by Calculated Risk on 4/20/2015 08:35:00 AM

Monday, April 20, 2015

Chicago Fed: "Index shows economic growth slowed in March"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth slowed in March

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to –0.42 in March from –0.18 in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

Two of the four broad categories of indicators that make up the index decreased from February, and three of the four categories made negative contributions to the index in March.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.27 in March from –0.12 in February. March’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in March (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, April 19, 2015

Sunday Night Futures

by Calculated Risk on 4/19/2015 08:24:00 PM

From the NY Times: Greece Flashes Warning Signals About Its Debt

By the standards of his frenzied schedule here last week, the meeting on Friday between Yanis Varoufakis, the Greek finance minister, and Lee C. Buchheit, the dean of international debt lawyers, was a quiet one.Monday:

...

But the get-together with Mr. Buchheit carried critical meaning, according to experts here. After all, it was Mr. Buchheit who helped broker Greece’s most recent debt refinancing, in 2012.

...

Unless the creditors agree soon to release the next allotment of bailout money, Greece could have trouble making a $763 million payment to the I.M.F. on May 12. It almost certainly would not be able to meet the €11 billion in payments to the European Central Bank in June and July.

• 8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

Weekend:

• Schedule for Week of April 19, 2015

• Existing Home Sales: Lawler vs. the Consensus

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up slightly and DOW futures are up 25 (fair value).

Oil prices were up sharply over the last week with WTI futures at $56.09 per barrel and Brent at $63.45 per barrel. A year ago, WTI was at $104, and Brent was at $107 - so prices are down over 40% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.46 per gallon (down about $1.20 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 4/19/2015 09:43:00 AM

The NAR will report March Existing Home Sales on Wednesday, April 22nd. The consensus, according to Bloomberg, is that the NAR will report sales of 5.04 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.18 million on a seasonally adjusted annual rate (SAAR) basis, up from 4.88 million SAAR in February.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last five years, the consensus average miss was 150 thousand with a standard deviation of 160 thousand. Lawler's average miss was 70 thousand with a standard deviation of 45 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little better recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, April 18, 2015

Schedule for Week of April 19, 2015

by Calculated Risk on 4/18/2015 10:56:00 AM

The key economic reports this week are March new home sales on Thursday and existing home sales on Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Regional and State Employment and Unemployment (Monthly), March 2015

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for February 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.03 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.88 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.18 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 294 thousand.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for a decrease in sales to 510 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 539 thousand in February.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

Friday, April 17, 2015

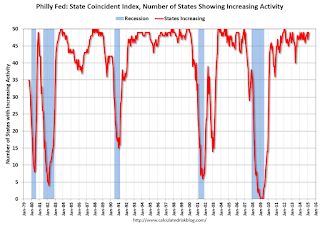

Philly Fed: State Coincident Indexes increased in 46 states in February

by Calculated Risk on 4/17/2015 07:29:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2015. In the past month, the indexes increased in 46 states, decreased in one, and remained stable in three, for a one-month diffusion index of 90. Over the past three months, the indexes increased in 49 states and decreased in one (West Virginia), for a three-month diffusion index of 96.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In February, 49 states had increasing activity (including minor increases). This measure has been moving up and down, and is in the normal range for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. It seems likely that several oil producing states will turn red sometime in 2015 - possibly Texas, North Dakota, Alaska or Oklahoma.