by Calculated Risk on 10/18/2016 09:04:00 PM

Tuesday, October 18, 2016

Wednesday: Housing Starts, Beige Book, 3rd Presidential Debate

From Tim Duy: Are Yellen and Fischer Really Worlds Apart?

Bottom Line: The key debate within the Fed at the moment centers around the need for preemptive rate hikes. The hawks prefer more preemption, the doves favor less. Federal Reserve Lael Brainard pulled the FOMC to the dovish camp, primarily through her influence at Constitution Ave. Yellen is probably somewhat more sympathetic to Brainard than Fischer, but as I said last week, Fischer has moved substantially in Brainard's direction. It is really the presidents that are on the hawkish side of the aisle. There just isn't that much space between Yellen and Fischer at the moment.Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September. Total housing starts decreased to 1.142 million (SAAR) in August. Single family starts decreased to 722 thousand SAAR in August. The consensus for 1.180 million, up from the August rate.

• During the day, The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• At 9:00 PM ET, the Third Presidential Debate, at University of Nevada, Las Vegas, Las Vegas, NV

FNC: Residential Property Values increased 5.7% year-over-year in August

by Calculated Risk on 10/18/2016 03:04:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.5% from July to August (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.6% (NSA), the 20-MSA RPI increased 0.5%, and the 30-MSA RPI also increased 0.5% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 9.6% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through August 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The August Case-Shiller index will be released on Tuesday, October 27th.

Key Measures Show Inflation close to 2% in September

by Calculated Risk on 10/18/2016 11:13:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in September. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here. Motor fuel was up 94% annualized in September!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.6% annualized rate) in September. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy also rose 2.2%. Core PCE is for August and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 2.1% annualized, and core CPI was at 1.4% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are at or above the Fed's target (Core PCE is still below).

NAHB: Builder Confidence at 63 in October

by Calculated Risk on 10/18/2016 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 63 in October, down from 65 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Remains Solid in Octobe

Builder confidence in the market for newly constructed single-family homes remained on firm ground in October, down two points to a level of 63 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

...

“The October reading represents a mild pullback from a jump in September, and indicates that the housing market continues to make slow and steady gains,” said NAHB Chief Economist Robert Dietz. “Moreover, mortgage rates remain low and the HMI index measuring future sales expectations has been over 70 for the past two months. These factors will sustain continued growth in the single-family market in the months ahead.”

...

Two of the three HMI components posted losses in October. The component gauging current sales conditions dropped two points to 69 and the index charting buyer traffic fell one point to 46. Meanwhile, the index measuring sales expectations in the next six months rose one point to 72.

Looking at the three-month moving averages for regional HMI scores, the West increased two points to 75 while the Northeast, Midwest and South each posted one-point gains to 43, 56 and 65, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast of 63, and is another solid reading.

Cost of Living Adjustment increases 0.3% in 2017, Contribution Base increased to $127,200

by Calculated Risk on 10/18/2016 09:47:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2017.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (0.3% increase) and a list of previous Cost-of-Living Adjustments. Note: this is not the headline CPI-U.

The latest COLA is 0.3 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 0.3 percent beginning with the December 2016 benefits, which are payable in January 2017.The contribution and benefit base will be $127,200 in 2017.

The National Average Wage Index increased to $48,098.63 in 2015, up 3.48% from $46,481.52 in 2014 (used to calculate contribution base).

CPI increased 0.3% in September

by Calculated Risk on 10/18/2016 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.5 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.3% increase for CPI, and below the forecast of a 0.2% increase in core CPI.

Increases in the shelter and gasoline indexes were the main causes of the rise in the all items index. The gasoline index rose 5.8 percent in September and accounted for more than half of the all items increase. The shelter index increased 0.4 percent, its largest increase since May.

The energy index increased 2.9 percent, its largest advance since April. Along with the gasoline index, other energy component indexes also rose. The index for food, in contrast, was unchanged for the third consecutive month, as the food at home index continued to decline.

The index for all items less food and energy rose 0.1 percent in September after a 0.3-percent increase in August. ... The index for all items less food and energy rose 2.2 percent for the 12 months ending September.

emphasis added

Monday, October 17, 2016

Tuesday: CPI, Homebuilder Confidence

by Calculated Risk on 10/17/2016 08:57:00 PM

Along with CPI, the BLS will release CPI-W, the Cost-Of-Living Adjustment (COLA) for 2017, the contribution base, and the National Average Wage Index. I expect COLA to be slightly positive, and for a fairly significant increase in the contribution base.

Tuesday:

• At 8:30 AM ET, the Consumer Price Index for September from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, the October NAHB homebuilder survey. The consensus is for a reading of 63, down from 65 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/17/2016 05:20:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.55 million in September, up 4.1% from August’s preliminary pace and up 2.0% from last September’s seasonally-adjusted pace.

Local realtor/MLS data also suggest that existing home listings in aggregate declined slightly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of August will be 1.99 million, down by about 2.5% from August’s preliminary estimate and down 9.1% from last September. Finally, I project that the NAR’s estimate of the median single-family existing home sales price for September will be $236,700, up 6.0% from last September.

Some readers will probably remember that my forecast for existing home sales for August – SAAR of 5.49 million, was both above consensus and above the NAR’s preliminary estimate (SAAR of 5.33 million). I attributed my miss partly to a misread of likely seasonal factors, and partly to the fact that my “early sample” proved not to be a good reflection of the entire market. Few probably recall, however, that my forecast for last August’s existing home sales number was similarly too high, and I also attributed that miss to the same factor’s as this August’s mix. My projection for September’s EHS, which I posted on October 16, 2015 (SAAR of 5.56 million) was almost spot on (the NAR’s preliminary EHS estimate was 5.55 million).

Sometimes it’s a good idea to review your own history!

CR Note: The NAR is scheduled to release September existing home sales on Thursday, October 20th. The consensus is for 5.35 million SAAR in September.

Hotels: Occupancy Rate on Track to be 2nd Best Year

by Calculated Risk on 10/17/2016 01:27:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 8 October

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 2-8 October 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy decreased 1.0% to 70.9%. However, average daily rate (ADR) was up 1.8% to US$127.88, and revenue per available room (RevPAR) increased 0.8% to US$90.67. STR analysts note that overall performance for the week was affected by the Rosh Hashanah calendar shift from 14 September 2015 to 3 October 2016. Performance in the Group segment was down in most major markets.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Year-to-date, the three best years are:

1) 2015: 67.6% average occupancy.

2) 2016: 67.4% average.

3) 2000: 67.0% average.

For hotels, this is now the Fall business travel season that will continue for another month or so - and then the occupancy rate will decline into the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com

Fed: Industrial Production increased 0.1% in September

by Calculated Risk on 10/17/2016 09:22:00 AM

From the Fed: Industrial production and Capacity Utilization

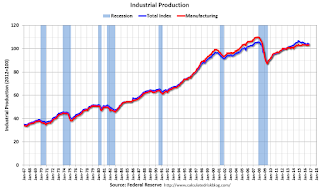

Industrial production edged up 0.1 percent in September after falling 0.5 percent in August. For the third quarter as a whole, industrial production rose at an annual rate of 1.8 percent for its first quarterly increase since the third quarter of 2015. Manufacturing output increased 0.2 percent in September and moved up at an annual rate of 0.9 percent in the third quarter. In September, the index for utilities declined 1.0 percent; mining posted a gain of 0.4 percent, which partially reversed its August decline. At 104.2 percent of its 2012 average, total industrial production in September was 1.0 percent lower than its year-earlier level. Capacity utilization for the industrial sector edged up 0.1 percentage point in September to 75.4 percent, a rate that is 4.6 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.4% is 4.6% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.1% in September to 104.1. This is 19.2% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.2% increase.