by Calculated Risk on 7/29/2015 03:41:00 PM

Wednesday, July 29, 2015

Duy on FOMC: "Somewhat more hawkish as the Fed gears up to hike rates later this year"

From Tim Duy: FOMC Recap

The July FOMC meeting yielded the widely expected outcome of no policy change. Very little change in the statement either - pulling out any useful information is about as easy as reading tea leaves or chicken bones. But that won't stop me from trying! On net, I would count it was somewhat more hawkish as the Fed gears up to hike rates later this year. By no means, however, did the statement make any definitive signal about September. The Fed continues to hold true to its promise to make the next move about the data. The era of handholding fades further into memory.There is much more in Professor Duy's piece. A rate hike in September is possible. It depends on the data.

...

Bottom Line: All else equal, the next two labor reports will factor strongly into the Fed's decision in September. A continuation of recent labor trends is likely sufficient to induce them to pull the trigger. Further signs of stronger wage growth would make a September move a certainty.

emphasis added

FOMC Statement: No Change in Policy, No Clues for September

by Calculated Risk on 7/29/2015 02:02:00 PM

Information received since the Federal Open Market Committee met in June indicates that economic activity has been expanding moderately in recent months. Growth in household spending has been moderate and the housing sector has shown additional improvement; however, business fixed investment and net exports stayed soft. The labor market continued to improve, with solid job gains and declining unemployment. On balance, a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year. Inflation continued to run below the Committee's longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports. Market-based measures of inflation compensation remain low; survey‑based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

How large will the first Fed Funds Rate increase be?

by Calculated Risk on 7/29/2015 11:49:00 AM

Just wondering ...

No one expects a rate hike from the FOMC today. And most of the focus has been on WHEN the first rate hike will happen - and also how quickly the Fed will subsequently raise rates. Note: Most analysts expect the first rate hike in either September or December - and some think the Fed will wait until 2016.

But how large will the first rate hike be? Most analysts seem to expect a 25 bps increase - but what does that mean?

In December 2008, the Fed lowered the Fed Funds rate from 1.0% to a range of 0.0% to 0.25%. From December 2008:

"The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent."So is a 25 bps increase from zero to 0.25%? Or is it from the top of the range to 0.5%?

It seems unlikely the FOMC will increase the range to 0.25% to 0.5%.

Currently the effective Fed Funds rate is at 0.14%. This bounces around every day, but it has been close to 1/8 percent on average.

So it is possible the FOMC will raise rates 25 bps to 3/8 percent (0.375%).

NAR: Pending Home Sales Index decreased 1.8% in June, up 8% year-over-year

by Calculated Risk on 7/29/2015 10:02:00 AM

From the NAR: Pending Home Sales Dip in June

After five consecutive months of increases, pending home sales slipped in June but remained near May's level, which was the highest in over nine years, according to the National Association of Realtors®. Modest gains in the Northeast and West were offset by larger declines in the Midwest and South.This was below expectations of a 1.0% increase.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 1.8 percent to 110.3 in June but is still 8.2 percent above June 2014 (101.9). Despite last month's decline, the index is the third highest reading of 2015 and has now increased year-over-year for ten consecutive months.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 18% YoY

by Calculated Risk on 7/29/2015 07:00:00 AM

From the MBA: Refinance Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 24, 2015. ...

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier. The unadjusted Purchase Index increased 0.2 percent compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.17 percent, the lowest level since June 2015, from 4.23 percent, with points increasing to 0.36 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is very low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, July 28, 2015

Wednesday: FOMC, Pending Home Sales

by Calculated Risk on 7/28/2015 07:25:00 PM

A few excerpts from an FOMC preview by Goldman Sachs economist Zach Pandl:

The July 28-29 FOMC meeting is shaping up to be the calm before the storm. Short-term interest rate markets imply a zero probability that the committee will raise policy rates next week, but show a high likelihood of at least one hike before the end of the year. Thus, although changes to the stance of policy look very unlikely, the upcoming statement will be closely watched for any clues on the precise timing of liftoff (we continue to see December as most likely). We will be focused on three main items:Wednesday:

...

• First, the description of economic conditions will likely acknowledge the decline in the unemployment rate. We expect the statement to drop its prior reference to stable oil prices, but to leave other comments about inflation unchanged.

• Second, we do not expect additional language intended to prepare for rate hikes in the statement. In 2004 the FOMC used the “measured” phrase for this purpose, but Fed Chair Yellen downplayed the need for new guidance at the June press conference. A change along these lines is a risk for next week, however.

• Third, we do not expect dissents, but see them as a risk from President Evans (dovish) and President Lacker (hawkish).

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 1.0% increase in the index.

• Also at 2:00 PM, FOMC Meeting Announcement. No change is expected to policy.

Real Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/28/2015 01:11:00 PM

A great discussion from Nick Timiraos at the WSJ: Are Home Prices Again Breaking Records? Not Really

The National Association of Realtors‘ monthly home sales report made a big splash last week with news that median home prices in June had broken the record set in 2006 at the peak of the housing bubble, reaching a nominal high of $236,400.The price-to-rent does seem a little high (last graph below), but the speculation associated with a bubble isn't present. No worries.

Does this mean we have another problem on our hands? Not really.

...[see data and graphs]

...

There may be other reasons to worry about housing affordability by comparing prices with incomes or prices with rents for a given market. But crude comparisons of nominal home prices with their 2006 and 2007 levels shouldn’t be used to make cavalier claims about a new bubble.

The year-over-year increase in prices is mostly moving sideways now at a little over 4%. In October 2013, the National index was up 10.9% year-over-year (YoY). In May 2015, the index was up 4.4% YoY.

Here is the YoY change since last May for the National Index:

| Month | YoY Change |

|---|---|

| May-14 | 7.1% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.7% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.4% |

| Feb-15 | 4.3% |

| Mar-15 | 4.2% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

Most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

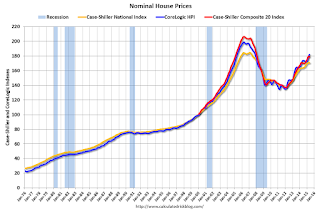

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to April 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to October 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.6% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to March 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

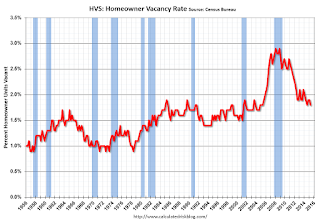

HVS: Q2 2015 Homeownership and Vacancy Rates

by Calculated Risk on 7/28/2015 10:16:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.4% in Q2, from 63.7% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate is the lowest in decades.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Case-Shiller: National House Price Index increased 4.4% year-over-year in May

by Calculated Risk on 7/28/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Lead Housing According to the S&P/Case-Shiller Home Price Indices

The 10-City Composite and National indices showed slightly higher year-over-year gains while the 20-City Composite had marginally lower year-over-year gains when compared to last month. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 4.9% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.4% annual increase in May 2015 versus a 4.3% increase in April 2015.

...

Before seasonal adjustment, in May the National index, 10-City Composite and 20-City Composite all posted a gain of 1.1% month-over-month. After seasonal adjustment, the National index was unchanged; the 10-City and 20-City Composites were both down 0.2% month-over-month. All 20 cities reported increases in May before seasonal adjustment; after seasonal adjustment, 10 were down, eight were up, and two were unchanged.

...

“As home prices continue rising, they are sending more upbeat signals than other housing market indicators,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, single family home price increases have settled into a steady 4%-5% annual pace following the double-digit bubbly pattern of 2013. Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate."

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.4% from the peak, and down 0.2% in May (SA).

The Composite 20 index is off 13.3% from the peak, and down 0.2% (SA) in May.

The National index is off 7.5% from the peak, and unchanged (SA) in May. The National index is up 24.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to May 2014.

The Composite 20 SA is up 4.9% year-over-year..

The National index SA is up 4.4% year-over-year.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in May seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 39.5% from the peak, and prices in Denver are at a new high (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 51% above January 2000 (51% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 11% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

Monday, July 27, 2015

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 7/27/2015 08:14:00 PM

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May prices. The consensus is for a 5.6% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in May.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

• Also at 10:00 AM, Q2 Housing Vacancies and Homeownership survey.

To put the recent 5 day sell-off in perspective, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...