by Calculated Risk on 9/24/2011 08:12:00 AM

Saturday, September 24, 2011

Summary for Week Ending Sept 23rd

The top story of the week was the Fed’s decision “to extend the average maturity of its holdings of securities”, and “reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities”. These measures are intended to reduce longer term interest rates and probably spur another round of mortgage refinancing. For a discussion of the impact, see Jim Hamilton’s Effects of operation twist

The Fed definitely scared investors by adding the word “significant” to their description of downside risks. The August phrase "downside risks to the economic outlook have increased" was changed to "there are significant downside risks to the economic outlook, including strains in global financial markets." (emphasis added). As Tim Duy noted: “The downside risks are now ‘significant’, and we can thank the Europeans for that.”

And once again the European financial crisis was on the front pages. And once again the story seemed to change day-to-day. Early in the week there were reports of good progress in talks with Greece, and later in the week there were less optimistic reports.

In the U.S., talk of a possible double-dip recession continue to grow, however the data released last week still indicated sluggish growth. Housing starts were off a little in August, but are mostly moving sideways. The Architecture Billings Index was positive for the first time in five months. Existing home sales were up in August, although sales will probably decline in September. And weekly initial unemployment claims are still elevated, but declined slightly.

Here is a summary in graphs:

• Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

The NAR reported: August Existing-Home Sales Rise Despite Headwinds, Up Strongly from a Year Ago

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2011 (5.03 million SAAR) were 7.7% higher than last month, and were 18.6% above the August 2010 rate (depressed in Aug 2010 following expiration of tax credit).

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.1% year-over-year in August from August 2010. This is the seventh consecutive month with a YoY decrease in inventory.

Months of supply decreased to 8.5 months in August, down from 9.5 months in July. This is much higher than normal.

Months of supply decreased to 8.5 months in August, down from 9.5 months in July. This is much higher than normal.

Here is a graph of existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2011.

Sales NSA are above last August - of course sales declined sharply last year following the expiration of the tax credit in June 2010 - but sales are also above August 2008 and 2009 (pre-revision).

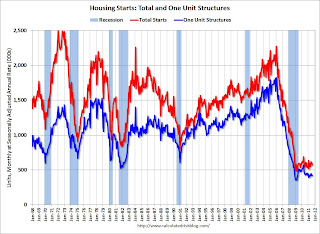

• Housing Starts declined in August

This graph shows total and single unit starts since 1968.

This graph shows total and single unit starts since 1968.

Total housing starts were at 571 thousand (SAAR) in August, down 5.0% from the revised July rate of 601 thousand (revised from 604).

Single-family starts declined 1.4% to 417 thousand in August.

There was a sharp decline in housing starts following the housing bubble, and housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.

Multi-family starts are increasing in 2011 - although from a very low level. This was below expectations of 592 thousand starts in August, but permits increased in August suggesting a slight increase for starts in September.

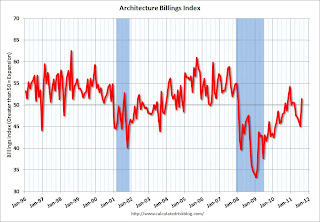

• AIA: Architecture Billings Index Turns Positive

From AIA: Architecture Billings Index Turns Positive after Four Straight Monthly Declines

From AIA: Architecture Billings Index Turns Positive after Four Straight Monthly Declines

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index increased to 51.4 in August from 45.1 in July. Anything above 50 indicates expansion in demand for architects' services.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent contraction suggests further declines in CRE investment in early 2012, but possibly flattening out in 9 to 12 months (just one month's data).

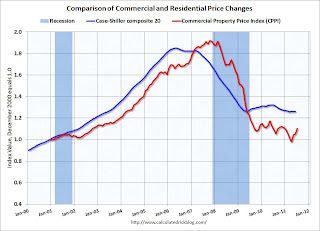

• Moody's: Commercial Real Estate Prices increased in July

From Bloomberg: Commercial Real Estate Prices in U.S. Increased 5% in July, Moody’s Says

From Bloomberg: Commercial Real Estate Prices in U.S. Increased 5% in July, Moody’s Says

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 1.2% from a year ago and down about 42% from the peak in 2007. Some of this increase was probably seasonal - also this index is very volatile because there are relatively few transactions. Also, this report was for July, and the index will probably be weaker in August after the debt ceiling debate and the renewed fears about Europe.

• Weekly Initial Unemployment Claims decline slightly to 423,000

The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

The DOL reported:

The DOL reported:

"In the week ending September 17, the advance figure for seasonally adjusted initial claims was 423,000, a decrease of 9,000 from the previous week's revised figure of 432,000. The 4-week moving average was 421,000, an increase of 500 from the previous week's revised average of 420,500."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 421,000.

The 4-week average has been increasing recently and this is the highest level since early July.

• Residential Remodeling Index at new high in July

The BuildFax Residential Remodeling Index was at 130.4 in July, up from 129.5 in June. This is based on the number of properties pulling residential construction permits in a given month.

The BuildFax Residential Remodeling Index was at 130.4 in July, up from 129.5 in June. This is based on the number of properties pulling residential construction permits in a given month.

This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Even though new home construction is still moving sideways, it appears that two other components of residential investment will increase in 2011: multi-family construction and home improvement.

• Other Economic Stories ...

• FOMC Statement: Extend Maturities, Reinvest in agency mortgage-backed securities

• Fed Study: Lack of Home equity and underwriting changes limited Refinancing in 2010

• From Freddie Mac: Fixed-Rate Mortgages Hold Steady, Remain Near Record Lows

• From MarketWatch: August economic indicators signal weak growth

• NAHB Builder Confidence index declines slightly in September

• Philly Fed State Coincident Indexes Decline in August

• DOT: Vehicle Miles Driven decreased 2.5% in July compared to July 2010

Friday, September 23, 2011

Mortgage Refinancing increasing as Mortgage Rates Fall

by Calculated Risk on 9/23/2011 11:37:00 PM

Earlier this week, in reaction to the Fed lowering long term rates, I asked: Will there be another Refinance Boom?. And reader Soylent Green is People (mortgage broker) commented:

"Refinance boom will be much larger than 2009 when the Feds remove the 125% LTV cap on HARP loans. There are so many whispers about it I can hardly hear myself think."From Nick Timiraos at the WSJ: Rate Drop Spurs Home Refinancing

The 30-year fixed-rate mortgage dipped below 4%, possibly triggering a refinancing boom for many of the same borrowers who already have taken advantage of rock-bottom interest rates.There are a few key points: 1) rates are now below 4% with 1 point, 2) but only certain borrowers can refinance at this rate - most borrowers can't because of tighter underwriting standards and lack of equity in their homes, and 3) there might be a large refinancing boom if HARP is expanded - although only for borrowers with loans guaranteed by Fannie or Freddie.

According to a survey by Credit Suisse on Thursday, lenders were offering an average rate of 3.91% on 30-year fixed-rate mortgages [with 1 point].

...

Obama administration officials and U.S. regulators are in talks with lenders about ways to revamp an existing White House refinancing initiative designed to help borrowers with little or no equity. The program is open to borrowers whose loans are backed by Fannie and Freddie, which guarantee about half of all outstanding home loans.

Bank Failure #73: Citizens Bank of Northern California, Nevada City, CA

by Calculated Risk on 9/23/2011 09:22:00 PM

From the FDIC: Tri Counties Bank, Chico, California, Assumes All of the Deposits of Citizens Bank of Northern California, Nevada City, California

As of June 30, 2011, Citizens Bank of Northern California had approximately $288.8 million in total assets and $253.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.2 million. ... Citizens Bank of Northern California is the 73rd FDIC-insured institution to fail in the nation this year, and the fourth in California. The last FDIC-insured institution closed in the state was San Luis Trust Bank, FSB, San Luis Obispo, on February 18, 2011.That was a long time between failures in California!

Bank Failure #72: Bank of the Commonwealth, Norfolk, VA

by Calculated Risk on 9/23/2011 06:25:00 PM

Common sense says follow them

Commonwealth should of.

by Soylent Green is People

From the FDIC: Southern Bank and Trust Company, Mount Olive, North Carolina, Assumes All of the Deposits of Bank of the Commonwealth, Norfolk, Virginia

As of June 30, 2011, Bank of the Commonwealth had approximately $985.1 million in total assets and $901.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $268.3 million. ... Bank of the Commonwealth is the 72nd FDIC-insured institution to fail in the nation this year, and the second in Virginia.It feels like Friday.

DOT: Vehicle Miles Driven decreased 2.5% in July compared to July 2010

by Calculated Risk on 9/23/2011 05:15:00 PM

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -2.5% (-6.7 billion vehicle miles) for July 2011 as compared with July 2010. Travel for the month is estimated to be 261.8 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2011 changed by -1.2% (-21.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 44 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. The current decline is not as a severe as in 2008, but this is significant.

The second graph shows the year-over-year change from the same month in the previous year. The current decline is not as a severe as in 2008, but this is significant.With the slowdown at the end of July and in August, miles driven will probably decline further in August.

Misc: Europe, Auto Sales

by Calculated Risk on 9/23/2011 03:25:00 PM

First on Europe ... it would really help to have a consistent message, or maybe Merkel and Schaeuble are just playing good cop, bad cop!

From the WSJ: New Doubts on Greece's Ability to Secure More Aid

New doubts about Greece's ability to secure further aid and avoid default emerged Friday ... German Finance Minister Wolfgang Schaeuble led the chorus, saying that Greece's creditors may need to revise the July 21 agreement on additional aid for the country, because conditions may have changed since the deal was reached.From Bloomberg: Europe May Speed Permanent Fund Enactment

... The week also saw increasing speculation that Greece may need to default or at least seek much more debt relief than was foreseen in July as a result of its repeated failures to meet targets for economic growth and deficit reduction.

"It would surprise me if the conditions for a disbursement of the next tranche of aid in September had changed, but not if the conditions for an additional program had changed," Mr. Schaeuble said at a news briefing on the sidelines of a series of international meetings in Washington. "However, I want to wait and see first."

European governments are exploring speeding the setup of a permanent rescue fund ... Drawing on paid-in capital, the fund will wield a 500 billion-euro ($677 billion) war chest that could help shield countries like Italy. It also includes provisions for sharing costs with bondholders for countries with “unsustainable” debt.And on auto sales ...

Senior finance officials next week will examine the cost advantages of creating the fund, known as the European Stability Mechanism, in July 2012, a year ahead of schedule, according to a staff paper prepared for the meetings and obtained by Bloomberg News.

From the LA Times: Car sales strengthen in September

The retail sales rate for new vehicles in the U.S. this month looks “much stronger than in August,” according to J.D. Power & Associates, which gathers sales data from about 8,900 dealers. That's about half of all the dealers selling cars nationally.From the WSJ: Ford Analyst Sees Strong Sales for Sector

“Coming off a solid Labor Day sale, retail sales exhibited unexpected strength in the second week of September, as the recovering inventory levels have helped to bring buyers back into the market,” said Jeff Schuster, executive director of global forecasting at J.D. Power.

The annual sales rate for all vehicles, including the retail segment of the market and what rental car companies, commercial customers and government agencies purchase, will hit 12.9 million this month ...

The annualized rate of sales in September is tracking at about 12.5 million cars and light trucks on a seasonally adjusted rate, the highest since April.Another sign of sluggish growth.

NY Fed's Dudley: Financial Stability and Economic Growth

by Calculated Risk on 9/23/2011 01:54:00 PM

"[W]hen [bubbles] are underway, [they] are typically enjoyable. As a result, regulatory interventions that temper booms normally are going to be unpopular."

From NY Fed President William Dudley: Financial Stability and Economic Growth. Dudley makes several interesting comments. I've long argued that the primary causes of the housing bubble were rapid innovation in the mortgage market combined with a lack of regulatory oversight.

Here are a few excerpts:

Turning first to the issue of financial booms and busts, empirical observation makes it clear that financial markets are inherently unstable. Throughout history we have seen numerous sizable booms and damaging busts. The notion that financial markets are dynamically unstable is also supported by controlled experiments conducted by behavioral economists.

...

Although it is impossible to attribute the instability of financial markets to any one single driving force, recent experience suggests that in many cases innovation plays an important role. ... innovations that initially create real value generate feedback mechanisms that often fuel the development of excessive expectations—a boom that eventually reverses when the basic belief system that sustained it is contradicted by events.

Such innovations can occur in the real economy—consider the Internet—or in the financial sector—think of subprime lending and structured finance products. Although the role of innovation has differed across various booms and busts, some important common elements are evident in many of these episodes.

Early on in the cycle, an innovation can lead to changes in fundamental valuations or the creation of new markets and financial products. Examples of this might include the technology boom that followed the creation of the Internet or the subprime lending and the associated structured finance innovations that supported the housing boom.

...

As market participants respond to the innovation, this may cause a surge in business activity. ... This surge in activity drives up profits and prices, which in turn sustains the boom. As part of this process, feedback mechanisms work to reinforce beliefs in the importance and sustainability of the innovation. ... In the case of the subprime lending boom, the provision of credit led to increased demand, which pushed up prices, and rising prices, in turn, held down credit losses. These feedback mechanisms reinforce belief in the sustainability of the boom, often extending the boom far beyond activity levels or valuations justified by how the innovation has changed the “fundamentals.”

The process often comes to an abrupt end, and generally does so when the basic belief system that underpinned the boom is contradicted by events. ... the U.S. housing boom was unsustainable because it was not possible to indefinitely keep relaxing credit underwriting standards to qualify new buyers to stoke demand. It was also unsustainable because the rise in prices often led to a supply response that limited the prospect of further price increases.

...

When sudden reversals occur, large costs are imposed on the real economy and the financial system, costs that are not fully internalized by the market participants that may have benefited from the boom.

...

[A] critical objective of prudential oversight and regulation should be to enhance the system so that financial transactions of all forms reflect an assessment of risk and return by both the borrower and the lender that is as accurate as possible, recognizing that we live in an inherently uncertain world. This means that our reform efforts should be aimed at strengthening the quality of information and the system of incentives governing risk-taking by both institutions and individuals. And on those occasions when regulators judge that a systematic understatement and mispricing of risk may be occurring, we need to find better and more effective ways to actively lean against those dynamics. This includes using the bully pulpit to point out why a particular boom is likely to prove unsustainable.

...

[R]egulation needs to be oriented to establishing standards that will be appropriate throughout the cycle—for both the boom period and the bust. For example, in terms of subprime mortgage underwriting, this would have included enforcing standards with respect to loan valuation, loan-to-value ratios, household income verification, and the quality of loan documentation.

...

[N]o matter how effectively we reform the financial system, it seems unlikely that we will ever be able to completely eliminate booms and busts. There will be problems in identifying the boom—distinguishing between what is sustainable and what is unsustainable. There also will be broader and even more subtle obstacles—booms, when they are underway, are typically enjoyable. As a result, regulatory interventions that temper booms normally are going to be unpopular. So in practice even activist regulators may struggle to act early enough and with sufficient force to arrest a boom before it becomes a bubble. This suggests that to make the financial system secure, we are going to have to do much more than just act to temper booms and busts.

Mortgage Settlement Update

by Calculated Risk on 9/23/2011 11:40:00 AM

Still talking ...

From the WaPo: Banks to meet with state, federal officials over foreclosure deal

State and federal officials on Friday were again to meet with representatives of the nation’s largest banks, trying to finalize a much-anticipated settlement over shoddy foreclosure practices ... the session in Washington would center around how broad a release from future liability banks should receive in exchange for agreeing to overhaul their mortgage servicing practices and paying billions of dollars in penalties.There are a large number of seriously delinquent mortgage loans in limbo waiting for this settlement. According to LPS, at the end of August there were about 1.87 million loans seriously delinquent and another 2.15 million loans in the foreclosure process. This is only down slightly from a year ago when 4.4 million loans were seriously delinquent or in-foreclosure. Once the settlement is reached, the pace of foreclosures will pick up sharply.

...

State and federal officials are hoping to extract about $20 billion in collective penalties from the banks involved, with Bank of America footing the largest share, followed by J.P. Morgan Chase and Wells Fargo. The final amount, however, likely will depend on the scope of the legal release.

The key issue is the release from future liabilities. Obviously the banks would like the release to be very broad, and the State AGs would like the release to be very narrow.

Morning Greece: Bank Downgrades, Default Rumor Denied, G20 Statement

by Calculated Risk on 9/23/2011 08:29:00 AM

Just another day ...

From the NY Times: With a Joint Statement, the Leading Economies Try to Reassure World Markets

The world’s major economies released an unexpected joint statement Thursday night ...From the WSJ: Moody's Downgrades 8 Greek Banks

“We are committed to supporting growth, implementing credible fiscal consolidation plans, and ensuring strong sustainable growth,” said the communiqué from the Group of 20 nations. “This will require a collective and bold action plan with everyone doing their part.”

Moody's Investors Service Inc. downgraded eight Greek banks by two notches Friday, citing expected losses due to their holdings of Greek government bonds, increasing concerns about the impact of a recession as well as fragile liquidity and funding positions.From Reuters: Greek default talk gathers pace

"The government faces significant solvency challenges and historical experience shows that small sovereign debt restructurings have often been followed by larger sovereign defaults," Moody's warned.

Greek Finance Minister Evangelos Venizelos was quoted by two newspapers as saying an orderly default with a 50 percent haircut for bondholders was one of three possible scenarios for resolving the heavily indebted euro zone nation's fiscal woes.And the denial: Greece Denies Reports on Default Scenarios

Given the history of the European financial crisis, denials are frequently taken as confirmation ...

The Greek 2 year yield was up to 67%. The Greek 1 year yield is at 134%.

The Portuguese 2 year yield is up to 17.6% (rising quickly) and the Irish 2 year yield was down to 9.05%.

Thursday, September 22, 2011

Fed Study: Lack of Home equity and underwriting changes limited Refinancing in 2010

by Calculated Risk on 9/22/2011 08:19:00 PM

Here is a new study released today of mortgage originations in 2010. From the Federal Reserve: The Mortgage Market in 2010: Highlights from the Data Reported under the Home Mortgage Disclosure Act

Back in 2003, about 35.5% of all homeowners refinanced. In 2010 only 10.7% of homeowners refinanced. On page 62, the study provides a table by FICO score, year of origination, and states with steep house price declines compared to all other states ("Steepest declines" consists of the five states with the steepest declines in house prices from 2006 to 2009: Arizona, California, Florida, Michigan, and Nevada; "other" consists of all remaining states.) Only a few borrowers with low FICO scores refinanced in 2010, and the rates for refinancing were lower in the five states than in the other states.

This is important - although we may see sub 4% conforming 30 year fixed rate mortgages soon, many borrowers will not be able to refinance.

I've excerpted a few key findings with highlights.

• Mortgage originations declined between 2009 and 2010 in the HMDA data from just under 9 million loans to fewer than 8 million loans. Most significant was the decline in the number of refinance loans despite historically low baseline mortgage interest rates throughout the year. Home-purchase loans also declined, but less so than the decline in refinance lending.

• We draw on data from a national credit bureau to highlight the importance of house price declines and changes in underwriting relative to earlier in the decade for refinance activity during 2010. We estimate that, in the absence of home equity problems and underwriting changes, roughly 2.3 million first-lien owner-occupant refinance loans would have been made during 2010 on top of the 4.5 million such loans that were actually originated.

• A sharp drop in home-purchase lending activity occurred in the middle of 2010, right alongside the June closing deadline (although the deadline was retroactively extended to September). The ending of this program during 2010 may help explain the decline in the incidence of home-purchase lending to lower-income borrowers between the first and second halves of the year.

• Home-purchase lending in highly distressed census tracts identified by the Neighborhood Stabilization Program (NSP) was 75 percent lower in 2010 than it had been in these same tracts in 2005. This decline was notably larger than that experienced in other tracts, and appears to primarily reflect a much sharper decrease in lending to higher-income borrowers in the highly distressed neighborhoods.

• National single-family home loan limits on both FHA loans and Freddie Mac and Fannie Mae purchases are scheduled to fall on October 1, 2011. Analysis of the 2010 HMDA data suggests that the number of loans affected by these limit changes is likely to be small. For example, about 1.3 percent of both the 2010 home-purchase and refinance loans fell into a size range affected by the proposed limit changes for Freddie Mac and Fannie Mae. Although the affected number of loans is small relative to the total number of loans, the analysis also shows that the number is large relative to the current jumbo loan market. How easily the private market would be able to absorb this potentially large increase in the market for jumbo loans is unclear.