by Calculated Risk on 10/26/2016 10:12:00 AM

Wednesday, October 26, 2016

New Home Sales at 593,000 Annual Rate in September

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 593 thousand.

The previous three months were revised down by a total of 85 thousand (SAAR).

"Sales of new single-family houses in September 2016 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.1 percent above the revised August rate of 575,000 and is 29.8 percent above the September 2015 estimate of 457,000. "

emphasis added

Click on graph for larger image.

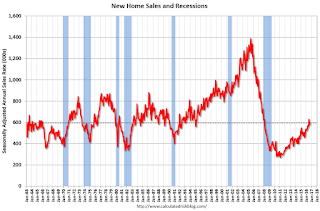

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

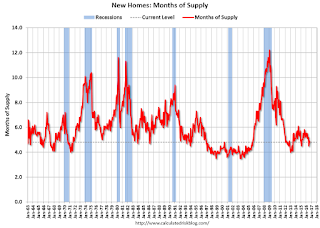

The second graph shows New Home Months of Supply.

The months of supply decreased in September to 4.8 months.

The months of supply decreased in September to 4.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 235,000. This represents a supply of 4.8 months at the current sales rate."

On inventory, according to the Census Bureau:

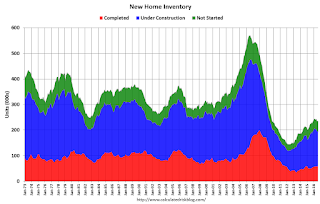

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2016 (red column), 50 thousand new homes were sold (NSA). Last year 35 thousand homes were sold in September.

The all time high for September was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was below expectations of 600,000 sales SAAR in September. I'll have more later today.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 10/26/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 21, 2016. The prior week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index decreased 2 percent from the previous week to its lowest level since June 2016. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier to its lowest level since January 2016. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.71 percent from 3.73 percent, with points increasing to 0.37 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

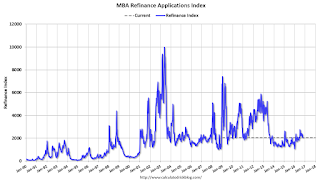

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased this year since rates declined, however, since rates are up a little recently, refinance activity has declined a little.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "9 percent higher than the same week one year ago".

Tuesday, October 25, 2016

Wednesday: New Home Sales

by Calculated Risk on 10/25/2016 07:27:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Stuck at Highs For Now

Mortgage Rates were unchanged in many cases today, with a handful of lenders inconsequentially better or worse versus yesterday's latest offerings [at 3.55% for 30 year fixed]. Despite moving lower on 4 out of the past 6 days, rates were never able to put meaningful distance between themselves and the highest levels in more than 4 months.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for a decrease in sales to 600 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 609 thousand in August.

Chemical Activity Barometer indicated Solid Growth in October

by Calculated Risk on 10/25/2016 02:31:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Enters Third Quarter with Strong Performance

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), notched another solid gain of 0.3 percent in October, following an upwardly revised gain of 0.4 percent in September. Accounting for adjustments, the CAB is up 4.2 percent over this time last year, a marked increase over earlier comparisons and the greatest year-over-year gain since August 2014. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.3 percent in October, following a 0.4 percent gain in September.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production over the next year.

Real Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/25/2016 11:55:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.3% year-over-year in August

The year-over-year increase in prices is mostly moving sideways now around 5%. In August, the index was up 5.3% YoY.

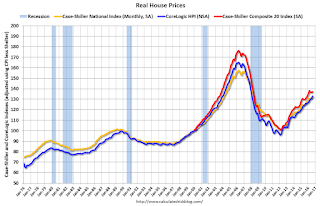

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being only 1.6% below the bubble peak (seasonally adjusted). However, in real terms, the National index is still about 16.2% below the bubble peak.

Nominal House Prices

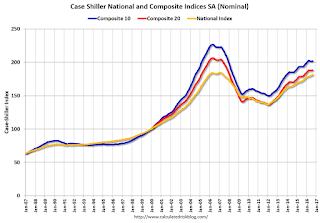

In nominal terms, the Case-Shiller National index (SA) is back to December 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

CPI less Shelter has declined over the last two years pushing up real house prices.

In real terms, the National index is back to February 2004 levels, the Composite 20 index is back to October 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.3% year-over-year in August

by Calculated Risk on 10/25/2016 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Continues in August According to the S&P CoreLogic Case-Shiller Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.3% annual gain in August, up from 5.0% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.1% the previous month. The 20-City Composite reported a year-over-year gain of 5.1%, up from 5.0% in July.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.5% in August. Both the 10-City Composite and the 20-City Composite posted a 0.4% increase in August. After seasonal adjustment, the National Index recorded a 0.6% month-over-month increase, and both the 10-City Composite and the 20-City Composite reported 0.2% month-over-month increases. After seasonal adjustment, 14 cities saw prices rise, two cities were unchanged, and four cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.9% from the peak, and up 0.2% in August (SA).

The Composite 20 index is off 8.9% from the peak, and up 0.2% (SA) in August.

The National index is off 1.6% from the peak (SA), and up 0.6% (SA) in August. The National index is up 33.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to August 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.3% year-over-year.

Note: According to the data, prices increased in 15 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Black Knight: Mortgage "Foreclosure Rate Falls to Nine-Year Low" in September

by Calculated Risk on 10/25/2016 07:01:00 AM

From Black Knight: Black Knight’s First Look at September Mortgage Data: Post-‘Brexit’ Prepay Activity Remains Strong; Foreclosure Rate Falls to Nine-Year Low

• Despite declining from August, September saw the third highest prepayment rate in three yearsAccording to Black Knight's First Look report for September, the percent of loans delinquent increased slightly in September compared to August, and declined 12.2% year-over-year.

• September’s less-than-one-percent seasonal increase in the delinquency rate was relatively mild by historical standards

• At one percent, the rate of all mortgages that are in active foreclosure fell to its lowest point in nine years

• Non-current mortgage rates continue to struggle in oil states, with Alaska and Wyoming seeing the largest increases over the past six months

The percent of loans in the foreclosure process declined 3.4% in September and were down 31.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.27% in September, up from 4.24% in August.

The percent of loans in the foreclosure process declined in September to 1.00%.

The number of delinquent properties, but not in foreclosure, is down 292,000 properties year-over-year, and the number of properties in the foreclosure process is down 228,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for September on November 7th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2016 | Aug 2016 | Sept 2015 | Sept 2014 | |

| Delinquent | 4.27% | 4.24% | 4.87% | 5.66% |

| In Foreclosure | 1.00% | 1.04% | 1.46% | 1.89% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,165,000 | 2,151,000 | 2,457,000 | 2,849,000 |

| Number of properties in foreclosure pre-sale inventory: | 509,000 | 527,000 | 737,000 | 951,000 |

| Total Properties | 2,674,000 | 2,678,000 | 3,194,000 | 3,800,000 |

Monday, October 24, 2016

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in September

by Calculated Risk on 10/24/2016 04:29:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in September.

On distressed: Total "distressed" share is down year-over-year in most of these markets.

Short sales and foreclosures are down in most of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | Sep- 2016 | Sep- 2015 | |

| Las Vegas | 4.6% | 6.8% | 6.0% | 7.1% | 10.6% | 13.9% | 26.5% | 26.8% |

| Reno** | 3.0% | 3.0% | 2.0% | 3.0% | 5.0% | 6.0% | ||

| Phoenix | 1.7% | 2.4% | 2.0% | 3.5% | 3.7% | 5.9% | 20.2% | 23.1% |

| Sacramento | 1.4% | 2.9% | 3.1% | 4.1% | 4.5% | 6.9% | 16.3% | 17.6% |

| Minneapolis | 1.1% | 1.9% | 4.3% | 6.6% | 5.4% | 8.5% | 12.8% | 12.5% |

| Mid-Atlantic | 3.1% | 3.9% | 8.9% | 11.1% | 11.9% | 14.9% | 16.5% | 17.5% |

| Florida SF | 2.3% | 3.5% | 7.8% | 16.0% | 10.1% | 19.4% | 28.0% | 34.1% |

| Florida C/TH | 1.6% | 2.1% | 7.0% | 14.3% | 8.6% | 16.4% | 55.8% | 59.7% |

| Miami MSA SF | 3.3% | 5.1% | 9.4% | 18.6% | 12.7% | 23.7% | 28.5% | 33.2% |

| Miami MSA CTH | 2.7% | 2.7% | 9.5% | 18.0% | 12.1% | 20.7% | 58.1% | 63.0% |

| Chicago (city) | 12.1% | 17.5% | ||||||

| Spokane | 7.8% | 7.8% | ||||||

| Northeast Florida | 12.9% | 23.4% | ||||||

| Orlando | 31.3% | 35.5% | ||||||

| Toledo | 28.0% | 26.5% | ||||||

| Tucson | 22.2% | 25.9% | ||||||

| Peoria | 20.5% | 22.3% | ||||||

| Georgia*** | 20.8% | 22.3% | ||||||

| Omaha | 15.5% | 18.1% | ||||||

| Pensacola | 29.1% | 31.4% | ||||||

| Rhode Island | 11.1% | 9.0% | ||||||

| Richmond VA | 8.7% | 10.5% | 18.4% | 15.2% | ||||

| Memphis | 8.8% | 13.1% | ||||||

| Springfield IL** | 9.7% | 10.3% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DOT: Vehicle Miles Driven increased 3.4% year-over-year in August

by Calculated Risk on 10/24/2016 01:37:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 3.4% (9.3 billion vehicle miles) for August 2016 as compared with August 2015.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 284.9 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for August 2016 is 268.6 billion miles, a 2.5% (6.5 billion vehicle miles) increase over August 2015. It also represents a 0.8% decrease (-2.2 billion vehicle miles) compared with July 2016.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January 2015.

The second graph shows the year-over-year change from the same month in the previous year. Miles driven are up 3.4% year-over-year.

In August 2016, gasoline averaged $2.28 per gallon according to the EIA. That was down from August 2015 when prices averaged $2.73 per gallon.

In August 2016, gasoline averaged $2.28 per gallon according to the EIA. That was down from August 2015 when prices averaged $2.73 per gallon.Gasoline prices aren't the only factor - demographics are also important. However, with lower gasoline prices, miles driven on a rolling 12 month basis, is setting a new high each month.

WSJ: "Retailers Rushed to Hire for Holidays"

by Calculated Risk on 10/24/2016 10:40:00 AM

From the Eric Morath at the WSJ: Retailers Rushed to Hire for Holidays, a Sign of Tight Labor Market

Retailers geared up to hire holiday-season workers in August this year, an unusually early start showing how competition has intensified for temporary help in a tight labor market.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Data from job-search site Indeed.com shows retailers, and the warehouse and logistics firms they compete with for seasonal labor, started searching for temporary workers a month earlier than in recent years. This suggests retailers and other firms “anticipate stronger consumer demand and expect that it will be harder to find the people they want to hire,” said Indeed economist Jed Kolko.

Last year, more than one in four retail workers hired in the fourth quarter of 2015 started their jobs in October, the highest share on records back to the 1930s.

Click on graph for larger image.

Click on graph for larger image.This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels.

Note that retailers have been hiring earlier with more seasonal hires in October (red).

Based on the information in the WSJ article, it appears seasonal hiring will be at record levels in October this year.