by Calculated Risk on 3/01/2021 10:15:00 AM

Monday, March 01, 2021

Construction Spending Increased 1.7% in January

From the Census Bureau reported that overall construction spending increased:

Construction spending during January 2021 was estimated at a seasonally adjusted annual rate of $1,521.5 billion, 1.7 percent above the revised December estimate of $1,496.5 billion. The January figure is 5.8 percent above the January 2020 estimate of $1,437.7 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,160.0 billion, 1.7 percent above the revised December estimate of $1,140.9 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $361.5 billion, 1.7 percent above the revised December estimate of $355.5 billion.

Click on graph for larger image.

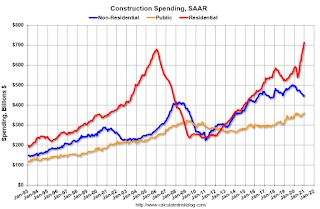

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 5% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 1% above the previous peak in March 2009, and 38% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 21.0%. Non-residential spending is down 10.1% year-over-year. Public spending is up 6.8% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential will be under pressure. For example, lodging is down 23% YoY, multi-retail down 31% YoY, and office down 4% YoY.

This was well above consensus expectations of a 0.7% increase in spending, and construction spending for the previous two months was revised up slightly. A strong report.