by Calculated Risk on 9/23/2016 10:50:00 AM

Friday, September 23, 2016

Unemployment and Wages: "A Dirty Little Secret"

I'm reminded of a post I wrote in May 2011: Employment: A dirty little secret

[I]t really isn't much of a secret that Wall Street and corporate America like the unemployment rate to be a little high. But it is "dirty" in the sense that it is unspoken. Higher unemployment keeps wage growth down, and helps with margins and earnings - and higher unemployment also keeps the Fed on the sidelines. Yes, corporations like to see job growth, so people have enough confidence to spend (and they can have a few more customers). And they definitely don't want to see Depression era unemployment - but a slowly declining unemployment rate (even at 9%) with some job growth is considered OK.And from others, like Kash Mansori, also in 2011: Why a Bad Job Market is Good News for Some

[T]his opens up an interesting line of reasoning, one that is certainly not new but which this data reminds us of. If a bad labor market means that workers get a smaller share of the productivity they bring to their employers, then the owners of companies will have a strong preference for a weak labor market. Firms don't like recessions, of course -- it's hard to make money when your sales are falling. But companies do enjoy the way that a very slow recovery in the job market can allow them to keep wages down, and thus keep a larger share of the output of their workers for themselves.And from Paul Krugman in 2013: The Plight of the Employed

And may I suggest that employers, although they’ll never say so in public, like this situation? That is, there’s a significant upside to them from the still-weak economy. I don’t think I’d go so far as to say that there’s a deliberate effort to keep the economy weak; but corporate America certainly isn’t feeling much pain, and the plight of workers is actually a plus from their point of view.The good news is that the unemployment rate has finally declined enough that are seeing a pickup in wage growth.

This graph is from the Atlanta Fed Wage Growth Tracker and shows year-over-year wage growth for job switchers and job stayers:

The Atlanta Fed's Wage Growth Tracker is a measure of the wage growth of individuals. It is constructed using microdata from the Current Population Survey (CPS), and is the median percent change in the hourly wage of individuals observed 12 months apart.This measure is indicating a pickup in wages - especially over the last year or two - and especially for job switchers.

Different policies (more infrastructure spending in 2011, no immediate pivot to austerity) would have boosted employment, and wages would have increased sooner.

Lawler: Table of Distressed Sales and All Cash Sales for Selected Cities in August

by Calculated Risk on 9/23/2016 08:21:00 AM

Economist Tom Lawler sent me the table below of short sales, foreclosures and all cash sales for selected cities in August.

On distressed: Total "distressed" share is down year-over-year in all of these markets.

Short sales and foreclosures are down in all of these areas (except a minor increase in Springfield).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors continue to pull back, the share of all cash buyers continues to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | Aug- 2016 | Aug- 2015 | |

| Las Vegas | 4.1% | 6.2% | 5.5% | 7.0% | 9.6% | 13.2% | 25.8% | 28.2% |

| Phoenix | 2.1% | 2.7% | 2.3% | 3.4% | 4.4% | 6.1% | 20.3% | 22.6% |

| Sacramento | 2.9% | 4.3% | 2.9% | 3.8% | 5.8% | 8.0% | 15.3% | 18.8% |

| Minneapolis | 1.1% | 1.7% | 3.8% | 6.1% | 4.9% | 7.8% | 12.1% | 11.7% |

| Mid-Atlantic | 2.8% | 3.2% | 8.6% | 10.5% | 11.4% | 13.7% | 16.7% | 16.5% |

| Florida SF | 2.1% | 3.5% | 8.0% | 16.6% | 10.1% | 20.2% | 27.3% | 33.6% |

| Florida C/TH | 1.4% | 2.3% | 7.3% | 15.3% | 8.6% | 17.6% | 55.0% | 59.7% |

| Miami MSA SF | 2.9% | 5.9% | 9.5% | 17.9% | 12.4% | 23.8% | 26.5% | 32.0% |

| Miami MSA C/TH | 1.7% | 3.0% | 10.0% | 19.2% | 11.7% | 22.2% | 56.1% | 62.9% |

| Chicago (city) | 12.4% | 15.0% | ||||||

| Northeast Florida | 14.2% | 25.8% | ||||||

| Rhode Island | 8.0% | 10.1% | ||||||

| Spokane | 6.1% | 10.0% | ||||||

| Toledo | 24.9% | 30.3% | ||||||

| Tucson | 20.9% | 25.8% | ||||||

| Knoxville | 22.5% | 23.4% | ||||||

| Peoria | 20.2% | 17.2% | ||||||

| Georgia*** | 19.8% | 21.9% | ||||||

| Omaha | 15.2% | 16.9% | ||||||

| Pensacola | 24.3% | 30.6% | ||||||

| Richmond VA | 6.9% | 9.3% | 16.0% | 16.0% | ||||

| Memphis | 8.6% | 12.2% | ||||||

| Springfield IL** | 6.8% | 6.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Thursday, September 22, 2016

Lawler on August Existing Home Sales

by Calculated Risk on 9/22/2016 06:49:00 PM

From housing economist Tom Lawler:

In a report released this morning, the National Association of Realtors estimated that US existing home sales ran a seasonally adjusted annual rate of 5.33 million, down 0.9% from July’s downwardly revised (to 5.38 million from 5.39 million) pace and up 0.8% from last August’s seasonally adjusted pace. The NAR’s estimate was well below my above-consensus projection from last week (5.49 million) based on then-available local realtor/MLS reports.

My unusually large “miss” was partly attributable to an under-estimate of the “gap” between the growth in unadjusted home sales compared to seasonally adjusted sales. According to NAR estimates, the YOY growth in unadjusted home sales last month was7.3%, or 6.5 percentage points higher than the YOY increase in seasonally adjusted sales. I had assumed a “gap” of 4.7 percentage points. (This August had two more business days than last August).

In addition, local realtor/MLS reports released since last week (including quite a few released today) showed somewhat lower home sales than I had been assuming for those areas. And finally, even after incorporating local realtor/MLS reports released through today, my “tracking” suggests somewhat faster YOY growth in home sales than that shown by the NAR.

I apologize for my miss this month.

On the inventory front, the NAR estimated that the inventory of existing homes for sale at the end of August totaled 2.04 million, down 3.3% from July and down 10.1% from last August.

Finally, the NAR estimated that the median existing SF home sales price last month was $242.200, up 5.3% from last August.

| YOY % Change, Existing Home Sales (NAR Estimate) | ||

|---|---|---|

| Not Seasonally Adjusted | Seasonally Adjusted | |

| July | -6.9% | -1.8% |

| Aug | 7.3% | 0.8% |

| July-August Average | -0.1% | -0.6% |

FHFA: House Price Index Up 0.5 Percent in July

by Calculated Risk on 9/22/2016 03:56:00 PM

Earlier from the FHFA: FHFA House Price Index Up 0.5 Percent in July 2016

U.S. house prices rose in July, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.2 percent increase in June was revised upward to reflect a 0.3 percent increase.Most of the other indexes are also showing mid-single digit year-over-year gains.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From July 2015 to July 2016, house prices were up 5.8 percent.

emphasis added

Kansas City Fed: Regional Manufacturing Activity "Rebounded Moderately" in September

by Calculated Risk on 9/22/2016 02:15:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Rebounded Moderately

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity increased moderately.The Kansas City region was hit hard by the decline in oil prices, and activity may now be stabilizing.

“For the second time in four months we had a positive reading on our composite index,” said Wilkerson. “This followed 15 straight months of contraction and suggests regional factory activity may be stabilizing.”

...

The month-over-month composite index was 6 in September, up from -4 in August and -6 in July ... The production, shipments, and capital spending indexes were moderately higher, while the employment and order backlog indexes were unchanged. ...

emphasis added

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/22/2016 11:15:00 AM

Earlier: Existing Home Sales decreased in August to 5.33 million SAAR

Inventory remains a key issue. Here is repeat of two paragraphs I wrote about inventory a few months ago:

I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 10.1% year-over-year in August). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

A key point: Some areas are seeing more inventory. For example, there is more inventory in some coastal areas of California, in New York city and for high rise condos in Miami.

Another key point: I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in August (red column) were the highest for August since 2006 (NSA).

Note that sales NSA were strong in August (up 7.3% from August 2015, and up 5.5% from last month), but there were more selling days this year - so the seasonally adjusted number was lower than last month.

Existing Home Sales decreased in August to 5.33 million SAAR

by Calculated Risk on 9/22/2016 10:11:00 AM

Update: Headline typo fixed.

From the NAR: Existing-Home Sales Soften Further in August

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 0.9 percent to a seasonally adjusted annual rate of 5.33 million in August from a downwardly revised 5.38 million in July. After last month's decline, sales are at their second-lowest pace of 2016, but are still slightly higher (0.8 percent) than a year ago (5.29 million). ...

Total housing inventory at the end of August fell 3.3 percent to 2.04 million existing homes available for sale, and is now 10.1 percent lower than a year ago (2.27 million) and has declined year-over-year for 15 straight months. Unsold inventory is at a 4.6-month supply at the current sales pace, which is down from 4.7 months in July.

Click on graph for larger image.

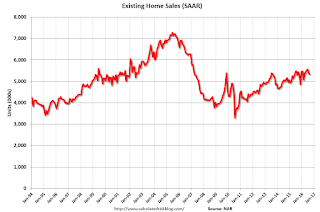

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.33 million SAAR) were 0.9% lower than last month, and were 0.8% above the August 2015 rate.

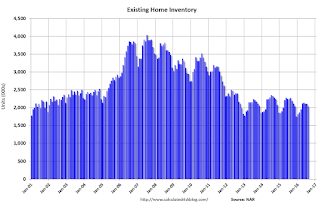

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.04 million in August from 2.11 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.04 million in August from 2.11 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 10.1% year-over-year in August compared to August 2015.

Inventory decreased 10.1% year-over-year in August compared to August 2015. Months of supply was at 4.6 months in August.

This was below consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims decreased to 252,000

by Calculated Risk on 9/22/2016 08:34:00 AM

The DOL reported:

In the week ending September 17, the advance figure for seasonally adjusted initial claims was 252,000, a decrease of 8,000 from the previous week's unrevised level of 260,000. The 4-week moving average was 258,500, a decrease of 2,250 from the previous week's unrevised average of 260,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 81 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 258,500.

This was lower than the consensus forecast of 261,000. The low level of claims suggests relatively few layoffs.

Black Knight: Mortgage Delinquencies declined in August

by Calculated Risk on 9/22/2016 07:00:00 AM

From Black Knight: Black Knight’s First Look at August 2016 Mortgage Data: Prepayments Skyrocket, Fueled by Post-‘Brexit’ Activity, Hit Highest Single-Month Rate in Over Three Years

• Monthly prepayment rate (historically a good indicator of refinance activity) increased by 32 percent month-over-monthNote: the "spike" in delinquencies in July was seasonal.

• August’s prepayment rate of 1.67 percent is the highest Single Month Mortality (SMM) rate in over three years

• Delinquencies fully recovered from July’s spike, falling 6 percent (-135,000) from one month ago

• Inventory of loans in foreclosure has now declined for 19 consecutive months -- and 51 of the past 52 months

According to Black Knight's First Look report for August, the percent of loans delinquent decreased 6.0% in August compared to July, and declined 11.4% year-over-year.

The percent of loans in the foreclosure process declined 4.3% in August and were down 29.9% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.24% in August, down from 4.51% in July.

The percent of loans in the foreclosure process declined in August to 1.04%.

The number of delinquent properties, but not in foreclosure, is down 262,000 properties year-over-year, and the number of properties in the foreclosure process is down 221,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for August on October 3rd.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2016 | July 2016 | Aug 2015 | Aug 2014 | |

| Delinquent | 4.24% | 4.51% | 4.87% | 5.93% |

| In Foreclosure | 1.04% | 1.09% | 1.48% | 1.92% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,151,000 | 2,286,000 | 2,413,000 | 2,985,000 |

| Number of properties in foreclosure pre-sale inventory: | 527,000 | 550,000 | 748,000 | 970,000 |

| Total Properties | 2,678,000 | 2,836,000 | 3,161,000 | 3,955,000 |

Wednesday, September 21, 2016

Merrill: "Fed signals December hike"

by Calculated Risk on 9/21/2016 06:46:00 PM

This is now the consensus view - one rate hike in 2016, most likely in December (but the November meeting is "live") ... From Merrill Lynch: Fed signals December hike

The FOMC clearly signaled a hike before the end of the year in both the language and the dots. The Fed made two important changes to the statement. First, the committee noted that near-term risks to the economic outlook “appear roughly balanced”. This is an important step for the Fed to justify hiking rates at an upcoming meeting and is a page out of the playbook from last year. ...Thursday:

Second, the FOMC noted that “the Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of further progress toward its objectives.” This is a strong signal that the Fed is planning to hike in an upcoming meeting. It is not explicit calendar guidance, but it is a small step in that direction.

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 261 thousand initial claims, up from 260 thousand the previous week.

• Also at 8:30 AM, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for July 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.44 million SAAR, up from 5.39 million in July. Housing economist Tom Lawler expects the NAR to report sales of 5.49 million SAAR in August, up 1.9% from July’s preliminary pace.