by Calculated Risk on 12/20/2014 08:07:00 AM

Saturday, December 20, 2014

Unofficial Problem Bank list declines to 401 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 19, 2014.

Changes and comments from surferdude808:

The OCC released an update on its latest enforcement action activity that contributed to many changes to the Unofficial Problem Bank List this week. Also, the FDIC closed a bank this Friday in what will likely will be the last closure of the year. In all, there were nine removals and four additions that leave the list with 401 institutions with assets of $125.1 billion. A year ago, the list held 633 institutions with assets of $216.7 billion. Assets on the list increased by $1.2 billion this week and one would have to go all the way back about two years to the week ending November 16, 2012 for a similar increase in assets.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 401.

Actions were terminated against The First National Bank of Layton, Layton, UT ($276 million); Stephens Federal Bank, Toccoa, GA ($147 million); First Federal Savings and Loan Association of Independence, Independence, KS ($137 million Ticker: FFSL); First Federal Bank, A FSB, Tuscaloosa, AL ($128 million); First National Community Bank, Chatsworth, GA ($124 million); Community Federal Savings Bank, Woodhaven, NY ($123 million); The Citizens National Bank of Meyersdale, Meyersdale, PA ($76 million); and Port Byron State Bank, Port Byron, IL ($75 million).

The FDIC shuttered Northern Star Bank, Mankato, MN ($19 million) today making it the 18th failure this year. A total of 23 institutions headquartered in Minnesota have failed since the on-set of the Great Recession, which ranks fifth after Georgia (88), Florida (71), Illinois (61), and California (40).

Additions this week were CertusBank, National Association, Easley, SC ($1.5 billion); Bank of Manhattan, N.A., El Segundo, CA ($496 million Ticker: MNHN); Solera National Bank, Lakewood, CO ($148 million Ticker: SLRK); and First Scottsdale Bank, National Association, Scottsdale, AZ ($95 million).

Next week we anticipate the FDIC will release an update on its enforcement action activity.

Friday, December 19, 2014

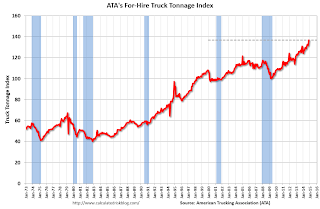

ATA Trucking Index increased 3.5% in November

by Calculated Risk on 12/19/2014 07:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Surged 3.5% in November

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 3.5% in November, following an increase of 0.5% during the previous month. In November, the index equaled 136.8 (2000=100), which was the highest level on record.

Compared with November 2013, the SA index increased 4.4%, down slightly from October’s 4.5% increase but still was the second highest year-over-year gain in 2014. Year-to-date, compared with the same period last year, tonnage is up 3.3%. ...

“With strong readings for both retail sales and factory output in November, I’m not surprised that tonnage increased as well,” said ATA Chief Economist Bob Costello. “However, the strength in tonnage did surprise to the upside.”

“The index has increased in four of the last five months for a total gain of 6.4%,” Costello said. “Clearly, the economy is doing well with tonnage on such a robust trend-line.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.4% year-over-year.

Lawler Update: Read on November Existing Home Sales, Distressed Sales and Cash buyers for Selected Cities

by Calculated Risk on 12/19/2014 02:54:00 PM

CR Note: The consensus is that on Monday, the NAR will report 5.20 million existing home sales for November, on a seasonally adjusted annual rate basis (SAAR). Housing economist Tom Lawler isn't always correct, but usually he is much closer than the consensus - so I expect a consensus miss on Monday.

From Tom Lawler: "Based on local realtor/MLS reports released through this morning, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.90 million in November, down 6.8% from October’s pace and up 1.4% from last November’s pace. Unadjusted sales last month should be down slightly from a year ago."

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a selected cities in November.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales (the Mid-Atlantic and Orlando were unchanged).

Short sales are down significantly in these areas.

Foreclosures are up in several areas (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | |

| Las Vegas | 9.5% | 21.0% | 8.7% | 7.0% | 18.2% | 28.0% | 32.8% | 43.7% |

| Reno** | 6.0% | 17.0% | 6.0% | 6.0% | 12.0% | 23.0% | ||

| Phoenix | 4.1% | 7.8% | 5.7% | 8.0% | 9.7% | 15.8% | 28.0% | 34.0% |

| Sacramento | 6.1% | 11.0% | 5.4% | 4.6% | 11.5% | 15.6% | 16.9% | 25.0% |

| Minneapolis | 3.1% | 5.0% | 10.2% | 16.9% | 13.4% | 21.9% | ||

| Mid-Atlantic | 4.7% | 7.5% | 11.0% | 8.1% | 15.7% | 15.7% | 19.1% | 19.6% |

| Orlando | 6.2% | 13.7% | 27.8% | 20.3% | 34.0% | 34.0% | 42.1% | 46.2% |

| California * | 6.2% | 10.2% | 5.8% | 6.8% | 12.0% | 17.0% | ||

| Bay Area CA* | 4.3% | 7.2% | 2.8% | 3.7% | 7.1% | 10.9% | 18.9% | 22.4% |

| So. California* | 6.2% | 10.5% | 5.3% | 6.3% | 11.5% | 16.8% | 23.9% | 28.1% |

| Miami MSA SF | 8.9% | 15.0% | 20.8% | 15.8% | 29.7% | 30.8% | 41.9% | 45.5% |

| Miami MSA C/TH | 5.0% | 9.2% | 22.4% | 18.3% | 27.4% | 27.5% | 67.8% | 74.6% |

| Chicago (City) | 20.2% | 32.8% | ||||||

| Hampton Roads | 20.4% | 26.9% | ||||||

| Northeast Florida | 29.7% | 38.1% | ||||||

| Tucson | 26.3% | 32.2% | ||||||

| Toledo | 35.4% | 37.2% | ||||||

| Wichita | 26.6% | 26.5% | ||||||

| Des Moines | 19.3% | 19.9% | ||||||

| Peoria | 19.7% | 21.8% | ||||||

| Georgia*** | 26.5% | N/A | ||||||

| Omaha | 21.1% | 21.6% | ||||||

| Pensacola | ||||||||

| Knoxville | ||||||||

| Memphis* | 15.1% | 20.5% | ||||||

| Birmingham AL | 14.9% | 21.0% | ||||||

| Springfield IL** | 11.8% | 17.6% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DOT: Vehicle Miles Driven increased 2.6% year-over-year in October

by Calculated Risk on 12/19/2014 02:12:00 PM

With lower gasoline prices, vehicle miles driven might reach a new peak in 2015.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.6% (6.6 billion vehicle miles) for October 2014 as compared with October 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 264.2 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.9% (23.2 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 83 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.6% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon.

In October 2014, gasoline averaged of $3.26 per gallon according to the EIA. That was down from October 2013 when prices averaged $3.42 per gallon. Prices will really be down year-over-year in November and December too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a little more time before we see a new peak in miles driven - but it is possible that a new peak could happen in 2015.

Kansas City Fed: Regional Manufacturing "Activity Expanded at a Moderate Pace" in December

by Calculated Risk on 12/19/2014 11:05:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Moderate Pace

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a moderate pace in December, and producers’ expectations for future activity remained at solid levels.Two more regional Fed manufacturing surveys for December will be released this month (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated decent growth in December and optimism about the future.

“This month’s results are similar to what we’ve seen most of the year, said Wilkerson. The main change in December, which we started to see in November, is that input price pressures have come down.”

The month-over-month composite index was 8 in December, up slightly from 7 in November and 4 in October. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The employment index jumped from 10 to 18, its highest level in nearly two years. ...

Future factory indexes were mostly stable at solid levels. The future composite index was unchanged at 22, while the future shipments, new orders, and employment indexes increased further. The future capital spending index jumped from 15 to 23, its highest level in five months. In contrast, the future production index eased from 34 to 30, and the future order backlog index also inched lower.

emphasis added