by Calculated Risk on 5/03/2010 10:00:00 AM

Monday, May 03, 2010

ISM Manufacturing Index Shows Expansion in April

PMI at 60.4% in April, up from 59.6% in March. Any reading above 50 shows expansion.

From the Institute for Supply Management: April 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in April for the ninth consecutive month, and the overall economy grew for the 12th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.This suggest the expansion in the manufacturing sector increased at a faster pace in April. Although slightly below expectations, this shows continued expansion in the manufacturing sector.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the ninth consecutive month during April. The rate of growth as indicated by the PMI is the fastest since June 2004 when the index hit 60.5 percent. Manufacturers continue to see extraordinary strength in new orders, as the New Orders Index has averaged 61.6 percent for the past 10 months. The signs for employment in the sector continue to improve as the Employment Index registered its fifth consecutive month of growth. Overall, the recovery in manufacturing continues quite strong, and the signs are positive for continued growth."

...

ISM's Employment Index registered 58.5 percent in April, which is 3.4 percentage points higher than the 55.1 percent reported in March. This is the fifth consecutive month of growth in manufacturing employment. An Employment Index above 49.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

March Personal Income up 0.3%, Spending Increases 0.6%

by Calculated Risk on 5/03/2010 08:33:00 AM

The BEA released Q1 data on Friday, and here is the March data from the BEA: Personal Income and Outlays, March 2010

Personal income increased $36.0 billion ... Personal consumption expenditures (PCE) increased $58.6 billion, or 0.6 percent.Once again spending increased much faster than income ... meaning the saving rate declined again.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in March, the same increase as in February.

...

Personal saving -- DPI less personal outlays -- was $304.0 billion in March, compared with $332.2 billion in February. Personal saving as a percentage of disposable personal income was 2.7 percent in March, compared with 3.0 percent in February.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the March Personal Income report. The saving rate fell to 2.7% in March.

I still expect the saving rate to rise over the next couple of years slowing the growth in PCE.

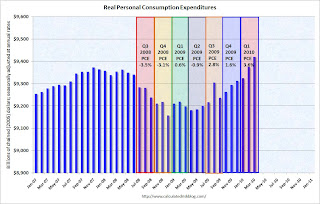

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The increase in PCE in March was strong and PCE increased 3.6% SAAR in Q1 2010. This increase in spending was driven by less saving and transfer payments.

The National Bureau of Economic Research (NBER) uses several measures to determine if the economy is in recession. One of the measures is real personal income less transfer payments (see NBER memo). This was flat in March at $9,039.4 billion (SAAR) compared to 9,037.5 billion in February, and is barely above the low of September 2009 ($9,000 billion).

This graph shows real personal income less transfer payments since 1969.

This graph shows real personal income less transfer payments since 1969.This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

This is a solid report for PCE, but PCE growth is not sustainable without jobs and income growth.

Sunday, May 02, 2010

Greek Austerity: Can they do it?

by Calculated Risk on 5/02/2010 09:45:00 PM

Note: here is the weekly summary and a look ahead.

The bailout is official ...

From Bloomberg: Greece Gets $146 Billion Rescue on EU, IMF Austerity Package

From the NY Times: Greece Takes Its Bailout, but Doubts for the Region Persist

The austerity program is intended to reduce the deficit from 13.6% of GDP to 3% of GDP by 2012. This will be especially difficult because Greece is expected to be in a recession for most of that time (so GDP is shrinking).

Can it be done? It has been done before ...

From the IMF: The State of Public Finances Cross-Country Fiscal Monitor: November 2009 (ht JA)

The adjustment needed in many advanced economies will be difficult, but is not unprecedented. More than twenty advanced economies have achieved improvements in their structural primary balances of at least 5 percent of GDP at least once in the last four decades; ten of them have achieved improvements in excess of 10 percent of GDP in that period (Table 9). Of course, adjustment going forward will be more challenging than in some past episodes, because it will have to be undertaken in an environment of adverse demographics and potentially sluggish potential growth. Some past adjustment episodes in Europe also benefited from nominal exchange rate depreciation and the “carrot” of joining the euro, neither of which will apply in the future. The data also suggest that it has been hard for countries to maintain this adjustment: in most cases, the primary balance deteriorated in the period after consolidation ended. However, this may reflect in part the fact that as the debt ratio declines, smaller primary surpluses are required to stabilize it at its current level.Greece has done it before (as have several other countries), but this time they have to do it with 1) a shrinking economy, 2) poor demographics (aging population), and 3) no exchange rate depreciation. This will be a huge challenge.

Update to Fed Rent-to-House Price Graph

by Calculated Risk on 5/02/2010 06:00:00 PM

Last night I posted some excerpts from the just released 2004 FOMC transcripts showing there was some concern about a housing bubble in June 2004. A key graph, presented by Fed associate research director Stephen Oliner, showed the rent-to-price ratio through Q1 2004. Oliner used the OFHEO (now FHFA) house price index. Usually the invert is presented (price-to-rent).

Here is an update to that graph through Q4 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrow shows the rent-to-price ratio when Oliner warned that "even after you account for the fundamentals, there’s a part of the increase [in house prices] that is hard to explain".

Clearly the ratio was even more out of line with fundamentals in 2005.

But the OFHEO (now FHFA) price index is GSE mortgages only, and by far the worst loans were part of the Wall Street originate-to-distribute machine. Using the OFHEO house prices missed the worst loans. However the Case-Shiller index included these non-GSE transactions, so I added the blue line showing the rent-to-price ratio using the quarterly Case-Shiller National House Price index.

If the Fed had been paying attention to all house prices, the graph presented at the 2004 meeting would have been even more alarming. It was scary enough ...

Weekly Summary and a Look Ahead

by Calculated Risk on 5/02/2010 12:35:00 PM

The key economic report for the week will be the April Employment Report to be released on Friday.

On Monday the Personal Income and Outlays report for March will be released at 8:30 AM ET. This will also include the underlying details for the Q1 GDP report. At 10 AM ET, the ISM Manufacturing index for April will be released (expectations are for an increase to 61 from 59.6 in March) and Construction Spending for March (consensus is for another decline in spending).

Also on Monday, the automakers will report vehicle sales for April. Expectations are for a slight increase from the 11.75 million SAAR for light vehicles in March. The American Bankruptcy Institute will probably report personal bankruptcy filings for April too. This will probably show another "surge" in filings.

On Tuesday, the Census Bureau will release factory orders for March, and the NAR will release March Pending Home Sales at 10 AM (expect a tax credit related increase).

On Wednesday, the ADP employment report will be released (consensus is for an increase of 28K private sector jobs). This will probably be the first increase in the ADP employment report since the recession started. Also on Wednesday, the ISM non-manufacturing report for April will be released. Consensus is for an increase in the service sector.

On Thursday, the closely watched initial weekly unemployment claims will be released. Consensus is for a decline to 440K from 448K last week. Also the Q1 Productivity and Costs report will be released at 8:30 AM.

Also on Thursday, Fed Chairman Ben Bernanke will speak at 9:30 AM at the Chicago Federal Reserve Bank 46th Annual Conference on Bank Structure. There are some interesting topics being covered at the conference, including a discussion of The Future of the Housing GSEs.

And on Friday, the BLS will release the April Employment report at 8:30 AM. The consensus is for a gain of 200K in payroll jobs in April (about 100K from temporary census hiring), and for the unemployment rate to decline slightly to 9.6%. It will be important to remove the Census hiring to try to determine the underlying trend.

Also on Friday the Federal Reserve will release consumer credit for March (expectations are for another decline in credit), and of course the FDIC will probably have another busy Friday afternoon ...

The NMHC Apartment Tightness index for Q1 might be released with week. This is a leading indicator for apartment rents.

And a summary of last week:

From the BEA: Gross Domestic Product: First Quarter 2010. A couple of graphs ...

The first graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. Red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The key leading sector - residential investment - is lagging the recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

The second graph shows real personal income less transfer payments as a percent of the previous peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak.Unlike the recovery in GDP, real personal income less transfer payments has barely increased and is still 6.6% below the pre-recession level.

The peak of the stimulus spending is in Q2 2010 (right now), and then the stimulus spending starts to taper off in the 2nd half of 2010. So underlying demand better increase soon - and that means jobs and incomes going forward.

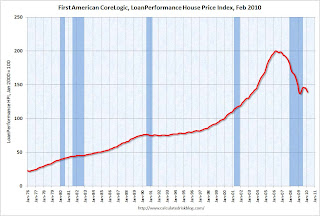

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.The index is up 0.3% over the last year and off 30.6% from the peak.

House prices are off 4.9% from the recent peak in August 2009 (although some of the decline is seasonal).

This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 30.0% from the peak, and up slightly in February (SA).

The Composite 20 index is off 29.3% from the peak, and down slightly in February (SA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.Prices decreased (SA) in 15 of the 20 Case-Shiller cities in February.

Prices in Las Vegas are off 55.7% from the peak, and prices in Dallas only off 6.0% from the peak.

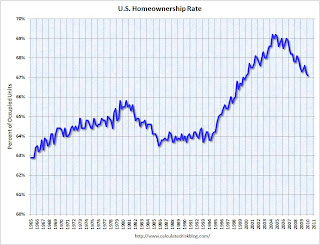

The Census Bureau reported the homeownership and vacancy rates for Q1 2010 this morning.

The homeownership rate declined to 67.1%. This is the lowest level since Q1 2000.

The homeownership rate declined to 67.1%. This is the lowest level since Q1 2000. Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

Best wishes to all.

Greece Reaches Bailout Deal

by Calculated Risk on 5/02/2010 09:01:00 AM

From the NY Times: Greece Reaches Agreement on Bailout

Prime Minister George Papandreou said Sunday that Greece had reached an agreement with the International Monetary Fund and European Union on a long-delayed rescue package that is expected to be as much as €120 billion.More details will be available later today. Greece might be in recession for several years ...

...

Finance Minister George Papaconstantinou set out some of the details of the austerity measures that are required for the bailout package, which were expected to be revealed in Brussels later Sunday. He said that Greece would make budget cuts of €30 billion, or $40 billion, to reduce the budget deficit to below 3 per cent by 2014.

...

Indicating that the steps would undermine economic growth, Mr. Papaconstantinou forecast a deeper than expected recession of 4 per cent for 2010, and 2.6 percent in 2011, before the economy returned to growth of 1.1 percent in 2012.

“We will be in recession for the next few years which means that we have to run faster to reduce the deficit,” he said.

More details from Bloomberg: Greece Accepts Terms of EU-Led Bailout, ‘Savage’ Cuts

Saturday, May 01, 2010

Fed Discussed Possible Housing Bubble in 2004

by Calculated Risk on 5/01/2010 08:53:00 PM

The Fed released the transcripts for the 2004 FOMC meeting this week. There definitely was some mention of a possible housing bubble, but little discussion.

From June 30, 2004:

This graph shows the Fed estimate of the rent-to-price ratio in June 2004. Usually this is drawn inverted (Price-to-rent). And this was after the Fed made some technical adjustments - otherwise, in the words of a Fed researcher, the graph would "have looked more alarming".

MR. FERGUSON [Roger Ferguson, Fed Vice Chairman in 2004]: The other question I have deals with chart 3, on housing prices. My question is about the footnote, which says that the rent–price ratio is adjusted for biases in the trends of both rents and prices. Is that where you pick up demographics and lifecycle factors? What are these biases in the trends, and how does one think about changing demographics and the relative attractiveness of owning a home versus renting? Give me some sense of whether or not the shape of the curve that you show here is likely to reverse, as you imply, or likely to stay relatively low.

MR. OLINER [Stephen Oliner, Fed associate research director]: The biases referred to in that footnote were really technical biases in the construction of the two measures shown here, the rent measure and the price measure. Had we not adjusted for them, the rent-to-price ratio would have been much lower at the end point. So it would have looked more alarming. In part we think the published data have some technical problems that need to be taken care of before this analysis can be done in a way that is meaningful. With regard to the question of owning versus renting, it depends to some extent on what is happening to interest rates because that changes that calculation at the margin. So it’s really important to plot any kind of valuation measure relative to an opportunity cost. Just showing the rent-to-price ratio I think would have been somewhat misleading; it’s really that gap that we think is the meaningful measure of valuation. And it looks somewhat rich, taking account of the fact that interest rates are relatively low and income growth has been relatively strong. I don’t want to leave the impression that we think there’s a huge housing bubble. We believe a lot of the rise in house prices is rooted in fundamentals. But even after you account for the fundamentals, there’s a part of the increase that is hard to explain.

And a couple of comments from the March 2004 meeting:

MR. GUYNN [Atlanta Fed President]: We keep looking to our directors and other contacts for indications of imbalances and pricing pressures that they might see developing, and we’ve begun to get hints of both. A number of folks are expressing growing concern about potential overbuilding and worrisome speculation in the real estate markets, especially in Florida. Entire condo projects and upscale residential lots are being pre-sold before any construction, with buyers freely admitting that they have no intention of occupying the units or building on the land but rather are counting on “flipping” the properties—selling them quickly at higher prices.

...

MR. KOHN [Fed Governor]: House prices are elevated relative to rents—and will look even more so when rates begin to rise—but are more likely to correct by rising less rapidly than by crashing. Eggs will get broken when rates begin to rise, but the capital in most intermediaries is high, and the system is resilient.

CR: Rampant speculation, an "alarming" price-to-rent chart, prices rising faster than explained by fundamentals, "eggs will be broken" - and this was in 2004. And Kohn was wrong - the system wasn't "resilient".

Investment Contributions to GDP: Leading and Lagging Sectors

by Calculated Risk on 5/01/2010 03:57:00 PM

By request, the following graph is an update to: The Investment Slump in Q2 2009

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) made a small positive contribution to GDP in the second half of 2009, but was a drag in Q1 2010. The rolling four quarter change is moving up, but as expected there has been no strong boost to GDP from RI.

Equipment and software investment has made a positive contribution to GDP for three straight quarters (it is coincident).

Nonresidential investment in structures continues to be a drag on the economy, and as usual the economy is recovering long before nonresidential investment in structures recovers.

The key leading sector - residential investment - is lagging the recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

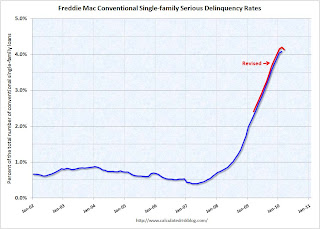

Freddie Mac: 90+ Day Delinquency Rate at 4.13% in March

by Calculated Risk on 5/01/2010 11:57:00 AM

Note: Freddie Mac reported the serious delinquency rate decreased in March from February, but that is only after the previous months were revised higher. Also there might be some distortion from the modification program - loans in trial mods were considered delinquent until the modifications were made permanent. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 4.13% in March 2010, down from 4.20% in February - and up from 2.41% in March 2009.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

The data from Fannie Mae will be released next week ...

96.5% of Mortgages Backed by Government entities in Q1

by Calculated Risk on 5/01/2010 08:42:00 AM

From Nick Timiraos at the WSJ: U.S. Role in Mortgage Market Grows Even Larger

Government-related entities backed 96.5% of all home loans during the first quarter, up from 90% in 2009, according to Inside Mortgage Finance.The following graph from San Francisco Fed Senior Economist John Krainer puts this in perspective (from Oct 2009): Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter.

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Without the government backed entities there would be almost no mortgage market. We are a long way from normal ...

...

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.