by Calculated Risk on 12/17/2014 04:48:00 PM

Wednesday, December 17, 2014

Zillow: Negative Equity declines further in Q3 2014, "Down by Almost Half Since 2012 Peak"

From Zillow: Negative Equity Down By Almost Half Since 2012 Peak, But There’s Still a Ways to Go

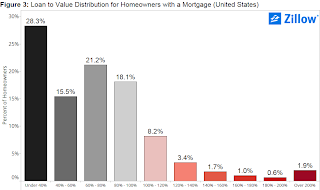

The national negative equity rate continued to decline in the third quarter, falling to 16.9 percent, according to the third quarter Zillow Negative Equity Report, down almost half from its 31.4 percent peak in the first quarter of 2012. More than 7 million previously underwater homeowners, those homeowners owing more on their home than it is worth, have been freed from negative equity since its peak.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q3 2014.

Negative equity fell from 21 percent in the third quarter of 2013 and 17.9 percent in the second quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Nationally, of the homeowners who are underwater, around half are only underwater by 20 percent or less, which is to say they are close to escaping negative equity. (Figure 3) On the other hand, 1.9 percent of owners with a mortgage remain deeply underwater, owing at least twice what their home is worth.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (8.2% in Q3 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or their loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight to ten years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q3 negative equity report in the next couple of weeks. For Q2, CoreLogic reported there were 5.3 million properties with negative equity, and that will be down further in Q3 2014.

FOMC Projections and Press Conference

by Calculated Risk on 12/17/2014 02:18:00 PM

Statement here "Considerable time" replaced with "patient" - viewed as consistent with previous statement.

As far as the "Appropriate timing of policy firming", participant views were mostly unchanged (15 participants expect the first rate hike in 2015, and 2 in 2016).

The FOMC projections for inflation are still on the low side through 2017.

Yellen press conference here.

On the projections, GDP for 2014 was revised up, the unemployment rate was revised down again, and inflation projections were revised down (include core inflation). Note: These projections were submitted before the CPI report this morning.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 2.3 to 2.4 | 2.6 to 3.0 | 2.5 to 3.0 | 2.3 to 2.5 |

| Sept 2014 Meeting Projections | 2.0 to 2.2 | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 | n.a. |

The unemployment rate was at 5.8% in October and November.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 5.8 | 5.2 to 5.3 | 5.0 to 5.2 | 4.9 to 5.3 |

| Sept 2014 Meeting Projections | 5.9 to 6.0 | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 | n.a. |

As of October, PCE inflation was up 1.4% from October 2013, and core inflation was up 1.6%. The FOMC expects inflation to remain below their 2% target in 2015 (Note: the FOMC target is symmetrical around 2%).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 1.2 to 1.3 | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 |

| Sept 2014 Meeting Projections | 1.5 to 1.7 | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 | n.a. |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 1.8 | 1.7 to 2.0 | 1.8 to 2.0 |

| Sept 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 | n.a. |

FOMC Statement: "Considerable Time" replaced with "patient", "consistent with previous statement"

by Calculated Risk on 12/17/2014 02:00:00 PM

Information received since the Federal Open Market Committee met in October suggests that economic activity is expanding at a moderate pace. Labor market conditions improved further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee's longer-run objective, partly reflecting declines in energy prices. Market-based measures of inflation compensation have declined somewhat further; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced. The Committee expects inflation to rise gradually toward 2 percent as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee's employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; and Daniel K. Tarullo.

Voting against the action were Richard W. Fisher, who believed that, while the Committee should be patient in beginning to normalize monetary policy, improvement in the U.S. economic performance since October has moved forward, further than the majority of the Committee envisions, the date when it will likely be appropriate to increase the federal funds rate; Narayana Kocherlakota, who believed that the Committee's decision, in the context of ongoing low inflation and falling market-based measures of longer-term inflation expectations, created undue downside risk to the credibility of the 2 percent inflation target; and Charles I. Plosser, who believed that the statement should not stress the importance of the passage of time as a key element of its forward guidance and, given the improvement in economic conditions, should not emphasize the consistency of the current forward guidance with previous statements.

emphasis added

Key Measures Show Low Inflation in November

by Calculated Risk on 12/17/2014 11:25:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.8% annualized rate) in November. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here. Motor fuel declined at a 55% annualized rate in November following a 31% annualized rate decline in October! There will be another sharp decline in December too.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.3% (-3.0% annualized rate) in November. The CPI less food and energy rose 0.1% (0.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI increased 0.9% annualized.

On a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

AIA: Architecture Billings Index shows slower expansion in November

by Calculated Risk on 12/17/2014 09:34:00 AM

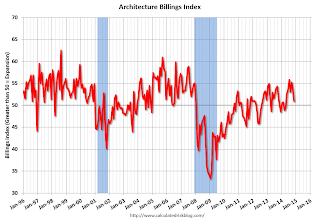

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Demand Softens, but Outlook for Architecture Billings Index Remains Positive

Buoyed by sustained demand for apartments and condominiums, coupled with state and local governments moving ahead with delayed public projects, the Architecture Billings Index (ABI) has been positive for seven consecutive months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 50.9, down from a mark of 53.7 in October. This score reflects a slight increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.8, following a mark of 62.7 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in November was 54.9.

“Demand for design services has slowed somewhat from the torrid pace of the summer, but all project sectors are seeing at least modest growth,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Architecture firms are expecting solid mid-single digit gains in revenue for 2014, but heading into 2015, they are concerned with finding quality contractors for projects, coping with volatile construction materials costs and with finding qualified architecture staff for their firms.”

• Regional averages: South (57.9), West (52.7), Midwest (49.8), Northeast (46.7) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in November, down from 53.7 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the positive readings over the last seven months suggest an increase in CRE investment in 2015.