by Calculated Risk on 4/28/2013 10:33:00 AM

Sunday, April 28, 2013

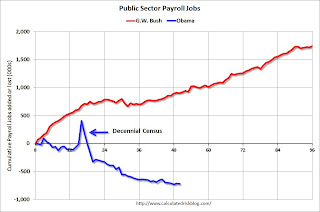

Public and Private Sector Payroll Jobs: Bush and Obama

With public sector jobs down over the last several years (Federal, State and local layoffs), several readers have asked if I could update the graphs comparing public and private sector job losses (or added) for President George W. Bush's two terms (following the stock market bust), and for President Obama tenure in office so far (following the housing bust and financial crisis).

Important: There are many differences between the two periods. Both followed the bursting of a bubble (stock and housing), although the housing bust also led to a severe financial crisis.

The first graph shows the change in private sector payroll jobs from when Mr. Bush took office (January 2001) compared to Mr. Obama's tenure (from January 2009).

Mr. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr Obama (blue) took office during the financial crisis and great recession.

Click on graph for larger image.

Click on graph for larger image.

The employment recovery during Mr. Bush's first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 jobs lost during Mr. Bush's two terms.

The recovery has been sluggish under Mr. Obama's presidency too, and there were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A couple of months into Mr. Obama's second term, there are now 2,282,000 more private sector jobs than when he took office.

A big difference between Mr. Bush's tenure in office and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 1,748,000 jobs), but the public sector has declined since Obama took office (down 718,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

A big difference between Mr. Bush's tenure in office and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 1,748,000 jobs), but the public sector has declined since Obama took office (down 718,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

Another important difference: I started warning about the housing bubble in 2004, and I started this blog in January 2005 - the beginning of Mr. Bush's 2nd term. My focus in 2005 was on the housing bubble and coming recession. Now - at a similar point in Mr. Obama's tenure - I expect the economy to continue to expand, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term.

Yesterday:

• Summary for Week ending April 26th

• Schedule for Week of April 28th