by Calculated Risk on 2/23/2011 07:50:00 AM

Wednesday, February 23, 2011

MBA: Mortgage Purchase Application activity increases

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 17.8 percent from the previous week. The seasonally adjusted Purchase Index increased 5.1 percent from one week earlier.

...

“Ongoing turmoil in the Middle East brought interest rates lower last week. Borrowers took advantage of these lower rates, bringing application activity back near levels from two weeks ago, following sharp declines last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.00 percent from 5.12 percent, with points increasing to 0.97 from 0.85 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Even with the slight increase in activity last week, the four-week moving average of the purchase index is still at 1997 levels - suggesting weak home sales through the first few months of 2011.

AIA: Architecture Billings Index shows no change in January

by Calculated Risk on 2/23/2011 12:01:00 AM

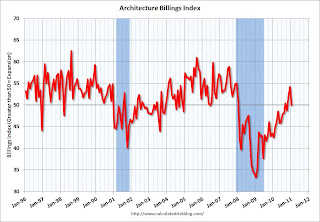

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From the American Institute of Architects: Billings at Architecture Firms Hold Steady in January

Following a healthy upturn in the fourth quarter, design billings at U.S. architecture firms remained flat in January. The national reading for the AIA’s Architecture Billings Index (ABI) was 50.0, meaning that on average billings in January exactly matched December levels.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so.

Tuesday, February 22, 2011

House Prices: Price-to-rent, Price-to-median Household Income

by Calculated Risk on 2/22/2011 08:35:00 PM

There is no perfect gauge of "normal" house prices. Changes in house prices depend on local supply and demand. However I've found the three most useful measures of house prices are 1) real house prices, 2) the house price-to-rent ratio, and 3) the house price-to-median household income ratio. These are just general guides, but they are still useful (these are national numbers, and it is better to use local numbers when possible).

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Here is a similar graph through December 2010 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

This ratio could decline another 10% to 15%, and possibly more if prices overshoot to the downside. The decline in the ratio will probably be a combination of house prices and increasing rents (recent reports suggest rents are now increasing).

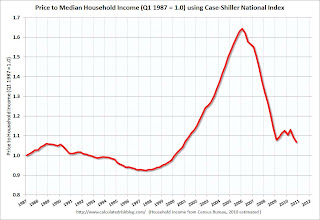

Price to Household Income

The second graph shows the Case Shiller National price index through Q4 2010 and the median household income (from the Census Bureau, Table H-8, 2010 estimated as increasing 0.5%).

The second graph shows the Case Shiller National price index through Q4 2010 and the median household income (from the Census Bureau, Table H-8, 2010 estimated as increasing 0.5%).

This ratio is still a little high, and could decline another 5% to 10% (and more if prices overshoot). The decline in the ratio could be a combination of falling house prices and an increase in the median household income.

Real House Prices

Earlier I posted real house prices using the Case-Shiller National Index, the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter). Note: some people use other inflation measures to adjust for real prices. Here is a repeat of that graph:

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to October 2000.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to October 2000.

It looks like real prices could fall another 5% to 10% (more with overshoot). However what everyone wants to know is the change in nominal prices (not inflation adjusted). If real prices eventually fall 10%, that doesn't mean nominal prices will fall that far (it depends on inflation).

My guess: Although Professor Shiller was quoted today saying house prices could fall another 15% to 25%, I'm sticking with my forecast that nominal national house prices - as measured by these repeat sales indexes - will decline another 5% to 10% from the October levels.

Earlier on house prices:

• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

FHA: REO inventory up 47% over last year

by Calculated Risk on 2/22/2011 05:25:00 PM

The FHA released the December Monthly Report today. The report shows the FHA REO inventory was at 60,739 at the end of December, up 9.5% from 55,488 in November, and up 47.5% from December 2009.

The combined REO inventory for the "Fs" (Fannie, Freddie and FHA) was at a record 293,171 at the end of Q3 2010. Fannie and Freddie will report for Q4 soon, and based on the increase at the FHA, REO inventory will be well over 300,000 at year end.

Here is the graph of Fannie, Freddie and FHA inventory over the last three years through Q3 2010.

Earlier on house prices:

• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

Misc: Shiller says house prices could fall 15% to 25%, Solid Manufacturing Survey, Libya Updates

by Calculated Risk on 2/22/2011 01:45:00 PM

House prices:

• From David Streitfeld at the NY Times: Home Prices Slid in December in Most U.S. Cities, Index Shows

Mr. Shiller, noting the unrest in the Middle East, a large backlog of foreclosed houses, the uncertain future of the mortgage holding companies Fannie Mae and Freddie Mac, and proposals to reduce the mortgage tax deduction, saw “a substantial risk” of declines of “15 percent, 20 percent, 25 percent.”• Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

• Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

Other U.S. economic news:

• From the Richmond Fed: Manufacturing Activity Advanced at a Healthy Pace in February

In February, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — rose seven points to 25 from January's reading of 18. ... The manufacturing employment index added two points to end at 16, and the average workweek measure moved up three points to 20. Moreover, wage growth gained five points to 18. ... District manufacturers reported that raw materials prices increased at an average annual rate of 4.72 percentAll good news except prices.

• From MarketWatch: Consumer confidence jumps in February

The gauge for consumer confidence rose to 70.4 in February from 64.8 in January.Libya updates:

• From the NY Times: Chaos Grows in Libya as Strife in Tripoli Intensifies

Libya appeared to slip further into chaos on Tuesday, as Col. Muammar el-Qaddafi vowed “to fight to the last drop of blood” and clashes intensified between rebels and his loyalists in the capital, Tripoli. ... Witnesses described the streets of Tripoli as a war zone.• The Telegraph blog that is updated frequently: Libya protests: live

• From al Jazeera: Libya Live Blog

Real House Prices fall to 2000 Levels, Update on NAR Overstating Sales

by Calculated Risk on 2/22/2011 11:11:00 AM

First, the WSJ has a followup on the story I broke on the NAR overstating sales in the 2006 through 2010 period (My January posts are here, here and here). From Nick Timiraos: Home Sales Data Doubted

Several economists approached NAR late last year with questions about its modeling. NAR economists promised to study the issue during a December conference call that included economists from the Mortgage Bankers Association, Fannie Mae, Freddie Mac, the Federal Reserve, the Federal Housing Finance Agency and CoreLogic.The real key is the level of inventory and months-of-supply. Prices were boosted in 2009 and early 2010 by a combination of policies, including the housing tax credits, foreclosure moratoriums (reducing supply), and low mortgage rates. Prices are now falling again, and if the months-of-supply is substantially higher than originally thought (the NAR reported 8.1 months in December), then prices will probably fall further than many analysts expect.

... Even assuming a high share of all-cash sales, purchase-loan application data suggests that home sales have been overstated by 10% to 15%, said Jay Brinkmann, the MBA's chief economist.

"If they are off by this much, this consistently, it would be sending the wrong signal to the market," said Mr. Brinkmann.

This morning S&P/Case-Shiller released the monthly Home Price indexes for December (a three month average) and the Q4 National quarterly index.

The following graph shows the Case-Shiller National Index, the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter). Note: some people use other inflation measures to adjust for real prices.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to October 2000.

A few key points:

• The real price indexes are at post-bubble lows. The National index is at a post-bubble low in nominal terms too (not inflation adjusted), and is now back to Q1 2003 prices. Those who argued prices bottomed some time ago are already wrong - and prices are still falling.

• I don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• Prices will probably fall some more and my forecast is for a decline of 5% to 10% from the October 2010 levels for the national price indexes. However we need to watch inventory (and months-of-supply) closely over the next few months - and it doesn't help that the NAR data is questionable.

Case-Shiller: National Home Prices Are Close to the 2009Q1 Trough

by Calculated Risk on 2/22/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December (actually a 3 month average of October, November and December).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities), plus the Q4 quarterly national house price index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: National Home Prices Are Close to the 2009Q1 Trough

Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices ... show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010. The National Index is down 4.1% versus the fourth quarter of 2009, which is the lowest annual growth rate since the third quarter of 2009, when prices were falling at an 8.6% annual rate. As of December 2010, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to December 2009.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.2% from the peak, and down 0.4% in December(SA). The Composite 10 is still 2.4% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.2% from the peak, and down 0.4% in December (SA). The Composite 20 is only 0.8% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low in January.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 1.2% compared to December 2009.

The Composite 20 SA is down 2.4% compared to December 2009.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 7 of the 20 Case-Shiller cities in December seasonally adjusted.

Prices increased (SA) in only 7 of the 20 Case-Shiller cities in December seasonally adjusted. Prices in Las Vegas are off 58% from the peak, and prices in Dallas only off 8% from the peak.

From S&P:

Eleven MSAs posted new index level lows in December 2010, since their 2006/2007 peaks. These cities are Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa. Nine of these cities had also posted lows with November’s report as well. New York and Phoenix are the new entrants to this group with December’s data.Prices are now falling just about everywhere, and more cities are hitting new post-bubble lows. Both composite indices are still slightly above the post-bubble low, but the indexes will probably be at new lows in early 2011.

Survey: Sales of Distressed Homes increased in January

by Calculated Risk on 2/22/2011 08:22:00 AM

From Campbell/Inside Mortgage Finance HousingPulse: HousingPulse Distressed Property Index Hits 49.6% in January

Perhaps the biggest news in the January data was a sharp rise in the HousingPulse Distressed Property Index or DPI, a key indicator of the health of the housing market. The DPI, or share of total transactions involving distressed properties, climbed from 47.2% in December to 49.6% in January. The increase was a continuation of a trend as the DPI registered just 44.5% back in November.This fits with other recent reports suggesting the percent of distressed sales was very high in January. The Case-Shiller house price data, to be released this morning, will be for last year (October, November and December) - and this survey suggests the repeat transaction house price indexes will show further weakness in 2011.

...

Already, in the key state of California, distressed property transactions account for 66% of the market. In Florida, distressed property transactions account for 63% of the market. And in the combined area of Arizona and Nevada, distressed property transactions are a stunning 72% of home sales.

...

The increase in distressed properties, combined with a reduction in first-time homebuyers, is causing downward pricing pressure to build in the market, especially for the categories of damaged REO and move-in ready REO.

Monday, February 21, 2011

$100 Oil

by Calculated Risk on 2/21/2011 07:38:00 PM

• From Reuters: Brent Hits 2-1/2 Year High on Libya Export Concerns

Clashes in oil producer Libya sent benchmark Brent crude to 2-1/2-year highs on Monday above $105 a barrel on fears that supplies to Western countries could be disrupted, while U.S. prices rallied by more than $4.• From the WSJ: The Stealth Return of $100 Oil

The days of $100 oil are back—and not just in Europe, where the Brent crude benchmark vaulted past $108 a barrel on Monday.• From Gail the Actuary at the Oil Drum: Why are WTI and Brent Oil Prices so Different?

While U.S. prices haven't scaled such heights ... many U.S. oil refiners and consumers are finding their costs have already escalated.

We have all heard at least a partial explanation as to why West Texas Intermediate (WTI) and Brent prices are so far apart. We have been told that the Midwest is oversupplied because of all of the Canadian imports, and the crude oil cannot get down as far as the Gulf Coast, because while there is pipeline capacity to the Midwest, there isn’t adequate pipeline capacity to the Gulf Coast. I have done a little research and tried to add some more context and details. For example, the opening of two pipelines from Canada (one on April 1, 2010 and one on February 8, 2011) seems to be contributing to the problem, as is rising North Dakota oil production.• Some earlier analysis from Professor Hamilton at Econbrowser: Geopolitical unrest and world oil markets

There are two pipelines (Seaway – 430,000 barrels a day capacity and Capline – 1.2 million barrels a day capacity) bringing oil up from the Gulf to the Midwest. It is really the conflict between the oil coming up from the Gulf and the oil from the North that is leading to excessive crude oil supply for Midwest refineries and the resulting lower price for WTI crude oil at Cushing. Demand for output from the refineries remains high though, so prices for refined products remains high, even as prices for crude oil are low.

Note: U.S. Markets were closed today in observance of Presidents' Day. Here are the weekly schedule and summary:

• Summary for Week ending February 19th

• Schedule for Week of February 20th

When will the Fed raise rates?

by Calculated Risk on 2/21/2011 05:08:00 PM

Short answer: it is very unlikely that the Fed will increase the Fed funds rate this year. There are a series of steps the Fed will most likely take before raising rates1:

• First the Fed needs to complete the $600 billion “QE2” large-scale asset purchase program. This is currently scheduled to be completed at the end of June, however, to “promote a smooth transition in markets”, it is possible the Fed will decide to "gradually slow the pace" of the purchases like they did with QE1 (quoted text from QE1 related FOMC statements). If the program is extended and purchases tapered off (but the size remains at $600 billion), this will probably be announced at the conclusion of the two day FOMC meeting in late April and the program will probably then be completed in August.

• Next the Fed will end the reinvestment of maturing MBS and Treasury Securities. This could be concurrent with the end of QE2, or the Fed might wait a few more months before halting reinvestment.

• Then the Fed will need to remove or change the extended period FOMC statement:

“The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.”If we look back to the “considerable period” language in 2003, the FOMC last used the “considerable period” phrase in the December 9, 2003 statement, and the first rate increase was on June 30th, 2004 – just over 6 months later.

This suggests a timeline for the earliest Fed funds rate increase:

• End of QE2 in June (maybe tapered off into August).

• End of reinvestment 0 to 2 months later.

• Drop extended period language a couple months later

• Raise rates in early 2012.

That is probably the earliest the Fed will raise rates - and it could be later in 2012 or even later ...

1 A research note on these steps by Jan Hatzius at Goldman Sachs on Friday lead me to revisit this.