by Calculated Risk on 6/20/2013 11:49:00 AM

Thursday, June 20, 2013

Comment on Existing Home Sales: Inventory near Bottom

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased 3.3% in May from April, and is only down 10.1% from May 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of May since 2002, but this is also the smallest year-over-year decline since July 2011. The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 12.9% from May 2012, but conventional sales are probably up over 20% from May 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 18 percent of May sales, unchanged from April, but matching the lowest share since monthly tracking began in October 2008; they were 25 percent in May 2012.Although this survey isn't perfect, if total sales were up 12.9% from May 2012, and distressed sales declined from 25% of total sales (25% of 5.18 million) to 18% (18% of 4.59 million in May 2012), this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

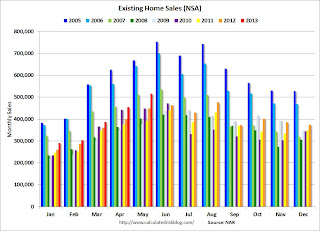

All-cash sales were at 33 percent of transactions in May, up from 32 percent in April and 28 percent in May 2012. Individual investors, who account for many cash sales, purchased 18 percent of homes in May; they were 19 percent in April and 17 percent in May 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in May: 5.18 million SAAR, 5.1 months of supply