by Calculated Risk on 5/22/2016 06:50:00 PM

Sunday, May 22, 2016

Sunday Night Futures

From Tim Duy at Fed Watch: This Is Not A Drill. This Is The Real Thing. Here is his conclusion:

Bottom Line: This is not a drill. This meeting is the real thing - an undoubtedly lively debate that could end with a rate hike. I think we narrowly avoid a rate hike, but at the cost of moving forward the next hike to the July meeting.Read the entire post!

Weekend:

• Schedule for Week of May 22, 2016

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $48.28 per barrel and Brent at $48.72 per barrel. A year ago, WTI was at $59, and Brent was at $64 - so prices are down about 20%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon (down about $0.45 per gallon from a year ago).

An update on oil prices

by Calculated Risk on 5/22/2016 10:30:00 AM

From the WSJ: Oil Prices Lower but Post Weekly Gain

U.S. crude for June delivery settled down 41 cents, or 0.9%, at $47.75 a barrel on the New York Mercantile Exchange. Prices rose 3.3% this week and are up 6.9% in the past two weeks.

Brent, the global benchmark, fell 9 cents, or 0.2%, to $48.72 a barrel on ICE Futures Europe. Prices rose 1.9% this week and 7.4% in the past two weeks.

Production outages around the world have fueled gains in oil prices in recent weeks, chipping away from the oversupply that has plagued the market for nearly two years. Wildfires in Canada have taken some oil fields there out of commission, while disruptions in Nigeria and Libya have also given prices a lift.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $48.41 per barrel today, and Brent is at $48.72

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again.

Some of the recent rebound is due to production outages, and some is probably seasonal.

Saturday, May 21, 2016

Schedule for Week of May 22, 2016

by Calculated Risk on 5/21/2016 08:12:00 AM

The key economic reports this week are April New Home sales, and the second estimate of Q1 GDP.

No economic releases scheduled.

10:00 AM ET: New Home Sales for April from the Census Bureau.

10:00 AM ET: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for a increase in sales to 523 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 511 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

11:00 AM: The New York Fed will release their Q1 2016 Household Debt and Credit Report

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for March 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 278 thousand the previous week.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for May.

8:30 AM ET: Gross Domestic Product, 1st quarter 2016 (Second estimate). The consensus is that real GDP increased 0.9% annualized in Q1, revised up from a 0.5% increase.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 95.5, down from the preliminary reading 95.8, and up from 89.0 in April.

10:30 AM: Fed Chair Janet Yellen will have a discussion with Professor Greg Mankiw at Radcliffe Institute for Advanced Study at Harvard University.

Friday, May 20, 2016

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/20/2016 01:39:00 PM

Earlier: Existing Home Sales increased in April to 5.45 million SAAR

First, please note that once again housing economist Tom Lawler nailed the NAR report.

I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.44 million in AprilSecond, I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. I've seen reports calling the February sales rate "dismal" and the March sales rate "a strong rebound". Nah. This is just normal volatility. Sales through April are up 5.5% from the same period in 2015. A solid increase.

As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

For existing homes, inventory is still key. I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 3.6% year-over-year in April). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were convert to rental units. Last year, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were the highest for April since 2006 (NSA).

Note that January and February are usually the slowest months of the year and March and April are the beginning of the "selling season". This is a solid start to the year.

BLS: Unemployment Rates stable in 41 states in April

by Calculated Risk on 5/20/2016 11:31:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly lower in April in 5 states, higher in 4 states, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in April, 2.5 percent and 2.6 percent, respectively. The unemployment rate in Arkansas (3.9 percent) set a new series low. (All region, division, and state series begin in 1976.) Alaska and Illinois had the highest rates, 6.6 percent each.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska and Illinois, at 6.6%, had the highest state unemployment rates.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states and D.C are at or above 6% (dark blue).

Existing Home Sales increased in April to 5.45 million SAAR

by Calculated Risk on 5/20/2016 10:09:00 AM

From the NAR: Existing-Home Sales Rise in April for Second Straight Month

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.7 percent to a seasonally adjusted annual rate of 5.45 million in April from an upwardly revised 5.36 million in March. After last month's gain, sales are now up 6.0 percent from April 2015. ...

Total housing inventory at the end of April increased 9.2 percent to 2.14 million existing homes available for sale, but is still 3.6 percent lower than a year ago (2.22 million). Unsold inventory is at a 4.7-month supply at the current sales pace, up from 4.4 months in March.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.45 million SAAR) were 1.7% higher than last month, and were 6.0% above the April 2015 rate.

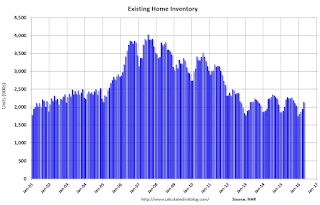

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.14 million in April from 1.96 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.14 million in April from 1.96 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 3.6% year-over-year in April compared to April 2015.

Inventory decreased 3.6% year-over-year in April compared to April 2015. Months of supply was at 4.7 months in April.

This was slightly above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Thursday, May 19, 2016

Friday: Existing Home Sales

by Calculated Risk on 5/19/2016 06:21:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.40 million SAAR, up from 5.33 million in March.

• Also at 10:00 AM: Regional and State Employment and Unemployment for April 2016

Brad Setser was a daily read for me years ago, and he has started blogging again at Follow the Money: It Has Been a Long Time

I stopped blogging almost seven years ago.

My interests have not really changed too much since then. There was a time when I was far more focused on Europe than China. But right now, the uncertainty around China is more compelling to me than the questions that emerge from the euro area’s still-incomplete union.

Some of the crucial issues have not changed. The old imbalances are starting to reappear, at least on the manufacturing side. China’s trade surplus is big once again—even if the recent rise in the goods surplus (from less than $300 billion a couple years back to around $600 billion in 2015) has not been matched by a parallel rise in China’s current account surplus. The U.S. non-petrol deficit is also big, and rising quite fast.

But some big things have also changed.

The United States imports a lot less oil, and pays a lot less for the oil it does import. That has held down the overall U.S. trade deficit.

LA area Port Traffic Declined in April

by Calculated Risk on 5/19/2016 02:32:00 PM

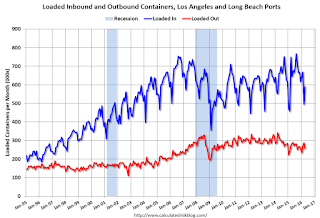

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.7% compared to the rolling 12 months ending in March. Outbound traffic was down 0.8% compared to 12 months ending in March.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports are moving sideways and imports are gradually increasing.

Earlier: Chicago Fed "Index shows economic growth picked up in April"

by Calculated Risk on 5/19/2016 12:07:00 PM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Picked Up in April

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.10 in April from –0.55 in March. All four of the broad categories of indicators that make up the index increased from March, but three of the four categories made nonpositive contributions to the index in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.22 in April from –0.18 in March. April’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in April (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Earlier: Philly Fed Manufacturing Survey showed Slight Contraction in May

by Calculated Risk on 5/19/2016 10:01:00 AM

Earlier from the Philly Fed: May 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey continued to report tenuous growth this month. The indicator for general activity was essentially unchanged in May and remained slightly negative. Other broad indicators also reflected general weakness in business conditions. The indicator for employment improved but remained negative. Manufacturers’ forecasts of future activity tempered slightly from last month, overall, but continue to suggest confidence in future growth.This was below the consensus forecast of a reading of 3.0 for May.

...

The diffusion index for current activity was essentially unchanged at -1.8 this month. The index has registered a negative reading in eight of the last nine months ...

The survey’s indicators of employment reflect similar weakness in May. Despite improving 15 points this month, the employment index registered its fifth consecutive negative reading, at -3.3.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys turned negative in May (yellow). This suggests the ISM survey will probably be below 50 this month.