by Calculated Risk on 6/23/2016 08:33:00 AM

Thursday, June 23, 2016

Weekly Initial Unemployment Claims decrease to 259,000

The DOL reported:

In the week ending June 18, the advance figure for seasonally adjusted initial claims was 259,000, a decrease of 18,000 from the previous week's unrevised level of 277,000. The 4-week moving average was 267,000, a decrease of 2,250 from the previous week's unrevised average of 269,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 68 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 267,000.

This was lower than the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, June 22, 2016

Thursday: New Home Sales

by Calculated Risk on 6/22/2016 07:53:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 277 thousand the previous week.

• Also at 8:30 AM, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for a decrease in sales to 565 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 619 thousand in April.

Something to watch after the Brexit vote - mortgage rates. From Matthew Graham at Mortgage News Daily: Mortgage Rates Higher Still Despite Market Improvement

3.625% is once again the most prevalent conventional 30yr fixed rate for top tier scenarios, although 3.5% is by no means extinct. Tomorrow brings the much-anticipated vote on membership in the European union for the U.K. (aka "Brexit"). As far as we know right now, the biggest risks from an interest rate standpoint won't materialize until Friday morning, but we could see the effects as early as tomorrow afternoon.

AIA: Architecture Billings Index increased "Sharply" in May

by Calculated Risk on 6/22/2016 04:35:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Healthy demand for all building types signaled in Architecture Billings Index

Led by a still active multi-family housing market and sustained by solid levels of demand for new commercial and retail properties, the Architecture Billings Index has accelerated to its highest score in nearly a year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 53.1, up sharply from the mark of 50.6 in the previous month. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, up from a reading of 56.9 the previous month.

“Business conditions at design firms have hovered around the break-even rate for the better part of this year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Demand levels are solid across the board for all project types at the moment. Of particular note, the recent surge in design activity for institutional projects could be a harbinger of a new round of growth in the broader construction industry in the months ahead.”

...

• Regional averages: West (53.8), South (53.7), Northeast (51.2), Midwest (49.9)

• Sector index breakdown: multi-family residential (53.7), institutional (53.0), commercial / industrial (51.0), mixed practice (51.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.1 in May, up from 50.6 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2016 and early 2017.

A Few Comments on May Existing Home Sales

by Calculated Risk on 6/22/2016 01:35:00 PM

Earlier: Existing Home Sales increased in May to 5.53 million SAAR

As usual, housing economist Tom Lawler nailed the NAR report.

I project that May existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.55 million in MayFor existing homes, inventory is still key. I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 5.7% year-over-year in May). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

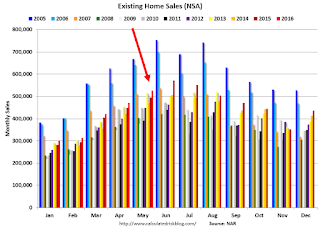

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) were the highest for May since 2006 (NSA).

This is a solid first five months for 2016.

Black Knight's First Look at May Mortgage Data; Foreclosure Inventory down 29% YoY

by Calculated Risk on 6/22/2016 11:55:00 AM

From Black Knight: Black Knight Financial Services’ First Look at May 2016

• Foreclosure inventory now below 575,000 from over 800,000 just 12 months agoAccording to Black Knight's First Look report for May, the percent of loans delinquent increased 0.4% in May compared to April, and declined 13.5% year-over-year.

• Foreclosure starts up from 10-year low in April, but at 62,100 remain below pre-crisis levels

• Prepayment speeds (historically a good indicator of refinance activity) continue to trail 2015 levels despite interest rates being lower than last year

• Delinquencies inched up in May; still down by over 13 percent on an annual basis

The percent of loans in the foreclosure process declined 3.6% in May and were down 28.8% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.25% in May, up from 4.24% in April.

The percent of loans in the foreclosure process declined in May to 1.13%.

The number of delinquent properties, but not in foreclosure, is down 325,000 properties year-over-year, and the number of properties in the foreclosure process is down 229,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for May by July 11th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2016 | Apr 2016 | May 2015 | May 2014 | |

| Delinquent | 4.25% | 4.24% | 4.91% | 5.63% |

| In Foreclosure | 1.13% | 1.17% | 1.59% | 2.03% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,153,000 | 2,146,000 | 2,478,000 | 2,836,000 |

| Number of properties in foreclosure pre-sale inventory: | 574,000 | 595,000 | 803,000 | 1,022,000 |

| Total Properties | 2,727,000 | 2,741,000 | 3,280,000 | 3,857,000 |

Existing Home Sales increased in May to 5.53 million SAAR

by Calculated Risk on 6/22/2016 10:10:00 AM

From the NAR: Existing-Home Sales Grow 1.8 Percent in May; Highest Pace in Over Nine Years

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 1.8 percent to a seasonally adjusted annual rate of 5.53 million in May from a downwardly revised 5.43 million in April. With last month's gain, sales are now up 4.5 percent from May 2015 (5.29 million) and are at their highest annual pace since February 2007 (5.79 million). ...

Total housing inventory at the end of May rose 1.4 percent to 2.15 million existing homes available for sale, but is still 5.7 percent lower than a year ago (2.28 million). Unsold inventory is at a 4.7-month supply at the current sales pace, which is unchanged from April.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May (5.53 million SAAR) were 1.8% higher than last month, and were 4.5% above the May 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.15 million in May from 2.12 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.15 million in May from 2.12 million in April. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 5.7% year-over-year in May compared to May 2015.

Inventory decreased 5.7% year-over-year in May compared to May 2015. Months of supply was at 4.7 months in May.

This was close to consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

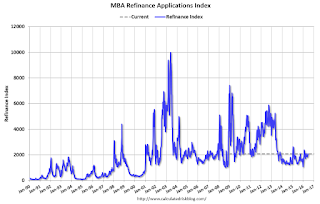

MBA: Mortgage "Rates Drop, Refi Apps Jump in Latest Weekly Survey"

by Calculated Risk on 6/22/2016 07:00:00 AM

From the MBA: Rates Drop, Refi Apps Jump in Latest MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 17, 2016.

...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since May 2013, 3.76 percent, from 3.79 percent, with points increasing to 0.33 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

30-year fixed rates would probably have to fall below 3.35% (the previous low) before there is a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "12 percent higher than the same week one year ago".

Tuesday, June 21, 2016

Wednesday: Existing Home Sales, Fed Chair Yellen

by Calculated Risk on 6/21/2016 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for April 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.6% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.45 million in April. Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR in May.

• Also at 10:00 AM, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

• During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

CoreLogic: Orange County home prices above Bubble Peak

by Calculated Risk on 6/21/2016 04:23:00 PM

From Andrew Khouri at the LA Times: Orange County home prices rise above their 2007 bubble-era peak

Median home prices in Orange County rose in May to surpass their bubble-era peak in 2007, making the county the first in Southern California where that has happened, according to a new report.This brings up a few important points ...

...

May's median in Los Angeles County — $525,000 — is still 4.5% below the county’s bubble-era peak of $550,000. Riverside County is 23.6% below, San Bernardino County 25% below, San Diego County 5.3% below and Ventura County 17.9% below.

1. This is the median price - not a repeat sales index - and the median price can be impacted by the mix of homes sold (not as useful as a repeat sales index).

2. As Khouri notes in the article, these are nominal prices. When adjusted for inflation (real prices), prices are still 13% below the bubble peak.

3. This is not a bubble. A bubble requires both excess appreciation and speculation, and there is a little evidence of speculation - these are qualified buyers who will not default if prices decline (unlike many buyers during the bubble).

4. Note that the central / coastal areas are closer to the previous peak than the outlying areas. This is the typical pattern; the price increases start in the central / coastal areas, and then move inland as the cycle matures. Plus the inland areas saw the most speculation during the bubble - especially using subprime loans - and it will take longer for prices to reach a new peak.

Chemical Activity Barometer indicated "Solid Growth in June"

by Calculated Risk on 6/21/2016 01:01:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues Solid Growth in June; Signals Higher U.S. Business Activity Through End Of The Year

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.8 percent in June following a revised 0.9 percent increase in May and 0.7 percent increase in April. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 2.5 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 2.7 percent year-over-year gain from 2014. On an unadjusted basis the CAB jumped 0.4 percent in June, following a similar 0.4 percent gain in May. The CAB is signaling higher U.S. business activity through the end of the year.

...

AApplying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB has increased over the last three months, and this suggests an increase in Industrial Production over the next year.