulatory policy in 2017. This is probably the biggest risk for the US economy this coming year. I assume some sort of tax cuts will be passed, possibly some additional infrastructure spending, and possibly some deregulation.

These is the potential for significant policy mistakes - like defaulting on the debt (seems unlikely) - or the start of a trade war. Usually at this point in the transition process, there is a pretty clear understanding of the new administration's policy proposals, but not this time.

Goldman Sachs economists David Mericle and Ben Snider recently looked at equity prices and concluded that investors expect the following policy changes:

We draw three conclusions. First, on the spending side, the equity market appears to expect large health care cutbacks, but has moderated its initial post-election expectations for increased infrastructure spending. Second, on the tax side, the equity market seems to expect meaningful corporate tax cuts, though the evidence that the market has even partially priced a switch to destination-based taxation with border adjustment is only mixed. Third, we see little evidence that the equity market expects major financial or energy-sector deregulation that meaningfully affects profits.Back in November I wrote: Some early Thoughts on the Impact of the Trump Economic Policies. Here are some excerpts:

"First, in broad brushes, the Trump economic plan seems to be:We are still waiting for the details. As far as the impact on 2017, my expectation is there will be both individual and corporate tax cuts - and some sort of infrastructure program. I expect that something will happen with the ACA (those that have insurance for 2017 will keep their insurance, but they might not have insurance in 2018 - and that impact would be in 2018). I think the negative proposals (immigration, trade) will impact the economy in 2018 or later - overall there will be a small boost to GDP in 2017.

1) Renegotiate trade deals and / or impose tariffs.

2) Stricter enforcement and control on immigration, and the deportation of illegal immigrants.

3) Significant Infrastructure spending.

4) Tax cuts mostly for high income earners and corporations.

5) No changes to Social Security and Medicare.

6) Deregulation.

...

Most analysts think there will be fiscal stimulus in 2017 and 2018, with a combination of tax cuts and some increase in infrastructure spending. In general, analysts believe that any changes to trade agreements will take time, and that deportations will not increase significantly. The bottom line for analysts is that the portions of the program that will boost the economy in the short term will be enacted, and the portions that won't (trade deals, deportations) and changes to the ACA (Obamacare) will be delayed.

This is why analysts have been somewhat positive on the impact of the Trump economic proposals for 2017. However no one knows what will actually be proposed. What matters is the details.

...

Members of Mr. Trump's team have been talking about a $1 trillion infrastructure plan. However the infrastructure proposal is really a proposal for about $100+ billion in tax credits to spur private investment in infrastructure. The $1 trillion in infrastructure investment is the projected size of the private investment, not the proposed government spending. This proposal is actually very modest in terms of a fiscal boost. If this is a privatization scheme, then there might be a modest short term boost, but the long term impact will be negative."

A final comment: The words of a President matter. Mr Trump has been impulsive, reckless and irresponsible with his comments, and that has continued since the election. One absurd comment could send the markets into a tailspin and negatively impact the economy (and that could happen at any time).

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Preliminary January Consumer Sentiment at 98.1

by Calculated Risk on 1/13/2017 10:13:00 AM

The preliminary University of Michigan consumer sentiment index for January was at 98.1, down slightly from 98.2 in December.

Consumer confidence remained unchanged at the cyclical peak levels recorded in December. The Current Conditions Index rose 0.6 points to reach its highest level since 2004, and the Expectations Index fell 0.6 points which was lower than only the 2015 peak during the past dozen years. The post-election surge in optimism was accompanied by an unprecedented degree of both positive and negative concerns about the incoming administration spontaneously mentioned when asked about economic news. The importance of government policies and partisanship has sharply risen over the past half century. From 1960 to 2000, the combined average of positive and negative references to government policies was just 6%; during the past six years, this proportion averaged 20%, and rose to new peaks in early January, with positive and negative references totaling 44%. This extraordinary level of partisanship has had a dramatic impact on economic expectations. In early January, the partisan divide on the Expectations Index was a stunning 42.7 points (108.9 among those who favorably mentioned government policies, and 66.2 among those who made unfavorable references). Needless to say, these extreme differences would imply either strong growth or a recession. Since neither is likely, one would anticipate that both extreme views will be tempered in the months ahead.

emphasis added

Click on graph for larger image.

Consumer sentiment is a concurrent indicator (not a leading indicator). The survey shows some people are now much more positive than prior to the U.S. election - and others are much more negative.

Retail Sales increased 0.6% in December

by Calculated Risk on 1/13/2017 09:12:00 AM

On a monthly basis, retail sales increased 0.6 percent from November to December (seasonally adjusted), and sales were up 4.1 percent from December 2015.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for December 2016, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $469.1 billion, an increase of 0.6 percent from the previous month, and 4.1 percent above December 2015. Total sales for the 12 months of 2016 were up 3.3 percent from 2015. ... The October 2016 to November 2016 percent change was revised from up 0.1 percent to up 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in December.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.0% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 4.0% on a YoY basis.The increase in December was below expectations, however sales for October and November were revised up. A solid report.

Thursday, January 12, 2017

Friday: Retail Sales, PPI, Consumer Sentiment

by Calculated Risk on 1/12/2017 07:39:00 PM

From Matthew Graham at Mortgage News Daily: Mixed Bag For Mortgage Rates Amid Market Volatility

Mortgage rates were mixed today, depending on the lender.Friday:

...

4.125% is still the most prevalent conventional 30yr fixed rate on top tier scenarios, with today's losses seen in the form of higher upfront costs.

emphasis added

• At 8:30 AM ET, Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.

• At 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.6% increase in inventories.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 98.6, up from 98.2 in November.