by Calculated Risk on 7/05/2005 11:22:00 PM

Tuesday, July 05, 2005

$1 Million Trailer: Land not included

The USA Today reports Mobile home madness: Prices top $1 million

A two-bedroom, two-bathroom mobile home perched on a lot in Malibu is selling for $1.4 million. This isn't a greedy seller asking a ridiculous amount no one will pay. (Photo gallery: Mobile home boasts of spectacular views)Uh, OK.

Two others sold in the area recently for $1.3 million and $1.1 million. Another, at $1.8 million, is in escrow. Nearby, another lists for $2.7 million.

"Those are the hottest (prices) I've ever heard," says Bruce Savage, spokesman for the Manufactured Housing Institute. He says prices in another hot spot, Key West, Fla., top $500,000. As if the price isn't tough enough to swallow, trailer buyers:

•Don't own the land. As with most mobile homes sold in Malibu, the land is owned by the proprietor of the trailer park, in this case, Point Dume Club.

•Still pay rent. Not owning the land means paying what's called "space rent" that is as high as or higher than many mortgages in other parts of the USA. On the $1.4 million trailer, space rent is $2,700 a month.

•Can't get mortgages. Since the buyers don't own the land, most of the mobile homes are paid for in cash or with a personal property loan that usually amounts to $100,000 or less, says Clay Dickens, mortgage loan agent at Community West Bank.

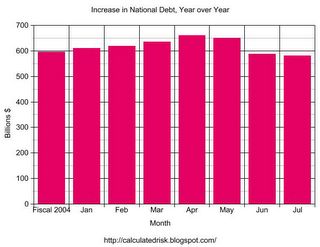

Budget Deficit: $581 Billion Year over Year

by Calculated Risk on 7/05/2005 03:58:00 PM

As of July 1, 2005 our National Debt is:

$7,827,306,264,287.53 (Over $7.8 Trillion)

As of July 1, 2004, our National Debt was:

$7,246,142,474,951.77

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

I still expect fiscal 2005 to set a new nominal budget deficit record although it might be close. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

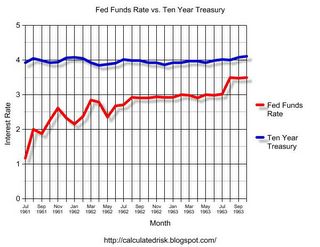

A Unique Conundrum?

by Calculated Risk on 7/05/2005 12:03:00 AM

The Federal Reserve has been steadily raising rates from a low of 1% to over 3%. And the yield on the Ten Year Treasury stubbornly refuses to budge.

Click on graph for larger image.

That is what happened in the early '60s. The Fed Funds rate moved from 1.1% in July 1961 to 3.5% in late 1963 and the Ten Year yield stayed steady at 4%.

All data from the Federal Reserve.

The yield curve narrowed and then what happened to the economy? It continued to grow and the stock market rallied.

There are many differences from forty years ago and today. But, with the constant drum beat in the financial press about the yield curve, I decided to check if the current situation was unique. It isn't. Nothing profound, I was just curious.

Also, my most recent post is up on Angry Bear: Housing Update.

Saturday, July 02, 2005

Housing: Boston is Looking Peaked

by Calculated Risk on 7/02/2005 12:00:00 AM

Many housing commentators have been looking to the UK and Australia housing markets as leading indicators for the US housing market. Now the housing bust may have reached the US shores: Boston is looking peaked.

In Massachusetts, the number of home sales dropped last month: Mass. home sales plunge 11.1 percent

There were about 36,259 homes on the market last month, or a supply of 8.8 months, a figure generally thought to be favorable to buyers, experts said.That is worth repeating; the supply of existing homes is now 8.8 months in Massachusetts. And that is exactly how many commentators felt the bubble would end:

Economists say this combination - higher prices amid lower sales volume - is precisely what you'd see in a bubble that's dying.And what happens when buyers use excessive leverage and can't sell? Massachusetts Foreclosure Filings Jump As Values Soar

Because of high housing prices, many first-time homebuyers have been using new, risky mortgage products that hold down costs in the early years of a loan, but they can face difficulties if payments rise later. In addition, people who already own homes have been tapping into rising property values to borrow money at historically low interest rates for college tuition, home improvements, credit-card debt, or other financial needs.And finally a quote from Bill Gross from Saturday's New York Times:

"When you tie all these factors together - the bubble in the real estate market, the popularity of interest-only loans, the willingness of lenders to give loans without a significant down payment, the lowering of standards for lenders, and the deep desire of people to own something priced beyond their means - you have a recipe for disaster," said Secretary of State William F. Galvin, whose office oversees the registries of deeds in a majority of the state's 14 counties. "That's what you're seeing in the Land Court."

"... if housing prices stop going up, which would be my forecast, that makes a substantial difference. Individuals have banked on that appreciation every year. You should come to a point where owners of houses realize we're in never-never land and stop buying on a speculative basis. Markets many times fall of their own weight. That's what happened with the Nasdaq in 2000."And maybe that's what is happening in Boston. Should we sound the alarm? The British Bust is coming!

Friday, July 01, 2005

Wells Fargo: Decade of Flat Home Prices

by Calculated Risk on 7/01/2005 01:19:00 AM

The Orange County Register reports on a presentation by Wells Fargo's chief economist Scott Anderson at the Westin South Coast Plaza on Wednesday. The Register quotes Anderson:

"We're talking about a decade at least – if not more – of (housing price) stagnation,"

"There will be a slow fizzle (in prices), not a pop,"Still Anderson is fairly positive:

There's a little oomph left in the market, he said. Anderson predicts that 30-year, fixed mortgage rates will remain around 5.8 percent over the next six months, which could help boost home prices about 5 percent this year. Next year, homeowners might see a 1 percent to 2 percent increase in appreciation, then Anderson expects prices will level off indefinitely until incomes can catch up.Previous housing booms also fizzled. But ten years of nominal price stagnation would be a 30% decline in real terms.

Even though much of Orange County's economic recovery can be attributed to the housing boom, Anderson doesn't think stagnant housing prices spell recession, because strength will remain in other sectors like technology and tourism.

I'm less confident than Mr. Anderson about avoiding a recession.