by Calculated Risk on 1/27/2015 10:00:00 AM

Tuesday, January 27, 2015

New Home Sales at 481,000 Annual Rate in December, Highest December since 2007

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 481 thousand.

October sales were revised up from 445 thousand to 462 thousand, and November sales were revised down from 438 thousand to 431 thousand.

"Sales of new single-family houses in December 2014 were at a seasonally adjusted annual rate of 481,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.6 percent above the revised November rate of 431,000 and is 8.8 percent above the December 2013 estimate of 442,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

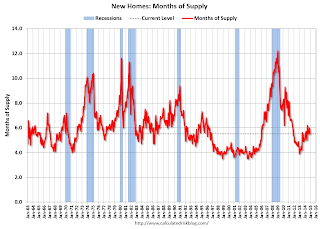

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 5.5 months from 6.0 months in November.

The months of supply decreased in December to 5.5 months from 6.0 months in November. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of December was 219,000. This represents a supply of 5.5 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2014 (red column), 34 thousand new homes were sold (NSA). Last year 31 thousand homes were sold in December. This is the highest for December since 2007.

The high for December was 87 thousand in 2005, and the low for December was 23 thousand in 1966 and in 2010.

This was above expectations of 450,000 sales in December, and with a decent finish to 2014, sales increased 1.2% from 2013. "An estimated 435,000 new homes were sold in 2014. This is 1.2 percent above the 2013 figure of 429,000."

I'll have more later today.

Case-Shiller: National House Price Index increased 4.7% year-over-year in November

by Calculated Risk on 1/27/2015 09:05:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Continue to Slow According to the S&P/Case-Shiller Home Price Indices

Data released today for November 2014 shows a continued slowdown in home prices nationwide, but with price increases in nine cities. ... Both the 10-City and 20-City Composites saw year-over-year growth rates decline in November compared to October. The 10-City Composite gained 4.2% year-over-year, down from 4.4% in October. The 20-City Composite gained 4.3% year-over-year, compared to 4.5% in October. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.7% annual gain in November 2014 versus 4.6% in October 2014.

...

The National and Composite Indices were both marginally negative in November. The 10 and 20-City Composites reported declines of -0.3% and -0.2%, while the National Index posted a decline of -0.1% for the month. Tampa led all cities in November with an increase of 0.8%. Chicago and Detroit offset those gains by reporting decreases of -1.1% and -0.9% respectively.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 17.4% from the peak, and up 0.7% in November (SA).

The Composite 20 index is off 16.4% from the peak, and up 0.7% (SA) in November.

The National index is off 9.1% from the peak, and up 0.8% (SA) in November. The National index is up 22.8% from the post-bubble low set in Dec 2011 (SA).

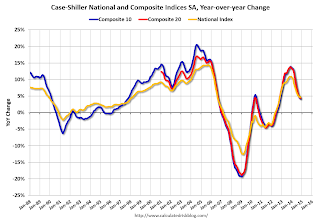

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.2% compared to November 2013.

The Composite 20 SA is up 4.3% year-over-year..

The National index SA is up 4.7% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in November seasonally adjusted. (Prices increased in 11 of the 20 cities NSA) Prices in Las Vegas are off 41.7% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.6% YoY increase for the National index, and suggests a slight further slowdown in price increases. I'll have more on house prices later.

Monday, January 26, 2015

Tuesday: New Home Sales, Case-Shiller House Prices, Durable Goods and More

by Calculated Risk on 1/26/2015 08:11:00 PM

I was looking at the outer Los Angeles and Long Beach harbor today, and I realized I've never seen so many loaded freighters queued up to unload at the port. The West Coast port slowdown is getting serious.

The Long Beach Press Telegram had an editorial today: Enough is enough on West Coast port labor dispute

West Coast dockworkers and their employers need to stop holding the economy hostage and sign a labor contract. ...Hopefully this will get resolved soon.

Meantime, both sides are blaming the other for slowdowns at the port.

But the real issues, the ones that are being discussed at the table, need to be resolved. Earlier this month, both sides agreed to bring in a federal mediator to do just that.

It’s unclear what’s going on beyond closed doors, but it has become apparent that both parties are going to have to work harder to get this contract signed.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for December from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices. The consensus is for a 4.6% year-over-year increase in the National Index for November, down from 4.7% in October.

• At 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for an increase in sales to 450 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 438 thousand in November.

• Also at 10:00 AM, Conference Board's consumer confidence index for January. The consensus is for the index to increase to 95.0 from 92.6.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for December 2014

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in December

by Calculated Risk on 1/26/2015 05:05:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a few selected cities in December.

On distressed: Total "distressed" share is down in almost all of these markets, mostly due to a decline in short sales.

Short sales are down in these areas (except Sacramento).

Foreclosures are up in a few areas (working through the logjam, mostly in judicial states - especially in Florida).

The All Cash Share (last two columns) is mostly declining year-over-year.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | |

| Las Vegas | 10.0% | 20.7% | 8.0% | 8.5% | 18.0% | 29.2% | 34.1% | 44.4% |

| Reno** | 8.0% | 24.0% | 5.0% | 4.0% | 13.0% | 28.0% | ||

| Phoenix | 4.6% | 9.5% | 5.2% | 7.5% | 9.8% | 17.1% | 29.2% | 34.6% |

| Sacramento | 6.2% | 6.1% | 7.1% | 5.4% | 13.3% | 11.5% | 15.4%** | 19.5%** |

| Minneapolis | 3.7% | 5.5% | 12.6% | 17.1% | 16.3% | 22.7% | ||

| Mid-Atlantic | 4.9% | 8.0% | 11.2% | 9.3% | 16.1% | 17.3% | 20.3% | 19.3% |

| Orlando | 4.8% | 13.5% | 26.7% | 19.1% | 31.5% | 32.7% | 40.0% | 45.0% |

| California * | 6.3% | 10.3% | 5.7% | 6.9% | 12.0% | 17.2% | ||

| Bay Area CA* | 4.0% | 7.9% | 3.7% | 4.6% | 7.7% | 12.5% | 19.0% | 23.5% |

| So. California* | 6.2% | 10.2% | 5.0% | 5.8% | 11.2% | 16.0% | 23.8% | 28.8% |

| Tampa MSA SF | 6.2% | 11.9% | 23.4% | 18.2% | 29.6% | 30.1% | 36.9% | 42.0% |

| Tampa MSA C/TH | 3.3% | 8.4% | 18.4% | 15.8% | 21.7% | 24.2% | 60.3% | 62.8% |

| Tampa MSA C/TH | 3.3% | 8.4% | 18.4% | 15.8% | 21.7% | 24.2% | 60.3% | 62.8% |

| Florida SF | 5.3% | 11.0% | 21.8% | 19.5% | 27.1% | 30.5% | 38.4% | 42.5% |

| Florida C/TH | 3.3% | 9.0% | 17.6% | 16.0% | 20.9% | 25.1% | 65.3% | 68.4% |

| Northeast Florida | 30.6% | 37.9% | ||||||

| Hampton Roads | 21.5% | 29.1% | ||||||

| Tucson | 28.7% | 32.3% | ||||||

| Toledo | 37.9% | 36.5% | ||||||

| Wichita | 26.8% | 30.2% | ||||||

| Des Moines | 20.3% | 23.1% | ||||||

| Peoria | 23.6% | 23.0% | ||||||

| Georgia*** | 25.5% | N/A | ||||||

| Omaha | 20.5% | 23.9% | ||||||

| Pensacola | 33.1% | 35.5% | ||||||

| Knoxville | 25.0% | 25.0% | ||||||

| Memphis* | 15.0% | 21.0% | ||||||

| Rhode Island | 14.7% | 19.1% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: D.R. Horton reports Home Sales Soared Last Quarter

by Calculated Risk on 1/26/2015 02:24:00 PM

From housing economist Tom Lawler:

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended December 31, 2014 totaled 7,370, up 35.1% from the comparable quarter of 2013. Net orders per active community were up about 27% YOY. Horton’s average net order price last quarter was $286,000, up 3.8% from a year earlier. Home deliveries last quarter totaled 7,973, up 28.8% from the comparable quarter of 2013, at an average sales price of $281,000, up 6.6% from a year earlier. A company official said that the YOY increase in its average sales price reflected a 4% increase in the average size of a home closed and a “small” increase in the average price per square foot. Company officials said that they expect the company’s average sales price in 2015 to be “flat” relative to 2014. The company’s order backlog at the end of December was 9,285, up 20.8% from last December, at an average order price of $293,600, up 6.8% from a year ago.

“Express” Homes, Horton’s “lower priced/fewer amenities” brand targeted at “entry-level” buyers, accounted for about 13% of last quarter’s net home orders (in units), up from 7% in the previous quarter and 3% in the comparable quarter of 2013, and about 10% of home deliveries, up from 5% in the previous quarter and 4% a year ago.

The company’s gross margin last quarter was down both from the previous quarter and a year ago, but was in line with guidance given by officials in the previous two quarters.

Horton “surprised” many analysts and competitors last spring by saying that it had increased its sales incentives from “unusually” low to “more normal” levels in order to drive its unit sales pace. As a result, Horton’s market share increased significantly since last spring. More recently a number of other builders have “warned” that they have had to increase incentives.