by Calculated Risk on 3/27/2015 08:31:00 AM

Friday, March 27, 2015

Q4 GDP unrevised at 2.2% Annual Rate

From the BEA: Gross Domestic Product: Fourth Quarter 2014 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.2 percent in the fourth quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.Here is a Comparison of Third and Secord Estimates. PCE was revised up from 4.2% to 4.4% - solid. Private investment was revised down from 5.1% to 3.7%. This was below expectations of a revision to 2.4%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 2.2 percent. While increases in exports and in personal consumption expenditures (PCE) were larger than previously estimated and the change in private inventories was smaller, GDP growth is unrevised, and the general picture of the economy for the fourth quarter remains the same

Thursday, March 26, 2015

Friday: Yellen, GDP, Consumer Sentiment

by Calculated Risk on 3/26/2015 08:44:00 PM

From Merrill Lynch on the March employment report:

The recent employment reports have been exceptionally strong with job growth averaging 293,000 a month for the past six months. Although we expect a slight moderation in March with job growth of 270,000, this would still be a healthy number. ...Friday:

Despite strong job growth, we think the unemployment rate will tick up to 5.6%. ... The risk is that the labor force participation rate increases, reversing the decline in February. As always, the focus will be on wages. We look for a 0.2% gain, an improvement from the 0.12% increase in February. This would leave the yoy rate at 2.0%. We think the risk, however, is that average hourly earnings surprises on the upside relative to our forecast.

• 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (third estimate). The consensus is that real GDP increased 2.4% annualized in Q4, up from the second estimate of 2.2%.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 91.8, up from the preliminary reading of 91.2, but down from the February reading of 95.4.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly), February 2015

• At 3:45 PM, Speech, Fed Chair Janet Yellen, Monetary Policy, At the Federal Reserve Bank of San Francisco Conference: The New Normal for Monetary Policy, San Francisco, Calif

Mortgage News Daily: Mortgage Rates increased Today

by Calculated Risk on 3/26/2015 05:24:00 PM

Earlier I posted the results of the weekly Freddie Mac survey that showed rates declined recently. However mortgage rates increased today.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Increase Rapidly

Mortgage rates rose rapidly today, almost completely erasing the improvement following last week's Fed Announcement. This is especially ironic considering most major media outlets are running Freddie Mac's weekly mortgage rate survey headline. Because that survey receives most of its responses on Monday and Tuesday, it fully benefited from the stronger levels earlier in the week after having totally missed out on last Wednesday and Thursday's big move lower. As such, the headlines suggest that rates are significantly lower this week. That was certainly true on Tuesday afternoon, but rates have risen roughly an eighth of a point since then. That's a big move considering we've gone entire months without moving more than an eighth.Here is a table from Mortgage News Daily:

Specifically, what had been 3.625 to 3.75% is now 3.75 to 3.875% in terms of the most prevalently-quoted conventional 30yr fixed rates for top tier scenarios. The upfront costs associated with moving down to 3.75 from 3.875% are still quite low.

Freddie Mac: 30 Year Mortgage Rates decrease to 3.69% in Latest Weekly Survey

by Calculated Risk on 3/26/2015 02:01:00 PM

From Freddie Mac today: Mortgage Rates Move Down Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down again across the board. Average fixed rates that continue to run below four percent will help keep affordability high for those in the market to buy a home as we head into the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending March 26, 2015, down from last week when it averaged 3.78 percent. A year ago at this time, the 30-year FRM averaged 4.40 percent.

15-year FRM this week averaged 2.97 percent with an average 0.6 point, down from last week when it averaged 3.06 percent. A year ago at this time, the 15-year FRM averaged 3.42 percent

Click on graph for larger image.

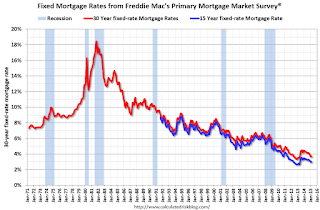

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.40% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Kansas City Fed: Regional Manufacturing Activity Declined in March

by Calculated Risk on 3/26/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive.Some of this decline was due to lower oil prices (Oklahoma was especially weak), however overall, lower oil prices will a positive for the economy. Also some of this decline was related to the West Coast port labor issues that are now resolved.

“We saw our first monthly decline in regional factory activity in over a year," said Wilkerson. “Some firms blamed the West Coast port disruptions, while producers of oil and gas-related equipment blamed low oil prices.”

Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive. Most price indexes continued to decrease, with several reaching their lowest level since 2009. In a special question about the West Coast port disruptions, 32 percent of firms said it had affected them negatively.

The month-over-month composite index was -4 in March, down from 1 in February and 3 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to declines in plastics, food, and chemical production and continued weakness in metals and machinery. Looking across District states, the largest decline was in Oklahoma, with moderate slowdowns in Kansas and Nebraska. ... the employment and new orders for exports indexes inched higher but remained negative.

emphasis added

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.