by Calculated Risk on 6/05/2009 04:02:00 PM

Friday, June 05, 2009

Miscellaneous: Market and Bank Failure

First the market graph from Doug:

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

And since it is BFF (bank failure friday), here is an update from Bloomberg: FDIC Closes Seized Silverton Bank After Failing to Sell Assets (ht lncolnpk, mark, ron and others)

The Federal Deposit Insurance Corp. will shut Georgia’s Silverton Bank, seized by regulators in May, after failing to find a buyer for the assets.Silverton was seized by regulators in early May.

A sale is “no longer feasible” and Silverton will be sold in parts, spokesman Andrew Gray said today in an e-mailed statement. The FDIC unsuccessfully sought a buyer before the bank was taken over by regulators May 1, he said.

Consumer Credit Declines at 7% Annual Rate in April

by Calculated Risk on 6/05/2009 03:11:00 PM

From MarketWatch: U.S. consumer debt falls by $15.7 billion

Consumer credit fell by $15.7 billion, or 7.4% at an annual rate, to $2.52 trillion. It was the second largest decline in outstanding debt on record, exceeded by March's $16.6 billion drop.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in consumer credit. Consumer credit is off 1.4% over the last 12 months - however, consumer credit has declined at a 6.6% rate over the last 6 months - a record pace.

Note: Consumer credit does not include real estate debt.

Employment-Population Ratio and Part Time Workers

by Calculated Risk on 6/05/2009 01:39:00 PM

A couple more graphs based on the (un)employment report ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

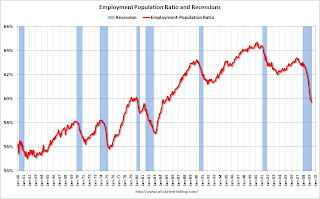

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is close to 50%.

This measure is at the lowest level since the early '80s and shows the weak recovery following the 2001 recession - and the current cliff diving!

From the BLS report:

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in May at 9.1 million. The number of such workers has risen by 4.4 million during the recession.Note: "This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs."

Not only has the unemployment rate risen sharply to 9.4%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.1 million.

Not only has the unemployment rate risen sharply to 9.4%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.1 million.Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record.

Earlier employment posts today:

Rising Rates: The Next Fed Meeting Will be Interesting

by Calculated Risk on 6/05/2009 12:04:00 PM

First from Reuters: Fed's Lockhart: Can't wait too long to tighten (ht Alan)

The Federal Reserve needs to be "anticipatory" and not wait too long to tighten monetary policy, Atlanta Fed President Dennis Lockhart said in an interview published on Friday. ... Lockhart is a voter on the Fed's policy-setting Federal Open Market Committee, which meets June 23-24.This is similar to the comments of Kansas Fed President Thomas Hoenig on Wednesday.

Yields are rising across the board, with the Ten Year yield at 3.84%.

This will push mortgage rates higher ... here is a scatter graph I posted last month showing the relationship between the Ten Year yield and 30 year mortgage rates.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, a Ten Year yield at 3.84% suggests a 30 year mortgage rate of around 5.75%.

Freddie Mac reported that 30 year mortgage rates were at 5.29% for the week ending June 4th, and the MBA reported rates at 5.25% for the week ending May 29th. These rates should jump again next week putting pressure on the Fed.

Unemployment Compared to Stress Test Scenarios, and Diffusion Index

by Calculated Risk on 6/05/2009 09:30:00 AM

Note: earlier Employment post: Employment Report: 345K Jobs Lost, 9.4% Unemployment Rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: in Q1 the unemployment rate was higher than the "more adverse" scenario. The Unemployment Rate in Q2 (only two months) is already higher than the "more adverse" scenario, and will probably rise further in June.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

In May, job losses continued to be widespread across major industry sectors. Steep job losses continued in manufacturing, while the rate of decline moderated in several industries, including construction, professional and business services, and retail trade.

BLS, April Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has recovered since then (32.7 in May), suggesting job losses are less widespread.

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index is still very low at 12, and manufacturing employment is still getting hit hard:

Steep job losses continued in manufacturing, while declines moderated in construction and several service-providing industries.

Employment Report: 345K Jobs Lost, 9.4% Unemployment Rate

by Calculated Risk on 6/05/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment fell by 345,000 in May, about half the average monthly decline for the prior 6 months, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The unemployment rate continued to rise, increasing from 8.9 to 9.4 percent.

Steep job losses continued in manufacturing, while declines moderated in construction and several service-providing industries.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 345,000 in May. The economy has lost almost 3.6 million jobs over the last 6 months, and over 6 million jobs during the 17 consecutive months of job losses.

The unemployment rate rose to 9.4 percent; the highest level since 1983.

Year over year employment is strongly negative (there were 5.4 million fewer Americans employed in May 2009 than in May 2008).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last 8 months (4.6 million jobs lost, red line cliff diving on the graph), and the current recession is now one of the worst recessions since WWII in percentage terms - although not in terms of the unemployment rate.

This is another weak employment report ... more soon.

Thursday, June 04, 2009

Mish Speaks at Google

by Calculated Risk on 6/04/2009 10:17:00 PM

Here is a video of Mish from Global Economic Analysis giving a talk at Google (most Q&A). Yes, I helped him get started ...

Update: To be clear, I disagree with Mish on many points. I didn't want to turn this into a debate ...

S&P on CMBS: Potential Downgrades from AAA to A

by Calculated Risk on 6/04/2009 07:26:00 PM

S&P put out a report this afternoon: The Potential Rating Impact Of Proposed Methodology Changes On U.S. CMBS. A few excerpts:

In our preliminary review of outstanding transactions, there were a number of recent-vintage transactions that required 'AAA' credit enhancement of more than 30% using our 'AAA' stress, which implies that super-senior classes within those deals would be downgraded.Note: This appears to be a change from the request for comments issued May 26th, but it really isn't. In the request for comment S&P stated: “approximately 25%, 60%, and 90% of the most senior tranches (by count) within the 2005, 2006, and 2007 vintages, respectively, may be downgraded.” However that included both shorter and longer weighted-average life classes. It is the Ten-year super dupers that will be hit the hardest.

...Transactions from the 2007 vintage are likely to experience the greatest impact if the criteria are adopted, as most tranches currently rated 'AAA' with 30% credit enhancement ("super dupers") would likely be downgraded. The downgraded classes would have a weighted average rating (WAR) of 'A'.

...Shorter weighted-average life 'AAA' classes benefit from structural protection and would likely perform better than longer-weighted average life 'AAA' classes. Of the A-2 (five-year) classes from 2005-2007, 25% of the 2005 deals (12 classes, 12 transactions), 10% of the 2006 deals (five classes, four transactions), and 25% of the 2007 deals (15 classes, 13 transactions) are potentially at risk for downgrade based on our analysis.

...

Ten-year super-duper (30% credit-enhanced) classes have a higher potential for downgrades than the shorter weighted-average life classes: 50% (2005), 85% (2006), and 95% (2007) of the super-duper 'AAA' tranches would likely be at risk.

NY Fed President on PPIP

by Calculated Risk on 6/04/2009 05:47:00 PM

From Bloomberg: Dudley’s TALF Comments Add Signs of a PPIP Stall (ht Brian, Bob_in_MA)

The Federal Reserve may not start lending against residential mortgage-backed securities under its Term Asset-Backed Securities Loan Facility, Federal Reserve Bank of New York President William Dudley indicated.From the Financial Times: Fed damps hopes on mortgage-backed securities

“We’re still in the process of assessing whether a legacy RMBS program is feasible, and if it were feasible, whether it would be significant enough to make a major impact,” Dudley said at a conference today ... His comments add to signs that Treasury Secretary Timothy Geithner’s Public-Private Investment Program to boost debt prices and rid banks of devalued assets to expand lending is stalling

The US Federal Reserve on Thursday damped expectations that it was preparing to prop up the market for distressed bubble-era securities backed by mortgages.

Hopes that the Fed would in the coming months start providing financing to investors seeking to buy residential mortgage-backed securities (RMBS) – many of which have lost their triple A credit ratings – have pushed prices on these assets higher in recent months.

William Dudley, president of the Federal Reserve Bank of New York, said on Thursday that a decision had not been made. “We have not made a final decision on whether it is doable and, if it is doable, whether it is worth the cost,” he said.

Record High Yield Curve, Rising Mortgage Rates

by Calculated Risk on 6/04/2009 03:23:00 PM

The difference in yields between Treasury two- and 10-year notes widened to a record again today ... The so-called yield curve steepened to 2.79 percentage points, surpassing the previous record of 2.75 percentage points set last week. The previous record was 2.74 on Aug. 13, 2003. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the difference between the ten- and two-year yields.

Usually a steep yield curve precedes a period of decent growth, but several analysts suggest the current ten year sell-off is due to concerns about increased Treasury issuance to finance the deficit. Whatever the reason, mortgage rates higher are moving higher, from Freddie Mac: Mortgage Rates Climb in Response to Recent Rise in Bond Yields

Freddie Mac (today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.29 percent with an average 0.7 point for the week ending June 4, 2009, up from last week when it averaged 4.91 percent. Last year at this time, the 30-year FRM averaged 6.09 percent.Update: From Bloomberg: Treasuries Fall as Claims Drop Suggests Worst of Slump Ending (ht speed)

...

"30-year fixed-rate mortgage rates caught up to the recent rise in long-term bond yields this week to reach a 25-week high," said Frank Nothaft, Freddie Mac vice president and chief economist."

Yields on 10-year notes approached a six-month high ... The difference between two- and 10-year notes steepened to a record 2.793 percentage points as the U.S. announced it would auction $30 billion in 10- and 30-year securities next week.

...

The increase in Treasury yields have also driven rates on mortgage-backed bonds higher, leading holders of the securities to sell U.S. debt used as a hedge to protect portfolios against rising interest rates. The same trade helped drive 10-year Treasury yields to 3.75 percent last week, the highest since November.

“There is mortgage selling going on,” Mizuho’s Combias said. “The volatility is causing all the big mortgage portfolios to have to hedge.”

Yields on Washington-based Fannie Mae’s current-coupon 30- year fixed-rate mortgage bonds rose 19 basis points to 4.72 percent, up from 3.94 percent on May 20.

Report: SEC to Charge Angelo Mozilo with Insider Trading

by Calculated Risk on 6/04/2009 03:09:00 PM

Headline from the WSJ: The SEC is expected to approve civil fraud charges against former Countrywide executives as soon as today.

From CNBC: SEC to Charge Ex-Countrywide CEO: Sources

The SEC will charge Angelo Mozilo, former chairman and CEO of Countrywide Financial, with insider trading, according to people familiar with the situation.

The SEC will also charge the company's former chief operating officer, David Sambol, and former financial chief, Eric Sieracki, with securities fraud for failing to disclose the firm's relaxed lending standards in its 2006 annual report.

The charges, which are expected to be announced by the SEC later today, will not be accompanied by any criminal indictments.

Hotel Occupancy Rate Falls to 51.6%

by Calculated Risk on 6/04/2009 12:24:00 PM

Note: some of the decline in occupancy rate is seasonal, and the rate should increase during the Summer months - especially since leisure travel has not declined as much as business travel and Summer has a higher mix of vacation travel (see: Hotels: "By the numbers" )

From HotelNewsNow.com: STR reports US performance for week ending 30 May 2009

In year-over-year measurements, the industry’s occupancy fell 10.2 percent to end the week at 51.6 percent. Average daily rate dropped 9.6 percent to finish the week at US$93.00. Revenue per available room [RevPAR] for the week decreased 18.9 percent to finish at US$47.96.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.4% from the same period in 2008.

The average daily rate is down 9.6%, so RevPAR is off 18.9% from the same week last year.

Report: Investors Seeking to Buy Assets of Corus

by Calculated Risk on 6/04/2009 09:53:00 AM

From Bloomberg: Corus Bankshares Said to Draw Interest From Colony, Related

... Colony Capital LLC and ... Related Cos. have indicated they may seek to buy the assets of Corus Bankshares Inc. ...From the Corus 10-Q in May:

Corus ... hired Bank of America Corp. to solicit capital this month or sell the entire firm to avoid being shuttered ... Investors may offer to buy the lender while it’s still in business or to purchase its assets out of receivership, said the people, who requested anonymity because the process isn’t public.

...

Federal regulators found that Corus was undercapitalized and may place the bank into receivership if it fails to satisfy capital requirements, according to the May filing. Its nonperforming assets more than quadrupled to $2.5 billion as of March 31, the filing showed. It had reserves of $338.6 million and reported a first-quarter loss of $285 million.

emphasis added

In its report dated April 6, 2009, our independent registered public accounting firm stated that our net losses raise substantial doubts about our ability to continue as a going concern. Our ability to continue as a going concern is in doubt as a result of the continued deterioration of our loan portfolio and is subject to our ability to service our existing loans in a manner that will return the Company to profitability or, in the alternative, identify and consummate a strategic transaction, including the potential sale of the Company.This is similar to BankUnited, except we don't have a date. Something to watch for tomorrow.

...

The Bank may be subject to a federal conservatorship or receivership if it cannot comply with the OCC Order, the Prompt Corrective Action requirements, or if its condition continues to deteriorate.

Unemployment Claims: 621 Thousand

by Calculated Risk on 6/04/2009 08:35:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 30, the advance figure for seasonally adjusted initial claims was 621,000, a decrease of 4,000 from the previous week's revised figure of 625,000. The 4-week moving average was 631,250, an increase of 4,000 from the previous week's revised average of 627,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 23 was 6,735,000, a decrease of 15,000 from the preceding week's revised level of 6,750,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims declined slightly to 6.73 million after increasing for 19 consecutive weeks. This is 5.0% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975. So this isn't a record as a percent of covered employment.

The four-week average of weekly unemployment claims increased this week by 4,000, and is now 27,500 below the peak of 7 weeks ago. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (over 621 thousand) is still very high, indicating significant weakness in the job market.

In other employment news, the Monster Employment Index declined slightly in May:

The Monster Employment Index edged two points lower in May, as U.S. online recruitment activity eased slightly following a seasonal rise in April. Year-over-year, the Index was down 29 percent, a slight improvement from the previous month, indicating the rate of slowdown in the labor market may have stabilized.

Wednesday, June 03, 2009

Daily Show: The BiG Mess

by Calculated Risk on 6/03/2009 10:08:00 PM

FDIC PPIP LLP DOA? Part II

by Calculated Risk on 6/03/2009 05:50:00 PM

From the FDIC: FDIC Statement on the Status of the Legacy Loans Program

The FDIC today formally announced that development of the Legacy Loans Program (LLP) will continue, but that a previously planned pilot sale of assets by open banks will be postponed. In making the announcement, Chairman Bair stated, "Banks have been able to raise capital without having to sell bad assets through the LLP, which reflects renewed investor confidence in our banking system. As a consequence, banks and their supervisors will take additional time to assess the magnitude and timing of troubled assets sales as part of our larger efforts to strengthen the banking sector."Yeah, they will be prepared to offer the program.

As a next step, the FDIC will test the funding mechanism contemplated by the LLP in a sale of receivership assets this summer. This funding mechanism draws upon concepts successfully employed by the Resolution Trust Corporation in the 1990s, which routinely assisted in the financing of asset sales through responsible use of leverage. The FDIC expects to solicit bids for this sale of receivership assets in July.

Chairman Bair added, "The FDIC will continue its work on the LLP and will be prepared to offer it in the future as an important tool to cleanse bank balance sheets and bolster their ability to support the credit needs of the economy."

Just more wasted letters ... MLEC!

Hotels: "By the numbers"

by Calculated Risk on 6/03/2009 03:39:00 PM

Note: Market graph at bottom of post.

Mark Lomanno, President of Smith Travel Research gave a presentation on hotel performance in New York. Stacey Higgins at HotelNewsNow has some details: NYU: By the numbers

When contrasting this downturn with others, one of the most important differences is that as demand has declined at historically low rates, supply is still increasing.Here are a couple of graphs from Lomanno's presentation:

...

Another noteworthy trend is the weakness of weekday performance, according to Lomanno.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the 12 month moving average for hotel room supply and demand.

As Lomanno noted, this is very unusual for supply to be increasing while demand is falling - and this is probably because of the huge surge in hotel construction in recent years (and these projects are just now being completed).

The second graph shows investment in lodging (based on data from the BEA) as a percent of GDP through Q1 2009.

The second graph shows investment in lodging (based on data from the BEA) as a percent of GDP through Q1 2009.The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.33% of GDP in Q3 2008 and is now declining sharply (0.28% in Q1 2009).

Notice that lodging investment continued to grow right into the recession - suggesting very loose lending for new hotel construction.

And the final chart - also from Lomanno's presentation - shows that weekday lodging (business travel) has fallen off much more than weekend lodging (leisure travel).

And the final chart - also from Lomanno's presentation - shows that weekday lodging (business travel) has fallen off much more than weekend lodging (leisure travel).For weekdays, occupancy is off 14.4% and RevPAR (revenue per available room) is off 21.4%.

This suggests there might be a little increase in occupancy later this year as businesses gain confidence.

| By popular demand ... Click on graph for larger image in new window. This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

Fed's Hoenig Calls for Rate Hikes

by Calculated Risk on 6/03/2009 02:40:00 PM

From Kansas Fed President Thomas Hoenig: An Economy at Risk: Tough Decisions Ahead. A few excerpts:

"While I am convinced the economic recovery we all want will develop, it will be slower and more fragile than we hope for."It is interesting that Hoenig believes growth will be sluggish for some time, and he is still advocating raising rates. This will not happen any time soon.

...

"I would direct you to an article by Martin Barnes, the managing editor of Bank Credit Analyst, published in May. In estimating the effect on consumption growth if the annual savings rate steadily increased from zero to 8 percent between now and the end of 2013, the article suggests that consumer spending would grow at an average rate of only 1.3 percent per year. This would be a significant reduction of consumption growth, the slowest since the 1930s."

...

"The markets won't be fooled by artificially low rates for long. Market participants realize that a period of high deficits and accommodative monetary policy are an invitation to increased inflationary pressure. I suspect we are experiencing the first signs of the markets' concerns in the rising rates and increased volatility in longer-term Treasury markets. I suggest strongly that we need to be alert to the markets' message and begin in earnest to bring monetary policy into better balance before inflation forces our hand."

Home ATM Cartoon

by Calculated Risk on 6/03/2009 12:54:00 PM

May ISM Non-Manufacturing Index Shows Slower Contraction

by Calculated Risk on 6/03/2009 11:01:00 AM

This was released earlier this morning ...

From the ISM: May 2009 Non-Manufacturing ISM Report On Business®

The NMI (Non-Manufacturing Index) registered 44 percent in May, 0.3 percentage point higher than the 43.7 percent registered in April, indicating contraction in the non-manufacturing sector for the eighth consecutive month, but at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased 2.8 percentage points to 42.4 percent. The New Orders Index decreased 2.6 percentage points to 44.4 percent, and the Employment Index increased 2 percentage points to 39 percent. The Prices Index increased 6.9 percentage points to 46.9 percent in May, indicating a slower decrease in prices from April.Still contracting, but at a slower pace.

...

Some respondents indicate that there are signs of stabilization, while others continue to have a negative outlook on the economy.