by Calculated Risk on 2/05/2014 07:03:00 AM

Wednesday, February 05, 2014

MBA: Mortgage Applications Increase Slightly

From the MBA: Mortgage Applications Increase Slightly in Latest MBA Weekly Survey

Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 31, 2014. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. ...

...

The average contract rate declined for all loan products in the survey. Contract rates were at their lowest level since November 2013, except for the 5/1 ARM, which was at the lowest level since December 2013.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.47 percent from 4.52 percent, with points decreasing to 0.25 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

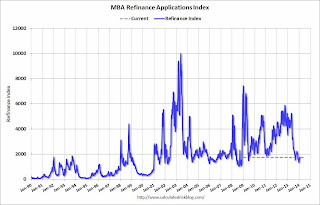

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 67% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 14% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.