by Calculated Risk on 5/05/2014 01:19:00 PM

Monday, May 05, 2014

Construction Employment: Pace of Hiring Increasing

Here is an excerpt from a post I wrote in 2012: Where are the construction jobs?

Back in 2006, I predicted we'd see construction job losses in the seven figures. All through 2006 and into 2007, I was constantly asked: "Where are the construction job losses you predicted?"And from Michelle Meyer last year on the lag between activity and construction employment: Construction Coming Back and other researchers More Research on Construction Employment

And then it started ... and the BLS reported construction employment fell 2.27 million from peak to trough. No one asks that question any more.

There were several reasons why construction jobs didn't decline at the same time as housing starts. First, construction includes residential, commercial and other construction (like roads). Even after housing starts began to collapse, commercial real estate was still booming and workers shifted from residential to commercial (many commercial projects have long time frames - and many developers remained in denial). Also some construction workers are paid in cash (illegal immigrants), and these workers weren't counted on the BLS payrolls.

Now people are asking "Where are the construction jobs?"

Oh, Grasshopper ... the construction jobs are coming.

Now is appears the pace of hiring is starting to pickup:

| Annual Change in Construction Payroll jobs (000s) | |

|---|---|

| Year | Total Construction Jobs |

| 2002 | -85 |

| 2003 | 127 |

| 2004 | 290 |

| 2005 | 416 |

| 2006 | 152 |

| 2007 | -195 |

| 2008 | -789 |

| 2009 | -1,047 |

| 2010 | -192 |

| 2011 | 144 |

| 2012 | 114 |

| 2013 | 156 |

| 20141 | 124 |

| 1Change through April, 372 thousand annualized rate | |

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 568 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

ISM Non-Manufacturing Index increased in April to 55.2

by Calculated Risk on 5/05/2014 10:00:00 AM

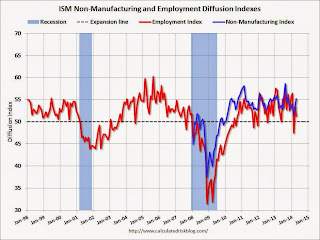

The April ISM Non-manufacturing index was at 55.2%, up from 53.1% in March. The employment index decreased in April to 51.3%, down from 53.6% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 51st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.2 percent in April, 2.1 percentage points higher than March's reading of 53.1 percent. The Non-Manufacturing Business Activity Index increased substantially to 60.9 percent, which is 7.5 percentage points higher than the March reading of 53.4 percent, reflecting growth for the 57th consecutive month at a much faster rate. The New Orders Index registered 58.2 percent, 4.8 percentage points higher than the reading of 53.4 percent registered in March. The Employment Index decreased 2.3 percentage points to 51.3 percent from the March reading of 53.6 percent and indicates growth for the second consecutive month, but at a slower rate. The Prices Index increased 2.5 percentage points from the March reading of 58.3 percent to 60.8 percent, indicating prices increased at a faster rate in April when compared to March. According to the NMI®, 14 non-manufacturing industries reported growth in April. The majority of survey respondents' comments indicate that both business conditions and the economy are improving."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.0% and suggests faster expansion in April than in March.

Mortgage Monitor: Mortgage delinquency rate in March lowest since October 2007, "Only One in 10 American Borrowers Underwater"

by Calculated Risk on 5/05/2014 09:14:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for March today. According to BKFS, 5.52% of mortgages were delinquent in March, down from 5.97% in February. BKFS reports that 2.13% of mortgages were in the foreclosure process, down from 3.38% in March 2013.

This gives a total of 7.65% delinquent or in foreclosure. It breaks down as:

• 1,571,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,199,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,070,000 loans in foreclosure process.

For a total of 3,840,000 loans delinquent or in foreclosure in March. This is down from 4,997,000 in March 2013.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

The data showed that, as home prices have risen over the past two years and many distressed loans have worked their way through the system, the percentage of Americans in negative equity positions on their mortgage has declined considerably. Meanwhile, those loans already in the foreclosure process have been aging substantially. According to Kostya Gradushy, Black Knight’s manager of Loan Data and Customer Analytics, both data trends point to a healthier housing market.There is much more in the mortgage monitor.

“Two years of relatively consecutive home price increases and a general decline in the number of distressed loans have contributed to a decreasing number of underwater borrowers,” said Gradushy. “Looking at current combined loan-to-value (CLTV), we see that while four years ago 34 percent of borrowers were in negative equity positions, today that number has dropped to just about 10 percent of active mortgage loans. While negative equity levels have declined for both judicial vs. non-judicial foreclosure states from the peak of the crisis, non-judicial states are now at just under eight percent, as compared to 13.4 percent in their judicial counterparts. Overall, nearly half of all borrowers today are both in positive equity positions and of strong credit quality – credit scores of 700 or above. Four years ago, that category of borrowers represented over a third of active mortgages.

emphasis added

Sunday, May 04, 2014

Sunday Night Futures

by Calculated Risk on 5/04/2014 08:25:00 PM

Some great analysis and graphs from Jim Hamilton at Econbrowser: Is the Fed near its target?

Monday:

• Early: the Black Knight Mortgage Monitor for March.

• At 10:00 AM ET, ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, up from 53.1 in March. Note: Above 50 indicates expansion, below 50 contraction.

Weekend:

• Schedule for Week of May 4th

• Goldman Sachs on the Labor Force Participation Rate

• Participation Rate: Trends and Cohorts

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are up slightly (fair value).

Oil prices are down over the last week with WTI futures at $99.88 per barrel and Brent at $108.59 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.65 per gallon (might have peaked, but still more than 10 cents above the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Participation Rate: Trends and Cohorts

by Calculated Risk on 5/04/2014 12:59:00 PM

A frequent question is: "I've heard the participation rate for older workers is increasing, yet you say one of the reasons the overall participation rate has fallen is because people are retiring. Is this a contradiction?"

Answer: This isn't a contradiction. When we talk about an increasing participation rate for older workers, we are referring to people in a certain age group. As an example, for people in the "60 to 64" age group, the participation rate has increased over the last ten years from 51.1% in April 2004 to 55.7% in April 2014 (see table at bottom for changes in all 5 year age groups over the last 10 years).

However, when we talk about the overall participation rate, we also need to know how many people are in a particular age group at a given time. As an example, currently there is a large cohort that has recently moved into the "60 to 69" age group. To calculate the overall participation rate we need to multiple the participation rate for each age group by the number of people in the age group.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in each 5 year age group in April 2004 (blue) and April 2014 (red). Note: Not Seasonally Adjusted, Source: BLS.

In April 2004, the two largest groups were in the "40 to 44" and "45 to 49" age groups. These people are now the 50 to 59 age group.

In April 2004, there were also a large number of people in the 50 to 59 age group. These people are now 60 to 69.

The following table summarizes what has happened if we follow these two cohorts (40 to 49 in April 2004, and 50 to 59 and April 2004).

| Cohort 11 | Apr-04 | Apr-14 |

|---|---|---|

| Population | 44,508 | 43,455 |

| Participation Rate | 83.8% | 74.9% |

| Labor Force | 37,294 | 32,535 |

| Cohort 22 | Apr-04 | Apr-14 |

| Population | 35,373 | 33,322 |

| Participation Rate | 76.1% | 45.2% |

| Labor Force | 26,915 | 15,065 |

| 1Cohort 1: People aged 40 to 49 in April 2004. 2Cohort 2: People aged 50 to 59 in April 2004. | ||

So even though the participation rate for an age group is increasing, the participation rate for a cohort decreases as it moves into an older age group. This shows we need to follow 1) the trend for each age group, and 2) the number of people in each age group.

Note in the table below that the participation rate has been falling sharply for younger age groups (staying in school - a positive for the future) - and that the population is increasing for those age groups. This is another key trend that has been pushing down the overall participation rate.

This table is population, labor force and participation rate by age group for April 2004 and April 2014.

| Populaton and Labor Force by Age Group (000s) NSA | |||

|---|---|---|---|

| Apr-04 | Apr-14 | ||

| 16 to 19 Age Group | Population | 16,198 | 16,652 |

| Participation Rate | 40.7% | 31.1% | |

| Labor Force | 6,600 | 5,174 | |

| 20 to 24 Age Group | Population | 20,173 | 22,107 |

| Participation Rate | 74.2% | 69.2% | |

| Labor Force | 14,970 | 15,287 | |

| 25 to 29 Age Group | Population | 18,886 | 21,151 |

| Participation Rate | 81.4% | 79.8% | |

| Labor Force | 15,383 | 16,871 | |

| 30 to 34 Age Group | Population | 20,027 | 20,877 |

| Participation Rate | 83.4% | 81.4% | |

| Labor Force | 16,712 | 17,001 | |

| 35 to 39 Age Group | Population | 20,595 | 19,332 |

| Participation Rate | 83.3% | 81.9% | |

| Labor Force | 17,151 | 15,841 | |

| 40 to 44 Age Grou[ | Population | 22,683 | 20,232 |

| Participation Rate | 83.9% | 82.6% | |

| Labor Force | 19,026 | 16,701 | |

| 45 to 49 Age Group | Population | 21,825 | 20,554 |

| Participation Rate | 83.7% | 81.4% | |

| Labor Force | 18,268 | 16,737 | |

| 50 to 54 Age Group | Population | 19,247 | 22,306 |

| Participation Rate | 80.4% | 78.1% | |

| Labor Force | 15,480 | 17,416 | |

| 55 to 59 Age Group | Population | 16,126 | 21,149 |

| Participation Rate | 70.9% | 71.5% | |

| Labor Force | 11,435 | 15,119 | |

| 60 to 64 Age Group | Population | 12,499 | 18,441 |

| Participation Rate | 51.1% | 55.7% | |

| Labor Force | 6,384 | 10,273 | |

| 65 to 69 Age Group | Population | 9,716 | 14,881 |

| Participation Rate | 26.6% | 32.2% | |

| Labor Force | 2,585 | 4,792 | |

| 70 to 74 Age Group | Population | 8,349 | 10,915 |

| Participation Rate | 15.3% | 19.0% | |

| Labor Force | 1,280 | 2,070 | |

| 75 and older | Population | 16,434 | 18,841 |

| Participation Rate | 6.0% | 8.3% | |

| Labor Force | 986 | 1,563 | |

| Total | Population | 222,758 | 247,438 |

| Participation Rate | 65.7% | 62.6% | |

| Labor Force | 146,260 | 154,845 | |