by Calculated Risk on 5/28/2016 02:09:00 PM

Saturday, May 28, 2016

May 2016: Unofficial Problem Bank list declines to 205 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2016. During the month, the list fell from 214 institutions to 205 after 12 removals and three additions. Assets dropped by $1.6 billion, even after a $343 million increase with the roll to 2016q1 figures, to an aggregate $60.8 billion. A year ago, the list held 324 institutions with assets of $91.2 billion. We were expecting the FDIC to release first quarter industry results and an update on the Official Problem Bank List but the FDIC was a no-show.

Actions have been terminated against Home State Bank, National Association, Crystal Lake, IL ($603 million); International Bank of Chicago, Chicago, IL ($503 million); Pan American Bank, Los Angeles, CA ($160 million Ticker: PAMB); Citizens Bank & Trust Company, Eastman, GA ($130 million); American Founders Bank, Inc., Lexington, KY ($100 million); and SouthFirst Bank, Sylacauga, AL ($89 million Ticker: SZBI). Pan American Bank had been operating under an enforcement action since 2005.

Other departure methods included the failure of First CornerStone Bank, King of Prussia, PA ($107 million); voluntary liquidation of SouthBank, a Federal Savings Bank, Huntsville, AL ($65 million); and the mergers of National Bank of California, Los Angeles, CA ($424 million Ticker: NCAL); National Bank of Tennessee, Newport, TN ($144 million); Park Federal Savings Bank, Chicago, IL ($142 million Ticker: PFED); and American Bank of Huntsville, Huntsville, AL ($113 million). The removal SouthBank is an infrequent way to leave the list with the last voluntary liquidation removal being Hartford Savings Bank, Hartford, WI, back in March 2014.

Added this month were Delaware Place Bank, Chicago, IL ($265 million); Indus American Bank, Edison, NJ ($247 million); and The First National Bank of Scott City, Scott City, KS ($121 million). This is the most new monthly additions to the list since December 2015.

Schedule for Week of May 29, 2016

by Calculated Risk on 5/28/2016 08:09:00 AM

The key report this week is the May employment report on Friday.

Other key indicators include May vehicle sales, the May ISM manufacturing and non-manufacturing indexes, and the April trade deficit.

All US markets will be closed in observance of Memorial Day.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for March. The Zillow forecast is for the National Index to increase 5.3% year-over-year in March.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 50.7, up from 50.4 in April.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 50.6, down from 50.8 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 50.6, down from 50.8 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 50.8% in April. The employment index was at 49.2%, and the new orders index was at 55.8%.

10:00 AM: Construction Spending for April. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in May from 17.4 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in May from 17.4 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in May, up from 156,000 added in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 267 thousand initial claims, down from 268 thousand the previous week.

8:30 AM: Employment Report for May. The consensus is for an increase of 158,000 non-farm payroll jobs added in May, down from the 160,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate to decline to 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was 2.69 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for April from the Census Bureau.

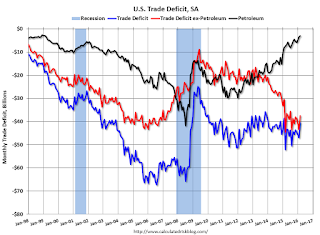

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.0 billion in April from $40.4 billion in March.

10:00 AM: the ISM non-Manufacturing Index for May. The consensus is for index to decrease to 55.5 from 55.7 in April.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is a 2.0% increase in orders.

Friday, May 27, 2016

Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rates declined in April

by Calculated Risk on 5/27/2016 04:51:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate decreased in April to 1.15% from 1.20% in March. Freddie's rate is down from 1.66% in April 2015. This is the lowest rate since August 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in April to 1.40%, down from 1.44% in March. The serious delinquency rate is down from 1.73% in April 2015.

This is the lowest rate since June 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.51 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will be below 1% until the second half of this year.

The Fannie Mae serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2017.

I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Lawler: Sustained Regional Home Price Declines Were Not That Uncommon from the Mid-80’s to the Mid-90’s

by Calculated Risk on 5/27/2016 12:29:00 PM

From housing economist Tom Lawler: Sustained Regional Home Price Declines Were Not That Uncommon from the Mid-80’s to the Mid-90’s

During any 5-year period that including any part the late 70’s there were virtually no areas that experienced a drop in home prices. That isn’t too surprising given the high inflation rate/nominal income growth rate of the period. What was more surprising is that for any 5-year periods ending from early 2000 (which basically means the latter half of the 1990’s) to the fall of 2006 there were no MSA which experienced a drop in home prices, since those periods were characterized by relative modest inflation and nominal income growth.

It is worth noting that most “models” of mortgage defaults used in the early and mid 2000’s were based on loans originated from 1995/6 or later, as it was around then that the use of credit scores become widespread. As such, these “models” used a period when there were hardly any parts of the country where home prices had declined. ... During this period actual mortgage losses were incredibly low, models predicted low losses going forward, and in hindsight it’s not surprising that mortgage lending criteria eased considerably over the period, moving from “historically very easy” in 2000-2001 to “ridiculously easy” in the 2003-2006” period.

Click on graph for larger image.

Click on graph for larger image.Chart uses Freddie Mac’s Home Price Index for 381 MSAs. The chart shows the number of MSA HPIs that declined over a rolling 5-year (60 month) period.

These models based on “good times” proved to be useless in predicting how mortgages performed during “bad times,” which was “a tragedy” that was predicted by the band Poison in its most excellent song “Good Times, Bad Times, How Life Loves a Tragedy.”1CR Note: These are some key point in understanding the bubble. The models used to predict defaults were based on a period with rising home prices, and also on a period with different lending criteria. In the early '90s, lending was based on the 3Cs (Collateral, Capacity, and Credit), and that moved to mostly credit scores in the 2000s.

1 See, e.g., “Model Stability and the Subprime Mortgage Crisis,” An, Deng, Rosenblatt, and Yen, September 2010.

Consumer Sentiment at 94.7

by Calculated Risk on 5/27/2016 10:05:00 AM

Click on graph for larger image.

The University of Michigan consumer sentiment index for May was at 94.7, down from the preliminary reading of 95.8, and up from 89.0 in April:

"Consumers were a bit less optimistic in late May than earlier in the month, but sentiment was still substantially higher than last month. Indeed, there have only been four prior months since the January 2007 peak in which the Sentiment Index was higher than in May 2016, all recorded at the start of 2015. Despite the meager GDP growth as well as a higher inflation rate, consumers became more optimistic about their financial prospects and anticipated a somewhat lower inflation rate in the years ahead. Positive views toward vehicle and home sales also posted gains in May largely due to low interest rates. The biggest uncertainty consumers see on the horizon is not whether the Fed will hike interest rates in the next few months, but the outlook for future government economic policies under a new president. "

emphasis added

Q1 GDP Revised Up to 0.8% Annual Rate

by Calculated Risk on 5/27/2016 08:33:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.8 percent in the first quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 1.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was unrevised at 1.9%. Residential investment was revised up from 14.8% to 17.1%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 0.5 percent. With the second estimate for the first quarter, the decrease in private inventory investment was smaller than previously estimated ...

emphasis added

Thursday, May 26, 2016

Friday: GDP, Yellen

by Calculated Risk on 5/26/2016 07:22:00 PM

A few excerpts from a research piece by Ethan Harris at Merrill Lynch: Fed Watch: June, July or September?

It is now clear that June is very much on the table. What is less clear is whether the Fed is just protesting the super-low probability priced into the markets or is setting us up for a June hike. In other words, should we stick to our September call or flip flop?Friday:

We are sticking to September. In our view, the distribution of outcomes is very flat, but September still seems most consistent with Yellen’s high risk aversion. June seems a bit early given how dovish she has sounded. Moreover, with the market pricing in just a 34% chance of a move, it would shock the markets and bring into question their credibility. This would draw attention to the competence of the Fed during an election year. The Fed would also be moving in front of the Brexit vote, a potential serious shock to financial markets. What is the cost of waiting?

July is also live, but suffers the usual problem of not having a scheduled press conference. The Fed has made it clear that they can call a press conference on short notice. However, it would still require meticulous preparation from Yellen. ...

This is a close call and we will be nimble going forward. Payrolls on June 2nd and a Yellen speech on June 6th could change our mind. In our view, the Fed will want the market to be pricing in at least a 50% probability before it moves and hawkish news from these events could do the trick. Regardless of the exact timing, we think the economy and inflation are a lot more resilient than the markets believe. Hence, the Fed is likely to hike more than what the bond market is pricing in over the next several years

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2016 (Second estimate). The consensus is that real GDP increased 0.9% annualized in Q1, revised up from a 0.5% increase.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 95.5, down from the preliminary reading 95.8, and up from 89.0 in April.

• At 1:15 PM, Discussion with Fed Chair Janet Yellen, A conversation with Professor Gregory Mankiw, followed by the presentation of the Radcliffe Medal to Chair Yellen. Watch live here.

Vehicle Sales Forecasts: Sales to be Over 17 Million SAAR in May

by Calculated Risk on 5/26/2016 01:40:00 PM

The automakers will report May vehicle sales on Wednesday, June 1st.

Note: There were 24 selling days in May, down from 26 in May 2015.

From WardsAuto: May Forecast Calls for Improved Sales, Days’ Supply

WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles in May.From Kelley Blue Book: Despite Memorial Day Sales, New-car Sales To Decrease 6 Percent In May 2016, According To Kelley Blue Book

The forecast daily sales rate of 63,443 units over 24 days represents a 1.3% improvement from like-2015 (26 days), while total volume for the month would fall 6.5% from year-ago. The 14.4% DSR increase from April (27 days) is ahead of the 7-year average 8% growth.

The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, slightly above the 17.1 million SAAR from the first four months of the year, but below the 17.6 million SAAR reached in May 2015.

emphasis added

New-vehicle sales are expected to decrease 6 percent year-over-year to a total of 1.53 million units in May 2016, resulting in an estimated 17.4 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...And from J.D. Power: Memorial Day Weekend Is Key to May’s New-Vehicle Retail Sales

The SAAR for total sales is projected at 17.4 million units in May 2016, down from 17.7 million a year ago.Looks like another strong month for vehicle sales, but down from May 2015.

Kansas City Fed: Regional Manufacturing Activity "declined modestly" in May

by Calculated Risk on 5/26/2016 11:36:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Modestly

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined modestly.The Kansas City region was hit hard by lower oil prices.

“Regional factory activity continued to drift down in May, as weakness in energy and agriculture-related manufacturing persisted,” said Wilkerson. “Still, firms expect a modest pickup in activity later this year.”

...

The month-over-month composite index was -5 in May, which is largely unchanged from April and March readings ...

emphasis added

NAR: Pending Home Sales Index increased 5.1% in April, up 4.6% year-over-year

by Calculated Risk on 5/26/2016 10:03:00 AM

From the NAR: Pending Home Sales Lift Off in April to Over 10-Year High

Pending home sales rose for the third consecutive month in April and reached their highest level in over a decade, according to the National Association of Realtors®. All major regions saw gains in contract activity last month except for the Midwest, which saw a meager decline.This was way above expectations of a 0.8% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, hiked up 5.1 percent to 116.3 in April from an upwardly revised 110.7 in March and is now 4.6 percent above April 2015 (111.2). After last month's gain, the index has now increased year-over-year for 20 consecutive months.

...

The PHSI in the Northeast climbed 1.2 percent to 98.2 in April, and is now 10.1 percent above a year ago. In the Midwest the index declined slightly (0.6 percent) to 112.9 in April, but is still 2.0 percent above April 2015.

Pending home sales in the South jumped 6.8 percent to an index of 133.9 in April and are 5.1 percent higher than last April. The index in the West soared 11.4 percent in April to 106.2, and is now 2.8 percent above a year ago.

emphasis added