by Calculated Risk on 5/26/2015 04:32:00 PM

Tuesday, May 26, 2015

Regional Fed Manufacturing Surveys for May and the ISM Index

Earlier today the last two regional Fed surveys for May were released. As expected, the Dallas Fed was especially weak due primarily to weakness in the oil sector.

From the Dallas Fed: Texas Manufacturing Activity Contracts Further

Texas factory activity declined again in May, according to business executives responding to the Texas Manufacturing Outlook Survey. ... The general business activity index fell to -20.8 in May, its lowest reading since June 2009.And from the Richmond Fed: Manufacturing Sector Activity Remained Tepid; Employment Edged Up, Wage Growth Accelerated

Labor market indicators reflected employment declines and shorter workweeks. The May employment index declined 10 points to -8.2, after rebounding slightly above zero last month. Twelve percent of firms reported net hiring, compared with 21 percent reporting net layoffs. The hours worked index fell from -5 to -11.6.

emphasis added

Manufacturing activity remained soft this month, with several components flattening. The composite index for manufacturing moved to 1 following April's reading of −3, while the shipments index leveled off to −1 from −6. In addition, the index for new orders gained eight points, reaching a nearly flat reading of 2. ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Manufacturing employment continued to grow at a modest pace in May. The index ended the survey period at 3 compared to last month's reading of 7. The average workweek increased; the index moved up two points to end at 6. Additionally, the index for average wages advanced 11 points to finish at a reading of 20.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM index will be weak again in May, and will probably be around the same level as in April.

Real Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/26/2015 02:29:00 PM

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In March 2015, the index was up 4.1% YoY. However the YoY change has only declined slightly over the last six months.

As I've noted before, I think most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to March 2005.

Real House Prices

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to July 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.5% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Comments on New Home Sales

by Calculated Risk on 5/26/2015 11:32:00 AM

The new home sales report for April was above expectations at 517 thousand on a seasonally adjusted annual rate basis (SAAR).

Earlier: New Home Sales increased to 517,000 Annual Rate in April

The Census Bureau reported that new home sales this year, through April, were 179,000, Not seasonally adjusted (NSA). That is up 23.7% from 145,000 during the same period of 2014 (NSA). That is a solid first four months!

Sales were up 26.1% year-over-year in April, but that was an easy comparison.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be strong through July (the first seven months were especially weak in 2014), however I expect the year-over-year increases to slow later this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 517,000 Annual Rate in April

by Calculated Risk on 5/26/2015 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 517 thousand.

The previous three months were revised up by a total of 5 thousand (SA).

"Sales of new single-family houses in April 2015 were at a seasonally adjusted annual rate of 517,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.8 percent above the revised March rate of 484,000 and is 26.1 percent above the April 2014 estimate of 410,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 4.8 months.

The months of supply decreased in April to 4.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of April was 205,000. This represents a supply of 4.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2015 (red column), 49 thousand new homes were sold (NSA). Last year 39 thousand homes were sold in April. This is the highest for April since 2008.

The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was above expectations of 509,000 sales in April, and this is still a solid start for 2015. I'll have more later today.

Case-Shiller: National House Price Index increased 4.1% year-over-year in March

by Calculated Risk on 5/26/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Accelerate, Led by San Francisco and Denver According to the S&P/Case-Shiller Home Price Indices

Data released today for March 2015 show that home prices continued their rise across the country over the last 12 months. ... Both the 10-City and 20-City Composites saw year-over-year increases in March. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 5.0% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual gain in March 2015 versus a 4.2% increase in February 2015.

...

The National index increased again in March with a 0.8% increase for the month. Both the 10- and 20-City Composites increased significantly, reporting 0.8% and 0.9% month-over-month increases, respectively. Of the 19 cities reporting increases, San Francisco led all cities with an increase of 3.0%. Seattle followed next with a reported increase of 2.3%. Cleveland reported an increase of 0.4%, its first positive month-over-month increase since August 2014. New York was the only city to report a negative month-over-month change with a -0.1% decrease for March 2015.

...

“Home prices have enjoyed year-over-year gains for 35 consecutive months,” says David M. Blitzer, Managing Director & Chairman of the Index Committee for S&P Dow Jones Indices. “The pattern of consistent gains is national and seen across all 20 cities covered by the S&P/Case-Shiller Home Price Indices. The longest run of gains is in Detroit at 45 months, the shortest is New York with 27 months. However, the pace has moderated in the last year; from August 2013 to February 2014, the national index gained more than 10% year-over-year, compared to 4.1% in this release.

“Given the long stretch of strong reports, it is no surprise that people are asking if we’re in a new home price bubble. The only way you can be sure of a bubble is looking back after it’s over. The average 12 month rise in inflation adjusted home prices since 1975 is about 1.0% per year compared to the current 4.1% pace, arguing for a bubble. However, the annual rate of increase halved in the last year, as shown in the first chart. Home prices are currently rising more quickly than either per capita personal income (3.1%) or wages (2.2%), narrowing the pool of future home-buyers. All of this suggests that some future moderation in home prices gains is likely. Moreover, consumer debt levels seem to be manageable. I would describe this as a rebound in home prices, not bubble and not a reason to be fearful.”

emphasis added

Click on graph for larger image.

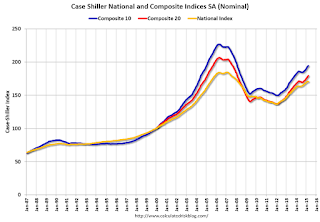

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.2% from the peak, and up 0.9% in March (SA).

The Composite 20 index is off 13.1% from the peak, and up 0.9% (SA) in March.

The National index is off 7.6% from the peak, and up 0.1% (SA) in March. The National index is up 24.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.1% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 40.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (50% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.