by Calculated Risk on 2/07/2014 10:02:00 AM

Friday, February 07, 2014

Comments on Employment Report: Disappointing Payroll Number

This was another disappointing employment report, but there were several positive - as an example there were upward revisions to prior months, the unemployment rate declined while the participation rate increased (a good sign), the number of long term unemployed declined, and the number of people working part time for economic reasons declined sharply.

Private payroll employment increased 142 thousand and is now 291 thousand below the previous peak (total employment is still 866 thousand below the peak in January 2008). It is likely that private employment will be at a new high in March.

Of course government employment was down again, and even state and local employment is barely above the post-recession minimum (last graph).

This is the second consecutive month with a disappointing headline payroll number, but my outlook hasn't changed (I still expect payroll employment to pickup this year). Of course if the employment data continues at this level, I'll change my mind.

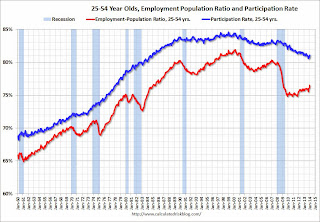

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.1% from 80.7%, and the 25 to 54 employment population ratio increased to 76.5% from 76.1%. This was a large increase in participation, and as the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 514,000 to 7.3 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.These workers are included in the alternate measure of labor underutilization (U-6) that declined to 12.7% in January. This is the lowest level since November 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.646 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.878 in December. This is the lowest level since March 2009 (this might have been impacted by the expiration of extended unemployment benefits). This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In January 2014, state and local governments lost 17,000 jobs.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.

January Employment Report: 113,000 Jobs, 6.6% Unemployment Rate

by Calculated Risk on 2/07/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 113,000 in January, and the unemployment rate was little changed at 6.6 percent, the U.S. Bureau of Labor Statistics reported today. ...

After accounting for the annual adjustment to the population controls, the civilian labor force rose by 499,000 in January, and the labor force participation rate edged up to 63.0 percent. Total employment, as measured by the household survey, increased by 616,000 over the month, and the employment-population ratio increased by 0.2 percentage point to 58.8 percent.

...

The change in total nonfarm payroll employment for November was revised from +241,000 to +274,000, and the change for December was revised from +74,000 to +75,000. With these revisions, employment gains in November and December were 34,000 higher than previously reported.

...

[Benchmark revision] The total nonfarm employment level for March 2013 was revised upward by 369,000 (+347,000 on a not seasonally adjusted basis, or 0.3 percent). ... This revision incorporates the reclassification of jobs in the QCEW. Private household employment is out of scope for the establishment survey. The QCEW reclassified some private household employment into an industry that is in scope for the establishment survey--services for the elderly and persons with disabilities. This reclassification accounted for an increase of 466,000 jobs in the establishment survey. This increase of 466,000 associated with reclassification was offset by survey error of -119,000 for a total net benchmark revision of +347,000 on a not seasonally adjusted basis. Historical time series have been reconstructed to incorporate these revisions.

Click on graph for larger image.

Click on graph for larger image.The headline number was well below expectations of 181,000 payroll jobs added.

The first graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is 0.6% below the pre-recession peak (866 thousand fewer total jobs).

NOTE: The second graph is the change in payroll jobs ex-Census - meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The third graph shows the unemployment rate.

The unemployment rate decreased in January to 6.6% from 6.7% in December.

The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in January to 63.0% from 62.8% in December. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in January to 58.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was a disappointing employment report, however there were some positives including upward revisions to previous reports, a decline in the unemployment rate, and an increase in the participation rate. I'll have much more later ...

Thursday, February 06, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 2/06/2014 06:24:00 PM

My Employment Preview for January: Taking the Over. The annual revision will be released tomorrow too (and revisions to prior months will be important).

From Tim Duy: Another Month, Another Employment Report

I will venture a guess of a 200k gain in nonfarm payrolls for January. ... This is a bit over consensus of 181k, but pretty much right in the middle of the range of estimates (125k-270k). Full disclosure: Last month my forecast was wildly optimistic. Still, I think that report was an outlier. Overall I don't see that the pace of improvement in the labor market has changed dramatically one way or another in the last few months. The economy have been generating 180-200k jobs a month for two years despite the ups and downs in the data. I suspect underlying activity continues to support a similar trend. Any improvements that were evident prior to the December report were likely modest.CR Note: Unlike Duy, I was pessimistic last month.

Friday:

• At 8:30 AM ET, the Employment Report for January will be released. The consensus is for an increase of 181,000 non-farm payroll jobs in January, up from the 74,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 6.7% in January.

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $12.0 billion in December.

Lawler: Expect Downward Revisions to Census Q4 New Home Sales, Broad-Based Builder Optimism for 2014

by Calculated Risk on 2/06/2014 02:08:00 PM

From economist Tom Lawler:

Below is a table showing some stats for nine large publicly-traded home builders reporting results for the quarter and year ending December 31.

There are a couple of observations. First, “home sales” at these builders defined as net orders in 2013 were up just 6.9%, from 2012, while “home sales” rightly defined as settlements (closed sales) were up 21.6%.

Second, net orders at these builders did not experience the fourth quarter rebound suggested by Census’ estimate of new SF home sales, and net orders at these builders were up for the year by far less than Census’ estimate of new SF home sales.

There are several possible reasons for these differences. First, of course, the market share of these large builders may have fallen significantly. Second, builder net orders in a quarter are that quarter’s gross orders less sales cancellations in that quarter, while Census new home sales are, in effect, gross orders less orders on homes for which a previously signed contract had been canceled. Third, there may be (and appears to be) a timing difference between when a builder logs an order and when that order is reflected in Census’ Survey of Construction. (Builder net orders “lead” Census new home sales). And finally, the Census data, and especially the preliminary data – which is subject to huge revisions – may “suck.”

While the above factors make it “most difficult” to compare builder results with Census new home sales data, I have found that builder results have been useful in projecting revisions to Census new home sales. Based on these builder results, I would expect that Census’ estimates of new home sales in the fourth quarter of 2013 will be revised downward significantly.

While results varied massively across builders, there were several common “themes” across many builders. First, fueled by low mortgage rates, low new and existing home inventories, and some “pent-up” demand, builders as a group experienced a significant increase in net home orders starting in the latter part of 2012 and continuing into the spring of 2013. While many builders responded by increasing significantly land acquisitions and development spending in 2012 and 2013, many builders were unable to meet demand, partly reflecting longer-than-normal development timelines related to “supply-chain” issues. Many responded by increasing prices substantially, in some areas at a pace seldom seen. When mortgage rates subsequently rose sharply, the combination of higher mortgage rates and substantially higher new home prices resulted in a significant slowdown in net home orders. While mortgage rates eased somewhat in the latter part of last year, orders did not rebound much (or for some builders at all), mainly reflecting potential buyers balking at the higher home prices.

That slowdown did not dampen most builders’ optimism for the 2014 spring selling season, and most builders have the land/lots to increase substantially their community counts this year, and plan to do so. One reason for their optimism is that the previous hikes in prices have at many builders pushed margins up well above “normal” levels, meaning they can drive higher revenues with higher volumes without price increases, and in fact can be “quite profitable” by holding prices even if construction costs rise. As such, a reasonable assumption for new home prices from the end of 2013 to the end of 2014 would be “flattish.”

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg |

| D.R. Horton | 5,454 | 5,259 | 3.7% | 6,188 | 5,182 | 19.4% | $263,542 | $236,067 | 11.6% |

| PulteGroup | 3,214 | 3,926 | -18.1% | 4,964 | 5,154 | -3.7% | $325,000 | $287,000 | 13.2% |

| NVR | 2,631 | 2,625 | 0.2% | 3,342 | 2,788 | 19.9% | $365,300 | $331,900 | 10.1% |

| The Ryland Group | 1,428 | 1,502 | -4.9% | 2,178 | 1,578 | 38.0% | $314,000 | $270,000 | 16.3% |

| Beazer Homes | 895 | 932 | -4.0% | 1,038 | 1,038 | 0.0% | $279,300 | $235,500 | 18.6% |

| M/I Homes | 793 | 673 | 17.8% | 1,120 | 887 | 26.3% | $292,000 | $273,000 | 7.0% |

And here is a table showing some stats for calendar-year 2013 compared to calendar-year 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | '13 | '12 | % Chg | '13 | '12 | % Chg | '13 | '12 | % Chg |

| D.R. Horton | 25,315 | 22,513 | 12.4% | 25,161 | 19,954 | 26.1% | $255,646 | $228,395 | 11.9% |

| PulteGroup | 17,080 | 19,039 | -10.3% | 17,766 | 16,505 | 7.6% | $305,000 | $276,000 | 10.5% |

| NVR | 11,800 | 10,954 | 7.7% | 11,834 | 9,843 | 20.2% | $349,043 | $317,073 | 10.1% |

| The Ryland Group | 7,263 | 5,781 | 25.6% | 7,035 | 4,897 | 43.7% | $296,000 | $262,000 | 13.0% |

| Beazer Homes | 4,989 | 5,111 | -2.4% | 5,056 | 4,603 | 9.8% | $262,004 | $229,126 | 14.3% |

| M/I Homes | 3,787 | 3,020 | 25.4% | 3,472 | 2,765 | 25.6% | $286,000 | $264,000 | 8.3% |

| Total | 70,234 | 66,418 | 5.7% | 70,324 | 58,567 | 20.1% | $289,824 | $261,263 | 10.9% |

Trulia: Asking House Prices up 11.4% year-over-year in January

by Calculated Risk on 2/06/2014 11:24:00 AM

From Trulia chief economist Jed Kolko: 5 Truths of Tech-Hub Housing Costs

In January, asking home prices rose 1.1% month-over-month, the largest monthly gain since June 2013. But the quarter-over-quarter price increase of 2.1% remains below spring 2013 levels, when asking prices accelerated at their fastest rate in the recovery. Year-over-year, asking prices are up 11.4% nationally and are positive in 97 of the 100 largest metros.It appears the year-over-year asking price gains are slowing, but asking prices are still increasing. In November, asking prices were up 12.2% year-over-year. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. And in January, the year-over-year increase was 11.4%.

emphasis added

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.