by Calculated Risk on 10/25/2012 04:17:00 PM

Thursday, October 25, 2012

Lawler: Home Builders: On Balance, Strong Results

From economist Tom Lawler:

Several publicly-traded home builders posted results for the quarter ended September 30th this week, and the general theme was strong net orders, slightly lower cancellation rates, higher margins/lower concessions, and higher home sales prices. Below are some summary stats.

Average sales prices, of course, don’t necessarily reflect gains in “constant-quality” homes, but are affected by changes in the type of homes sold and the regional mix of homes sold. Nevertheless, most home builders appear to be selling homes at “effective” prices well above a year ago.

The combined order backlog of the five builders on September 30th, 2012 was 17,907, up 42.2% from last September.

| New Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 10,570 | 8,283 | 27.6% | 10,339 | 8,890 | 16.3% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $287,229 | $270,558 | 6.2% |

Housing: What Numbers Matter (Part 2)

by Calculated Risk on 10/25/2012 02:28:00 PM

Apparently some people think if existing home sales go flat, or even decline, the housing recovery is in trouble ... or something ...

From Diana Olick at CNBC: Why Today's Housing Report Spooked Investors So Much

[T]he National Association of Realtors reported no change in signed contracts to buy existing homes in September. ...The number of existing home sales is just part of the story.

It wasn't so much the slight disappointment in the monthly index, it was more the comment from the Realtors' chief economist Lawrence Yun:

"This means only minor movement is likely in near-term existing-home sales, but with positive underlying market fundamentals they should continue on an uptrend in 2013.”

Not exactly a rave.

We know we're coming off the bottom of the housing crash, but over the summer it felt to some like we were rocketing off the bottom. Now, not so much.

...

Existing home sales are coming off lows from last year, but last year was the hangover from the 2010 home buyer tax credit ...

"The year-over-year gain was the smallest of the year and comps against last year when the housing market was in a full blown double-dip mode," notes analyst Mark Hanson.

Let me repeat what I wrote earlier this year: Home Sales Reports: What Matters: "When we look at sales for existing homes, the focus should be on the composition between conventional and distressed. Total sales are probably close to the normal level of turnover, but the composition of sales is far from normal - sales are still heavily distressed sales. Over time, existing home sales will probably settle around 5 million per year, but the percentage of distressed sales will eventually decline. Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. Look at inventory and the percent of conventional sales."

Unfortunately I have little confidence in the NAR's estimate of conventional sales, but most local data shows a fairly strong increase in conventional sales (as opposed to short sales and foreclosures). As an example, the percent of conventional sales in Phoenix increased from 35.9% in September 2011 to 60.1% in September 2012. Now overall sales were down sharply - the Arizona Regional MLS reported sales in September were down 17.9% from September 2011, but conventional sales were up 37%. I think this is a positive.

Of course the key housing numbers for the economy and jobs are housing starts and new home sales. Also house prices matter too. But the housing report this morning (pending home sales) was mostly irrelevant.

Misc: Pending Home Sales index increases slightly, KC Mfg Index contracts, Remodeling increases

by Calculated Risk on 10/25/2012 11:00:00 AM

A few miscellaneous releases:

• From the NAR: September Pending Home Sales Show Slight Improvement

The Pending Home Sales Index, a forward-looking indicator based on contract signings, edged up 0.3 percent to 99.5 in September from 99.2 in August and is 14.5 percent above September 2011 when it was 86.9. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this is for sales in October and November.

• From the Kansas City Fed: Tenth District Manufacturing Activity Declined Slightly

Tenth District manufacturing activity declined slightly in October, and producers’ expectations for future activity fell considerably but remained slightly positive. Several producers commented on growing uncertainty related to the upcoming election and fiscal situation, which has put a hold on many customers’ orders and spending. Price indexes were mixed, with minimal changes overall.Another weak regional manufacturing survey.

The month-over-month composite index was -4 in October, down from 2 in September and 8 in August, and the lowest in over three years ... The employment index moved into negative territory for the first time this year, while the shipments index inched higher but still remained negative.

“We saw factories pull back this month for the first time in quite a while, which many firms attributed to the impact of the uncertain political and fiscal situation on customers’ willingness to order” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City]. “Expectations also weakened considerably for production and employment but, encouragingly, factories’ capital spending plans for early next year remained largely intact.”

• From the NAHB: Remodeling Market Index Climbs Five Points, Returns to 2005 Levels

The Remodeling Market Index (RMI) climbed to 50 in the third quarter of 2012, up from 45 in the previous quarter, according to the National Association of Home Builders (NAHB). Released today, the RMI is at its highest point since the third quarter of 2005, tracking the positive trends recently seen in the rest of the housing sector.

...

“The improvement in the RMI provides more evidence that the remodeling industry is making the orderly recovery from its low point in 2009 as we’ve been expecting,” said NAHB Chief Economist David Crowe. “Although remodeling projects over $25,000 are now showing some signs of strength, they are still lagging behind smaller property alterations and maintenance and repair jobs."

Chicago Fed: Economic Activity Improved in September

by Calculated Risk on 10/25/2012 09:58:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity improved in September

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to 0.00 in September from –1.17 in August. All four broad categories of indicators that make up the index increased from August, and each one except the consumption and housing category made a positive contribution to the index in September.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from –0.53 in August to –0.37 in September—its seventh consecutive reading below zero. September’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity improved, but growth was still below trend in September.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Weekly Initial Unemployment Claims decline to 369,000

by Calculated Risk on 10/25/2012 08:30:00 AM

The DOL reports:

In the week ending October 20, the advance figure for seasonally adjusted initial claims was 369,000, a decrease of 23,000 from the previous week's revised figure of 392,000. The 4-week moving average was 368,000, an increase of 1,500 from the previous week's revised average of 366,500.The previous week was revised up from 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,000. This is 5,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 372,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the previous two weeks were related to timing and technical factors.

Wednesday, October 24, 2012

Thursday: Unemployment Claims, Durable Goods Orders, Pending Home Sales

by Calculated Risk on 10/24/2012 09:01:00 PM

From the NY Times Dealbook: Federal Prosecutors Sue Bank of America Over Mortgage Program

In a civil complaint that seeks to collect $1 billion from the bank, the Justice Department took aim at a home loan program known as the “hustle,” a venture that has become emblematic of the risk-fueled mortgage bubble.Thursday:

...

Bank of America inherited the “hustle” home loan program with its purchase of Countrywide Financial in 2008. Prosecutors say the effort, kept alive by Bank of America through 2009, was intended to churn out mortgages at a rapid pace without proper checks on wrongdoing. The bank then sold the “defective” loans without warning to Fannie Mae and Freddie Mac, the government-controlled housing giants, which were stuck with heavy losses and a glut of foreclosed properties.

“The fraudulent conduct alleged in today’s complaint was spectacularly brazen in scope,” Preet Bharara, the United States attorney in Manhattan, said in a statement.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 372 thousand from 388 thousand..

• Also at 8:30 AM, the Durable Goods Orders for September will be released by the Census Bureau. The consensus is for a 7.0% decrease in durable goods orders.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September will be released. This is a composite index of other data.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 2.5% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for October will be released. The consensus is for an a reading of 4, up from 2 in September (above zero is expansion).

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

Updates to the ADP Employment Report

by Calculated Risk on 10/24/2012 06:50:00 PM

ADP announced some changes to their monthly employment report today (ht Rob). Here is the press release, and here is the website with FAQs, methodology and more:

The newly expanded ADP National Employment Report will be issued each month by the ADP Research InstituteSM, a specialized group within ADP that provides insights around employment trends and workforce strategy. The first enhanced monthly report issued in collaboration with Moody’s Analytics will be released on November 1, and will report private payroll changes for the month of October 2012.Basically ADP/Moody's uses the ADP payroll data and attempts to predict the BLS report of private sector payroll jobs added or lost each month. They use matched pairs (companies that report for both the current month and the previous month), and adjust the data by category to align with the BLS data (final data after revisions). It is a fairly complicated process.

...

This new collaboration allows the ADP National Employment Report to increase the number of industry categories reported and expands the number of business sizes reported each month. Other key enhancements of the report include the development of a new methodology to further align with the final, revised U.S. Bureau of Labor Statistics (BLS) numbers. A look back at historical data from 2001 to present using the new methodology shows a very strong correlation (96%) with the revised BLS numbers. In addition, the overall sample size used to create the report has been increased from 344,000 U.S. companies to 406,000, and from 21 million employees to 23 million; which accounts for more than 20% of all U.S. private sector employees. Originally launched in 2006, the ADP National Employment Report is a derived from actual payroll data from an anonymous subset of ADP’s clients in the U.S.

However the ADP employment report is still a black box and we will not be able to judge the "improvements" for a few years. I think it would be much better for analysts if ADP just reported actual payroll gains or losses by industry (perhaps in percentage terms). That would be a useful and independent measure of the labor market.

The first "enhanced" report will be released next week on Nov 1st.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

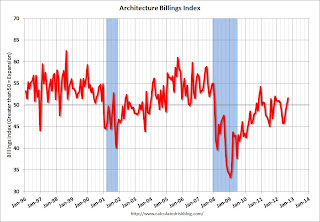

AIA: Architecture Billings Index increases in September

by Calculated Risk on 10/24/2012 04:08:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Increase for Architecture Billings Index

The American Institute of Architects (AIA) reported the September ABI score was 51.6, up from the mark of 50.2 in August. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.3, compared to a mark of 57.2 the previous month.

“Going back to the third quarter of 2011, the multi-family residential sector has been the best performing segment of the construction field,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With high foreclosure levels in recent years, more stringent mortgage approvals and fewer people in the market to buy homes there has been a surge in demand for rental housing. The upturn in residential activity will hopefully spur more nonresidential construction.”

Sector index breakdown: multi-family residential (57.3), institutional (51.0), commercial / industrial (48.4), mixed practice (47.8)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests increase in CRE investment next year (it will be some time before investment in offices and malls increases).

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales and Distressing Gap

• New Home Sales graphs

FOMC Statement: "Economic activity has continued to expand at a moderate pace"

by Calculated Risk on 10/24/2012 02:15:00 PM

Not much changed ...

FOMC Statement:

Information received since the Federal Open Market Committee met in September suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has advanced a bit more quickly, but growth in business fixed investment has slowed. The housing sector has shown some further signs of improvement, albeit from a depressed level. Inflation recently picked up somewhat, reflecting higher energy prices. Longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without sufficient policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of Treasury securities, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens. In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed additional asset purchases and disagreed with the description of the time period over which a highly accommodative stance of monetary policy will remain appropriate and exceptionally low levels for the federal funds rate are likely to be warranted.

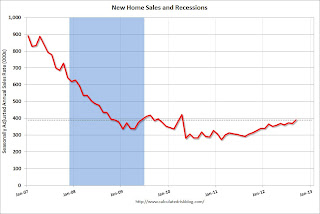

New Home Sales and Distressing Gap

by Calculated Risk on 10/24/2012 11:55:00 AM

New home sales have averaged 364,000 on an annual rate basis through September. That means sales are on pace to increase 19% from last year (and based on the last few months, sales will probably increase more than 20% this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 364 | 19% |

| 12012 pace through September. | ||

But even with a 20%+ increase this year, 2012 will be the 3rd or 4th lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, and it is possible - with a fairly strong last three months - that sales will be close to, or even above, the 375,000 sales in 2009.

Click on graph for larger image.

Click on graph for larger image.This graph shows new home sales over the last few years. Although sales have increased this year, total sales are still very low. The two tax credit related "peaks" were at 418 thousand and 422 thousand, and sales are still below those levels.

Given the current low level of sales, and current market conditions (supply and demand), sales will probably continue to increase over the next few years. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

Here is an update to the distressing gap graph.

Note: I started posting this graph four years ago when the "distressing gap" first appeared!

Note: I started posting this graph four years ago when the "distressing gap" first appeared!This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through September. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 389,000 SAAR in September

• New Home Sales graphs