by Calculated Risk on 5/23/2013 11:47:00 AM

Thursday, May 23, 2013

Kansas City Fed: Regional Manufacturing expanded in May

From the Kansas City Fed: Tenth District Manufacturing Survey Improved Somewhat

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved somewhat, rising above zero for the first time in seven months, and producers’ expectations for future activity also increased.The last regional surveys for May will be released next Tuesday (Dallas and Richmond), and the ISM index for May will be released on Monday, June 1st. Based on the regional surveys released so far, and the Markit Flash PMI released this morning, I expect a fairly weak reading for the ISM index (perhaps at or below 50).

“It was good to finally see a positive number after seven months of modest declines, and for optimism about future activity to return after dropping last month,” said Wilkerson. “Still, activity remains at only about year-ago levels and firms are having difficulty passing cost increases through.”

The month-over-month composite index was 2 in May, up from -5 in both April and March. ... Other month-over-month indexes were mixed. The production index edged up from 1 to 5, and the shipments, new orders, and new orders for export indexes also rose. In contrast, the employment index fell from -3 to -7, while the order backlog index was unchanged.

New Home Sales at 454,000 SAAR in April

by Calculated Risk on 5/23/2013 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 454 thousand. This was up from 444 thousand SAAR in March (March sales were revised up from 417 thousand).

January sales were revised up from 445 thousand to 458 thousand, and February sales were revised up from 411 thousand to 429 thousand. Very strong upward revisions.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in April 2013 were at a seasonally adjusted annual rate of 454,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.3 percent above the revised March rate of 444,000 and is 29.0 percent above the April 2012 estimate of 352,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in April at 4.1 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of April was 156,000. This represents a supply of 4.1 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

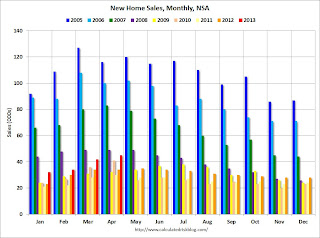

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2013 (red column), 45 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in April. The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was well above expectations of 425,000 sales in April, and a solid report, especially with all the upward revision to previous months. I'll have more soon ...

Weekly Initial Unemployment Claims decline to 340,000

by Calculated Risk on 5/23/2013 08:51:00 AM

The DOL reports:

In the week ending May 18, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 23,000 from the previous week's revised figure of 363,000. The 4-week moving average was 339,500, a decrease of 500 from the previous week's revised average of 340,000.The previous week was revised up from 360,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 339,500.

Claims were slightly below the 345,000 consensus forecast.

Wednesday, May 22, 2013

Thursday: New Home Sales, Weekly Unemployment Claims

by Calculated Risk on 5/22/2013 08:50:00 PM

Most of the coverage of the FOMC minutes today focused on this sentence:

"A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome."Three words: Will Not Happen. Not in June. Probably not this year (although tapering could start late this year).

emphasis added

The real Fed story today was that Fed Chairman Ben Bernanke scolded Congress. In his speech he said:

"Notably, over the past four years, state and local governments have cut civilian government employment by roughly 700,000 jobs, and total government employment has fallen by more than 800,000 jobs over the same period. For comparison, over the four years following the trough of the 2001 recession, total government employment rose by more than 500,000 jobs.And in the Q&A, Bernanke added:

Most recently, the strengthening economy has improved the budgetary outlooks of most state and local governments, leading them to reduce their pace of fiscal tightening. At the same time, though, fiscal policy at the federal level has become significantly more restrictive. In particular, the expiration of the payroll tax cut, the enactment of tax increases, the effects of the budget caps on discretionary spending, the onset of the sequestration, and the declines in defense spending for overseas military operations are expected, collectively, to exert a substantial drag on the economy this year."

“I fully realize the importance of budgetary responsibility, but I would argue that it’s not responsible to focus all of the restraint on the very near term and do nothing about the long term, which is where most of the problem exists. I do think that we would all be better off, with no loss to fiscal sustainability or market confidence, if we had somewhat less restraint in the very near term – this year and next year, say – and more aggressive action to address these very real long-term issues, which threaten within a decade or so to begin to put our fiscal budget on an unsustainable path.”Current policy is "not responsible". Unfortunately most members of Congress weren't even aware that Bernanke was giving them a failing grade! Most of the media reports ignored the reprimand too. Even the FOMC statement mentioned fiscal restraint several times. Oh well ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 345 thousand from 360 thousand last week.

• At 9:00 AM, FHFA House Price Index for March 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.9% increase.

• Also at 9:00 AM, The Markit US PMI Manufacturing Index Flash for May. The consensus is for a decrease to 50.8 from 52.0 in April.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 417 thousand in March.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for May. The consensus is for a reading of minus 2, up from minus 5 in April (below zero is contraction).

Existing Home Sales: A few comments

by Calculated Risk on 5/22/2013 04:52:00 PM

The most important number in the existing home sales report was inventory, and the NAR reported that inventory increased 11.9% in April from March, and is only down 13.6% from April 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of April since 2001, but this is also the smallest year-over-year decline since July 2011. The key points are: 1) inventory is very low, but 2) the inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 9.7% from April 2012, but conventional sales are probably up close to 25% from April 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 18 percent of April sales, down from 21 percent in March and 28 percent in April 2012.Although this survey isn't perfect, if total sales were up 9.7% from April 2012, and distressed sales declined from 28% of total sales to 18%, this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

All-cash sales were at 32 percent of transactions in April, up from 30 percent in March; they were 29 percent in April 2012. Individual investors, who account for most cash sales, purchased 19 percent of homes in April, unchanged from March; they were 20 percent in April 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) are above the sales for for 2008 through 2012, and close to the level in 2007. Sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in April: 4.97 million SAAR, 5.2 months of supply