by Calculated Risk on 10/04/2016 09:47:00 AM

Tuesday, October 04, 2016

CoreLogic: House Prices up 6.2% Year-over-year in August

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.2 Percent Year Over Year in August 2016

Home prices nationwide, including distressed sales, increased year over year by 6.2 percent in August 2016 compared with August 2015 and increased month over month by 1.1 percent in August 2016 compared with July 2016, according to the CoreLogic HPI.

...

“Home prices are now just 6 percent below the nominal peak reached in April 2006,” said Dr. Frank Nothaft, chief economist for CoreLogic. “With prices forecasted to increase by 5 percent over the next year, prices will be back to their peak level in 2017.”

“Housing values continue to rise briskly on stronger fundamental and investor-fueled demand, as well as lack of adequate supply,” said Anand Nallathambi, president and CEO of CoreLogic. “This continued price appreciation is contributing to a growing affordability crisis in many markets around the country.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in August (NSA), and is up 6.2% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 6.0% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty five consecutive months since turning positive year-over-year in February 2012.

Monday, October 03, 2016

U.S. Light Vehicle Sales increase to 17.7 million annual rate in September

by Calculated Risk on 10/03/2016 05:46:00 PM

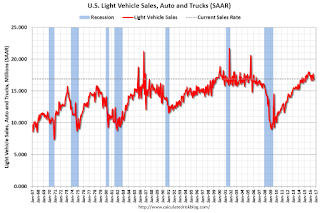

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.65 million SAAR in September.

That is down about 2% from September 2015, and up 4.3% from the 16.92 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 17.65 million SAAR from WardsAuto).

This was above the consensus forecast of 17.4 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first nine months - are up slightly from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now moving mostly sideways ...

Construction Spending declined in August

by Calculated Risk on 10/03/2016 01:01:00 PM

Earlier today, the Census Bureau reported that overall construction spending declined in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2016 was estimated at a seasonally adjusted annual rate of $1,142.2 billion, 0.7 percent below the revised July estimate of $1,150.6 billion. The August figure is 0.3 percent below the August 2015 estimate of $1,145.2 billion.Private spending and public spending decreased in August:

Spending on private construction was at a seasonally adjusted annual rate of $871.6 billion, 0.3 percent below the revised July estimate of $874.6 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $270.5 billion, 2.0 percent below the revised July estimate of $276.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential and public spending have slumped a little recently.

Private residential spending has been generally increasing, but is 34% below the bubble peak.

Non-residential spending is now 2.0% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 17% below the peak in March 2009, and only 3% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 1%. Non-residential spending is up 4% year-over-year. Public spending is down 9% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still fairly low, non-residential is increasing - although there has been a recent decline in public spending.

This was well below the consensus forecast of a 0.3% increase for August.

Reis: Office Vacancy Rate unchanged in Q3 at 16.0%

by Calculated Risk on 10/03/2016 11:31:00 AM

Reis released their Q3 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.0% in Q3, unchanged from 16.0% in Q2. This is down from 16.4% in Q3 2015, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate was unchanged in the third quarter at 16.0%. It had fallen for the eight previous quarters. While one quarter does not make for a trend, the year's overall performance has been lackluster. Vacancy has fallen only 20 basis points year to date, in 2015 the vacancy rate fell 40 basis points. ...

For the third consecutive quarter, the absolute levels of construction and absorption declined. While any pullback in a given quarter should not be viewed with alarm, the second consecutive quarterly deceleration was a bit surprising, particularly on the demand side. Once again, new supply exceeded net absorption this quarter which was unexpected. Only conversion activity prevented the national vacancy rate from increasing during the quarter. Net absorption had been outpacing new construction so consistently over the last two years that this second quarter of a reverse in this trend – new supply exceeding net absorption – was somewhat concerning.

...

Both asking and effective rents growth decelerated to 0.3% and 0.4%, respectively from 0.6% growth (for both) in the previous quarter, the twenty-third consecutive quarter of asking and effective rent growth. The 12-month changes for asking and effective rent growth both also slowed slightly versus the figures from the last two quarters.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.0% in Q3. The office vacancy rate is remains elevated.

Office vacancy data courtesy of Reis.

ISM Manufacturing index increased to 51.5 in September

by Calculated Risk on 10/03/2016 10:03:00 AM

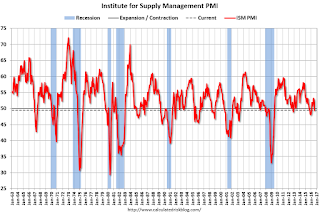

The ISM manufacturing index indicated expansion in September. The PMI was at 51.5% in August, up from 49.4% in August. The employment index was at 49.7%, up from 48.3% in August, and the new orders index was at 55.1%, up from 49.1% in August.

From the Institute for Supply Management: September 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in September following one month of contraction in August, and the overall economy grew for the 88th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The September PMI® registered 51.5 percent, an increase of 2.1 percentage points from the August reading of 49.4 percent. The New Orders Index registered 55.1 percent, an increase of 6 percentage points from the August reading of 49.1 percent. The Production Index registered 52.8 percent, 3.2 percentage points higher than the August reading of 49.6 percent. The Employment Index registered 49.7 percent, an increase of 1.4 percentage points from the August reading of 48.3 percent. Inventories of raw materials registered 49.5 percent, an increase of 0.5 percentage point from the August reading of 49 percent. The Prices Index registered 53 percent in September, the same reading as in August, indicating higher raw materials prices for the seventh consecutive month. Manufacturing expanded in September following one month of contraction in August, with nine of the 18 industries reporting an increase in new orders in September (up from six in August), and 10 of the 18 industries reporting an increase in production in September (up from eight in August)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.2%, and suggests manufacturing expanded in September.

Black Knight August Mortgage Monitor: "Purchase Lending Highest Since 2007"

by Calculated Risk on 10/03/2016 08:00:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for August today. According to BKFS, 4.24% of mortgages were delinquent in August, down from 4.87% in August 2015. BKFS also reported that 1.04% of mortgages were in the foreclosure process, down from 1.48% a year ago.

This gives a total of 5.28% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: 42 Percent of Q2 2016 Refinances Were Cash-Out Transactions, Largest Quarterly Sum of Equity Tapped Since 2009

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of August 2016. This month, Black Knight took a close look at mortgage refinance activity through the first half of 2016. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, borrowers are continuing the trend of drawing upon growing equity in their homes, though at nowhere near the levels at which they had pre-crisis.

“The roughly 350,000 cash-out refinances in Q2 2016 accounted for 42 percent of all refinances in the quarter, and marked the ninth consecutive quarterly increase in cash-out lending, not only by count, but also by the amount of equity tapped,” said Graboske. “At $22.6 billion, that works out to approximately $65,000 in equity tapped per borrower. While that per-borrower number is slightly down from Q1 2016 – but $6,000 higher than one year ago – the $22.6 billion total is the largest equity sum tapped since Q2 2009. Just to put that into perspective, though, it’s still a nearly 80 percent lower equity draw than at the peak in Q3 2005. And, given that we saw over $550 billion in tappable equity growth last year alone, this equates to borrowers only tapping into 15 percent of the growth in equity over the past 12 months, without even touching the $4.5 trillion balance in tappable equity available. All in all, it’s clear that cash-outs are helping to prop up the refinance market – their 42 percent share is up from only 30 percent in early 2015 when interest rates had also dropped. What’s more, refi volumes are down from 2015 – at least through the second quarter – but while overall they’re down nine percent from Q1 2015, rate/term refinances are actually down 25 percent over that same period.

“Today’s cash-out refinance borrowers continue to present a relatively low risk profile, historically speaking,” Graboske continued. “The average credit score of 748 among Q2 2016 cash-out refinance borrowers is 67 points higher than that of the low point recorded in Q3 2006, and is in fact nearly 60 points higher than the overall average credit score from 2005 through 2007. In addition, post-cash-out loan-to-value ratios remain low. At 66 percent, it’s slightly higher than in Q1 2016, but it’s the second lowest quarterly average recorded in over 11 years. This is nearly six percent below the 2005-2007 average and 10 percent below the highs recorded in late 2008. In addition, while not specific to cash-out refinancing, we continue to see prudent behavior on the part of borrowers. Some 40 percent of Q2 2016 rate/term refinances involved the borrower reducing their loan term, the highest share of term reductions since late 2013/early 2014.”

This month, Black Knight also found that the remaining inventory of loans in active foreclosure is declining at the fastest rate since 2014, and the rate of reduction has been accelerating throughout 2016.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows first lien Cash-out Refinances.

From Black Knight:

• The roughly 350,000 cashout refinances in Q2 2016 accounted for 42 percent of all refinances in the quarter, and marked the ninth consecutive quarterly increase in cash-out lending in terms of both count and amount of equity tapped

• Cash-outs are helping to prop up the refinance market: their 42 percent share is up from only 30 percent in early 2015 as interest rates dropped; though overall refi volumes are down nine percent from Q1 2015, rate/term refinances are actually down 25 percent

• The $22.6 billion tapped via cash-out refinances in Q2 is the largest equity sum tapped since Q2 2009; that’s still nearly an 80 percent lower equity draw than at the peak in Q3 2005

• This works out to approximately $65,000 in equity tapped per borrower, which is down slightly from Q1 but $6,000 higher than one year ago

The second graph shows the credit scores and Loan-to-value (LTV) for cash-out refinance activity. From Black Knight:

The second graph shows the credit scores and Loan-to-value (LTV) for cash-out refinance activity. From Black Knight:

• Historically speaking, today’s cash-out refinance borrowers continue to present a relatively low risk profileCash-out refinance activity is picking up, but the level is still fairly low - and the quality of the loans (and LTV) is good. There is much more in the mortgage monitor.

• The average credit score of 748 among Q2 cash-out refinance borrowers is 67 points higher than that of the low point recorded in Q3 of 2006, and is nearly 60 points higher than the overall average credit score from 2005 through 2007

• Post-cash-out average loan-to-value ratios (LTVs) remain low at 66 percent; this is slightly higher than in Q1, but is the second lowest quarterly average recorded in over 11 years - nearly six percent below the 2005-2007 average and 10 percent below the highs recorded in late 2008

Sunday, October 02, 2016

Monday: ISM Mfg, Construction Spending, Auto Sales

by Calculated Risk on 10/02/2016 07:35:00 PM

Weekend:

• Schedule for Week of Oct 2, 2016

Monday:

• Early, Reis Q3 2016 Office Survey of rents and vacancy rates.

• At 10:00 AM, ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.2, up from 49.4 in August. The employment index was at 48.3%, and the new orders index was at 49.1%.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.3% increase in construction spending.

• All Day, Light vehicle sales for September. The consensus is for light vehicle sales to increase to 17.4 million SAAR in September, from 16.9 million in August (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $47.88 per barrel and Brent at $50.19 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so oil prices are UP year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.22 per gallon (down less than $0.10 per gallon from a year ago).

SNL on The Debate

by Calculated Risk on 10/02/2016 01:19:00 PM

First, here are a few serious articles about the Trump meltdown:

From the NY Times: Donald Trump Tax Records Show He Could Have Avoided Taxes for Nearly Two Decades, The Times Found

Donald J. Trump declared a $916 million loss on his 1995 income tax returns, a tax deduction so substantial it could have allowed him to legally avoid paying any federal income taxes for up to 18 years, records obtained by The New York Times show.From the WaPo: Trump Foundation lacks the certification required for charities that solicit money (A major story).

From Newsweek: How Donald Trump's Company Violated the United States Embargo Against Cuba

From the Financial Times: Donald Trump’s problem with impulse control

Even if he were able to exercise self-control, it will be hard for wavering voters to lose the impression that he is an unhinged egotist who cares more about women’s figures, say, than US national security. Or worse, that he does not know the difference.Here is the link to the SNL video if it doesn't appear below:

Saturday, October 01, 2016

September 2016: Unofficial Problem Bank list declines to 177 Institutions, Q3 2016 Transition Matrix

by Calculated Risk on 10/01/2016 04:58:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for September 2016. During the month, the list fell from 184 institutions to 177 after eight removals and one addition. Assets dropped by $1.1 billion to an aggregate $55.4 billion. A year ago, the list held 276 institutions with assets of $82.0 billion.

This month, actions have been terminated against Frontier State Bank, Oklahoma City, OK ($661 million); Peoples State Bank of Commerce, Nolensville, TN ($152 million); North Georgia National Bank, Calhoun, GA ($119 million); Anchor Commercial Bank, Juno Beach, FL ($105 million); State Bank of Taunton, Taunton, MN ($50 million); and Mainstreet Bank, Ashland, MO ($44 million).

Allied Bank, Mulberry, AR ($66 million) failed on September 23rd and, in an infrequent event, Fidelity National Bank, Medford, WI closed through a voluntary liquidation on September 1st.

The addition this month was First Trust & Savings Bank of Albany, Illinois, Albany, IL ($222 million).

With it being the end of the third quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,713 institutions have appeared on a weekly or monthly list at some point. Only 10.3 percent of the banks that have appeared on the list remain today. In all, there have been 1,536 institutions that have transitioned through the list. Departure methods include 875 action terminations, 400 failures, 245 mergers, and 16 voluntary liquidations. Of the 389 institutions on the first published list, 20 or 5.1 percent still remain more than seven years later. The 400 failures represent 23.4 percent of the 1,713 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 169 | (63,786,937) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (1,465,675) | ||

| Still on List at 9/30/2016 | 20 | 5,962,376 | |

| Additions after 8/7/2009 | 157 | 49,503,834 | |

| End (9/30//2016) | 177 | 55,466,210 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 706 | 284,256,499 | |

| Unassisted Merger | 206 | 80,490,602 | |

| Voluntary Liquidation | 12 | 2,474,477 | |

| Failures | 243 | 119,858,467 | |

| Total | 1,167 | 487,080,045 | |

| 1Institution not on 8/7/2009 or 9/30/2016 list but appeared on a weekly list. | |||

Schedule for Week of Oct 2, 2016

by Calculated Risk on 10/01/2016 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing and non-manufacturing indexes, September auto sales, and the August trade deficit.

Also the quarterly Reis surveys for office, apartment and malls will be released this week.

A key focus will be on the second Presidential debate on Sunday, Oct 9th.

Early: Reis Q3 2016 Office Survey of rents and vacancy rates.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.2, up from 49.4 in August.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.2, up from 49.4 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction at 49.4 in August. The employment index was at 48.3%, and the new orders index was at 49.1%.

10:00 AM: Construction Spending for August. The consensus is for a 0.3% increase in construction spending.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to increase to 17.4 million SAAR in September, from 16.9 million in August (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for September. The consensus is for light vehicle sales to increase to 17.4 million SAAR in September, from 16.9 million in August (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

Early: Reis Q3 2016 Apartment Survey of rents and vacancy rates.

At 9:00 PM ET, the Vice Presidential Debate, at Longwood University in Farmville, Virginia

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in September, down from 177,000 added in August.

Early: Reis Q3 2016 Mall Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $39.0 billion in August from $39.5 billion in July.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is a 0.2% decrease in orders.

10:00 AM: the ISM non-Manufacturing Index for September. The consensus is for index to increase to 52.9 from 51.4 in August.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 256 thousand initial claims, up from 254 thousand the previous week.

8:30 AM: Employment Report for September. The consensus is for an increase of 168,000 non-farm payroll jobs added in September, up from the 151,000 non-farm payroll jobs added in August.

The consensus is for the unemployment rate to decline to 4.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was 2.45 million jobs.

A key will be the change in wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $16.8 billion increase in credit.

At 9:00 PM ET, the Second Presidential Debate, at Washington University in St. Louis, St. Louis, MO