by Calculated Risk on 10/02/2009 03:09:00 PM

Friday, October 02, 2009

Bloomberg: Banks With 20% Unpaid Loans

Since it is Friday ...

From Bloomberg: Banks With 20% Unpaid Loans at 18-Year High Amid Recovery Doubt

The number of U.S. lenders that can’t collect on at least 20 percent of their loans hit an 18-year high, signaling that more bank failures and losses could slow an economic recovery.And here is a classic quote:

[There are] 26 firms with more than one-fifth of their loans 90 days overdue or not accruing interest as of June 30 -- a level of distress almost five times the national average ...

For banks with 20 percent of loans overdue, “either they’ve got a massive amount of capital, or the FDIC just hasn’t gotten around to them,” said Jeff Davis, an analyst with FTN Equity Capital Markets in Nashville.

“Everything was so positive for so long in this area, it came as a surprise when it stopped,” said John Medernach, Benchmark’s CEO ...Hey, Hoocoodanode? (Who could have known?)

“I stop and think of all the rich farmland that has been developed into subdivisions during the boom years,” Medernach said. “It makes you wonder what we’ve been doing.”

The article includes a table with all 62 banks. Here are the "leaders" according to Bloomberg:

| Company | Location | Nonaccrual Loans as % of Total |

|---|---|---|

| Community Bank of Lemont | Lemont, IL | 49.45 |

| Eastern Savings Bank FSB | Hunt Valley, MD | 48.01 |

| City Bank | Lynnwood, WA | 43.95 |

ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

by Calculated Risk on 10/02/2009 12:41:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Surge Past One Million During First Nine Months of 2009

Consumer bankruptcies totaled 1,046,449 filings through the first nine months of 2009 (Jan. 1-Sept. 30), the first time since the 2005 bankruptcy overhaul that filings have surged past the 1 million mark during the first three calendar quarters of a year, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The filings for the first three-quarters of 2009 were the highest total since the 1,350,360 consumer filings through the first nine months of 2005.

"Bankruptcy filings continue to climb as consumers look to shelter themselves from the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "The consumer filing total through the first nine months is consistent with our expectation that consumer bankruptcies will top 1.4 million in 2009."

The September 2009 consumer filing total reached 124,790, a 41 percent increase from the 88,663 consumer filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Employment-Population Ratio, 10% Unemployment, Part Time Workers

by Calculated Risk on 10/02/2009 11:26:00 AM

A few more graphs based on the (un)employment report ...

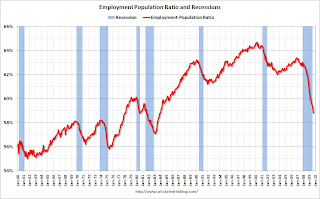

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure fell in September to 58.8%, the lowest level since the early '80s.

The Labor Force Participation Rate fell to 65.2% (the percentage of the working age population in the labor force). This is also the lowest since the mid-80s.

When the job market starts to recover, many of these people will reenter the workforce and look for employment - and that will keep the unemployment rate elevated for some time.

This second graph shows the quarterly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis. Although this data is from two different surveys, there is a clear relationship between the data. For a discussion of the two surveys, see Jobs and the Unemployment Rate.

The following data is for the last 40 years: 1969 through Q3 2009. The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The U-3 headline unemployment rate for September was reported at 9.8% (this was actually rounded down from 9.83%).

Notice the relationship is not linear. As the job market starts to recover, more people will participate in the labor force - and the Labor Force Participation Rate and the employment-population ratio will increase.

10% Unemployment

It is possible that the unemployment rate will hit 10% in October (the current unemployment rate is 9.83%, an increase of 0.17% from August).

With similar job losses in October as in September, or just more people participating in the work force - perhaps looking for one of the scarce holiday retail jobs - the unemployment rate could easily hit 10% this month. If not in October, then probably in November.

Part Time for Economic Reasons

From the BLS report:

In September, the number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 9.2 million. The number of such workers rose sharply throughout most of the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million. Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

Earlier employment posts today:

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 10/02/2009 09:30:00 AM

Note: earlier Employment post: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate. The earlier post includes a graph of percent job losses in a recession - the current recession is the worst post-WWII.

Stress Test Scenarios

The economy is performing better that the stress test baseline scenario for GDP and house prices, but worse than the "more adverse" stress test scenario for unemployment.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 is 9.63% (rounded to 9.6%), and will move higher in Q4. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.1 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although many workers are starting to exhaust their extended benefits too).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 5.4 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.5% of the civilian workforce. (note: records started in 1948)

Diffusion Index The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Both the "all industries" and "manufacturing" employment diffusion indices had been trending up - meaning job losses were becoming less widespread. However both turned down in September. This series is noisy month-to-month, but it still appears job losses are widespread across industries.

Ugly. Ugly. Ugly.

Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

by Calculated Risk on 10/02/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in September (-263,000), and the unemployment rate (9.8 percent) continued to trend up, the U.S. Bureau of Labor Statistics reported today. The largest job losses were in construction, manufacturing, retail trade, and government.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon. This is a very weak employment report - just not as bad as earlier this year. Much more to come ...

Note: The the preliminary benchmark payroll revision is minus 824,000 jobs. (This is the preliminary estimate of the annual revision - this is very large).