by Calculated Risk on 3/25/2013 08:43:00 AM

Monday, March 25, 2013

Chicago Fed: "Economic Activity Improved in February"

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Improved in February

Led by gains in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.44 in February from –0.49 in January. All four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.09 in February from +0.28 in January, marking its fourth consecutive reading above zero. February’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity improved in February, and growth was somewhat above its historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 24, 2013

Sunday Night Futures

by Calculated Risk on 3/24/2013 09:16:00 PM

Cyprus and the "troika" have reached a deal tonight. Reports are the euro zone finance ministers have also approved the plan. Preliminary reports are that there will be no tax on depositors, and apparently this means approval from the Cypriot Parliament is not required.

Update: Eurogroup statement: Eurogroup Statement on Cyprus

A few details from CyprusMail: Bailout deal reached

Deposits below 100,000 euros in Laiki will be transferred to Bank of Cyprus. Deposits above 100,000 euros, which under EU law are not insured, will be frozen and will be used to resolve debt. It remains unclear how large the writedown on those funds will be. Some reports suggested it might be as high as 40 per cent. Sources told Reuters that the proposal involved shifting deposits below 100,000 euros from the Popular Bank of Cyprus (also known as Laiki) to the Bank of Cyprus to create a "good bank".Monday economic releases:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. The consensus is an increase to 3.4 from 2.2 in February (above zero is expansion).

• At 1:15 PM, Speech by Fed Chairman Ben Bernanke, Monetary Policy and the Global Economy, At the London School of Economics and Political Science, London, United Kingdom

Weekend:

• Summary for Week Ending March 22nd

• Schedule for Week of March 24th

The Asian markets opened green tonight with the Nikkei up 1.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 8 and Dow futures are up 70 (fair value).

Oil prices are up with WTI futures at $94.02 per barrel and Brent at $107.95 per barrel.

Reports: Cyprus Draft Deal Reached, No Details Yet

by Calculated Risk on 3/24/2013 08:10:00 PM

From CNBC: Cyprus, European Union Reach Draft Bailout Deal

Cyprus and its international lenders have reached a draft deal to rescue Cyprus, sources told CNBC.From the Peter Spiegel of the Financial Times:

No levy will be imposed on any deposits in Cypriot banks, but there will be a 'bail in' of Laiki depositors.

All Laiki deposits over €100k will be whacked. Total of haircut at BoC has not been decided.The Eurogroup still needs to meet, and then the Cyprus Parliament.

Update: CyprusMail: Bailout deal reached

Acting president Yiannakis Omirou has confirmed that a deal has been struck between Cyprus and international lenders.

Government sources suggest that the deal provides for a 30 per cent haircut on deposits of over €100,000 at Bank of Cyprus while reports said Popular Bank would be resolved.

Laiki deposits under 100,000 will be transferred to a ‘good bank,’ reports said.

Housing Starts and the Unemployment Rate

by Calculated Risk on 3/24/2013 02:05:00 PM

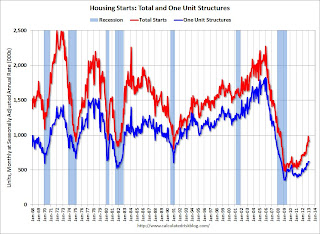

By request, here is an update to a graph that I've been posting for several years. This shows single family housing starts (through February 2013) and the unemployment rate (inverted) also through February. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing steadily near the end of 2011. This was one of the reasons the unemployment rate remained elevated.

Click on graph for larger image.

Click on graph for larger image.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover. However this time, with the huge overhang of existing housing units, this key sector didn't participate for an extended period.

The good news is single family starts have been increasing steadily for over a year, and that should mean more construction employment this year, and that the unemployment rate should decline further in 2013.

Cyprus Sunday

by Calculated Risk on 3/24/2013 09:50:00 AM

Updates at 1:45 PM ET: Meeting now scheduled for 3 PM ET. Cyprus central bank is now limiting cash withdrawals to 100 euros per day.

Cypriot President Nicos Anastasiades is in Brussels to hold talks with the "troika" and the Eurogroup meeting is scheduled to start at 1700 GMT (1 PM ET). Of course these meetings always start and run late ...

From the NY Times: As Deadline Nears, Cyprus Scrambles to Devise a Bailout

The Cypriot president, Nicos Anastasiades, flew to Brussels on Sunday after mapping out a tentative outline of a deal late Saturday with representatives of the troika of negotiators involved in the bailout: the European Central Bank, the European Commission and the International Monetary Fund.From the CyprusMail: Cyprus seeks 11th-hour deal to avert financial collapse

His first order of business was a meeting with Mario Draghi, the president of the central bank; Christine Lagarde, the managing director of the monetary fund; and José Manuel Barroso, the president of the commission. Herman Van Rompuy, the president of the European Council, which represents European Union leaders, was expected to preside over the meeting.

Mr. Anastasiades had also briefed Cypriot political leaders on the outline...

The revised bailout terms now under discussion would assess a one-time tax of 20 percent on deposits above 100,000 euros at one of the nation’s biggest banks, the Bank of Cyprus, which has the largest number of savings accounts on the island. ...

A separate tax of 4 percent would be assessed on uninsured deposits at all other banks, including the 26 foreign banks that operate in Cyprus.

Under the plan, savings under 100,000 euros would not be touched ...

Without a deal on Monday, the ECB says it will cut off emergency funds to Cypriot banks, spelling certain collapse and potentially pushing the country out of the euro zone.

Finance Ministers of the 17-nation euro zone will meet at 1700 GMT Sunday. ...

A senior Cypriot official said Nicosia had agreed with its lenders on a 20 per cent levy over and above €100,000 at the island's largest lender, Bank of Cyprus, and four per cent on deposits above the same level at other banks.

Media reports suggested talks were stuck on a demand by the IMF that Bank of Cyprus absorb the good assets of competitor Popular Bank and take on its nine billion euro debt to the central bank as well.

Saturday, March 23, 2013

Unofficial Problem Bank list declines to 797 Institutions

by Calculated Risk on 3/23/2013 05:32:00 PM

Here is the unofficial problem bank list for Mar 22, 2013.

Changes and comments from surferdude808:

As expected, a quiet week as there were only four removals from the Unofficial Problem Bank List. The removals leave the list at 797 institutions with assets of $294.3 billion. The list has not been under 800 since Friday, July 23, 2010. A year ago, the list held 949 institutions with assets of $379.8 billion.Earlier:

Actions were terminated against Saehan Bank, Los Angeles, CA ($602 million Ticker: SAEB); CIBM Bank, Champaign, IL ($471 million Ticker: CIBH); Bank of Little Rock, Little Rock, AR ($193 million); and Bank VI, Salina, KS ($65 million). In a more rare event, the Federal Reserve terminated a Prompt Corrective Action order against Bank of Bartlett, Bartlett, TN ($370 million).

Next week, we anticipate the FDIC will release its enforcement action through February 2013.

• Summary for Week Ending March 22nd

• Schedule for Week of March 24th

Schedule for Week of March 24th

by Calculated Risk on 3/23/2013 01:09:00 PM

Earlier:

• Summary for Week Ending March 22nd

The key reports this week are the February New Home sales report on Tuesday, Case-Shiller house prices for January, also on Tuesday, the February Personal Income and Outlays report on Friday, and the third estimate of Q4 GDP on Thursday.

Fed Chairman Ben Bernanke will speak on Monday at the London School of Economics.

Also, for manufacturing, the Dallas, Richmond and Kansas City Fed surveys for March will be released this week.

Note: the ECB deadline for Cyprus is Monday evening.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for March. The consensus is an increase to 3.4 from 2.2 in February (above zero is expansion).

1:15 PM: Speech by Fed Chairman Ben Bernanke, Monetary Policy and the Global Economy, At the London School of Economics and Political Science, London, United Kingdom

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 3.5% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through December 2012 (the Composite 20 was started in January 2000).

The consensus is for a 8.2% year-over-year increase in the Composite 20 index (NSA) for January. The Zillow forecast is for the Composite 20 to increase 8.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a decrease in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 437 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. The consensus is for a reading of 5.5 for this survey, down from 6.0 in February (Above zero is expansion).

10:00 AM: Conference Board's consumer confidence index for March. The consensus is for the index to decrease to 69.0.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Pending Home Sales Index for February. The consensus is for a 0.7% decrease in this index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 336 thousand last week. The "sequester" budget cuts might start impacting weekly claims soon.

8:30 AM: Q4 GDP (third estimate). This is the third estimate of GDP from the BEA. The consensus is that real GDP increased 0.6% annualized in Q4, revised up from 0.1% in the second estimate.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a decrease to 56.1, down from 56.8 in February.

11:00 AM: Kansas City Fed regional Manufacturing Survey for March. The consensus is for a reading of minus 3, up from minus 10 in February (below zero is contraction).

SIFMA recommends 2:00 PM market close on Thursday in observance of the Good Friday Holiday.

Note: Markets Closed in observance of the Good Friday Holiday.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.9% increase in personal income in February (following the sharp increase in December due to some people taking income early to avoid higher taxes, and then the sharp decline in January), and for 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 72.5.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for February 2013

Summary for Week ending March 22nd

by Calculated Risk on 3/23/2013 08:11:00 AM

The major story this week was the ongoing crisis in Cyprus. There will be further developments this weekend with a Monday deadline (the ECB will not provide liquidity to Cyprus banks after Monday, without an "EU/IMF programme in place"). The resolution is unclear and anything could happen, although it seems likely that Cyprus will remain in eurozone and receive a bailout - and that large depositors (over €100,000) will take significant losses.

The events in Cyprus are a reminder that there are downside risks to the economy, with the two most obvious risks being Europe and overly restrictive US fiscal policy. Otherwise the economy appears to be improving.

This was another week of solid economic data. Housing starts were up again, and are now up 27.7% year-over-year. Even with the strong increase in starts, total housing starts are still historically very low suggesting more growth over the next few years.

The existing home sales report was solid too with a strong increase in conventional sales. Inventory is still falling sharply on a year-over-year basis, but it appears the year-over-year decline may be slowing (inventory is very low right now).

Other positive data included an increase in the Architecture Billings Index (leading indicator for commercial real estate) that was at the highest level since 2007, and a decrease in the 4-week average of initial weekly unemployment claims - at the lowest level since February 2008. It is a good sign when indicators are the highest in years (or lowest in years for negative indicators like unemployment claims). Even manufacturing showed signs of life in the New York and Philly Fed manufacturing surveys.

The sequestration budget cuts will probably start slowing the economy soon, but right now the economy is clearly improving.

Here is a summary of last week in graphs:

• Housing Starts increased to 917 thousand SAAR in February

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: "Privately-owned housing starts in February were at a seasonally adjusted annual rate of 917,000. This is 0.8 percent above the revised January estimate of 910,000 and is 27.7 percent above the February 2012 rate of 718,000.

Single-family housing starts in February were at a rate of 618,000; this is 0.5 percent above the revised January figure of 615,000. The February rate for units in buildings with five units or more was 285,000."

This was at expectations of 919 thousand starts in February. Starts in February were up 27.7% from February 2012; single family starts were up 31.5% year-over-year. Starts in December and January were revised up, and permits were strong. This was another solid report.

• Existing Home Sales in February: 4.98 million SAAR, 4.7 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2013 (4.98 million SAAR) were 0.8% higher than last month, and were 10.2% above the February 2012 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 4.7 months in February.

This was close to expectations of sales of 5.01 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index increases, Strongest Growth since 2007

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."This graph shows the Architecture Billings Index since 1996.

Every building sector is now expanding and new project inquiries are strongly positive (highest since January 2007). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for seven consecutive months and suggests some increase in CRE investment in the second half of 2013.

• Weekly Initial Unemployment Claims increase to 336,000

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The previous week was revised up from 332,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 339,750 - this is the lowest level since early February 2008.

Weekly claims were below the 340,000 consensus forecast. Note: Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

• Philly Fed Manufacturing Survey Shows Expansion in March

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased in March, and is back above zero. This suggests the ISM manufacturing index will show further expansion in March.

Friday, March 22, 2013

Cyprus: Bank Resolution Bills Passed, Vote Saturday on Tax on uninsured deposits

by Calculated Risk on 3/22/2013 09:05:00 PM

From the NY Times: Cyprus Passes Parts of Bailout Bill, but Delays Vote on Tax

Lawmakers took steps late Friday to revise a formula for obtaining a bailout of Cyprus’s banks but faced strong signals that the plan would not pass muster with international lenders.There will be additional votes tomorrow, and a meeting with the Eurogroup on Sunday.

The Parliament put off until later this weekend a vote on a crucial new proposal that would confiscate 22 to 25 percent of uninsured deposits above 100,000 euros through a new tax on account holders in one of the nation’s most troubled banks.

From the WSJ: Cyprus Adopts Bank Overhaul Plan

[T]he Parliament in Nicosia passed two key bills that would allow it to close down its second largest bank, Popular Bank of Cyprus, and aggressively curtail the free flow of money on the island. The bank restructuring law would see depositors in Popular Bank, also known as Laiki Bank, to lose as much as 40% of their savings above €100,000 ... As details of the latest plan emerged late Friday, there were signs that the country may be forced to also resolve Bank of Cyprus, its biggest lender. ...Additional resources:

[T]he government in Nicosia had proposed to levy a 20% tax on depositors with more than €100,000 in their accounts in Bank of Cyprus. The government hoped that would allow them to protect the lender ... But senior European finance-ministry officials in a call Friday evening expressed doubts that the plan would raise enough money to ring fence the lender ...

The Telegraph: Cyprus bail-out: live

The CyprusMail: Cyprus Crisis Update, Friday March 22nd

DOT: Vehicle Miles Driven increased 0.5% in January

by Calculated Risk on 3/22/2013 05:50:00 PM

The Department of Transportation (DOT) reported:

Based on preliminary reports from the State Highway Agencies, travel during January 2013 on all roads and streets in the nation changed by +0.5 percent (1.2 billion vehicle miles) resulting in estimated travel for the month at 226.9 billion vehicle-miles.The following graph shows the rolling 12 month total vehicle miles driven.

This total includes 71.6 billion vehicle-miles on rural roads and 155.3 billion vehicle-miles on urban roads and streets.

Traffic was up slightly in all regions. The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 62 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in January compared to January 2012. In January 2013, gasoline averaged of $3.39 per gallon according to the EIA. In 2012, prices in January averaged $3.44 per gallon. However prices spiked in February, and that will probably impact miles driven in the next monthly report.

Gasoline prices were down in January compared to January 2012. In January 2013, gasoline averaged of $3.39 per gallon according to the EIA. In 2012, prices in January averaged $3.44 per gallon. However prices spiked in February, and that will probably impact miles driven in the next monthly report.However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.