by Calculated Risk on 11/26/2014 12:24:00 PM

Wednesday, November 26, 2014

Comments on October New Home Sales

The new home sales report for October was below expectations at 458 thousand on a seasonally adjusted annual rate basis (SAAR).

Also, sales for the previous three months (July, August and September), were revised down.

Sales this year are significantly below expectations, however, based on the low level of sales, more lots coming available, and demographics, it seems likely sales will continue to increase over the next several years.

Earlier: New Home Sales at 458,000 Annual Rate in October

The Census Bureau reported that new home sales this year, through October, were 371,000, Not seasonally adjusted (NSA). That is up 1% from 367,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year.

Sales were up 1.8% year-over-year in October.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will be small in Q4, but I expect sales to be up for the quarter and for the year.

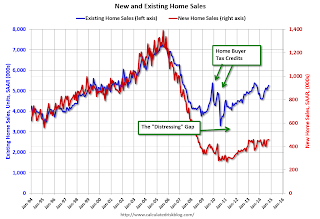

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be somewhat offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 458,000 Annual Rate in October

by Calculated Risk on 11/26/2014 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 458 thousand.

September sales were revised down from 467 thousand to 455 thousand, and August sales were revised down from 466 thousand to 453 thousand.

"Sales of new single-family houses in October 2014 were at a seasonally adjusted annual rate of 458,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.7 percent above the revised September rate of 455,000 and is 1.8 percent above the October 2013 estimate of 450,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 5.6 months from 5.5 months in September.

The months of supply increased in October to 5.6 months from 5.5 months in September. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of October was 212,000. This represents a supply of 5.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2014 (red column), 37 thousand new homes were sold (NSA). Last year 36 thousand homes were sold in October. This was the best October since 2007.

The high for October was 105 thousand in 2005, and the low for October was 23 thousand in 2010.

This was below expectations of 470,000 sales in October, and there were downward revisions to sales in July, August and September.

I'll have more later today.

Personal Income increased 0.2% in October, Spending increased 0.2%

by Calculated Risk on 11/26/2014 08:48:00 AM

The BEA released the Personal Income and Outlays report for October:

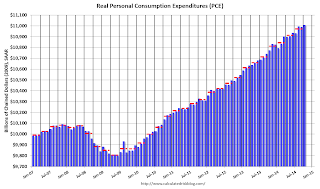

Personal income increased $32.9 billion, or 0.2 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $27.3 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in October, in contrast to a decrease of less than 0.1 percent in September. ... The price index for PCE increased 0.1 percent in October, the same increase as in September. The PCE price index, excluding food and energy, increased 0.2 percent in October, compared with an increase of 0.1 percent in September.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was lower than expected, Also the increase in PCE was below the 0.3% consensus, however that consensus was prior to the upward revisions to August and September PCE in the GDP report. It looks like PCE is off to a decent start to Q4.

On inflation: The PCE price index increased 1.4 percent year-over-year, and at a 0.7% annualized rate in October. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in October, and at a 2.2% annualized rate in October.

Weekly Initial Unemployment Claims increased to 313,000

by Calculated Risk on 11/26/2014 08:30:00 AM

The DOL reported:

In the week ending November 22, the advance figure for seasonally adjusted initial claims was 313,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 291,000 to 292,000. The 4-week moving average was 294,000, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 287,500 to 287,750.The previous week was revised up to 292,000

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 294,000.

This was higher than the consensus forecast of 288,000, but the level suggests few layoffs.

Tuesday, November 25, 2014

Wednesday: New Home Sales, Personal Income, Durable Goods, Unemployment Claims, Pending Home sales

by Calculated Risk on 11/25/2014 08:12:00 PM

Earlier the FDIC released the Quarterly Banking Profile for Q3 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $38.7 billion in the third quarter of 2014, up $2.6 billion (7.3 percent) from earnings of $36.1 billion the industry reported a year earlier. The increase in earnings was mainly attributable to a $7.8 billion (4.8 percent) increase in net operating revenue (the sum of net interest income and total noninterest income), the biggest since the fourth quarter of 2009. ...Wednesday:

The number of "problem banks" fell for the 14th consecutive quarter. The number of banks on the FDIC's "Problem List" declined from 354 to 329 during the quarter, the lowest since the 305 in the first quarter of 2009. The number of "problem" banks now is 63 percent below the post-crisis high of 888 at the end of the first quarter of 2011. Two FDIC-insured institutions failed in the third quarter, compared to six in the third quarter of 2013.

The Deposit Insurance Fund (DIF) balance continued to increase. The DIF balance (the net worth of the Fund) rose to a record $54.3 billion as of September 30 from $51.1 billion at the end of June. The Fund balance increased primarily due to assessment income, recoveries from litigation settlements, and receivership asset recoveries that exceeded estimates.

• At 7:00 AM ET, (This might be delayed due to the holiday) the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

• At 10:00 AM, the New Home Sales for October from the Census Bureau. The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

• Also at 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.