by Calculated Risk on 7/28/2016 11:21:00 AM

Thursday, July 28, 2016

Kansas City Fed: Regional Manufacturing Activity "Declined Modestly" in July

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Modestly

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined modestly.This was the last of the regional Fed surveys for July.

“Factories in our region reported a slight pullback in July following modest expansion in June,” said Wilkerson. “However, their expectations for future activity continued to increase.”

...

The month-over-month composite index was -6 in July, down from 2 in June and -5 in May ... The employment index inched down to -5 ...

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

It seems likely the ISM manufacturing index will show expansion again in July.

HVS: Q2 2016 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2016 10:10:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2016.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.1% in Q2, from 63.5% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and the Reis survey is showing rental vacancy rates have started to increase.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom.

Weekly Initial Unemployment Claims increased to 264,000

by Calculated Risk on 7/28/2016 08:35:00 AM

The DOL reported:

In the week ending July 23, the advance figure for seasonally adjusted initial claims was 266,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 253,000 to 252,000. The 4-week moving average was 256,500, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised down by 250 from 257,750 to 257,500.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 73 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 256,500.

This was close to the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, July 27, 2016

Thursday: Unemployment Claims

by Calculated Risk on 7/27/2016 07:13:00 PM

Based on the FOMC statement, the likelihood of a rate hike in September (or November or December) has increased. Most analysts talk about possible rate hikes in September or December (ignoring November) because of the scheduled press conferences. However Fed Chair Janet Yellen has made it clear that all meetings are "live", so November is possible too. Some people think the Fed will wait until after the election, but I doubt that is a factor being considered.

Back to the FOMC statement: The first paragraph was about as upbeat as back in April when many analysts thought a rate hike in June was possible. So now the key is the data (the minutes will also be interesting). There are two employment reports (the July and August reports) between now and the meeting on September 20th and 21st. Also the advance and second estimate of Q2 GDP will be released, and PCE for June and July, and CPI for July and August will be released before the September meeting. If the data is solid, the FOMC might raise rates in September.

If the data is disappointing - as has happened so many times before - the FOMC will wait.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 264 thousand initial claims, up from 253 thousand the previous week.

• At 10:00 AM, the Q2 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for July. This is the last of the regional Fed surveys for July.

Freddie Mac: Mortgage Serious Delinquency rates declined in June, Lowest since July 2008

by Calculated Risk on 7/27/2016 03:47:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate decreased in June to 1.08% from 1.11% in May. Freddie's rate is down from 1.53% in June 2015.

This is the lowest rate since July 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.45 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will be below 1% in two or three months.

Note: Fannie Mae will report in the next few days.

FOMC Statement: No Change to Policy, Upgrade Economy, Risks "diminished"

by Calculated Risk on 7/27/2016 02:02:00 PM

Information received since the Federal Open Market Committee met in June indicates that the labor market strengthened and that economic activity has been expanding at a moderate rate. Job gains were strong in June following weak growth in May. On balance, payrolls and other labor market indicators point to some increase in labor utilization in recent months. Household spending has been growing strongly but business fixed investment has been soft. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will strengthen. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook have diminished. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent. emphasis added

NAR: Pending Home Sales Index increased Slightly in June, up 1.0% year-over-year

by Calculated Risk on 7/27/2016 10:04:00 AM

From the NAR: Pending Home Sales Marginally Rise in June

Pending home sales were mostly unmoved in June, but did creep slightly higher as supply and affordability constraints prevented a bigger boost in activity from mortgage rates that lingered near all-time lows through most of the month, according to the National Association of Realtors®. Increases in the Northeast and Midwest were offset by declines in the South and West.This was below expectations of a 1.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched 0.2 percent to 111.0 in June from 110.8 in May and is now 1.0 percent higher than June 2015 (109.9). With last month's minor improvement, the index is now at its second highest reading over the past 12 months, but is noticeably down from this year's peak level in April (115.0).

...

The PHSI in the Northeast advanced 3.2 percent to 96.0 in June, and is now 1.7 percent above a year ago. In the Midwest the index increased 0.8 percent to 108.9 in June, and is now 1.6 percent higher than June 2015.

Pending home sales in the South decreased modestly (0.6 percent) to an index of 125.9 in June but are still 1.8 percent higher than last June. The index in the West declined 1.3 percent in June to 101.3, and is now 1.8 percent below a year ago.

emphasis added

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 7/27/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 11.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 22, 2016.

... The Refinance Index decreased 15 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier to the lowest level since February 2016. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.69 percent from 3.65 percent, with points unchanged at 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "12 percent higher than the same week one year ago".

Tuesday, July 26, 2016

Wednesday: FOMC Announcement, Pending Home Sales, Durable Goods

by Calculated Risk on 7/26/2016 06:47:00 PM

Here was my FOMC preview: FOMC Preview: No Rate Hike, Possibly Preparing for September Rate Hike

From Merrill Lynch on the FOMC:

The July meeting of the Federal Open Market Committee (FOMC) is unlikely to result in any policy changes by the Fed, in our view. In fact, we do not expect the Fed to give any signals about September or subsequent meetings, maintaining its data dependent approach to a gradual hiking cycle. Markets will likely be looking for any clues of how this week's meeting will set up Fed policy decisions at subsequent meetings this year. Our base case remains that the Fed will next hike in December, but a September move cannot be completely ruled out. We believe the bar to hike then, however, is relatively high: the US activity data would need to remain solid, inflation indicators generally would need to point higher, and global risks would have to settle down to a dull rumble.Wednesday:

Our base case of a more optimistic tone to the July statement, given better data on net, should lead at most to a modest increase in market-implied probabilities of hikes this year. More substantive language changes are unlikely, in our view, but would be more market moving if they occur. Perhaps the biggest risk to market pricing will come not from this week's statement, but from the minutes in three weeks' time. Recall the sharp market reaction when the April minutes revealed significant support on the FOMC for a possible June rate hike. There is the potential for a similarly surprising amount of FOMC interest in a September hike this time around.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 1.3% increase in the index.

• At 2:00 PM, FOMC Meeting Announcement. No change in policy is expected at this meeting.

Real Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/26/2016 03:25:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.0% year-over-year in May

The year-over-year increase in prices is mostly moving sideways now around 5%. In May, the index was up 5.0% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 2.8% below the bubble peak. However, in real terms, the National index is still about 17.1% below the bubble peak.

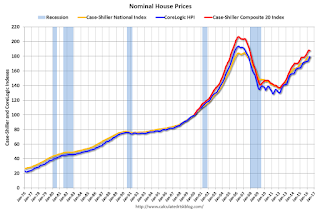

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

CPI less Shelter has declined over the last two years pushing up real house prices.

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to October 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

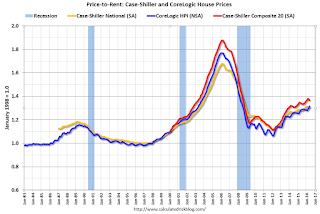

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to July 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back toMay 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.