by Calculated Risk on 7/20/2016 12:47:00 PM

Wednesday, July 20, 2016

CoreLogic: Orange County Median Home Prices Hit New Record

From Jeff Collins at the O.C. Register: $657,500: O.C. median home price hits record

The median price of an Orange County home – or the price at the midpoint of all sales – was $657,500, real estate data firm CoreLogic reported Tuesday. That’s up $29,000, or 4.6 percent, in a year and $6,000 in a month.This brings up a few important points that I've mentioned before ...

...

The previous peak of $645,000, reached in June 2007, is equivalent to $750,000 in today’s dollars – or $92,000 higher than June’s median.

1. This is the median price - not a repeat sales index - and the median price can be impacted by the mix of homes sold (not as useful as a repeat sales index).

2. As Collins notes in the article, these are nominal prices. When adjusted for inflation (real prices), prices are still 14% below the bubble peak.

3. This is not a bubble. A bubble requires both excess appreciation and speculation, and there is a little evidence of speculation - these are qualified buyers who will not default if prices decline (unlike many buyers during the bubble).

4. Note that the central / coastal areas are closer to the previous peak than the outlying areas. This is the typical pattern; the price increases start in the central / coastal areas, and then move inland as the cycle matures. Plus the inland areas saw the most speculation during the bubble - especially using subprime loans - and it will take longer for prices to reach a new peak.

AIA: Architecture Billings Index "remains on solid footing" in June

by Calculated Risk on 7/20/2016 09:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index remains on solid footing

Buoyed by increasing levels of demand across all project types, the Architecture Billings Index (ABI) was positive in June for the fifth consecutive month. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 52.6, down from the mark of 53.1 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, down from a reading of 60.1 the previous month.Note that multi-family has picked up again, so we might see another pickup in multi-family starts.

“Demand for residential projects has surged this year, greatly exceeding the pace set in 2015. This suggests strong future growth for housing in the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While we expect to see momentum continue for the overall design and construction industry in the months ahead, the fact that the value of design contracts dipped into negative territory in June for the first time in more than two years is something of a concern.”

...

• Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2)

• Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.6 in June, down from 53.1 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment through mid-2017.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 7/20/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 15, 2016. The prior week’s results included an adjustment for the July 4th holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 23 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.65 percent from 3.60 percent, with points unchanged at 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

If refinance mortgage rates fell a little further, we might see a significant pickup in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "16 percent higher than the same week one year ago".

Tuesday, July 19, 2016

Existing Home Sales: Take the Over

by Calculated Risk on 7/19/2016 05:54:00 PM

The NAR will report June Existing Home Sales on Thursday, July 21st at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.48 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.62 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.53 million SAAR in May.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 6 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last six years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | --- |

| 1NAR initially reported before revisions. | |||

WSJ: "A rate increase could come as early as September if economic data hold firm"

by Calculated Risk on 7/19/2016 01:47:00 PM

Jon Hilsenrath and Michael Derby write in the WSJ: Fed Officials Gain Confidence They Can Raise Rates This Year

Officials are almost certain to leave rates unchanged when they meet July 26-27, according to their public comments and interviews with officials. But the message in their postmeeting policy statement could be that the economy is on a more solid footing than appeared to be the case when they last gathered in June, setting the stage for raising rates if the data hold up in the months ahead.Meanwhile Tim Duy writes at Bloomberg: Why the Fed Can't and Shouldn't Raise Interest Rates

The Fed needs to remember that how they got into this policy stance may offer a lesson for how to get out. Policy makers cut rates to zero and then instituted quantitative easing. Now they should consider selling assets before raising rates. Or, at a minimum, utilizing a mixed strategy of rate hikes and asset sales. The objective of meeting the Fed's mandate in the context of maintaining financial stability may be unattainable using the interest rate tool and associated forward guidance alone. Unfortunately, the Fed does not appear to be debating the policy mix — at least not in public. They remain focused on interest rates, delaying balance sheet policy to a later date. On the current trajectory, however, that later date may never come.

Comments on June Housing Starts

by Calculated Risk on 7/19/2016 11:04:00 AM

Earlier: Housing Starts increased to 1.189 Million Annual Rate in June

The housing starts report this morning was above consensus, however there were downward revisions to the prior two months. Also starts were down 2.0% from June 2015. Still a decent report.

Once again the key take away from the Housing Starts report is that multi-family is slowing, and single family growth is ongoing year-over-year.

This graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 7.1% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 3.9% year-to-date, and single-family starts are up 13.2% year-to-date.

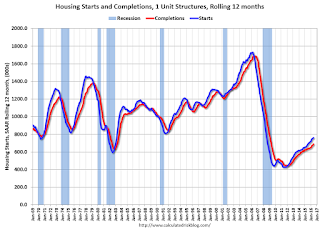

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will probably catch up to starts soon (completions lag starts by about 12 months).

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, however - as I've noted before - I expect most of the growth will be from single family going forward.

Housing Starts increased to 1.189 Million Annual Rate in June

by Calculated Risk on 7/19/2016 08:41:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,189,000. This is 4.8 percent above the revised May estimate of 1,135,000, but is 2.0 percent below the June 2015 rate of 1,213,000.

Single-family housing starts in June were at a rate of 778,000; this is 4.4 percent above the revised May figure of 745,000. The June rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,153,000. This is 1.5 percent above the revised May rate of 1,136,000, but is 13.6 percent below the June 2015 estimate of 1,334,000.

Single-family authorizations in June were at a rate of 738,000; this is 1.0 percent above the revised May figure of 731,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in June compared to May. Multi-family starts are down 22% year-over-year.

Single-family starts (blue) increased in June, and are up 13% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in June were above to expectations, however combined starts for April and May were revised down. I'll have more later ...

Monday, July 18, 2016

Tuesday: Housing Starts

by Calculated Risk on 7/18/2016 09:11:00 PM

Tuesday:

• At 8:30 AM ET, Housing Starts for June. Total housing starts decreased to 1.164 million (SAAR) in May. Single family starts increased to 764 thousand SAAR in May. The consensus for 1.170 million, up from the May rate.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways to Slightly Higher

Mortgage rates remain under pressure over the past few weeks after hitting near-all-time lows in early July. With one exception, rates have been either sideways or higher every day since July 6th. In that time, they've moved up roughly an eighth of a point. Today would be easier to characterize as "sideways" for most lenders, although a few raised costs just slightly. The most prevalently-quoted conventional 30yr fixed rate for top tier scenarios remains 3.375%.Here is a table from Mortgage News Daily:

emphasis added

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/18/2016 03:36:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.62 million in June, up 1.6% from May’s preliminary pace and up 3.9% from last June’s seasonally adjusted pace.

Local realtor/MLS data also suggest that existing home listings in aggregate increased modestly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of June will be 2.19 million, up 1.9% from May’s preliminary estimate and down 2.7% from last June. Finally, I project that the NAR’s estimate of the median existing single-family home sales price for June will be up 5.6% from last June’s estimate.

CR Note: The NAR is scheduled to release June existing home sales this Thursday, July 21st. The consensus is for 5.48 million SAAR in June, down from 5.53 million in May. Take the over!

LA area Port Traffic Mostly Unchanged in June

by Calculated Risk on 7/18/2016 01:34:00 PM

Special note: Now that the expansion to the Panama Canal has been completed, some of traffic that used the ports of Los Angeles and Long Beach will probably go through the canal. This could impact TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in May. Outbound traffic was down 0.1% compared to 12 months ending in May.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports are moving sideways and imports are gradually increasing.