by Calculated Risk on 6/24/2011 05:31:00 PM

Friday, June 24, 2011

NY Times: Overbuilding in Spain

Oh my ...

From the NY Times: Overbuilding in Spain Leaves Many White Elephants

Last March, local officials inaugurated a brand new airport in Castellón, a small city on Spain’s Mediterranean coast. They are still waiting for the first scheduled flight.That made me laugh ...

Castellón Airport, built at a cost of €150 million, or $213 million, is not the only white elephant that now dots Spain’s infrastructure landscape. ... Across the country, nearly empty toll roads are struggling to turn a profit. Other projects are surviving only with continued public financing ...This sounds like a classic bubble attitude: "Build it and they will come". Just a reminder that during a bubble, every project seems to make sense ... on paper.

Hotels: Occupancy Rate increased 3.7 percent compared to same week in 2010

by Calculated Risk on 6/24/2011 01:55:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: STR: Luxury segment leads weekly increases

Overall, the U.S. hotel industry’s occupancy rose 3.7% to 69.2%, ADR increased 3.3% to US$101.73, and RevPAR finished the week up 7.2% to US$70.37.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The summer leisure travel season is now starting, and the occupancy rate will increase over the next few of months. Right now the occupancy rate is tracking closer to 2008 than to 2010 - and well above 2009.

Even though the occupancy rate has mostly recovered back to 2008 levels, ADR and RevPAR are below the pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

By request, here are links to the posts and graph for May Home Sales:

• New Home Sales in May at 319 Thousand SAAR

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Graph Galleries: New Home sales and Existing Home sales

FHA sells record number of REO in May, Freddie Mac Serious Delinquency Rate declines

by Calculated Risk on 6/24/2011 11:27:00 AM

A couple of updates ...

• FHA Sells record number of REO (Real Estate Owned) in May.

In Q1, Fannie and Freddie were foreclosing at record levels - and selling REO even faster - so their REO inventory actually declined. However, the FHA was apparently having REO inventory problems and the FHA's REO inventory increased in Q1.

It now appears the FHA REO problem has been solved. The FHA sold a record number of REO in April, and even more in May.

According to data from HUD (ht Keith Jurow), the FHA acquired 6,727 REO in May and sold a record 12,671 properties. The FHA REO inventory has declined from 69,9581 at the end of Q1 2011, to 60,587 at the end of May 2011. It appears REO at the F's will decline again in Q2.

1REO for March was revised up slightly.

• Freddie Mac reported that the Single-Family serious delinquency rate decreased to 3.53% in May from 3.57% in April. This is down from 4.06% in May 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

The normal serious delinquency rate is under 1%, so this is still very high, but at least it is declining. (I'll post a graph when Fannie release their monthly delinquency report).

Note: These are loans that are "three monthly payments or more past due or in foreclosure".

Q1 real GDP growth revised up to 1.9%, Durable-goods orders up 1.9%

by Calculated Risk on 6/24/2011 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2011 (Third Estimate). This small upward revision, compared to the 2nd estimate, was because of a slight increase in Net exports, and a larger contribution from the change in private inventories - partially offset by a larger decrease in state and local government spending.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders May 2011

New orders for manufactured durable goods in May increased $3.6 billion or 1.9 percent to $195.6 billion, the U.S. Census Bureau announced today. This increase, up two of the last three months, followed a 2.7 percent April decrease. Excluding transportation, new orders increased 0.6 percent. Excluding defense, new orders increased 1.9 percent.This was above the consensus of a 1.6 percent increase.

Thursday, June 23, 2011

Greece Update and European Bond and CDS Spreads

by Calculated Risk on 6/23/2011 07:57:00 PM

First from the WSJ: EU Stops Greek Backtracking

European Union leaders fended off an effort by Greece to water down an austerity and privatization package that is the price for new aid, and EU President Herman Van Rompuy said they were nearing approval on a new rescue program to take Athens until the end of 2014.More austerity ...

...

"We have a deal after the Greek government agreed to more spending cuts and some higher taxes," said the [Greek] official.

And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released yesterday (graph as of June 22nd).

From the Atlanta Fed:

Since the April FOMC meeting, the 10-year Greece-to-German bond spread has widened by nearly 400 basis points (bps) through June 22. The spreads for Ireland and Portugal have soared by 157 bps and 199 bps, respectively, over the same period.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The spreads for Greece, Ireland and Portugal are all near record highs. The spreads for both Ireland and Portugal are about as high as Greece a couple of months ago!

Spreads for Spain and Italy have increased recently, but are still much lower than for Greece, Ireland and Portugal.

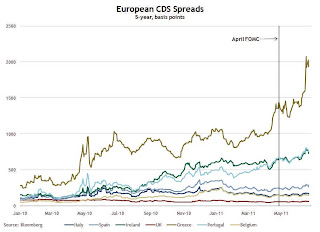

The second graph shows the Credit Default Swap (CDS) spreads:

From the Atlanta Fed:

From the Atlanta Fed: The CDS spread on Greek debt has widened about 500 basis points (bps) since the April FOMC meeting, while those on Portuguese and Irish debt continue to be high.The Greek 2 year yield was up to 28.6% today. The ten year yield was up to 16.9%.

Misc: Release of Oil Reserves, Greek Agreement, another House Price index shows increase

by Calculated Risk on 6/23/2011 04:10:00 PM

• The big story of the day was the announcement of the release of oil from reserves. From the WSJ: U.S., IEA to Release Oil from Reserves

[T]he International Energy Agency said its members will release 60 million barrels of crude from emergency stocks, half from the U.S. strategic reserve, to offset production lost to the unrest in Libya, only the third time in its history that the IEA has intervened in this way.• From CNBC: Greece Agrees on Austerity Plan With EU, IMF: Report

Greece won the consent of a team of EU-IMF inspectors for its new five-year austerity plan after committing to an additional round of tax rises and spending cuts, both Reuters and Dow Jones reported Thursday.• And on house prices from Radar Logic:

The 25-MSA RPX Composite price increased two percent month over month ... Nevertheless, the change in the RPX Composite from January to April was negative for only the third time in the last ten yearsThe Radar Logic index is based on public records of all closed housing transactions nationally for the month of April, expressed as a price per square foot (not a repeat sales index). This is another index showing a bounce in April.

Radar Logic has a pretty good track record of predicting Case-Shiller house prices, so this prediction was especially interesting:

Last month, we predicted that the S&P/Case-Shiller 10-City composite for March 2011 would be about 152 and the 20-City composite would be roughly 138. In fact, the 10-City composite was 151.66 and the 20-City composite was 138.16.This is for the Not Seasonally Adjusted (NSA) Case-Shiller data - and usually April is seasonally a tough month for Case-Shiller (since it is an average of closed transactions in February, March and April). This would be the first increase in Case-Shiller NSA since last July, and the first increase seasonally adjusted (SA) since last June.

This month, we expect the April 2011 10-City composite index to be about 153 and the 20-City index to be roughly 140.

The Case-Shiller index will be released next Tuesday.

And on May Home Sales:

• New Home Sales in May at 319 Thousand SAAR

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Graph Galleries: New Home sales and Existing Home sales

Chicago Fed: Economic growth remained below average in May

by Calculated Risk on 6/23/2011 03:22:00 PM

No surprise (this is a composite index) ... from the Chicago Fed: Index shows economic growth remained below average in May

The index’s three-month moving average, CFNAI-MA3, declined to –0.19 in May from –0.15 in April, remaining negative for a second consecutive month and reaching its lowest level since November 2010. May’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. With regard to inflation, the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in May, but below trend.

Home Sales: Distressing Gap

by Calculated Risk on 6/23/2011 12:20:00 PM

The following graph shows existing home sales (left axis) and new home sales (right axis) through May. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009 and 2010. Even with these revisions, most of the "distressing gap" will remain.

Earlier on May Home Sales:

• New Home Sales in May at 319 Thousand SAAR

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Graph Galleries: New Home sales and Existing Home sales

New Home Sales in May at 319 Thousand SAAR

by Calculated Risk on 6/23/2011 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 319 thousand. This was down from a revised 326 thousand in April (revised from 323 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new one-family houses in May 2011 were at a seasonally adjusted annual rate of 319,000 ... This is 2.1 percent (±10.7%)* below the revised April rate of 326,000, but is 13.5 percent (±13.6%)* above the May 2010 estimate of 281,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.And a long term graph for New Home Months of Supply.

Months of supply decreased to 6.2 in May from 6.3 months in April. The all time record was 12.1 months of supply in January 2009. This is still higher than normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of May was 166,000. This represents a supply of 6.2 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale fell to 64,000 units in May. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2011 (red column), 30 thousand new homes were sold (NSA). The record low for May was 26 thousand in 2010 (following the expiration of the homebuyer tax credit) and now 2011. The high was 120 thousand in 2005.

Although above the consensus forecast of 305 thousand, this was just above the record low for May - and new home sales have averaged only 300 thousand SAAR since the expiration of the tax credit ... moving sideways at a very low level.

Weekly Initial Unemployment Claims increase to 429,000

by Calculated Risk on 6/23/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 18, the advance figure for seasonally adjusted initial claims was 429,000, an increase of 9,000 from the previous week's revised figure of 420,000. The 4-week moving average was 426,250, unchanged from the previous week's revised average of 426,250.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged this week at 426,250.

This is the 11th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January. This suggests the labor market weakness in May continued into June.