by Calculated Risk on 4/21/2014 06:59:00 PM

Monday, April 21, 2014

Tuesday: Existing Home Sales, Richmond Fed Mfg Survey

Another builder reports below consensus results, from housing economist Tom Lawler: NVR: Net Orders Off Despite Jump in Community Count; Increased Mortgage Regulations Hit Mortgage Banking Income

NVR, Inc. the nation’s fourth largest home builder with a heavy concentration in the Mid-Atlantic region, reported that net home orders in the quarter ended March 31, 2014 totaled 3,325, down 5.3% from the comparable quarter of 2013. The company’s sales cancellation rate, expressed as a % of gross orders, was 12% last quarter, down from 13% a year ago. The company’s average community count last quarter was 481, up 10.6% from the comparable quarter of 2013. Home settlements totaled 2,211 last quarter, down 2.7% from the comparable quarter of 2013, at an average settlement price of $361,400, up 9.4% from a year ago. The company’s order backlog at the end of March was 6,059, down 2.5% from last March.Tuesday:

NVR’s operating income from its mortgage banking operation plunged by 91% from a year ago last quarter, with the decline attributed to a “more competitive” mortgage lending market, as well as higher G&A expenses “due to increased staffing in response to increased mortgage regulations and expected higher loan volume.”

NVR owned or controlled 65,800 lots at the end of March, up 10.2% from last March.

The company’s overall results last quarter were well below “consensus.”

• Early, the Black Knight "First Look" at Mortgage performance (delinquencies and foreclosures) in March.

• At 9:00 AM ET, the FHFA House Price Index for February 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 10:00 AM, the Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 4.56 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.60 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.64 million SAAR.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for April. The consensus is for a reading of 0, up from -7 in March.

Weekly Update: Housing Tracker Existing Home Inventory up 6.1% year-over-year on April 21st

by Calculated Risk on 4/21/2014 04:27:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February - March inventory data will be released tomorrow). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY.

Inventory in 2014 (Red) is now 6.1% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Chicago Fed: "Economic Growth Moderated in March"

by Calculated Risk on 4/21/2014 01:25:00 PM

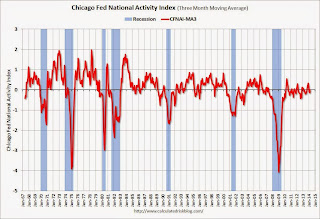

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Moderated in March

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to +0.20 in March from +0.53 in February. Two of the four broad categories of indicators that make up the index made positive contributions to the index in March, and two of the four categories decreased from February. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to a neutral reading in March from –0.14 in February, marking its third consecutive nonpositive value. March’s CFNAI-MA3 suggests that growth in national economic activity was at its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was at the historical trend in March (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Report: Property Tax Collections above Pre-Recession Peak

by Calculated Risk on 4/21/2014 11:22:00 AM

From Bloomberg: Property-Tax Collections Rising at Fastest Pace Since U.S. Crash

Property-tax collections nationally rose to $182.8 billion during the last three months of 2013 ... according to a U.S. Census estimate last month. That topped the previous peak four years earlier ...

In cities including San Jose, California, Nashville, Tennessee, Houston and Washington, revenue from real-estate levies has set records, or is poised to.

Local governments are using the money to hire police, increase salaries and pave roads after the decline in property values and 18-month recession that ended in 2009 forced them to eliminate about 600,000 workers ...

Click on graph for larger image.

Click on graph for larger image.Here is the report from the Census Bureau: Quarterly Summary of State and Local Government Tax Revenue for 2013:Q4

This graph from the Census Bureau report shows Q4 property taxes since 2003 - and property taxes have increased slightly in Q4 2013 and are back to the pre-recession peak.

This another data point suggesting that aggregate layoffs are over at the state and local level.

DOT: Vehicle Miles Driven decreased 0.8% year-over-year in February

by Calculated Risk on 4/21/2014 09:50:00 AM

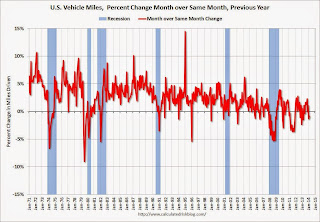

Some of this monthly decline appears weather related since miles driven were down 3.0% in the Northeast. Miles driven were up 0.4% in the West.

The Department of Transportation (DOT) reported:

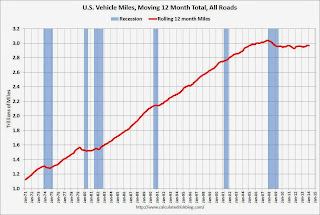

Travel on all roads and streets changed by -0.8% (-1.7 billion vehicle miles) for February 2014 as compared with February 2013.The following graph shows the rolling 12 month total vehicle miles driven.

...

Travel for the month is estimated to be 212.8 billion vehicle miles.

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 75 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In February 2014, gasoline averaged of $3.43 per gallon according to the EIA. that was down from February 2013 when prices averaged $3.73 per gallon.

In February 2014, gasoline averaged of $3.43 per gallon according to the EIA. that was down from February 2013 when prices averaged $3.73 per gallon.As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven.