by Calculated Risk on 10/13/2012 01:05:00 PM

Saturday, October 13, 2012

Schedule for Week of Oct 14th

Earlier:

• Summary for Week Ending Oct 12th

This will be a very busy week for economic data. There are three key housing reports to be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Friday.

Another key report is retail sales for September. For manufacturing, the October NY Fed (Empire state) and Philly Fed surveys, and the September Industrial Production and Capacity Utilization report will be released this week.

On prices, CPI for September will be released on Tuesday.

8:30 AM ET: Retail sales for September will be released.

8:30 AM ET: Retail sales for September will be released. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.7% in September, and for retail sales ex-autos to increase 0.5%.

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of minus 3, up from minus 10.4 in September (below zero is contraction).

10:00 AM: Manufacturing and Trade: Inventories and Sales for August (Business inventories). The consensus is for 0.5% increase in inventories.

8:30 AM: Consumer Price Index for September. The consensus is for CPI to increase 0.5% in September and for core CPI to increase 0.2%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 41, up from 40 in September. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Single-family starts increased 5.5% to 535 thousand in August.

The consensus is for total housing starts to increase to 765,000 (SAAR) in September, up from 750,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand.

10:00 AM: Philly Fed Survey for October. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.2% increase in this index.

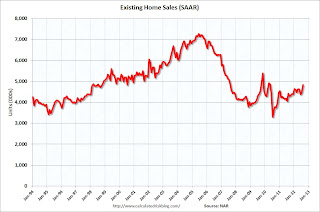

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in August 2012 were 4.82 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2012