by Calculated Risk on 2/04/2016 08:33:00 AM

Thursday, February 04, 2016

Weekly Initial Unemployment Claims increase to 285,000

The DOL reported:

In the week ending January 30, the advance figure for seasonally adjusted initial claims was 285,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 278,000 to 277,000. The 4-week moving average was 284,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised down by 250 from 283,000 to 282,750.The previous week was revised down to 277,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 284,750.

This was above the consensus forecast of 275,000. Although initial claims have increased recently, this is still a very low level and the 4-week average suggests few layoffs.

Wednesday, February 03, 2016

Tim Duy's Fed Watch: "Resisting Change?"

by Calculated Risk on 2/03/2016 06:36:00 PM

From Tim Duy: Resisting Change?

Bottom Line: Fischer is clearly less confident than earlier this month when he claimed that market participants were underestimating the pace of rate hikes. The baseline of four hikes is clearly is doubt; see here for my five potential scenarios. Financial market participants have almost completely discounted any rate hikes this year. This is a recession scenario that I am not enamored with. That said, I suspect market volatility and lack of inflation data keep them on hold in March and maybe April even if the recession does not come to pass. However (although not my baseline), I can tell a story where they feel like the employment data forces their hand. Especially so if they continue to downplay the inflation numbers. A substantial part of their policy still appears directed by a pre-conceived notion of "normal" policy. This I think is the Fed's largest error; the fact that the yield curve stubbornly resists being pushed higher suggests that the Fed's estimates of the terminal fed funds rates is wildly optimistic. There appear to be limits to which the Fed can resist the global pull of zero (or lower) rates.Thursday:

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 280 thousand initial claims, up from 278 thousand the previous week.

• 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is a 2.8% decrease in orders.

Goldman Forecast: No Rate Hike in March

by Calculated Risk on 2/03/2016 04:47:00 PM

A few excerpts from a research piece by Goldman Sachs economists Jan Hatzius and Zach Pandl: Revising our Fed Call

We ... now expect the FOMC to keep policy rates unchanged at the March 15-16 meeting ... financial conditions have tightened meaningfully, and officials sound inclined to take more time ... We therefore expect the next rate increase in June, and see a total of three rate increases this year.

... our forecasts remain well-above market pricing, which now shows only about a 50% chance that the Fed raises rates at all this year, and a 25% chance that the committee lowers rates. The first full rate hike is not priced in until about August 2017.

Preview: Employment Report for January

by Calculated Risk on 2/03/2016 01:15:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus, according to Bloomberg, is for an increase of 188,000 non-farm payroll jobs in January (with a range of estimates between 170,000 to 215,000), and for the unemployment rate to be unchanged at 5.0%.

The BLS reported 292,000 jobs added in December.

Note on Revisions: With the January release, the BLS will introduce revisions to nonfarm payroll employment to reflect the annual benchmark adjustment. The preliminary annual benchmark revision showed a downward adjustment of 208,000 jobs, and the preliminary estimate is usually pretty close.

Here is a summary of recent data:

• The ADP employment report showed an increase of 205,000 private sector payroll jobs in January. This was above expectations of 190,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in January to 45.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 40,000 in December. The ADP report indicated no change for manufacturing jobs. Note: Recently the ADP has been a better predictor for BLS reported manufacturing employment than the ISM survey.

The ISM non-manufacturing employment index decreased in December to 52.1%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 130,000 in January.

Combined, the ISM indexes suggests employment gains of 90,000. This suggests employment growth below expectations.

• Initial weekly unemployment claims averaged close to 283,000 in January, up from 275,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 294,000, up from 271,000 during the reference week in December.

The increase during the reference suggests more layoffs in January as compared to December.

• The final January University of Michigan consumer sentiment index decreased to 92.0 from the December reading of 92.6. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like lower gasoline prices.

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. However, based on these indicators, it appears job gains will be below consensus.

ISM Non-Manufacturing Index Decreased to 53.5% in January

by Calculated Risk on 2/03/2016 10:06:00 AM

The January ISM Non-manufacturing index was at 53.5%, down from 55.8% in December. The employment index decreased in January to 52.1%, down from 56.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 72nd consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 53.5 percent in January, 2.3 percentage points lower than the seasonally adjusted December reading of 55.8 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 53.9 percent, which is 5.6 percentage points lower than the seasonally adjusted December reading of 59.5 percent, reflecting growth for the 78th consecutive month at a slower rate. The New Orders Index registered 56.5 percent, 2.4 percentage points lower than the seasonally adjusted reading of 58.9 percent in December. The Employment Index decreased 4.2 percentage points to 52.1 percent from the seasonally adjusted December reading of 56.3 percent and indicates growth for the 23rd consecutive month. The Prices Index decreased 4.6 percentage points from the seasonally adjusted December reading of 51 percent to 46.4 percent, indicating prices decreased in January for the third time in the last five months. According to the NMI®, 10 non-manufacturing industries reported growth in January. The majority of the respondents’ comments are positive about business conditions; however, there is a concern that exists relative to global conditions, stock market volatility, and the effect on commercial and consumer confidence."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.5 and suggests slower expansion in January than in December.

ADP: Private Employment increased 205,000 in January

by Calculated Risk on 2/03/2016 08:15:00 AM

Private sector employment increased by 205,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 190,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 13,000 jobs in January, well off from December’s upwardly revised 30,000. The construction industry added 21,000 jobs, which was roughly in line with the average monthly jobs gained during 2015. Meanwhile, manufacturing neither added nor lost jobs.

Service-providing employment rose by 192,000 jobs in January, down from an upwardly revised 237,000 in December. The ADP National Employment Report indicates that professional/business services contributed 44,000 jobs, down from 69,000 in December. Trade/transportation/utilities grew by 35,000, up slightly from a downwardly revised 33,000 the previous month. The 19,000 new jobs added in financial activities were the most in that sector since March 2006.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong despite the turmoil in the global economy and financial markets. Manufacturers and energy companies are reducing payrolls, but job gains across all other industries remain robust. The U.S. economy remains on track to return to full employment by mid-year.”

The BLS report for January will be released Friday, and the consensus is for 188,000 non-farm payroll jobs added in January.

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Purchase Applications up 17% YoY

by Calculated Risk on 2/03/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 29, 2016. The previous week’s results included an adjustment for the Martin Luther King holiday

...

The Refinance Index increased 0.3 percent from the previous week to its highest level since October 2015. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 17 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 3.97 percent, from 4.02 percent, with points increasing to 0.41 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This is the fourth straight weekly decrease for this rate.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 17% higher than a year ago.

Tuesday, February 02, 2016

"Mortgage Rates Down to New 8-Month Lows"

by Calculated Risk on 2/02/2016 05:48:00 PM

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:15 AM, the ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in January, down from 257,000 in December.

• 10:00 AM, the ISM non-Manufacturing Index for January. The consensus is for index to be increased to 55.5 in January from 55.3 in December.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Down to New 8-Month Lows

Mortgage rates only paused for a brief moment of reflection yesterday before continuing with 2016's trend of improvement. Today's gains bring them easily back to new 8-month lows. Last Friday, that's a designation they shared with a few days in October. Today's rates don't need need to talk about sharing the trophy until we get all the way back to April 2015. The average lender is now easily down to conventional 30yr fixed rates of 3.75%. The stronger lenders have gradually been moving down to 3.625%.Here is a table from Mortgage News Daily:

emphasis added

U.S. Light Vehicle Sales at 17.46 million annual rate in January

by Calculated Risk on 2/02/2016 03:30:00 PM

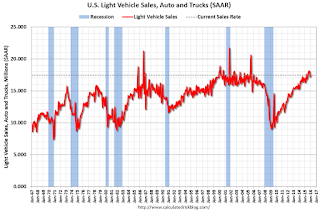

Based on an estimate from WardsAuto, light vehicle sales were at a 17.46 million SAAR in January.

That is up about 5% from January 2015, and up about 1.4% from the 17.2 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.46 million SAAR from WardsAuto).

This close to the consensus forecast of 17.5 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was at expectations, and vehicle sales in 2016 are off to a solid start.

The Return of Alt-A?

by Calculated Risk on 2/02/2016 12:03:00 PM

Kirsten Grind writes at the WSJ: Crisis-Era Mortgage Attempts a Comeback

These mortgages, which are given to borrowers that can’t fully document their income, helped fuel a tidal wave of defaults during the housing crisis and subsequently fell out of favor.Tanta explained Alt-A (and foresaw the name change): Reflections on Alt-A

Now, big money managers including Neuberger Berman, Pacific Investment Management Co. and an affiliate of Blackstone Group LP are lobbying lenders to make more of these “Alt-A” loans ...

...

There has also been a rebranding effort: Most lenders prefer to call these products “nonqualified mortgages” due to the stigma attached to the Alt-A category.

Eventually, after the bust works itself out and the economy leaves recession and the bankers crawl out from under their desks and stretch out those limbs that have been cramped into the fetal position, a kind of "not quite quite" lending will certainly return. I am in no way suggesting that the mortgage business has entered the Straight and Narrow Path and is going to stay on it forever because we have Learned Our Lessons. Credit cycles--not to mention institutional memories and economies like ours--don't work that way. It's just that whatever loosened lending re-emerges après le deluge will not be called "Alt-A."If you read closely, what Grind is describing isn't the bubble type "Alt-A" mortgages, rather it is collateral based lending - a version of subprime.

...

Alt-A is sort of a weird mirror-image of subprime lending. If subprime was traditionally about borrowers with good capacity and collateral but bad credit history, Alt-A was about borrowers with a good credit history but pretty iffy capacity and collateral. That is to say, while subprime makes some amount of sense, Alt-A never made any sense. It is a child of the bubble.

If bubble type "Alt-A" tries to make a return, then the regulators should just say No!