by Calculated Risk on 9/03/2008 09:01:00 AM

Wednesday, September 03, 2008

C&D Loans: Lender BB&T Forecloses on Comstock Properties

From the WaPo: BB& T Deal Eases Comstock's Debt (hat tip Don)

Comstock Homebuilding of Reston said yesterday it has reached a deal with lender BB&T to wipe $32.7 million worth of troubled development loans from its books as it struggles to rebound in an ailing housing market.Delinquency rates are rising quickly on C&D (construction and development) loans, and many mid-size institutions (assets in the $1 billion to $10 billion range) have excessively high concentration of C&D loans. This is a serious problem and these C&D loan defaults will probably lead to many of the bank failures of the next couple of years.

Under the deal, BB&T foreclosed on four of Comstock's properties in the Atlanta area yesterday. Two properties in Northern Virginia -- a condominium project in Manassas and a single-family home project in western Loudoun County -- are scheduled to go into foreclosure by Sept. 30, according to Comstock.

BB&T will probably have significant losses on these loans as they try to dispose of these properties. I'll post some FDIC graphs on this issue later today.

Construction Spending in July

by Calculated Risk on 9/03/2008 02:23:00 AM

Note: I'm back. I had to cut my hiking trip short due to a minor injury. I'm fine, no worries. My thanks to Paul Jackson and Lama for their guest posts. Best to all. CR

Construction spending declined in June for both residential and non-residential private construction.

From the Census Bureau: July 2008 Construction at $1,084.4 Billion Annual Rate

Residential construction was at a seasonally adjusted annual rate of $357.8 billion in July, 2.3 percent below the revised June estimate of $366.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $416.8 billion in July, 0.7 percent below the revised June estimate of $419.8 billion.

Click on graph for larger image in new window.

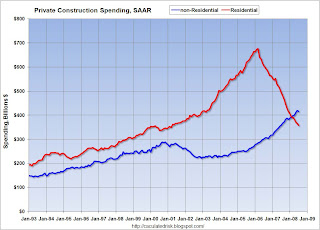

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993.

It's still too early to call the peak for nonresidential construction spending, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - so June 2008 might have been the peak for this nonresidential construction spending cycle.

Tuesday, September 02, 2008

Cartoon of the Day

by Calculated Risk on 9/02/2008 11:00:00 PM

Ambac Gets Approval for Connie Lee Clone

by PJ on 9/02/2008 08:34:00 PM

Looks like the good insurer/bad insurer model is pushing ahead, per Bloomberg:

Ambac Financial Group Inc., the world's second-biggest bond insurer, received approval from Wisconsin regulators to begin offering municipal bond insurance through a newly created insurer called Connie Lee.Essentially, as I understand it, Ambac will move all of its municipal business and employees to Connie Lee, and create Ambac v2.0. The toxic RMBS/CDO stuff will stay back with Ambac; what isn't being discussed by the company (or by regulators) is whether it intends to force counterparties into commutation of its CDS contracts on RMBS/CDO issues once the cloning process is complete.

Ambac rose as much as 15 percent in late trading as Wisconsin regulators, which have jurisdiction over the New York- based company, approved a plan to move $850 million out of Ambac Assurance Corp. into the new business, according to a statement today. Ambac is seeking to obtain an AAA credit rating from Moody's Investors Service and Standard & Poor's for Connie Lee.

The gutted Ambac will be in an interesting position should this go through; will it be well capitalized enough to pay on its claims? Will it focus on putting contracts back for fraud and misrepresentation? Or will it simply tell policyholders they'll get a reduced commutation or get nothing on the guarantee? That'd be a cram-down of an entirely different sort.

Fitch: Prime Auto ABS Losses Nearly Double in July

by PJ on 9/02/2008 03:20:00 PM

Fitch Ratings' prime and subprime U.S. auto asset-backed security (ABS) performance indexes produced higher delinquency and annualized net losses (ANL) in July...In July, ANL on prime auto ABS hit the highest level for the year at 1.42%, increasing 15% over June's level. ANL in July were 94% higher than in July 2007. The last time ANL were at this level was in late 2003/early 2004 ...

In the subprime sector, ANL were at 6.56% in July, a 16.5% increase over June, and 45% above a year earlier. Subprime delinquencies rose 11% in July to 3.63%. Delinquencies were 30% higher in July versus the same period in 2007.

While the wholesale vehicle market did show signs of stabilization in July, Fitch remains unconvinced that the market will improve structurally in the short term. The wholesale vehicle market remains soft with considerable weakness in the truck and sports utility segments, along with lower recovery rates in the luxury vehicle space ....

Something that's been discussed in a few closed circles, but not really brought to light, is how little the ABS market is moving these days. A look at the publicly-available stats from Asset-Backed Alert gives a great indication of where the market is headed.

And with prime ABS losses mounting for autos, that sound you hear is likely a few more economists jumping off the fence on their recession calls.

FHA Refis = FHASecure

by PJ on 9/02/2008 01:53:00 PM

Ever since the FHASecure program was first rolled out last year, it's been a moving target political hot potato, with Administration types changing the definition of the program to tout "success," and still others questioning why the goalposts had to be moved in order for the kicker to hit a field goal. (I'm not going to spend this week linking gratuitously to HW, but for those needing a background, you might want to read this.)

Today, we get an update on the heels of a Friday press statement from U.S. Housing and Urban Development Secretary Steve Preston, who touted that FHASecure had helped 325,000 American families refinance into affordable mortgages.

Only problem is that most weren't troubled, and nearly none were severely delinquent -- which, you'll recall, was the stated purpose of the program when it was first announced. Via Forbes:

IMF's Guy Cecala pretty much echoes what we've been saying for months now: that FHASecure was nothing but a PR stunt.Since late September of last year, just 1.2%, or 3,911, of the loans refinanced by the FHA, which is part of Housing and Urban Development (HUD), were made to borrowers in default, FHA data shows. This is far below what the government had forecast. The reason: Despite the hoopla about FHA helping borrowers in default, in reality, they only opened the window a crack.

So while the FHA refinanced 324,184 loans so far this year, that doesn’t necessarily mean that the program stopped a wave of would-be foreclosures.

“The deal is that true FHASecure delinquent loan refinance activity has been so low that HUD decided to call all of its refinance business FHASecure,” says Cecala. “In theory, the program could be expanded to accommodate more delinquent borrowers without loosening underwriting or taking on any more risk, but HUD and the Bush Administration has been reluctant to do so."

“FHASecure was a PR-driven program created to show that the Bush Administration wasn’t ignoring the mortgage crisis," says Cecala.

Seemed like a good idea at the time

by PJ on 9/02/2008 11:39:00 AM

(Note: Don't miss Tanta's post on Frannie, well worth your time to read)

The OC Register's Andrew Galvin has an interesting look at a retail concept that is a stunning failure now, but seemed like a good idea at the time:

By time and perseverance, Mulhall means you've got to have lots of cash to burn, with no guarantee you'll see any of it come back; such high-end retail might have a shot in Newport Beach, but Costa Mesa? I can think of much more fun ways to lose money, personally, and most involve a trip to Las Vegas.The vast sea of empty parking spaces at the South Coast Home Furnishings Centre tells a story about our local economy better than any graph or chart.

The Costa Mesa retail center, envisioned as a Mecca for people looking to upgrade home interiors, was conceived and built during the historic run-up in housing prices a few years back. It opened in 2007, just as the housing market was dropping into freefall.

Today, the center has the feel of a ghost town. Stores sit empty, while shoppers are few and far between. The food court has a single tenant. The center's owner is in foreclosure after defaulting on an $84 million mortgage.

Yet some merchants are sticking it out, convinced that better days are ahead.

"We'll get through it," said Chris Mulhall, whose store, Visions in Contemporary Living, sells what he calls "high-end contemporary" furniture. "It's just going to take time and perseverance."

It's a little early to pull out a quote of the week, but here's a candidate:

"When you think about all those mortgage guys driving around in their Lamborghinis and spending money hand over fist, driving up the local economy – what everybody's got to understand is that the weirdness was when those guys were making that kind of money, not what's happening now," said economist Chris Thornberg of Beacon Economics.I interviewed Thornberg when he was with the UCLA Andersen forecast, and he was always among the most bearish of the group. He's also been among the most correct, even if he's also the most blunt.

And, for those yearning for a little rock-blogging, this story conjures up a great little rock-and-roll song from the band OK GO, called A Good Idea at the Time. Rock on.

They Could Call It Moronic

by Tanta on 9/02/2008 09:01:00 AM

Every time I observe that something or other is the dumbest thing I've ever heard of, something even dumber comes along. You'd think I'd have learned by now. But this is the dumbest thing I've ever heard of:

Here’s a bold idea: Fannie Mae and Freddie Mac should merge.No; having Fannie Mae and Freddie Mac open a counter-cyclical side line of business mowing lawns on each other's REO would be a "bold" idea. This is just another Wall Street plan to solve all of our problems by laying off highly skilled employees with long institutional memories and a high degree of loyalty to their company in order to goose the damned share price. Oh, and it's easier to do that if you make these costly employees sound like fat cats:

Yes, the big benefits of a merger would come at the expense of some the 6,400 employees at Fannie and nearly 5,000 employees at Freddie. And frankly, that’s one reason, among many, such a scenario may not be palatable to folks in Washington — where, it should be noted, many of Fannie and Freddie employees work and live, some as the neighbors of politicians and their friends.Yeah, right. All those mortgage quality control analysts and remittance accounting clerks live next door to a Senator and hobnob with the K-Street Boyz. Especially all the ones who work in the regional field offices.

Fannie and Freddie have, in fact, historically paid decent salaries for skilled workers, and their benefit packages tend to be excellent. They are known for having diverse workforces and for recruiting and promoting women. They even offer family leave and flexible work hours and child-care plans and pinko crap like that. Obviously someone needs to teach these people the real meaning of capitalism, which is that we do not deal with big, structural, complicated problems. We "downsize" and collect bonuses in the M&A houses:

By merging them, they would really become too big to fail. And sometimes size can be a strength."Getting real" like this is what happened to the non-GSE part of the mortgage business over the last several years. Wall Street firms bought up mortgage companies, slashed back rooms and highly-paid experts, offshored collections and account management and swarmed all over the "wholesale" model that substituted "independent" brokers for origination employees whose long-term financial best interests were aligned with the company. The synergy, dude. It was really something.

A merger wouldn’t undo the mess that these two companies have made, nor does it erase the billions of dollars in potentially toxic loans they own or have guaranteed. Nor would it address the question of whether these companies deserve the implicit backing of the government in the future. . . .

But let’s get real: no matter what solution is chosen for Fannie and Freddie, pink slips are bound to be a part of any fix.

And since that worked so well at outfits like Countrywide or the Street-owned firms, let's try it again on the GSEs? I have had a theory for a long time that the very subject of the GSEs just makes a whole lot of people utterly insane, pretty much regardless of what they do or what the context of the conversation is. Being a hybrid of a private corporation and a government agency, they will always be ideologically intolerable to purists on one or the other side of any of the more annoying political arguments of our time. But this kind of thing is beyond the usual sloganeering about private vs. government sectors and competition and monopoly and so on. This is just a naked appeal to the Street's desire to eliminate skilled jobs to enrich consultants and executives. If you thought they learned anything by the fiasco of the mortgage securitization machine--put any dumb old loan in the deal because someone's got a spreadsheet showing hockey sticks on it--think again.

Monday, September 01, 2008

Cartoon of the Day

by Calculated Risk on 9/01/2008 11:00:00 PM

Culture shock, fraud in South Florida

by PJ on 9/01/2008 09:20:00 AM

Perhaps one of the more interesting outcomes of the real estate crash has been the reaction of those who bought at overinflated prices in overinflated markets. What we're seeing now is a mix of denial, anger, and acceptance, per the NY Times:

For sale: one newly constructed three-bedroom, four-bathroom home near the University of Miami, with South African wood in the kitchen, marble from India, Egypt and Spain, and a $4,500 top-of-the-line garage door.Such thinking must be culture shock for an area that believed "prices go up" almost as if it were gospel; after all prices had risen for 21 years prior to this downturn. Diaz is probably typical of more than a few homeowners in the area, who have cut prices dramatically -- but still not enough to beat out the short sellers and REO inventory in the area.

Listing price two years ago: $979,000. Listing price now: $599,000.

“I always figured the market trend wouldn’t catch me,” said Rafael Diaz, the owner and builder. He turned down $770,000 more than a year ago, he said, and has come to accept that he will never get the $700,000 he said he needed to break even. “By the end of the year,” he said, “I might just turn it over to the bank.”

Part of the reason this area has been hit so hard is because so many speculators were snapping up inventory -- regardless of what the original mortgage said:

As of last week, 24 percent of the roughly 34,000 single-family homes for sale in Miami-Dade and Broward Counties — and 20 percent of the 47,000 condominiums — were listed as potential short sales.

Homeowners trying to compete say they often feel flabbergasted by the competition. Alexandra Swanberg said she reduced the price of her 1,482-square-foot town house to $245,000, from $287,000 last year, to keep up with the dozens of for-sale signs sprouting throughout her middle-class South Miami neighborhood.

“Everyone has been in a panic,” Ms. Swanberg said. “The Realtors are crazy; they want you to drop the price really low.”

Which alludes to the sort of fraud that was going on during the boom; two out three properties put on the market are now being rented out. Why? Because they were investment properties to begin with. I'll bet you'd be hard-pressed to find two of three mortgages underwritten in the Miami area in the past three years as non-owner occupied.

In fact, it is common for apartments and homes here to simultaneously be for rent and for sale. And rentals, which have historically made up about a quarter of all transactions in the area, have come to dominate. Roughly two out of every three deals in the Miami-Fort Lauderdale corridor since January have been rentals, according to data from the Florida Association of Realtors. [emphasis added]

(Hat tip, Brian!)