by Calculated Risk on 7/21/2016 10:11:00 AM

Thursday, July 21, 2016

Existing Home Sales increased in June to 5.57 million SAAR

From the NAR: Existing-Home Sales Ascend Again in June, First-time Buyers Provide Spark

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 1.1 percent to a seasonally adjusted annual rate of 5.57 million in June from a downwardly revised 5.51 million in May. After last month's gain, sales are now up 3.0 percent from June 2015 (5.41 million) and remain at their highest annual pace since February 2007 (5.79 million). ...

Total housing inventory at the end of June dipped 0.9 percent to 2.12 million existing homes available for sale, and is now 5.8 percent lower than a year ago (2.25 million). Unsold inventory is at a 4.6-month supply at the current sales pace, which is down from 4.7 months in May.

Click on graph for larger image.

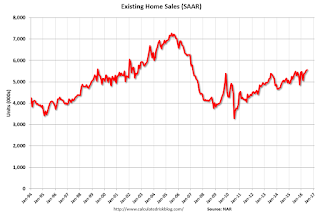

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.57 million SAAR) were 1.1% higher than last month, and were 3.0% above the June 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.12 million in June from 2.14 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.12 million in June from 2.14 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 5.8% year-over-year in June compared to June 2015.

Inventory decreased 5.8% year-over-year in June compared to June 2015. Months of supply was at 4.6 months in June.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims declined to 253,000

by Calculated Risk on 7/21/2016 08:33:00 AM

The DOL reported:

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 253,000, a decrease of 1,000 from the previous week's unrevised level of 254,000. The 4-week moving average was 257,750, a decrease of 1,250 from the previous week's unrevised average of 259,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 72 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 257,750.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, July 20, 2016

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey, FHFA House Price Index

by Calculated Risk on 7/20/2016 07:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 254 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.0, up from 4.7.

• Also at 8:30 AM, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for May 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, down from 5.53 million in May. Housing economist Tom Lawler estimates the National Association of Realtors will report sales at 5.62 million SAAR in June.

CoreLogic: Orange County Median Home Prices Hit New Record

by Calculated Risk on 7/20/2016 12:47:00 PM

From Jeff Collins at the O.C. Register: $657,500: O.C. median home price hits record

The median price of an Orange County home – or the price at the midpoint of all sales – was $657,500, real estate data firm CoreLogic reported Tuesday. That’s up $29,000, or 4.6 percent, in a year and $6,000 in a month.This brings up a few important points that I've mentioned before ...

...

The previous peak of $645,000, reached in June 2007, is equivalent to $750,000 in today’s dollars – or $92,000 higher than June’s median.

1. This is the median price - not a repeat sales index - and the median price can be impacted by the mix of homes sold (not as useful as a repeat sales index).

2. As Collins notes in the article, these are nominal prices. When adjusted for inflation (real prices), prices are still 14% below the bubble peak.

3. This is not a bubble. A bubble requires both excess appreciation and speculation, and there is a little evidence of speculation - these are qualified buyers who will not default if prices decline (unlike many buyers during the bubble).

4. Note that the central / coastal areas are closer to the previous peak than the outlying areas. This is the typical pattern; the price increases start in the central / coastal areas, and then move inland as the cycle matures. Plus the inland areas saw the most speculation during the bubble - especially using subprime loans - and it will take longer for prices to reach a new peak.

AIA: Architecture Billings Index "remains on solid footing" in June

by Calculated Risk on 7/20/2016 09:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index remains on solid footing

Buoyed by increasing levels of demand across all project types, the Architecture Billings Index (ABI) was positive in June for the fifth consecutive month. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 52.6, down from the mark of 53.1 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, down from a reading of 60.1 the previous month.Note that multi-family has picked up again, so we might see another pickup in multi-family starts.

“Demand for residential projects has surged this year, greatly exceeding the pace set in 2015. This suggests strong future growth for housing in the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While we expect to see momentum continue for the overall design and construction industry in the months ahead, the fact that the value of design contracts dipped into negative territory in June for the first time in more than two years is something of a concern.”

...

• Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2)

• Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.6 in June, down from 53.1 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 7/20/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 15, 2016. The prior week’s results included an adjustment for the July 4th holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 23 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.65 percent from 3.60 percent, with points unchanged at 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

If refinance mortgage rates fell a little further, we might see a significant pickup in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "16 percent higher than the same week one year ago".

Tuesday, July 19, 2016

Existing Home Sales: Take the Over

by Calculated Risk on 7/19/2016 05:54:00 PM

The NAR will report June Existing Home Sales on Thursday, July 21st at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.48 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.62 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.53 million SAAR in May.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 6 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last six years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | --- |

| 1NAR initially reported before revisions. | |||

WSJ: "A rate increase could come as early as September if economic data hold firm"

by Calculated Risk on 7/19/2016 01:47:00 PM

Jon Hilsenrath and Michael Derby write in the WSJ: Fed Officials Gain Confidence They Can Raise Rates This Year

Officials are almost certain to leave rates unchanged when they meet July 26-27, according to their public comments and interviews with officials. But the message in their postmeeting policy statement could be that the economy is on a more solid footing than appeared to be the case when they last gathered in June, setting the stage for raising rates if the data hold up in the months ahead.Meanwhile Tim Duy writes at Bloomberg: Why the Fed Can't and Shouldn't Raise Interest Rates

The Fed needs to remember that how they got into this policy stance may offer a lesson for how to get out. Policy makers cut rates to zero and then instituted quantitative easing. Now they should consider selling assets before raising rates. Or, at a minimum, utilizing a mixed strategy of rate hikes and asset sales. The objective of meeting the Fed's mandate in the context of maintaining financial stability may be unattainable using the interest rate tool and associated forward guidance alone. Unfortunately, the Fed does not appear to be debating the policy mix — at least not in public. They remain focused on interest rates, delaying balance sheet policy to a later date. On the current trajectory, however, that later date may never come.

Comments on June Housing Starts

by Calculated Risk on 7/19/2016 11:04:00 AM

Earlier: Housing Starts increased to 1.189 Million Annual Rate in June

The housing starts report this morning was above consensus, however there were downward revisions to the prior two months. Also starts were down 2.0% from June 2015. Still a decent report.

Once again the key take away from the Housing Starts report is that multi-family is slowing, and single family growth is ongoing year-over-year.

This graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 7.1% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 3.9% year-to-date, and single-family starts are up 13.2% year-to-date.

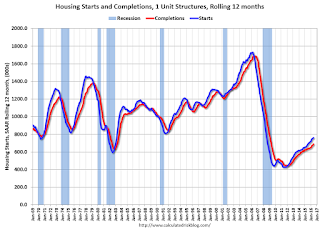

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will probably catch up to starts soon (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, however - as I've noted before - I expect most of the growth will be from single family going forward.

Housing Starts increased to 1.189 Million Annual Rate in June

by Calculated Risk on 7/19/2016 08:41:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,189,000. This is 4.8 percent above the revised May estimate of 1,135,000, but is 2.0 percent below the June 2015 rate of 1,213,000.

Single-family housing starts in June were at a rate of 778,000; this is 4.4 percent above the revised May figure of 745,000. The June rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,153,000. This is 1.5 percent above the revised May rate of 1,136,000, but is 13.6 percent below the June 2015 estimate of 1,334,000.

Single-family authorizations in June were at a rate of 738,000; this is 1.0 percent above the revised May figure of 731,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in June compared to May. Multi-family starts are down 22% year-over-year.

Single-family starts (blue) increased in June, and are up 13% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in June were above to expectations, however combined starts for April and May were revised down. I'll have more later ...