by Calculated Risk on 2/23/2012 06:36:00 PM

Thursday, February 23, 2012

Hotels: RevPAR increases 4.4% compared to same week in 2011

From HotelNewsNow.com: New Orleans benefits from Mardi Gras visitors

Overall, the U.S. hotel industry reported a 1.5% increase in occupancy to 59.7%, a 2.9% increase in ADR to $102.59 and a 4.4% increase in RevPAR to $61.27.Hotel occupancy and RevPAR have improved from 2011, but are still below the per-recession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Better than 2011, but the 4-week average of the occupancy rate is still below normal. Looking forward, business travel usually increases in the March to May period - and then increases during the summer with all the leisure travel.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Comments on Existing Home Inventory

by Calculated Risk on 2/23/2012 02:54:00 PM

Analysts are trying to explain the recent sharp decline in existing home inventory and trying to estimate the impact of less inventory on house prices. As an example, Goldman Sachs economist Zach Pandl wrote yesterday:

Inventory of existing homes on the market declined by 21% in the year to January, or by 600,000 units. The “months supply” of existing homes—homes for sale divided by the current sales pace—fell to 6.1 in January, the lowest level since April 2006. Although we consider these declines a modest positive for the housing market outlook, we also think they exaggerate the improvement in excess supply.

...

Active listings—which are what the existing home sales report measures—decline if a house is sold, but also if a current homeowner pulls their home off the market. They can also be held down by prospective home sellers who decide not to sell due to weak demand conditions. Available data suggest that the latter two factors may have been an important reason behind the improvement in existing home inventory and months supply.

Click on graph for larger image.

Click on graph for larger image.Here is a graph showing the months-of-supply and the year-over-year decline in inventory.

The two factors that Pandl identifies - homeowners pulling their homes off the market and prospective sellers not listing - can be grouped as 1) sellers waiting for a better market.

There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply (I've even included it is part of the "shadow inventory" in earlier posts). When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less inventory means less downward pressure on prices now.

There are other factors pushing down inventory and months-of-supply too:

2) There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.65 million by July (up from 2.31 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.7 to 7.0 months from the current 6.1 months.

The second graph shows nationwide inventory for existing homes and shows the seasonal pattern.

The second graph shows nationwide inventory for existing homes and shows the seasonal pattern. So some increase in inventory and months-of-supply is expected just based on seasonal factors.

3) The NAR reports active listing, and there a large number of "contingent short sales". This is another key point. The NAR reports active listings, although there is some variability across the country in what is considered active, most "contingent short sales" are not included. These are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory.

When we comparing inventory to 2005, we probably need to remember there were no "short sale contingent" listings in 2005 - so with the same inventory now, we probably shouldn't expect prices to increase by 16% in 2012! (just joking of course, but this is reminder that with just a little less listed inventory - and no distressed sales - prices increased 16% in 2005 according to Case-Shiller - and of course insanely loose underwriting too and a bubble attitude - This is a joke!! that I know some people won't understand).

And finally, in the areas I track, the number of "short sale contingent" listings is down sharply year-over-year.

4) The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and an increase in the level of inventory. Tom Lawler and I have both mentioned this before.

Jonathan Miller mentioned this yesterday at the Big Picture:

Declining foreclosure volume is one of the key reason inventory levels are dropping. The 1/3 decline in foreclosure volume in 2011 has resulted in a sharp drop in foreclosure inventory resulting in a sharp drop in total inventory. ... With a 2 million more homes expected to go into foreclosure over the next 2 years, a year long internal review of procedure after the 2010 “robo-signing” scandal and the 50 State AG settlement with the largest services/banks, distressed inventory is expected to rise sharply over the next several years.Although the number of completed foreclosures declined in 2011 from 1.07 million in 2010 to 843 thousand in 2011 (see here), the number of short sales increased - and increased significantly in Q4.

Also the number of lender REO declined sharply in 2011 (listings are a portion of REO owned, not all REO is listed immediately since it takes some time between acquisition and listing the property to make sure the property is in OK condition). So what would happen if completed foreclosures increased by 200 thousand units in 2012? Or by 400 thousand units? At most that would increase listed inventory by 200 to 400 thousand units and probably by much less since the lenders are currently selling REO faster than they are acquiring REO.

If we add 200 thousand most listed REO to the expected seasonal increase that would put listed inventory at 2.75 to 2.85 million in mid-summer - or about 7.2 to 7.5 months-of-supply at the current sales rate. That is higher than normal, but still well below the 9.3 months in July 2011, and the lowest level for July since 2006 (or even 2005). As I mentioned yesterday, Michelle Meyer and Ethan Harris at Merrill Lynch expect months-of-supply to reach 8 months this year (I think that is a little high).

The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year.

Misc: Tenth District manufacturing increases, FHFA House Prices decline slightly in Q4

by Calculated Risk on 2/23/2012 11:00:00 AM

• Kansas City Fed: Tenth District Manufacturing Activity Increased Further in February

The month-over-month composite index was 13 in February, up from 7 in January and -2 in December, and the highest since last June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased in both durable and nondurable goods-producing plants, with notable strength in machinery, fabricated metals, and aircraft production. Other month-over-month indexes were mixed in February but remained solid. The production and order backlog indexes moved higher, and the employment index edged up from 9 to 11. In contrast, the shipments and new order indexes fell slightly, and the new orders for exports index dropped from 10 to -7. Both inventory indexes increased.All of the regional manufacturing surveys released so far have indicated stronger expansion in February (Empire state, Philly, and Kansas City). The Richmond survey is scheduled for release on Feb 28th, and the Dallas Fed survey on Monday, Feb 27th.

...

Most indexes for future factory activity strengthened from the previous month. The future composite index climbed from 12 to 20, and the future production, shipments, and new orders indexes also rose. The future order backlog index jumped from 9 to 24, and the future employment index posted its highest level in a year.

• From the FHFA: U.S. House Prices Fell 0.1 Percent in Fourth Quarter 2011

U.S. house prices fell modestly in the fourth quarter of 2011 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The HPI, calculated using home sales price information from Fannie Mae and Freddie Mac-acquired mortgages, was 0.1 percent lower on a seasonally adjusted basis in the fourth quarter than in the third quarter. ... Over the past year, seasonally adjusted prices fell 2.4 percent from the fourth quarter of 2010 to the fourth quarter of 2011.The expanded-data index is closer to Case-Shiller and CoreLogic and includes non-GSE houses (and the worst mortgages). Note that real prices were down over 6% in 2011 according to the FHFA.

...

FHFA’s expanded-data house price index, a metric introduced in August that adds transactions information from county recorder offices and the Federal Housing Administration to the HPI data sample, fell 0.8 percent over the latest quarter.

...

While the national, purchase-only house price index fell 2.4 percent from the fourth quarter of 2010 to the fourth quarter of 2011, prices of other goods and services rose 4.0 percent over the same period. Accordingly, the inflation-adjusted price of homes fell approximately 6.2 percent over the latest year.

• From Freddie Mac: Average 30-Year Fixed-Rate Mortgage Up From All-Time Record Low

30-year fixed-rate mortgage (FRM) averaged 3.95 percent with an average 0.8 point for the week ending February 23, 2012, up from last week when it also averaged 3.87 percent. Last year at this time, the 30-year FRM averaged 4.95 percent.

Weekly Initial Unemployment Claims unchanged at 351,000

by Calculated Risk on 2/23/2012 08:30:00 AM

The DOL reports:

In the week ending February 18, the advance figure for seasonally adjusted initial claims was 351,000, unchanged from the previous week's revised figure of 351,000. The 4-week moving average was 359,000, a decrease of 7,000 from the previous week's revised average of 366,000.The previous week was revised up to 351,000 from 348,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 359,000.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down.

Note: Nomura analysts argue some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

Wednesday, February 22, 2012

Policy Status Update

by Calculated Risk on 2/22/2012 09:15:00 PM

Back in January I listed several policies and agreements that were expected soon. Here is a status update ...

• Extension of payroll tax cut and extended unemployment benefits: Signed into law today by President Obama.

• Mortgage Servicer Settlement. Announced, but still waiting for documents on the National Mortgage Settlement website.

• REO to Rental Program: A pilot program was announced on Feb 1st, from the FHFA: FHFA Announces Interested Investors May Pre-Qualify For REO Initiative. Reuters reported last week: Freddie Mac pitches REO plan to mortgage-bond investors

Freddie Mac has begun talks with institutional mortgage-bond investors interested in buying hundreds of distressed single-family residential properties across the US in order to convert them to rental units, according to people with knowledge of the discussions.And the NAR chief economist Lawrenece Yun said today:

Freddie Mac is making efforts to fast-track its own version of a proposed US foreclosure-rental program ...

"A government proposal to turn bank-owned properties into rentals on a large scale does not appear to be needed at this time.”It still isn't clear how soon this program will be in place (or the size).

• A surge in refinance activity in March from HARP. Still waiting ...

And on Europe:

• Greek debt deal: Announced, but there are several hurdles over the next couple of weeks.

• The second round of the ECB's 3 year Long Term Refinancing Operation (LTRO) will be held on February 29th.

FNC House Prices, Zillow's forecast for Case-Shiller

by Calculated Risk on 2/22/2012 04:52:00 PM

Note: The Case-Shiller House Price index for December will be released Tuesday, Feb 28th. CoreLogic has already reported that prices declined 1.4% in December (NSA, including foreclosures). It appears that the Case-Shiller indexes (both SA and NSA) were at new post-bubble lows in December.

• Today from FNC: December Residential Property Values Decline 0.7%

Based on the latest data on non-distressed home sales (existing and new homes) through December, FNC’s national RPI shows that single-family home prices fell in December to a seasonally unadjusted rate of 0.7%. ... As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts reflecting poor property conditions.The FNC index tables for four composite indexes and 30 cities are here.

...

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show month-to-month declines in December, ranging from -0.7% at the national level to -1.1% in the nation’s top 10 housing markets.

The indices’ year-to-year trends generally show the pace of price declines slowing. The national RPI indicates that December home prices declined at a seasonally adjusted rate of 3.5%, the smallest year-to-year declines since May 2010 when home prices rebounded under the federal homebuyer tax credits program. The year-to-year declines at the nation’s top housing markets, as indicated by the 30- and 10-MSA composites, have also decelerated to their slowest pace.

• Zillow Forecast: Zillow Forecast: December Case-Shiller Composite-20 Expected to Show 4.0% Decline from One Year Ago

Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will decline by 4.0 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will decline by 3.9 percent. The seasonally adjusted (SA) month-over-month change from November to December will be -0.5 percent and -0.6 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Case-Shiller will probably report house prices were at a new post-bubble lows in December for both the seasonally adjusted (SA) index and the Not Seasonally Adjusted (NSA) index.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (actual) | December 2010 | 156.04 | 155.91 | 142.39 | 142.32 |

| November 2011 | 151.9 | 150.89 | 138.49 | 137.52 | |

| Zillow December Forecast | YoY | -3.9% | -3.9% | -4.0% | -4.0% |

| MoM | -1.3% | -0.6% | -1.3% | -0.5% | |

| Zillow Forecasts1 | 150 | 149.9 | 136.7 | 136.7 | |

| Post Bubble Lows | 150.44 | 150.89 | 137.64 | 137.52 | |

| Date of Low | April 2009 | November 2011 | March 2011 | November 2011 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

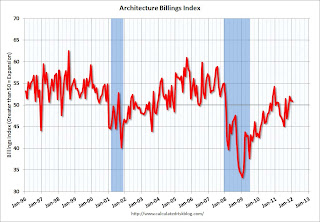

AIA: Architecture Billings Index indicated expansion in January

by Calculated Risk on 2/22/2012 01:48:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

On the heels of consecutive months of strengthening business conditions, the Architecture Billings Index (ABI) has now reached positive territory three months in a row. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 50.9, following a mark of 51.0 in December. This score reflects a slight increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.2, down just a notch from a reading of 61.5 the previous month.

“Even though we had a similar upturn in design billings in late 2010 and early 2011, this recent showing is encouraging because it is being reflected across most regions of the country and across the major construction sectors,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But because we still continue to hear about struggling firms and some continued uncertainty in the market, we expect overall economic improvements in the design and construction sector to be modest in the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 2/22/2012 11:54:00 AM

First a comment from Michelle Meyer and Ethan Harris at Merrill Lynch:

One of the most encouraging aspects of the report was the continued drop in inventory. The number of homes on the market for sale fell further in January after plunging 11.5% in December. This has left inventory almost 21% below the level last January. Combined with the recent gain in home sales, months supply has tumbled to 6.1 months, the lowest since April 2006. However, we expect this to be a temporary cyclical low. Part of the drop in inventory reflects delays in the foreclosure process which has slowed the flow of distressed properties into the market. We think the foreclosure process will accelerate, which will speed up the flow of distressed inventory. We expect supply to edge back to 8 months this year.The NAR reported inventory fell to 2.31 million in January. This is down 20.6% from January 2011, and this is about 8% above the inventory level in January 2005 (mid-2005 was when inventory started increasing sharply). This decline in inventory was a significant story in 2011.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.This year (dark red for January) inventory is at the lowest level for a January since 2005. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

Part of the reason inventory has fallen is because there are fewer foreclosures listed for sale. Merrill Lynch analysts think supply will edge back up to 8 months-of-supply as the lenders increase foreclosure activity.

There is also a seasonal pattern. Inventory usually starts increasing in February and March, and peaks in July and August. The seasonal increase in inventory will be something to watch this spring and summer, but the Merrill forecast would mean that inventory increases to over 3 million units this summer (assuming sales at the current rate). I don't think we will see inventory that high.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are slightly above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

Sales NSA (red column) are slightly above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales were unchanged at 31 percent in January; they were 32 percent in January 2011. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 23 percent of homes in January, up from 21 percent in December; they were 23 percent in January 2011.

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

• Existing Home Sales graphs

Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

by Calculated Risk on 2/22/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Rise Again in January, Inventory Down

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3 percent to a seasonally adjusted annual rate of 4.57 million in January from a downwardly revised 4.38 million-unit pace in December and are 0.7 percent above a spike to 4.54 million in January 2011.

...

Total housing inventory at the end of January fell 0.4 percent to 2.31 million existing homes available for sale, which represents a 6.1-month supply at the current sales pace, down from a 6.4-month supply in December.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2012 (4.57 million SAAR) were 4.3% higher than last month, and were 0.7% above the January 2011 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.31 million in January from 2.32 million in December. This is the lowest level of inventory since March 2005.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.Months of supply decreased to 6.1 months in January, down from 6.4 months in December.

MBA: Purchase Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/22/2012 08:21:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 4.8 percent from the previous week. The seasonally adjusted Purchase Index decreased 2.9 percent from one week earlier.The purchase index is still moving sideways at a very low level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.09 percent from 4.08 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)increased to 4.32 percent from 4.30 percent ...