by Calculated Risk on 7/28/2014 09:27:00 AM

Monday, July 28, 2014

Black Knight (formerly LPS): House Price Index up 0.9% in May, Up 5.9% year-over-year

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight (formerly LPS), Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.9 Percent for the Month; Up 5.9 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on May 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increases have been getting steadily smaller for the last 8 months - as shown in the table below:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

The LPS HPI is off 11.1% from the peak in June 2006.

Note: The press release has data for the 20 largest states, and 40 MSAs.

LPS shows prices off 42.6% from the peak in Las Vegas, off 35.7% in Orlando, and 31.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in San Jose, CA and in Nashville, TN.

Note: Case-Shiller for May will be released tomorrow.

Sunday, July 27, 2014

Monday: Pending Home Sales, Dallas Fed Mfg Survey

by Calculated Risk on 7/27/2014 08:36:00 PM

A quick note on employment ... Party like it's 1999?

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,770 | 2,662 |

| 1 2014 is current pace annualized (through June). | ||

Monday:

• At 10:00 AM ET, the Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

• During the day, the 2014 Social Security Trustees Report

Weekend:

• FOMC Preview: More Tapering

• Schedule for Week of July 27th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 29 (fair value).

Oil prices were mixed over the last week with WTI futures at $101.75 per barrel and Brent at $108.20 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.52 per gallon (down more than a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: More Tapering

by Calculated Risk on 7/27/2014 09:57:00 AM

The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday of this coming week, and it is almost certain that the FOMC will announce a reduction in monthly asset purchases by another $10 billion per month, from $35 billion to $25 billion. The FOMC statement will be released at 2:00 PM ET on Wednesday, and there will be no press conference after this meeting.

Right now it appears that the FOMC will also reduce QE3 another $10 billion at the September meeting (Sept 17th), and announce the end of QE3 in October (Oct 29th).

On the statement, the FOMC will probably only make small changes. From Goldman Sachs economist David Mericle:

We expect that next week’s FOMC statement will show very little change. The FOMC might choose to upgrade the language on growth in economic activity somewhat, and it might also strengthen the language on labor market indicators a touch in recognition of the strong June employment report. For the most part, however, recent data have supported the characterization of current conditions in the June statement. In particular, the softer June CPI print likely reinforced the Committee’s decision to downplay the firmer inflation prints seen from March to May, and weak housing starts and new home sales reports have likely reinforced concern about the housing sector.For review, here are the June FOMC projections (Projections will be updated next at the September meeting).

The advance estimate of Q2 GDP will be released Wednesday morning, and the consensus is that real GDP increased 2.9% annualized in Q2. Depending on revisions, this would suggest no growth in the first half of 2014 (although other indicators would suggest some growth) - and this would mean another downgrade for GDP at the September meeting.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.1% in June, and it seems the unemployment rate projection will be lowered again in September. It is possible the FOMC will also lower their long run unemployment projection too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of May, PCE inflation was up 1.8% from May 2013, and core inflation was up 1.5%. The FOMC expects inflation to increase in 2014, but remain below their 2% target (Note: the FOMC target is supposedly symmetrical around 2%, although some analysts think the FOMC is acting as if 2.0% is a ceiling).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Overall tapering will probably continue at the same pace, and the FOMC will be a little more positive. But I expect there will be no change on the timing for the end of QE3 (at the October meeting) or on the first rate hike (sometime in 2015).

Saturday, July 26, 2014

Schedule for Week of July 27th

by Calculated Risk on 7/26/2014 01:17:00 PM

This will be a busy week for economic data with several key reports including the July employment report on Friday and the advance Q2 GDP report on Wednesday.

Other key reports include the ISM manufacturing index on Friday, July vehicle sales, also on Friday, and the May Case-Shiller house price index on Tuesday.

There will a two-day FOMC meeting on Tuesday and Wednesday, and the Fed is expected to announce on Wednesday a decrease in asset purchases from $35 billion per month to $25 billion per month.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

During the day: the 2014 Social Security Trustees Reports

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May.

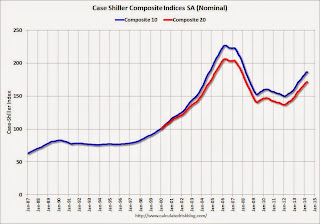

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the April 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May. The Zillow forecast is for the Composite 20 to increase 9.6% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

2:00 PM: FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 6.1% in July.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).June was the fifth month in a row with more than 200 thousand jobs added, and employment in June was up 2.495 million year-over-year.

The economy has added 9.7 million private sector jobs since employment bottomed in February 2010 (9.1 million total jobs added including all the public sector layoffs).

There are 895 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 415 thousand above the pre-recession peak.

8:30 AM: Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.

Unofficial Problem Bank list declines to 452 Institutions

by Calculated Risk on 7/26/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 25, 2014.

Changes and comments from surferdude808:

As anticipated, the FDIC provided an update on its enforcement action activity which contributed to many changes to the Unofficial Problem Bank list this week. In all, there were 11 removals this week pushing the list count down to 452 institutions with assets of $146.1 billion. A year ago the list held 729 institutions with assets of $260.9 billion. For the month, the list count fell by 16 after 10 action terminations, four mergers, and two failures. This is the smallest monthly count decline since a net drop of 12 during the month of June 2013. This may be the leading edge of a slowdown in action terminations.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 452.

The FDIC surprised us by closing GreenChoice Bank, FSB, Chicago, IL ($73 million) this Friday. This is the 14th failure this year approximating the pace last year when 16 banks had failed by this point. GreenChoice is the 60th Illinois-based institution to fail since the on-set of the Great Recession. The count in Illinois only trails the 88 in Georgia and 71 in Florida.

FDIC terminated actions against Alliance Bank Central Texas, Waco, TX ($187 million); Monarch Community Bank, Coldwater, MI ($182 million Ticker: MCBF); First Personal Bank, Orland Park, IL ($166 million); Rabun County Bank, Clayton, GA ($163 million); Flagship Bank Minnesota, Wayzata, MN ($94 million); One World Bank, Dallas, TX ($82 million); Bay Bank, Green Bay, WI ($81 million); and Kendall State Bank, Valley Falls, KS ($38 million).

Finding their way off the list through a merger partner were Atlas Bank, Brooklyn, NY ($116 million) and Bay Bank, Mobile, AL ($78 million).

Most likely there will be few changes to the list next week.