by Calculated Risk on 3/13/2014 03:04:00 PM

Thursday, March 13, 2014

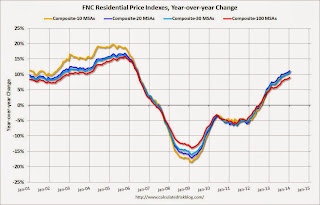

FNC: House prices increased 9.0% year-over-year in January

From FNC: FNC Index: Home Prices of Normal Sales Up 0.4% in January

The latest FNC Residential Price Index™ (RPI) shows U.S. home prices have gotten off to a positive start in 2014, rising a modest 0.4% in January. The index, constructed to gauge the price movement among normal home sales exclusive of distressed properties, indicates home prices of the underlying housing market continue to strengthen as market fundamentals and credit conditions continue to improve.The 100-MSA composite was up 9.0% compared to January2013. The FNC index turned positive on a year-over-year basis in July, 2012.

The index is up 9.0% from a year ago and continues to point to the fastest year-over-year growth to date since the recovery began. Home prices are expected to rise modestly in February as improving signs are emerging in the for-sale market: The for-sale market has strengthened in February and the average seller asking price discount dropped from 5.4% in January to 4.7% in February.

...

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC national composite index shows that in January home prices rose at a seasonally unadjusted rate of 0.4%. The two narrower indices (30- and 10- MSA composites) show faster month-over-month price appreciation in the nation’s top housing markets, up 0.6% and 0.8%, respectively. The 30- and 10-MSA composites’ year-over-year trends also show more rapid growth rate in the double digits and, similar to the national index, the fastest year-over-year growth to date since the recovery began.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 23.2% from the peak.

I'm expecting the year-over-year change in house prices to slow as more inventory comes on the market - but this index isn't showing a slowdown yet.