by Calculated Risk on 11/23/2012 08:34:00 PM

Friday, November 23, 2012

Las Vegas: Visitor Traffic on pace for Record High, Convention Attendance Lags

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered and here is an update.

Through September visitor traffic is running just ahead of the 2007 pace (the previous peak) and it is possible Las Vegas will see 40 million visitors this year. However convention attendance is barely ahead of last year, and about 20% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2012 is estimated based on traffic through September.

The gamblers are back, but not the conventions ...

ATA Trucking Index declines sharply in October, Impacted by Hurricane Sandy

by Calculated Risk on 11/23/2012 04:09:00 PM

This is a minor indicator that I follow. Clearly truck tonnage was impacted by Hurricane Sandy in October, and we will probably see a bounce back in November and December.

From ATA: ATA Truck Tonnage Index Fell 3.8% in October

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 3.8% in October after falling 0.4% in September. (The 0.4% decrease in September was revised from a 0.1% gain ATA reported on October 23, 2012.) October’s drop was the third consecutive totaling 4.7%. As a result, the SA index equaled 113.7 (2000=100) in October, the lowest level since May 2011. Compared with October 2011, the SA index was off 2.1%, the first year-over-year decrease since November 2009. Year-to-date, compared with the same period last year, tonnage was up 2.9%.Note from ATA:

...

“Clearly Hurricane Sandy negatively impacted October’s tonnage reading,” ATA Chief Economist Bob Costello said. “However, it is impossible for us to determine the exact impact.”

Costello noted that a large drop in fuel shipments into the affected area likely put downward pressure on October’s tonnage level since fuel is heavy freight, in addition to reductions in other freight.

“I’d expect some positive impact on truck tonnage as the rebuilding starts in the areas impacted by Sandy, although that boost may only be modest in November and December,” he said. “Excluding the Hurricane impacts, I still think truck tonnage is decelerating along with factory output and consumer spending on tangible-goods.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Even with the sharp decline in October, the index is at the pre-recession level. However, even before the hurricane, the index was mostly moving sideways this year due to the slowdown in manufacturing.

Q3 GDP: Here come the upward revisions

by Calculated Risk on 11/23/2012 11:55:00 AM

Next Thursday, the BEA will release the second estimate of Q3 GDP. The consensus is GDP will be revised up to 2.8% annualized growth, from the advance estimate of 2.0%. This would be a pretty sharp upward revision.

As an example, from Nomura analysts today:

"We believe real GDP growth will be revised significantly upward to an annualized pace of 3.0% versus the originally reported 2.0%, supported by greater inventory building and better net trade statistics than previously estimated."It is important to remember that the "advance" estimate is based on incomplete source data, or data subject to revisions. It appears the missing data (mostly for September) was better than expected, and that revisions have been favorable for GDP. I'll post some more Q3 estimates later.

LA area Port Traffic: Inbound Traffic up in October

by Calculated Risk on 11/23/2012 09:13:00 AM

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October. LA area ports handle about 40% of the nation's container port traffic. This data suggests trade with Asia will be fairly steady in October.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are up slightly compared to the 12 months ending in September.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports will probably decline in November.

Thursday, November 22, 2012

Irwin: "Five economic trends to be thankful for"

by Calculated Risk on 11/22/2012 07:30:00 PM

From Neil Irwin at the WaPo looked for a few positives: Five economic trends to be thankful for. Some excerpts a few comments:

Household debt is way down. ... The good news is that in the past three years, Americans have made remarkable progress cleaning up their balance sheets and paying down those debts. After peaking at nearly 98 percent of economic output at the start of 2009, the household debt was down to 83 percent of GDP in the spring of 2012. ...CR Note: This level is still fairly high, but households have made progress. We will have more data next week when the NY Fed releases their Q3 Report on Household Debt and Credit.

Click on graph for larger image.

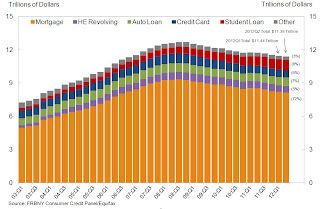

Click on graph for larger image.This graph is from the Q2 NY Fed Report on Household Debt and Credit and shows that aggregate consumer debt has been decreasing.

From the NY Fed: "Household indebtedness declined to $11.38 trillion [in Q2], a $53 billion decline from the first quarter of 2012. Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008."

Note: Irwin uses a different starting point, and also looks at household debt as percent of GDP (a good way to look at debt), and clearly household is debt is down significantly.

Irwin:

The cost of servicing that debt is way, way down. ... In late 2007, debt service payments added up to a whopping 14 percent of disposable personal income. Now it’s down to 10.7 percent, about the same as in the early 1990s. ..CR Note: Here is the data source: Household Debt Service and Financial Obligations Ratios.

Irwin:

Electricity and natural gas prices are falling. ... The retail price for consumers’ gas service piped into their homes is down 8.4 percent in the year ended in October. The lower wholesale price of natural gas is also pulling down electricity prices; they are off 1.2 percent over the past year. ...CR Note: I track the JOLTS data every month, and, as Irwin notes, layoffs and discharges are down.

Businesses aren’t firing people. ... While businesses aren’t adding new workers at a pace that would put the hordes of unemployed back on the job very rapidly, they also aren’t slashing jobs at a very rapid clip. Private employers laid off or discharged 1.62 million people in September, according to the Labor Department’s Job Openings and Labor Turnover data. ...

Irwin:

Housing is dramatically more affordable. ... In the spring of 2006, ... typical American home buyer would have faced a monthly mortgage payment of $1,247 a month ... home prices have fallen, so have mortgage rates ... Add it all up, and in the spring of 2012 that median American house would require a mortgage payment of only $889 a month ...CR Note: I'm not sure of all the numbers Irwin is using, but according to Case-Shiller, the Composite 20 house price index declined 31% from the peak (some areas more, some much less). Factor in low mortgage rates, and the payment would have fallen even further. There are definitely positive trends.

Happy Thanksgiving!