by Calculated Risk on 1/02/2014 10:52:00 AM

Thursday, January 02, 2014

Construction Spending increased in November, Highest since March 2009

The Census Bureau reported that overall construction spending increased in November:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2013 was estimated at a seasonally adjusted annual rate of $934.4 billion, 1.0 percent above the revised October estimate of $925.1 billion. The November figure is 5.9 percent (±2.0%) above the November 2012 estimate of $882.7 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $659.4 billion, 2.2 percent above the revised October estimate of $644.9 billion. Residential construction was at a seasonally adjusted annual rate of $345.5 billion in November, 1.9 percent above the revised October estimate of $339.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $313.9 billion in November, 2.7 percent above the revised October estimate of $305.7 billion. ...

November, the estimated seasonally adjusted annual rate of public construction spending was $275.0 billion, 1.8 percent below the revised October estimate of $280.2 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 49% below the peak in early 2006, and up 51% from the post-bubble low.

Non-residential spending is 24% below the peak in January 2008, and up about 39% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and up about 4% from the recent low.

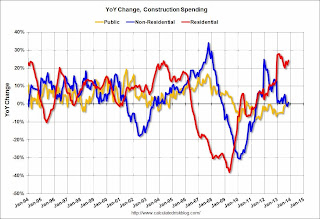

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 24%. Non-residential spending is up 1% year-over-year. Public spending is down slightly year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to increase in 2014

3) Public construction spending was down in November and is now only 4% above the low in April. However it appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, all categories of construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.