by Calculated Risk on 3/18/2009 11:08:00 PM

Wednesday, March 18, 2009

Sign of the Times: "Not Hiring" and Summary

| Sign of the Times. Click on photo for larger image in new window. Credit: Nades. This is on Mission Blvd in Pacific Beach, San Diego. |  |

The big news ... the Fed announced they have "decided to purchase up to $300 billion of longer-term Treasury securities over the next six months" and also buy more MBS. This is quantitative easing (printing money) ... and this should lead to lower mortgages rates and lower long term rates. I've seen forecasts of 30 year mortgage rates in the 4% to 4.5% range for conforming loans. This will have a some stimulus effect.

The Architecture Billings Index is still near a record low suggesting further weakness in non-residential construction investment later this year.

And here is some more on the two eventual bottoms for housing: the first will be single-family housing starts, new home sales, and residential investment, and the second will be for house prices.

And some futures:

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

2007 Data: Record Number of Babies Born in U.S.

by Calculated Risk on 3/18/2009 09:36:00 PM

Something a little different ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the CDC: Births: Preliminary Data for 2007

The preliminary estimate of births in 2007 rose 1 percent to 4,317,119, the highest number of births ever registered for the United States. The general fertility rate increased by 1 percent in 2007, to 69.5 births per 1,000 women aged 15–44 years, the highest level since 1990. Increases occurred within all race and Hispanic origin groups and for nearly all age groups.Although the chart only goes back to 1930, both the number of births, and the birth rate, declined precipitously in the late '20s as more and more families put off having children because of hard economic times (Times were tough for many families even before the stock market crash of 1929).

...

This number surpasses the peak of the postwar ‘‘baby boom,’’ in 1957 ...

The preliminary estimate of the total fertility rate (TFR) in 2007 was 2,122.5 births per 1,000 women, a 1 percent increase compared with the rate in 2006 (2,100.5, see Table 1). The TFR summarizes the potential impact of current fertility patterns on completed family size by estimating the average number of births that a hypothetical group of 1,000 women would have over their lifetimes, based on age-specific birth rates observed in the given year.

The U.S. TFR in 2007 marks the second consecutive year in which the rate has been above replacement. A replacement rate is the rate at which a given generation can exactly replace itself, generally considered to be 2,100 births per 1,000 women. The TFR had been below replacement from 1972 through 2005.

The original baby bust last throughout the '30s.

There is no evidence in this 2007 data of families putting off having children now. In fact the birth rate and total fertility rate were increasing in 2007.

Now we know who will pay off all that debt!

Lower Mortgage Rates as Economic Stimulus

by Calculated Risk on 3/18/2009 04:59:00 PM

David Greenlaw at Morgan Stanley makes an interesting point:

"The Fed’s announcement signals a clear intent to continue to drive mortgage rates lower and we expect them to meet this objective. ... In 2008, the average mortgage rate on the outstanding stock of loans was about 6.50%. So, if the Fed brings 30-yr fixed rate mortgages down to 4.50% and all homeowners are able refi, the aggregate permanent cash flow savings would be on the order of $200 billion per year."According to the BEA, the effective mortgage interest rate in 2008 was 6.235%.

David Greenlaw, Morgan Stanley, WSJ Real Time Economics March 18, 2009

If the Fed's actions drive mortgage rates to an effective rate of 4.5% on all outstanding mortgage debt that would be about $190 billion in stimulus (on an annual basis). However not all homebuyers will be eligible for a 4.5% interest rate mortgage. But even half that stimulus would be significant.

According to Housing Wire, we are already seeing a refinancing boom: Fannie Mae Refinancing Volume Jumps

Fannie Mae’s refinancing volume jumped to more than $41 billion in February, nearly three times the refinancing volume the company experienced during the month of January and the largest refinancing volume in nearly a year, the company said Wednesday.Just wait - the mortgage brokers will be really busy!

...

The Mortgage Bankers Association reported last week an 11.3 percent week-over-week surge in application volume –two-thirds of which were from homeowners who wanted to refinance.

More on Housing Bottoms

by Calculated Risk on 3/18/2009 03:23:00 PM

Yesterday I noted that housing starts might be nearing a bottom. This post led to a number of emails from readers stating that they believe prices will fall further. I agree.

There will almost certainly be two distinct bottoms for housing: the first will be single-family housing starts, new home sales, and residential investment, and the second will be for house prices.

These bottoms could happen years apart!

As I noted yesterday, it is way too early to try to call the bottom in prices. House prices will almost certainly fall for some time. My original prediction (a few years ago) was that real house prices would fall for 5 to 7 years, and we could start looking for a bottom in the 2010 to 2012 time frame for the bubble areas. That still seems reasonable to me. However some lower priced areas might be much closer to the bottom.

For the first bottom, we have several possible measure - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.  The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. Indicators like new home sales, housing starts and residential investment will bottom long before house prices.

Economists and analysts care about these housing indicators (starts, sales, RI) because they impact GDP and employment. However most people (homeowners, potential homebuyers) think 'house prices' when we talk about a housing bottom - so we have to be aware that there will be two different housing bottoms. And a bottom in starts doesn't imply a bottom in prices.

FOMC: Buy $300 Billion in Long Term Treasuries, More MBS

by Calculated Risk on 3/18/2009 02:05:00 PM

Information received since the Federal Open Market Committee met in January indicates that the economy continues to contract. Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending. Weaker sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories and fixed investment. U.S. exports have slumped as a number of major trading partners have also fallen into recession. Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months. The Federal Reserve has launched the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses and anticipates that the range of eligible collateral for this facility is likely to be expanded to include other financial assets. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of evolving financial and economic developments.

emphasis added

Charlie Rose: AIG and Meredith Whitney on Banks

by Calculated Risk on 3/18/2009 12:10:00 PM

Note: If embed doesn't work, the video is here.

From Transcript:

CHARLIE ROSE: Listen, you saw this early certainly in terms of the banks, and you got a lot of credit for that. Have we not seen the worst? Is the worst still to come, or have we passed some point of beginning to understand and just waiting for the plan to get us back on track?

MEREDITH WHITNEY: I really believe the longer we wait, the longer we head down this path -- well, the math is the worst is ahead of us. And...

CHARLIE ROSE: So the end of 2009 or beyond?

MEREDITH WHITNEY: At least the end of 2009. Look, you have credit continuing being pulled from the system, and until it stabilizes, there is nowhere to go but down. And from an unemployment perspective, no one is pricing in low, mid teens unemployment in any of their assumptions. So it is just a question of not if the banks need to raise capital, it’s when, and, you know, let’s get some capital back in the system by looking at who can provide it, like the local banks. We will go back to a time that was and not try to preserve a system that is and -- or was more recently and will never be again.

You are throwing good money down black holes ...

emphasis added

Architecture Billings Index Near Record Low

by Calculated Risk on 3/18/2009 09:14:00 AM

The American Institute of Architects reports: Architecture Billings Index Continues to Point to Difficult Conditions

A second headline reads: "No region or building sector immune from prolonged economic downturn" Click on graph for larger image in new window.

Click on graph for larger image in new window.

Following another historic low score in January, the Architecture Billings Index (ABI) was up two points in February. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI rating was 35.3, up from the 33.3 mark in January, but still pointing to a general lack of demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry score was 49.5.Note that historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending". The ABI fell off a cliff in early 2008 and that decline started showing up in non-residential construction spending in Q4.

“Despite a higher score than last month, we are likely to see light demand for new construction projects through much of the year,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “There is hope that the stimulus bill will result in more project activity, but that is also dependent on banks easing lending standards in the months ahead. Still, the improvement in the inquiries index does provide hope that some stalled projects will resurface in the near future.”

The ABI fell off a 2nd cliff in late 2008, and that will show up mid-2009.

Since the index is still well below 50 (anything below 50 means contraction in billings), this suggests non-residential investment in structures will decline all year (no surprise!).

CPI Increases 0.4% mostly due to gasoline

by Calculated Risk on 3/18/2009 08:50:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the CPI-U increased 0.4 percent in February after rising 0.3 percent in January. The energy index rose 3.3 percent in February following a 1.7 percent increase in January as the gasoline index rose 8.3 percent in February after a 6.0 percent increase in January. ... About two-thirds of the all items increase was due to the rise in the gasoline index.Core inflation increased 0.2 percent.

For some reason owners' equivalent rent increased even though rents are falling in most areas:

The indexes for rent and owners' equivalent rent both rose 0.1 percent in February after increasing 0.3 percent in January.This will probably lower the concern about deflation a little.

Tuesday, March 17, 2009

Jet Blue Pokes Fun at CEOs

by Calculated Risk on 3/17/2009 11:59:00 PM

The new Jet Blue ad campaign is pretty funny. You can see the three parts here. (ht Dave)

Here is part I:

Housing: Two Bottoms

by Calculated Risk on 3/17/2009 09:21:00 PM

Note: I've added a "ShareThis" button to the posts, and I'm now on Twitter.

In my previous post I discussed the question: Housing Starts: Is this the bottom?

We don't know the answer yet.

But some readers are confusing a bottom in housing starts with a bottom in pricing. It doesn't works that way!

There will be two distinct bottoms for housing:

1) First single-family housing starts and new home sales will bottom.

and then followed some time later ...

2) Prices for existing homes will bottom.

Just about every housing bust follows this pattern. The bottom in prices could be a year, or two, or more away. It is way too early to try to call the bottom in prices. House prices will almost certainly fall all year and probably next year too. Prices will continue to fall. Prices are not at the bottom.

Sorry for repeating myself.

Also, it is theoretically possible that single-family housing starts (off 80% from peak) and new home sales (off 78% from peak) could go to zero - but unlikely. Sometime this year housing starts and new home sales will probably bottom, but that doesn't indicate a bottom for house prices.

Housing Starts: Is this the Bottom?

by Calculated Risk on 3/17/2009 04:25:00 PM

Update: Please don't confuse a bottom in single family housing starts with a bottom in house prices! See next post: Housing: Two Bottoms.

The title to this post would have been laughable in 2008 or 2007, but as I noted in Looking for the Sun, there is a reasonable chance housing starts will bottom sometime this year - so I suppose it is not too early to start looking.

A few key points:

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the Census Bureau: "The seasonally adjusted estimate of new houses for sale at the end of January was 342,000. This represents a supply of 13.3 months at the current sales rate."

But the increase in Months of Supply has been driven by the denominator (sales), even though the numerator (inventory) has been falling steadily. note: Months of supply = inventory / sales.

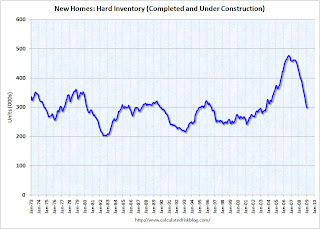

The second graph shows the level of hard inventory for new homes (completed plus under construction). With starts below sales, hard inventory has been falling for some time.

The second graph shows the level of hard inventory for new homes (completed plus under construction). With starts below sales, hard inventory has been falling for some time. Unless sales fall further, the months of supply should start to decline even with the current level of starts.

And this brings up a key point:

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows there were 65,000 single family starts, built for sale, in Q4 2008 and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders were selling more homes than they are starting – but not by much.

However starts have fallen much further in Q1 (almost 25% from Q4) although sales have fallen too (we only have January data for sales so far).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this isn’t perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last several quarters, starts have been below sales – and new home inventories have been falling - but it continues to be a race to the bottom between starts and sales.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last several quarters, starts have been below sales – and new home inventories have been falling - but it continues to be a race to the bottom between starts and sales. Of course, unless sales stabilize soon, starts might have to fall further.

Stock Market Update

by Calculated Risk on 3/17/2009 04:12:00 PM

Another up day with the NASDAQ up over 4%, and the S&P up 3.2%. The S&P 500 is now up 15% from the closing lows. Here are a couple of graphs: Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

This puts the 15% rally into perspective - the S&P is still off more than 50% from the 2007 high.

Thornburg Mortgage may file bankruptcy

by Calculated Risk on 3/17/2009 03:40:00 PM

From Reuters: Thornburg Mortgage may file Chapter 11 bankruptcy

Thornburg Mortgage ... a large and troubled provider of "jumbo" mortgage loans, on Tuesday said it may file for Chapter 11 bankruptcy protection.We're all subprime now!

...

A bankruptcy filing would make Thornburg one of the largest U.S. mortgage providers to seek protection from creditors since the housing slump began ...

Thornburg has specialized in making mortgages larger than $417,000 to borrowers with good credit ...

Last March, Thornburg arranged a $1.35 billion bailout from the distressed debt investor MatlinPatterson Global Advisors LLC and other investors to stay out of bankruptcy.

According to a Tuesday regulatory filing, MatlinPatterson surrendered all of its Thornburg common stock -- 120.8 million shares -- on March 12 and 16 without any compensation. ...

DataQuick: SoCal Home Sales Up, Foreclosure Resales 56.4% of Market

by Calculated Risk on 3/17/2009 01:18:00 PM

Note: I ignore the median price data because it is skewed by the mix of homes sold. A repeat sales index like Case-Shiller is a better indicator of price changes.

From DataQuick: Southland home sales outpace last year again; median price steady

Southland home sales stayed above year-ago levels for the eighth consecutive month in February ... Market activity was dominated by bargain-hunting in affordable neighborhoods while buying and selling in more expensive established areas remained largely on hold ...Sales are up because of foreclosure resales in less expensive neighborhoods. Meanwhile, sales in "more expensive established areas" have slowed to a trickle. This build up in supply will eventually lead to more price declines in the expensive areas ...

A total of 15,231 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was essentially unchanged from 15,227 for January, and up 41.3 percent from 10,777 for February 2008, according to MDA DataQuick of San Diego.

...

Regionwide, foreclosure resales accounted for 56.4 percent of February’s resales activity, which was the same as the revised January figure and up from 36.2 percent in February 2008.

Credit Crisis Indicators

by Calculated Risk on 3/17/2009 10:58:00 AM

Here is a quick look at a few credit indicators:

First, the British Bankers' Association reported that the three-month dollar Libor rates were fixed at 1.30%, down from 1.31% on Monday. This has been a slight improvement over the last week. Click on table for larger image in new window.

Click on table for larger image in new window.

The first graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

There has been some increase in the spread the last few weeks, but the spread is still way below the recent peak. The spreads are still very high, even for higher rated paper, but especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

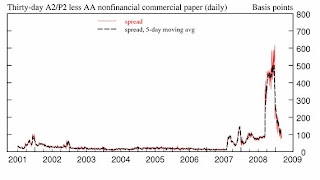

There has been improvement in the A2P2 spread. This has declined to 0.84. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

There has been improvement in the A2P2 spread. This has declined to 0.84. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased a little over the last week, and is now at 107.5. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.The recent surge in this index was a cause for alarm, but the index appears to have stabilized over the last week.

All of these indicators are still too high, but at least none of them are increasing this week.

Housing Starts Rebound

by Calculated Risk on 3/17/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 583 thousand (SAAR) in February, well off the record low of 477 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 357 thousand in February; just above the record low in January (353 thousand).

Permits for single-family units increased in February to 373 thousand, suggesting single-family starts could increase in March.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits increased slightly:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 547,000. This is 3.0 percent (±3.5%)* above the revised January rate of 531,000, but is 44.2 percent (±1.2%) below the revised February 2008 estimate of 981,000.On housing starts:

Single-family authorizations in February were at a rate of 373,000; this is 11.0 percent (±2.1%) above the January figure of 336,000.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 583,000. This is 22.2 percent (±13.8%) above the revised January estimate of 477,000, but is 47.3 percent (±5.3%) below the revised February2008 rate of 1,107,000.And on completions:

Single-family housing starts in February were at a rate of 357,000; this is 1.1 percent (±11.0%)* above the January figure of 353,000.

Privately-owned housing completions in February were at a seasonally adjusted annual rate of 785,000. This is 2.3 percent (±14.8%)* above the revised January estimate of 767,000, but is 37.3 percent (±7.7%) below the revised February 2008 rate of 1,251,000.Note that single-family completions are still significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Single-family housing completions in February were at a rate of 505,000; this is 8.2 percent (±11.8%)* below the January figure of 550,000.

One month does not make a trend - and the graph shows this is just a slight increase in total starts (and single family starts are basically flat with the record low). However I do expect housing starts to bottom sometime in 2009.

Monday, March 16, 2009

Obama Administration Hoping to Avoid Auto Bankruptcies

by Calculated Risk on 3/16/2009 09:58:00 PM

From the WSJ: Obama Seeks to Avoid Auto Bankruptcies

The leaders of President Barack Obama's auto task force are focused on restructuring General Motors Corp. and Chrysler LLC outside of bankruptcy court ...Meanwhile: Chrysler Presses Request for Loans. Just another $5 billion by the end of the month ...

...

"It sometimes becomes a necessary place for some companies, but it's certainly not a desired place and it is certainly not our goal to see these companies in bankruptcy, particularly considering the consumer-facing nature of their businesses," [Steven Rattner, a private-equity executive leading the team] said in an interview.

...

By the end of the month, the government plans to lay out its view on the companies' viability and what the industry should look like in future years, Mr. Rattner said.

Credit Card Defaults at 20 Year-High

by Calculated Risk on 3/16/2009 07:56:00 PM

From Reuters: U.S. credit card defaults rise to 20 year-high

U.S. credit card defaults rose in February to their highest level in at least 20 years, with losses particularly severe at American Express ... and Citigroup ...The Treasury and Federal Reserve haven't publicly released the indicative loss rates for various asset classes associated with the two stress test economic scenarios (baseline and more adverse), but these numbers are probably approaching the "more adverse" scenario range for credit cards.

AmEx ... said its net charge-off rate ... rose to 8.70 percent in February from 8.30 percent in January.

... Citigroup Inc (C.N) ... default rate soared to 9.33 percent in February, from 6.95 percent a month earlier ...

...

Chase ... reported its charge-off rate rose to 6.35 percent in February from 5.94 percent in January. ...

Capital One Financial Corp's ... default rate increased to 8.06 percent in February from 7.82 percent in January.

...

Analysts estimate credit card chargeoffs could climb to between 9 and 10 percent this year from 6 to 7 percent at the end of 2008.

Comparing the NAHB Housing Market Index and New Home Sales

by Calculated Risk on 3/16/2009 06:06:00 PM

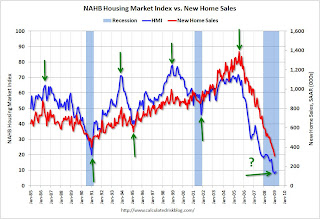

Here is a comparison of the National Association of Home Builders (NAHB) Housing Market Index and new home sales from the Census Bureau. Since new home sales are released with a lag, the NAHB index provides a possible leading indicator for sales.

Note: the NAHB index released this morning was for a March survey. New Home sales for February will be released on March 25th - so the NAHB is released almost 6 weeks ahead of the corresponding sales numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that major tops and bottoms (green arrows) for the two series line up pretty well (usually within 1 month). However both series are noisy month to month, and there are plenty of head fakes in between the significant peaks and troughs. Also the new home sales data is revised significantly (this graph uses revised data).

Just something to watch going forward ...

FASB to Propose Changes to Mark-to-Market

by Calculated Risk on 3/16/2009 03:46:00 PM

From Bloomberg: FASB Moves Toward Giving Banks More Flexibility on Fair-Value (ht Justin)

The Financial Accounting Standards Board, pressured by lawmakers to change the fair-value rule blamed for worsening the financial crisis, proposed permitting companies to use “significant judgment” in valuing assets.From the American Bankers Association: Breaking News: FASB to Propose Improvements to Mark-to-Market, OTTI

Companies would be able to apply the revised rule to their first-quarter financial statements, FASB Chairman Robert Herz said today during a meeting at the U.S. accounting rulemaker’s Norwalk, Connecticut, headquarters. The board is set to vote on the proposal April 2, after a 15-day public comment period. ...

Mark-to-Market. The proposal for estimating market values will take into consideration whether there is an active market (such as the number of recent transactions, whether price quotes are based on current information, whether price quotes vary substantially, etc.). If there is not an active market, then the quoted price is a distressed transaction unless certain other conditions exist. For distressed transaction prices, “Level 3” techniques (such as present values of future cash flows) are used instead of the distressed prices and should reflect an orderly transaction between market participants, including a reasonable profit margin for uncertainty in a non-distressed situation.

Other-Than-Temporary-Impairment. FASB will also propose that the full market loss continue to be reported through earnings (and capital) only if the entity intends to sell or will be required to sell the security prior to its recovery. For all other OTTI, the amount of market loss will be split between the credit portion of the loss, which will be reported in earnings, and the remainder of the loss, which will be reported in “other comprehensive income.”