by Calculated Risk on 8/27/2015 10:22:00 AM

Thursday, August 27, 2015

NAR: Pending Home Sales Index increased 0.5% in July, up 7% year-over-year

From the NAR: Pending Home Sales Inch Forward in July

The Pending Home Sales Index, a forward-looking indicator based on contract signings, marginally increased 0.5 percent to 110.9 in July from an upwardly revised 110.4 in June and is now 7.4 percent above July 2014 (103.3). The index has increased year-over-year for 11 consecutive months and is the third highest reading of 2015, behind April (111.6) and May (112.3).This was below expectations of a 1.0% increase.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

Q2 GDP Revised up to 3.7%, Weekly Initial Unemployment Claims decreased to 271,000

by Calculated Risk on 8/27/2015 08:37:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 3.7 percent in the second quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.6 percent.Here is a Comparison of Advance and Second Estimates. PCE growth was revised up from 2.9% to 3.1%. Residential investment was revised up from 6.6% to 7.8%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.3 percent. With the second estimate for the second quarter, nonresidential fixed investment and private inventory investment increased. ...

emphasis added

Solid growth. And above the consensus of 3.2%.

The DOL reported:

In the week ending August 22, the advance figure for seasonally adjusted initial claims was 271,000, a decrease of 6,000 from the previous week's unrevised level of 277,000. The 4-week moving average was 272,500, an increase of 1,000 from the previous week's unrevised average of 271,500.The previous week was unrevised at 277,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 272,500.

This was sligthly higher than the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, August 26, 2015

Thursday: GDP, Unemployment Claims, Penidng Home Sales, Jackson Hole Symposium

by Calculated Risk on 8/26/2015 09:16:00 PM

From Tim Duy: Dudley Puts The Kibosh On September

Monday's action on Wall Street was too much for the Fed. That day, Atlanta Federal Reserve President Dennis Lockhart pulled back his previous dedication to a September rate hike earlier, reverting to only an expectation that rates rise sometimes this year. But today New York Federal Reserve President William Dudley explicitly called September into question. ...I think the Fed is still data dependent, and the key will be if inflation picks up. This model is interesting, and suggests a slight pickup in inflation later this year and into 2016.

...

Bottom Line: The Fed has long argued that the timing of the first rate hike does not matter. I had thought so as well, but that is clearly no longer the case. A rate hike during a period of substantial financial market turmoil would matter a great deal. It looks like the Fed's plans to raise rate will once again be overtaken by events.

Thursday:

• All day: the Kansas City Fed Hosts Symposium in Jackson Hole, Wyoming (Thursday, Friday, and Saturday).

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2015 (second estimate). The consensus is that real GDP increased 3.2% annualized in Q2, revised up from 2.3% in the advance estimate.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 277 thousand the previous week.

• At 10:00 AM, Pending Home Sales Index for July. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

Last Week: Key Measures Show Low Inflation in July

by Calculated Risk on 8/26/2015 06:01:00 PM

While I was on vacation, there were several key economic releases. Here is the CPI release ...

Last week the Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

ccording to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.8% annualized rate) in July. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for July here. Motor fuel was down sharply in July.

[Last week], the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.6% annualized rate) in July. The CPI less food and energy also rose 0.1% (1.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for June and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.6% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/26/2015 03:01:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for selected cities in July.

On distressed: Total "distressed" share is down in most of these markets. Distressed sales are up in the Mid-Atlantic due to an increase in foreclosures.

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul- 2015 | Jul- 2014 | Jul- 2015 | Jul- 2014 | Jul- 2015 | Jul- 2014 | Jul- 2015 | Jul- 2014 | |

| Las Vegas | 7.0% | 11.5% | 7.7% | 9.1% | 14.7% | 20.6% | 27.1% | 35.6% |

| Reno** | 3.0% | 4.0% | 2.0% | 8.0% | 5.0% | 12.0% | ||

| Phoenix | 2.8% | 3.7% | 3.5% | 5.9% | 6.3% | 9.6% | 23.4% | 24.8% |

| Sacramento | 4.7% | 5.7% | 4.6% | 6.3% | 9.3% | 12.1% | 18.1% | 20.9% |

| Minneapolis | 1.9% | 3.1% | 5.4% | 9.3% | 7.3% | 12.4% | ||

| Mid-Atlantic | 3.4% | 4.3% | 9.4% | 7.7% | 12.8% | 12.1% | 15.8% | 17.1% |

| Orlando | 3.7% | 8.3% | 20.1% | 24.4% | 23.8% | 32.7% | 34.5% | 39.3% |

| Bay Area CA* | 2.4% | 2.8% | 2.4% | 2.6% | 4.8% | 5.4% | 20.1% | 20.7% |

| So. California* | 3.2% | 4.3% | 3.9% | 4.6% | 7.1% | 8.9% | 21.7% | 25.1% |

| Florida SF | 3.3% | 5.9% | 16.3% | 20.7% | 19.6% | 26.6% | 32.8% | 37.7% |

| Florida C/TH | 2.4% | 19.1% | 15.2% | 19.1% | 17.6% | 38.1% | 59.2% | 64.3% |

| Chicago (city) | 13.5% | 17.7% | ||||||

| Hampton Roads | 15.1% | 17.2% | ||||||

| Spokane | 9.0% | 12.2% | ||||||

| Northeast Florida | 26.4% | 31.0% | ||||||

| Toledo | 27.0% | 32.9% | ||||||

| Tucson | 23.7% | 26.2% | ||||||

| Peoria | 15.6% | 18.4% | ||||||

| Georgia*** | 20.3% | 24.1% | ||||||

| Omaha | 13.9% | 17.0% | ||||||

| Knoxville | 21.8% | 25.5% | ||||||

| Richmond VA MSA | 8.4% | 12.1% | 18.1% | 18.4% | ||||

| Memphis | 12.6% | 13.3% | ||||||

| Springfield IL** | 5.6% | 7.2% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Zillow Forecast: Expect Case-Shiller to show "Uptick in Appreciation" year-over-year change in July

by Calculated Risk on 8/26/2015 11:59:00 AM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: July Case-Shiller: Expect a Slight Uptick in Appreciation

The June S&P/Case-Shiller (SPCS) data published today showed home prices continuing to rise at an annual rate of five percent for the 20-city composite and 4.6 percent for the 10-city composite. The national index has risen 4.5 percent since June 2014.This suggests the year-over-year change for the July Case-Shiller National index will be slightly higher than in the June report.

The non-seasonally adjusted (NSA) 10- and 20-city indices were both down 0.1 percent from May to June. We expect the change in the July SPCS to show increases of 0.8 percent for the 20-city index and 0.7 percent for the 10-City Index.

All Case-Shiller forecasts are shown in the table below. These forecasts are based on today’s June SPCS data release and the July 2015 Zillow Home Value Index (ZHVI), release August 24. The SPCS Composite Home Price Indices for July will not be officially released until Tuesday, September 28.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| June Actual YoY | 4.6% | 4.6% | 5.0% | 5.0% | 4.5% | 4.5% |

| July Forecast YoY | 4.8% | 4.8% | 5.2% | 5.2% | 4.6% | 4.6% |

| July Forecast MoM | 0.7% | 0.1% | 0.8% | 0.1% | 0.7% | 0.3% |

AIA: Architecture Billings Index indicated expansion in July

by Calculated Risk on 8/26/2015 09:31:00 AM

This was released last week while I was on vacation.

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Firm Billings Continued to Rise in July

Business conditions at U.S. architecture firms continued to improve in July. While the pace of growth of architecture firm billings decreased modestly from June, the ABI score of 54.7 for the month indicates that firm billings remain on the upswing overall. In addition, there continues to be plenty of work in the pipeline, with firms reporting strong inquiries into new projects as well as the highest design contracts score since the end of 2014.

...

By firm specialization, firms with an institutional focus are still reporting some of the strongest business conditions they have ever experienced, and firms with a commercial/industrial specialization continue to recover from some softness earlier in the year. In addition, firms with a residential specialization are coming close to emerging from the slump that they have experienced for the last six months, which came on the heels of several years of strong growth. Scores for this segment have been ticking up for the last two months and will hopefully return to positive territory before the end of the summer.

...

Sector index breakdown: institutional (57.3), commercial / industrial (53.4) multi-family residential (49.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.7 in July, down from 55.7 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the sixth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey, Purchase Index up 18% YoY

by Calculated Risk on 8/26/2015 07:00:00 AM

From the MBA: Increase in Government Purchase Loans Drive Overall Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 21, 2015. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 0.3 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.08 percent from 4.11 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

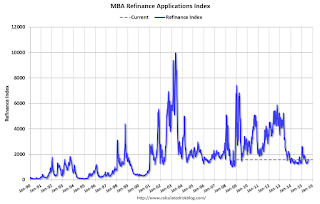

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, August 25, 2015

Wednesday: Durable Goods

by Calculated Risk on 8/25/2015 08:46:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 0.4% decrease in durable goods orders.

This is a leading indicator for industry production, from the ACC: Chemical Activity Barometer Follows Global Markets Downward

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), dropped 0.3 percent in August, a marked deceleration of activity from second quarter performance. The declined follows a 0.1 percent gain in July and 0.5 percent gain in both May and June. Data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.8 percent over this time last year, also a deceleration of annual growth as compared to this time last year when the barometer logged a 4.2 percent annual gain over 2013.

...

“Chemical, other equity, and product prices all suffered greatly in our latest reading of the Chemical Activity Barometer,” said ACC Chief Economist Kevin Swift. “There continued to be upward momentum in plastic resins for both consumer applications and light vehicles, but we also continue to see declines in oilfield chemicals and U.S. exports overall, largely as a result of softer oil prices and a strong U.S. dollar,” Swift said. Despite these modest headwinds, the Chemical Activity Barometer is still signaling slow gains in business activity into the early part of 2016.

Real Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/25/2015 03:04:00 PM

The year-over-year increase in prices is mostly moving sideways now at between 4% and 5%.. In October 2013, the National index was up 10.9% year-over-year (YoY). In June 2015, the index was up 4.5% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.2% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.4% |

| Feb-15 | 4.3% |

| Mar-15 | 4.2% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.5% |

Most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it is good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.5% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through June) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through June) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to May 2003 levels, the Composite 20 index is back to April 2003, and the CoreLogic index back to October 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.1% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to April 2003 levels, the Composite 20 index is back to January 2003 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.