by Calculated Risk on 3/02/2012 04:14:00 PM

Friday, March 02, 2012

House Prices and Future Contracts

From HUD: Housing Scorecard

The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury today released the February edition of the Obama Administration's Housing ScorecardThis monthly housing report is an overview of the U.S. housing market, and has data (and sources) for prices, inventory, foreclosures, modifications and much more.

One of the graphs shows house prices (using Case-Shiller composite 20 NSA) and future expectations of house prices from two different points: January 2009 and current.

From the report: "S&P/Case-Shiller 20 metro composite index (NSA) as reported monthly. Futures index figures report forward expectations of the level of the S&P/Case Shiller index as of the date indicated, estimated from prices of futures contracts reported by Radar Logic."

Click on graph for larger image.

Click on graph for larger image.The dark blue line is actual prices using the Case-Shiller Composite 20 index (NSA). The light blue dashed line shows the market expectations for the Case-Shiller index as of January 2009. Expectations in January 2009 were for prices to fall further, and for prices to bottom at the beginning of 2011 (prices didn't fall as far as expected, and, as of December 2011 (the most recent Case-Shiller report), still haven't bottomed.

The darker blue dashed line is current expectations for the Case-Shiller index. Investors now think the Case-Shiller composite 20 index has bottomed.

Hotels: RevPAR increases 6.9% compared to same week in 2011

by Calculated Risk on 3/02/2012 01:31:00 PM

From HotelNewsNow.com: STR: US hotel results week ending 25 February

In year-over-year comparisons for the week, occupancy was up 2.3 percent to 61.0 percent, average daily rate increased 4.6 percent to US$103.84, and revenue per available room was up 6.9 percent to US$63.38.Hotel occupancy and RevPAR have improved from 2011, but are still below the per-recession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, business travel usually increases over the next few months - and then occupancy increases during the summer with all the leisure travel. So far it looks like 2012 will have higher occupancy than 2011, but still be below the pre-recession median.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Europe Update

by Calculated Risk on 3/02/2012 09:08:00 AM

A few stories from Europe:

From the Financial Times Alphaville: The ‘hoarders’ are back (thanks to Ltro 2)

Yes, the ‘hoarders’ are back. From Dow Jones:From the WSJ: EU Leaders Sign Fiscal PactFRANKFURT—Banks’ overnight deposits with the European Central Bank surged 63% on Thursday, shattering the previous record high, indicating an extremely elevated level of liquidity in the banking system after the ECB’s second three-year loan operation.... courtesy of Danske Bank (on the first Ltro):

The level of ECB deposits rose to €776.941 billion ($1.034 trillion) from €475.219 billion the day before, far exceeding the previous record high of €528.184 billion reached Jan. 17 in the wake of the ECB’s first three-year loan. ...Does this mean that the operation has failed to stimulate government bond purchases? No, not really. If a bank uses money from the LTRO to buy government bonds (or any other paper) in the secondary market, the amount will still show up as a deposit at the ECB (now on behalf of the seller’s bank). If a bank buys government bonds in the primary market, the amount will also show up as bank deposits at the ECB if the government spends the receipts or places them at a private bank. Thus, the increase in deposits doesnot imply that the 36 months LTRO has failed to stimulate government bond purchases (or other trading for that matter).

European Union leaders Friday signed the region's new fiscal pact, adopting strict new rules on deficits and debts, even as some members warned a tougher economic environment is challenging their fiscal commitments.More austerity.

The fiscal accord, which was finalized in January and calls for sanctions on those member states that fail to meet targets, was signed by 25 member states. The U.K. and the Czech Republic opted out.

And from the WSJ: German Retail Sales Fall

German real seasonally-adjusted retail sales fell sharply in January, initial data from the Federal Statistics Office showed Friday. The 1.6% decrease was far below analysts' expectations of a 0.3% increase. This followed a 0.1% increase in December.

Thursday, March 01, 2012

Greece Update

by Calculated Risk on 3/01/2012 08:31:00 PM

From the WSJ: Euro Zone Clears Way for EU Decision on Greek Deal

Euro-zone finance ministers said Thursday they were ready to give Greece money from a new bailout—provided a bond swap that will cut the debt Greece owes its private creditors by more than €100 billion goes according to plan in the coming week.Talking about "headwinds to economic growth" in Europe, from the WaPo: Euro unemployment hits 10.7 percent in January, new high since euro established in 1999

European Union leaders at a summit Thursday evening said they would focus on policies aimed at battling the headwinds to economic growth created by government austerity programs across the 27-nation bloc.

Meanwhile, signs emerged that Germany was yielding to international pressure to boost the euro zone's bailout funds.

Mass unemployment in Greece and Spain, where nearly half of those under 25 are out of work, sent the jobless rate across the 17-nation eurozone on Thursday to its highest level since the euro was established in 1999. Eurozone unemployment rose to 10.7 percent from an upwardly revised 10.6 percent the previous month, according to EurostatOuch!

Earlier:

• U.S. Light Vehicle Sales at 15.1 million annual rate in February

• CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

• ISM Manufacturing index indicates slower expansion in February

• Personal Income increased 0.3% in January, Spending 0.2%

• Weekly Initial Unemployment Claims decline slightly to 351,000

U.S. Light Vehicle Sales at 15.1 million annual rate in February

by Calculated Risk on 3/01/2012 03:45:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).

This was well above the consensus forecast of 14.0 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 15.1 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The annualized sales rate is up sharply over the last two months, and this is the highest sales rate since February 2008 - and above the August 2009 rate with the spike in sales from "cash-for-clunkers".

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales will make another strong positive contribution GDP in Q1 2012 GDP.

CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

by Calculated Risk on 3/01/2012 01:54:00 PM

CoreLogic released the Q4 2011 negative equity report today.

CoreLogic ... today released negative equity data showing that 11.1 million, or 22.8 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2011. This is up from 10.7 million properties, 22.1 percent, in the third quarter of 2011. An additional 2.5 million borrowers had less than five percent equity, referred to as near-negative equity, in the fourth quarter. Together, negative equity and near-negative equity mortgages accounted for 27.8 percent of all residential properties with a mortgage nationwide in the fourth quarter, up from 27.1 in the previous quarter. Nationally, the total mortgage debt outstanding on properties in negative equity increased from $2.7 trillion in the third quarter to $2.8 trillion in the fourth quarter.Here are a couple of graphs from the report:

“Due to the seasonal declines in home prices and slowing foreclosure pipeline which is depressing home prices, the negative equity share rose in late 2011. The negative equity share is back to the same level as Q3 2009, which is when we began reporting negative equity using this methodology. The high level of negative equity and the inability to pay is the ‘double trigger’ of default, and the reason we have such a significant foreclosure pipeline. While the economic recovery will reduce the propensity of the inability to pay trigger, negative equity will take an extended period of time to improve, and if there is a hiccup in the economic recovery, it could mean a rise in foreclosures.” said Mark Fleming, chief economist with CoreLogic.

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, followed by Arizona (48 percent), Florida (44 percent), Michigan (35 percent) and Georgia (33 percent). This is the second consecutive quarter that Georgia was in the top five, surpassing California (29 percent) which previously had been in the top five since tracking began in 2009. The top five states combined have an average negative equity share of 44.3 percent, while the remaining states have a combined average negative equity share of 15.3 percent."

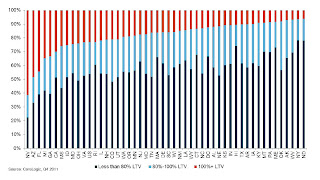

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.Some states - like New York - have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: "Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of $219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent.

The remaining 4.4 million upside-down borrowers had both first and second liens. Their average mortgage balance was $306,000 and they were upside down by an average of $84,000 or a combined LTV of 138 percent."

Construction Spending declines slightly in January

by Calculated Risk on 3/01/2012 12:05:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending declined slightly in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2012 was estimated at a seasonally adjusted annual rate of $827.0 billion, 0.1 percent (±1.1%)* below the revised December estimate of $827.6 billion. The January figure is 7.1 percent (±1.8%) above the January 2011 estimate of $772.0 billion.Private construction spending was unchanged in January:

Spending on private construction was at a seasonally adjusted annual rate of $538.7 billion, nearly the same as (±1.1%)* the revised December estimate of $538.7 billion. Residential construction was at a seasonally adjusted annual rate of $253.6 billion in January, 1.8 percent (±1.3%) above the revised December estimate of $249.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $285.0 billion in January, 1.5 percent (±1.1%) below the revised December estimate of $289.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 62.5% below the peak in early 2006, and up 13% from the recent low. Non-residential spending is 31% below the peak in January 2008, and up about 17% from the recent low.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and it appears the bottom is in for residential investment.

Earlier:

• ISM Manufacturing index indicates slower expansion in February

• Personal Income increased 0.3% in January, Spending 0.2%

• Weekly Initial Unemployment Claims decline slightly to 351,000

ISM Manufacturing index indicates slower expansion in February

by Calculated Risk on 3/01/2012 10:00:00 AM

PMI was at 52.4% in February, down from 54.1% in January. The employment index was at 53.2%, down from 54.3%, and new orders index was at 54.9%, down from 57.6%.

From the Institute for Supply Management: January 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the 31st consecutive month, and the overall economy grew for the 33rd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 52.4 percent, a decrease of 1.7 percentage points from January's reading of 54.1 percent, indicating expansion in the manufacturing sector for the 31st consecutive month. The New Orders Index registered 54.9 percent, a decrease of 2.7 percentage points from January's reading of 57.6 percent, reflecting the 34th consecutive month of growth in new orders. Prices of raw materials increased for the second consecutive month, with the Prices Index registering 61.5 percent. As was the case in January, new orders, production and employment all grew in February — although at somewhat slower rates than in January. Comments from the panel continue to reflect a generally positive outlook for the next few months."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.6%. This suggests manufacturing expanded at a slower rate in February than in January (the opposite of all the regional surveys). It appears manufacturing employment expanded slowly in February with the employment index at 53.2%.

Personal Income increased 0.3% in January, Spending 0.2%

by Calculated Risk on 3/01/2012 08:57:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $37.4 billion, or 0.3 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $23.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in January, in contrast to a decrease of less than 0.1 percent in December. ... The price index for PCE increased 0.2 percent in January, compared with an increase of 0.1 percent in December. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.2% in January, and real PCE increased less than 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.6% in January.

Real PCE has been essentially flat since October.

Weekly Initial Unemployment Claims decline slightly to 351,000

by Calculated Risk on 3/01/2012 08:30:00 AM

The DOL reports:

In the week ending February 25, the advance figure for seasonally adjusted initial claims was 351,000, a decrease of 2,000 from the previous week's revised figure of 353,000. The 4-week moving average was 354,000, a decrease of 5,500 from the previous week's revised average of 359,500.The previous week was revised up to 353,000 from 351,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 354,000.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down.

Note: Nomura analysts recently argued some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.