by Calculated Risk on 12/23/2015 02:42:00 PM

Wednesday, December 23, 2015

Philly Fed: State Coincident Indexes increased in 40 states in November

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2015. In the past month, the indexes increased in 40 states, decreased in five, and remained stable in five, for a one-month diffusion index of 70. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 44 states had increasing activity (including minor increases).

Five states have seen declines over the last 6 months, in order they are North Dakota (worst), Wyoming, Alaska, Montana, and Louisiana - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now. Source: Philly Fed.

Comments on November New Home Sales

by Calculated Risk on 12/23/2015 11:50:00 AM

The new home sales report for October was somewhat below expectations, and sales for August, September and October were revised down. Sales were up 9.1% year-over-year in November (SA).

Earlier: New Home Sales increased to 490,000 Annual Rate in November.

Even though the November report was somewhat disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through November, were 461,000, not seasonally adjusted (NSA). That is up 14.5% from 402,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for 2015 through November.

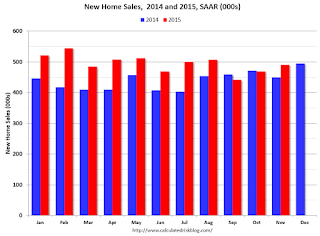

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gains were stronger earlier this year, but the overall year-over-year gain should be solid in 2015. The comparisons in early 2016 will be more difficult.

Overall this was a solid year for new home sales.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 490,000 Annual Rate in November

by Calculated Risk on 12/23/2015 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 490 thousand.

The previous three months were revised down by a total of 36 thousand (SAAR).

"Sales of new single-family houses in November 2015 were at a seasonally adjusted annual rate of 490,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.3 percent above the revised October rate of 470,000 and is 9.1 percent above the November 2014 estimate of 449,000"

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 5.7 months.

The months of supply decreased in November to 5.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of November was 232,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2015 (red column), 34 thousand new homes were sold (NSA). Last year 31 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was below expectations of 503,000 sales SAAR in November, and prior months were revised down - a somewhat disappointing report. I'll have more later today.

Personal Income increased 0.3% in November, Spending increased 0.3%

by Calculated Risk on 12/23/2015 08:30:00 AM

Note: Some of this data was inadvertently released early. The BEA released the Personal Income and Outlays report for November:

Personal income increased $44.4 billion, or 0.3 percent, ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $40.1 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through November 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in November, in contrast to a decrease of less than 0.1 percent in October. ... The price index for PCE increased less than 0.1 percent in November, compared with an increase of 0.1 percent in October. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

The November PCE price index increased 0.4 percent from November a year ago. The November PCE price index, excluding food and energy, increased 1.3 percent from November a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was larger than expected. And the increase in PCE was at the 0.3% increase consensus.

On inflation: The PCE price index increased 0.4 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.3 percent year-over-year in November.

Using the two-month method to estimate Q3 PCE growth, PCE was increasing at a 2.1% annual rate in Q3 2015 (using the mid-month method, PCE was increasing 2.0%). This suggests PCE growth will slow in Q4.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey, Purchase Applications up 37% YoY

by Calculated Risk on 12/23/2015 07:01:00 AM

From the MBA: Refinance, Purchase Applications Both Up in Latest MBA Weekly Survey

Mortgage applications increased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 18, 2015.

...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 37 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.16 percent from 4.14 percent, with points increasing to 0.47 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and 2015 was low too. Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 37% higher than a year ago.

Tuesday, December 22, 2015

Wednesday: New Home Sales, Durable Goods, Personal Income and Outlays and More

by Calculated Risk on 12/22/2015 07:24:00 PM

From Matt Busigin at Macrofugue: US Recession Callers Are Embarrassing Themselves

Through a combination of quackery, charlatanism, and inadequate utilisation of mathematics, callers for US recession in 2016 are embarrassing themselves. Again.CR Note: Usually there is a reason for a recession such as a bursting bubble or the Fed tightening quickly to fight inflation. Currently the recession callers seem to focus mostly on global weakness and the strong dollar. That has pushed U.S. manufacturing into contraction (along with low oil prices), but I don't think it will push the US economy into recession. Oh well, someone is always predicting a recession and they are usually wrong (I did forecast a recession in 2007, but I was on recession watch because of the housing bubble). Right now I'm not even on recession watch.

The most prominent reason for recession calling may well be the Institute of Supply Management’s Manufacturing Purchasing Manager Index. The problem with this recession forecasting methodology is that it doesn’t work.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for a increase in sales to 503 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 495 thousand in October.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 91.9, up from the preliminary reading 91.8.

Chemical Activity Barometer "Chemical Activity Barometer Ends Year with Modest Uptick"

by Calculated Risk on 12/22/2015 03:12:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Ends Year with Modest Uptick

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), strengthened slightly in December, rising 0.2 percent following a similar gain in November. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.5 percent over this time last year, a marked deceleration of activity since the second quarter....

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

This suggests that industrial production might have stabilized.

A Few Random Comments on November Existing Home Sales

by Calculated Risk on 12/22/2015 11:55:00 AM

First, the decline in existing home sales was not a surprise, see: Existing Home Sales: Take the Under Tomorrow

Second, a key reason for the decline was the new TILA-RESPA Integrated Disclosure (TRID). In early October, this new disclosure rule pushed down mortgage applications sharply - however applications have since bounced back. Note: TILA: Truth in Lending Act, and RESPA: the Real Estate Settlement Procedures Act of 1974. The impact from TRID will sort out over a few months.

Third, there are probably some economic reasons too for the decline (not just a change in disclosures). Low inventory is probably holding down sales in many areas, and weakness in some oil producing areas (see: Houston has a problem) are also impacting sales.

Earlier: Existing Home Sales declined in November to 4.76 million SAAR

I expected some increase in inventory this year, but that hasn't happened. Inventory is still very low and falling year-over-year (down 1.9% year-over-year in November). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Also, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. So some slowing for existing home sales is not be a big deal for the economy.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in November (red column) were the same as last year, matching the lowest for November since 2011 (NSA).

Existing Home Sales declined in November to 4.76 million SAAR

by Calculated Risk on 12/22/2015 10:11:00 AM

From the NAR: Existing-Home Sales Suffer Setback in November, Fall to Slowest Pace Since April 2014

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 10.5 percent to a seasonally adjusted annual rate of 4.76 million in November (lowest since April 2014 at 4.75 million) from a downwardly revised 5.32 million in October. After last month's decline (largest since July 2010 at 22.5 percent), sales are now 3.8 percent below a year ago — the first year-over-year decrease since September 2014. ...

Total housing inventory at the end of November decreased 3.3 percent to 2.04 million existing homes available for sale, and is now 1.9 percent lower than a year ago (2.08 million). Unsold inventory is at a 5.1-month supply at the current sales pace, up from 4.8 months in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (4.76 million SAAR) were 10.5% lower than last month, and were 3.8% below the November 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.04 million in November from 2.11 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.04 million in November from 2.11 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 1.9% year-over-year in November compared to November 2014.

Inventory decreased 1.9% year-over-year in November compared to November 2014. Months of supply was at 5.1 months in November.

This was below consensus expectations of sales of 5.32 million (but not a surprise for CR readers). For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Q3 GDP Revised Down to 2.0% Annual Rate

by Calculated Risk on 12/22/2015 08:36:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 2.0 percent in the third quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.9 percent.Here is a Comparison of Third and Second Estimates. PCE growth was unrevised at 3.0%. Residential investment was revised up from 7.3% to 8.2%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.1 percent. With the third estimate for the third quarter, the general picture of economic growth remains the same; private inventory investment decreased more than previously estimated ...

emphasis added