by Calculated Risk on 8/04/2012 08:05:00 AM

Saturday, August 04, 2012

Summary for Week ending Aug 3rd

The week started with expectations of central bank action. The Fed went first, and although the FOMC statement acknowledged that “economic activity decelerated”, the FOMC took no action. Then it was the European Central Bank’s turn; the eurozone economy has taken a turn for the worse, and the ECB took no action.

However, after further reflection, some analysts felt the ECB has laid the groundwork for sovereign bond buying, and that the Fed will announce QE3 in September. We will see.

In the meantime, the data was mixed. The employment report showed more payroll jobs added in July than in June, but the unemployment rate also increased to the highest level this year (the same rate as in January and February).

A key story early in the week was that the Case-Shiller house price indexes increased in May and are close to being up year-over-year. Also residential construction spending was up again in June.

However manufacturing was weak; the ISM index was below 50 (contraction) for the 2nd consecutive month. As a reminder, housing is usually a better leading indicator for the US economy than manufacturing. Manufacturing is more coincident. The ISM index suggests some weakness now, whereas housing suggests an ongoing sluggish recovery - and that appears to be what is happening.

Here is a summary of last week in graphs:

• July Employment Report: 163,000 Jobs, 8.3% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.

There were 163,000 payroll jobs added in July, with 172,000 private sector jobs added, and 9,000 government jobs lost. The economy has added 1.06 million jobs over the first seven months of the year (1.12 million private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

This was above expectations of 100,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.3% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate increased to 8.3% (red line).

The Labor Force Participation Rate declined slightly to 63.7% in July (blue line). This is the percentage of the working age population in the labor force.

The Employment-Population ratio declined to 58.4% in July (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

• Case Shiller: House Prices increased 2.2% in May

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up 0.9% in May (SA). The Composite 10 is up from the post bubble low set in March, Not Seasonally Adjusted (NSA).

The Composite 20 index is off 32.3% from the peak, and up 0.9% (SA) in May. The Composite 20 is also up from the post-bubble low set in March (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is down 1.0% compared to May 2011.

The Composite 20 SA is down 0.7% compared to May 2011. This was a smaller year-over-year decline for both indexes than in April, and the smallest year-over-year decline since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in April seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.4% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through May 2012) is above previous declines for most cities.

This was better than the consensus forecast and it is now possible that prices will turn positive year-over-year in June.

• Real House Prices, Price-to-Rent Ratio

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to May 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is gone.

Here is a graph using a ratio of the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes to Owners' Equivalent Rent (a price-to-rent ratio)..

Here is a graph using a ratio of the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes to Owners' Equivalent Rent (a price-to-rent ratio)..This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1998 levels, the Composite 20 index is back to May 2000 levels, and the CoreLogic index is back to June 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

• ISM Manufacturing index increases slightly in July to 49.8

This is the second consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.8% in July, up slightly from 49.7% in June. The employment index was at 52.0%, down from 56.6%, and new orders index was at 48.0%, up slightly from 47.8%.

This is the second consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.8% in July, up slightly from 49.7% in June. The employment index was at 52.0%, down from 56.6%, and new orders index was at 48.0%, up slightly from 47.8%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.1%.

• U.S. Light Vehicle Sales at 14.1 million annual rate in July

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.09 million SAAR in July. That is up 14% from July 2011, and down 1.7% from the sales rate last month (14.33 million SAAR in June 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.09 million SAAR in July. That is up 14% from July 2011, and down 1.7% from the sales rate last month (14.33 million SAAR in June 2012).This graph shows light vehicle sales since the BEA started keeping data in 1967.

This was slightly above the consensus forecast of 14.0 million SAAR (seasonally adjusted annual rate).

Sales have averaged a 14.12 million annual sales rate through the first seven months of 2012, up sharply from the same period of 2011.

• ISM Non-Manufacturing Index increases slightly, Employment index declines in July

The July ISM Non-manufacturing index was at 52.6%, up from 52.1% in June. The employment index decreased in July to 49.3%, down from 52.3% in June. Note: Above 50 indicates expansion, below 50 contraction.

The July ISM Non-manufacturing index was at 52.6%, up from 52.1% in June. The employment index decreased in July to 49.3%, down from 52.3% in June. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 52.0% and indicates slightly faster expansion in July than in June. The internals were mixed with the employment index weaker, and new orders stronger.

• Construction Spending in June: Private spending increases, Public Spending flat

The Census Bureau reported that overall construction spending increased in June: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2012 was estimated at a seasonally adjusted annual rate of $842.1 billion, 0.4 percent above the revised May estimate of $838.3 billion. The June figure is 7.0 percent above the June 2011 estimate of $786.8 billion."

The Census Bureau reported that overall construction spending increased in June: "The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2012 was estimated at a seasonally adjusted annual rate of $842.1 billion, 0.4 percent above the revised May estimate of $838.3 billion. The June figure is 7.0 percent above the June 2011 estimate of $786.8 billion."This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 19.4% from the recent low. Non-residential spending is 27% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and near the post-bubble low.

This graph shows the year-over-year change in construction spending.

This graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit). However the recent improvement in residential construction is being somewhat offset by declines in public construction spending.

• Weekly Initial Unemployment Claims increase to 365,000

The DOL reports:

The DOL reports:In the week ending July 28 the advance figure for seasonally adjusted initial claims was 365,000, an increase of 8,000 from the previous week's revised figure of 357,000. The 4-week moving average was 365,500, a decrease of 2,750 from the previous week's revised average of 368,250.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,500.

The sharp swings over the last few weeks are apparently related to difficulty adjusting for auto plant shutdowns.

This was below the consensus forecast of 370,000 and is the lowest level for the four week average since March - and is near the post bubble low of 363,000.

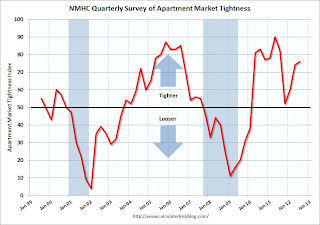

• NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues "For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter."

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues "For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter."This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

• Other Economic Stories ...

• Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

• Personal Income increased 0.5% in June, Spending decreased slightly

• Misc: Chicago PMI increases slightly, Consumer Confidence up, CoreLogic 60,000 Foreclosures in June

• Fannie Mae and Freddie Mac Serious Delinquency rates declined in June

• ADP: Private Employment increased 163,000 in July

• AAR: Rail Traffic "mixed" in July, Intermodal at Record Level

• FOMC Statement: "Economic activity decelerated", Takes no action